“The whole point is that all of these issues DID NOT come into existence only because of the rising interest rates. These issues, that were always present, only got highlighted as interest rates were raised. As such it can be counted as a blessing in disguise.”

I might miss out on the explainer and comments surrounding the recent developments at Silicon Valley Bank and the concerns regarding the lurking systemic risks. However, I am not an expert in the banking sector per se but I will still try to present my humble analysis of the situation as a common man. Before we move forward here is a short explainer about what actually happened.

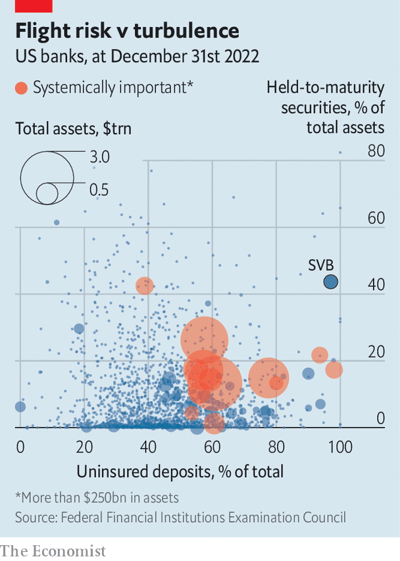

Short explainer: Silicon Valley Bank (SVB), a US-based bank catering to start-ups and technology firms, collapsed due to issues with its balance sheet. While the bank lent out too little, it channelled most of its deposits into investments, including mortgage-backed securities. There was a considerable asset-liability mismatch, as it had short-term deposits while buying long-duration securities. The bank also ran a concentration risk with most of the deposits coming from venture capital-funded start-ups and crypto companies. The bank had kept its assets below $250bn to escape regulation, but this proved disastrous as it wasn’t highly regulated. SVB was hit by rising interest rates as it had invested mostly in securities, especially mortgage-backed securities (MBS). Meanwhile, as money became more expensive, it became more difficult for its depositor companies to have ‘liquidity events,’ leading to a double whammy for the bank. The bank could have managed things better if it had recognised the problem in advance, but history shows that people rarely step back from a business that is doing well.

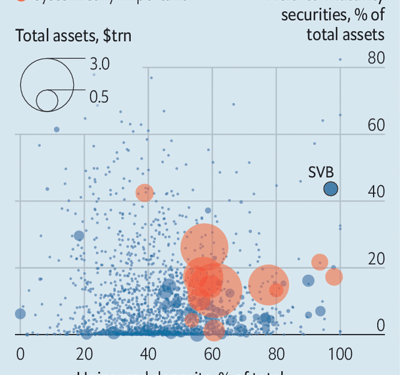

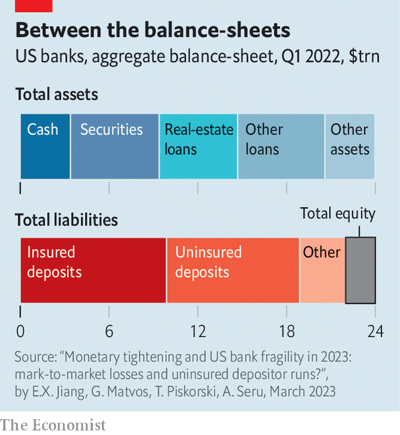

Silicon Valley Bank’s (SVB) recent collapse highlights potential risks in the banking sector, though regulators and the Treasury have stepped in to provide reassurance. The bank’s heavy reliance on long-dated bonds and relatively low percentage of loans made it more susceptible to market changes, leading to a US$1.8bn loss on a USD$21bn bond liquidation from its available-for-sale portfolio. Attempts to raise US$2.25bn in capital were not successful, and material deposit outflows led to the bank’s collapse. The Federal Deposit Insurance Corporation (FDIC) has acted as receiver in the clean-up exercise, with a weekend auction process beginning in search of suitors. Concerns of market contagion have arisen, though fewer banks hold such a high proportion of bonds to loans, making similar collapses less likely. Nonetheless, Treasury Secretary Janet Yellen has alluded to other potentially at-risk banks being monitored. The collapse has reinforced the importance of trust in the banking system, and the need for low breakdown risk.

Credit Suisse and many others have followed course. Why am I highlighting CS? Because of its size and importance in financial system. Credit Suisse is among the largest global wealth managers, and it holds a significant position as one of the 30 systemically important banks worldwide. Failure of any of these 30 banks would have a cascading impact on the entire financial system. Credit Suisse operates local Swiss banking, as well as investment banking, wealth management, and asset management services.

The whole point is that all of these issues DID NOT come into existence only because of the rising interest rates. These issues, that were always present, only got highlighted as interest rates were raised. As such it can be counted as a blessing in disguise. America’s financial institutions had $620bn in unrealised mark-to-market losses. In aggregate, a 10% hit to bond portfolios would wipe out over a quarter of banks’ equity.

This chart below shows the distribution of risks among American banks

The extraoridinary financialization of world economy is an important element in understanding the current problem in an holistic manner. Financialization and securitization of debt poses serious risk to the stability and integrity of economy. Many that have compared the current meltdown in the banking industry to the start of 2008 western financial crisis aren’t wrong in their assessments. We will speak about it further in our Monday Macro View.