I hope everyone is doing great. The global economy is moving on a blurring speed. It doesn’t necessarily mean it is doing so in the right direction but that the frequency of different developments is hard to keep up with. Needless to say it is almost impossible to keep track of the consequences of the said developments. However, through these articles I try my best to provide the readers with some perspective that (I personally and humbly believe) is important to understand for decision making as a trader, businessman or analyst. Here are three important developing news that you need to keep a track of for the rest of the year.

First of all, the most important issue at hand and which seems to be exacerbating is the growing food insecurity which has become a serious issue after Covid19 and Russia-Ukrainian war. Have a look at that the World Food Programme’s Chief Economist has to say about it.

The United Nations World Food Programme’s Chief Economist, Arif Husain, has said that the world needs a “Marshall Plan for food insecurity” as the global hunger crisis worsens. According to the U.N. World Food Programme, 345 million people in 82 countries are currently experiencing acute food insecurity. Complex issues like global food insecurity, pandemics and climate shocks can also pose peace and security challenges. Husain believes that the international community must rethink its approach to hunger and security by getting ahead of the next crisis and building resilience in the world’s most vulnerable places. He suggests that countries facing hunger challenges should be given debt relief to enable them to purchase food and fertilizer. Last fall, the IMF identified 48 countries that were worst hit by the food shock brought on by Russia’s invasion of Ukraine. These countries, the overwhelming majority of which are in Africa, are heavily dependent on food imports from Ukraine and Russia.

He highlights several other strategies to alleviate poverty and food insecurity, including exchanging debt relief for hunger relief, investing in agricultural sectors and diversified sources of food security, and investing in children’s nutrition. Food insecurity is a global issue and requires global cooperation and long-term solutions. One study estimates that ending global hunger by 2030 would require an annual investment of $39-$50 billion. Inaction carries a high cost and an early investment in prevention is less costly than addressing a crisis once it has hit.

As I explain in the upcoming Monday Macro View that one of the reasons we focus so much on global food security is that hunger and conflict are inextricably linked and that hunger often drives conflict and violence. That makes it an important policy matter that impacts a country’s socio-political dimension. This can be seen in recent events eventuating in Pakistan where people are dying in stampedes in order to get free flour and subsidized wheat.

Source: Dawn – Police try to control the people gathered at a free flour distribution centre at Garhi Shahu. — White Star / M. Arif

Another important development and one that is being put on the backburner by the main stream media and analysts is the silent trade war happening between US and China. But first some perspective:

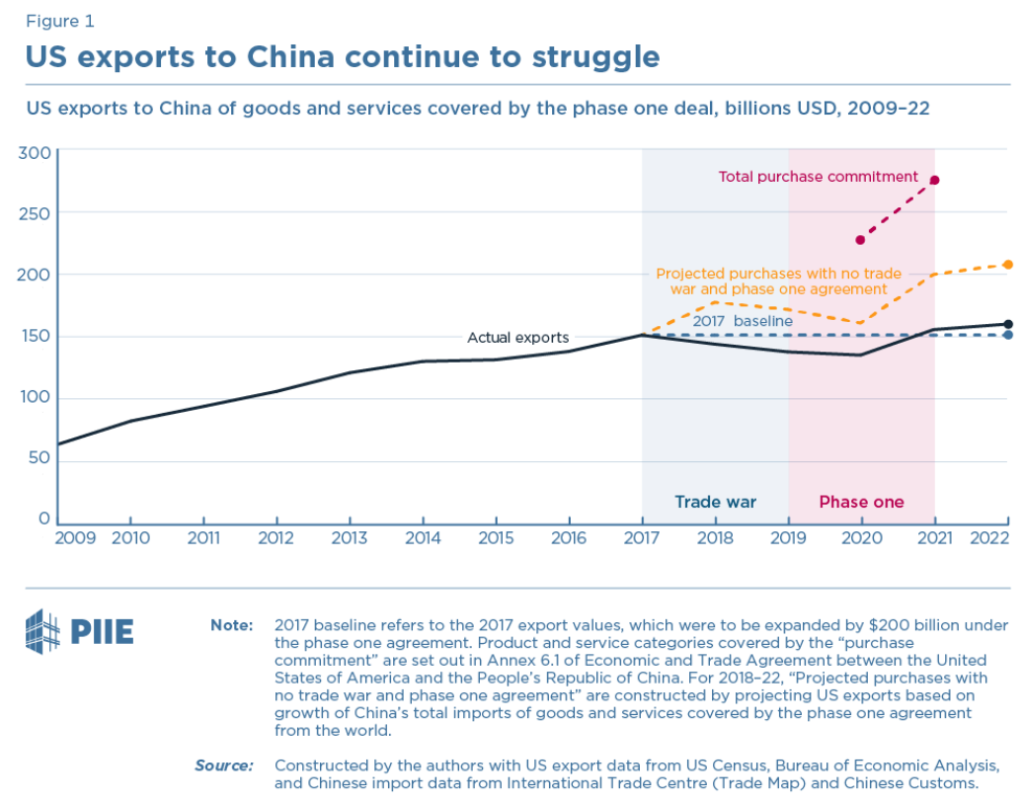

The US-China trading relationship was recently reported to have hit “record levels” in 2022, suggesting that economic “decoupling” has not occurred. However, the reported data point was misleading. US exports to China are continuing to suffer, and China is shifting some purchases of foreign goods away from the US. China began turning away from US exports in 2018, alongside its imposition of tariffs in response to Trump’s trade confrontation. Newly released data from 2022 shows that US exports are falling farther and farther behind foreign peers also selling into the Chinese market. The real news is that US exports to China are one more channel through which the bilateral relationship continues to deteriorate.

The value of US energy exports to China dropped 13 percent in 2022 from peak levels in 2021, reflecting a realignment of trade routes with Russia’s war on Ukraine. Despite skyrocketing world energy prices, US exports to China did not meet their purchase commitments in 2020-21 under the phase one agreement, but had expanded considerably from pre-trade war levels.

Now apart from these US has been adding Chinese groups to trade blacklist as recently as this month.

More details

More avenues are opening for what has been termed as the war of words between the two economic giants.

Moving forward I think a formal renewal of trade war remains the greatest tail-risk for global economic recovery that already seems to be on a shaky ground. U.S. allies are joining in as well:Japan plans to impose export controls on 23 types of semiconductor manufacturing equipment, including six categories used in chip manufacturing. The move aligns with the US policy of restricting China’s ability to produce advanced chips. Japan has not specified China as the target, and its goal is to prevent the use of advanced technology for military purposes. The new measures are expected to affect a dozen Japanese companies, including Nikon Corp, Tokyo Electron Ltd, Screen Holdings Co Ltd, and Advantest Corp. The restrictions will come into force in July and are likely to limit the impact on domestic companies.

Moving to the third factor which is that of the OPEC+ upcoming meeting on April 3rd. I and many other tend to believe that we might not see any extraordinary decision coming out of the April 3rd meeting. The markets have tipped into oversupply and there seems to be no sudden hike in demand at hand.

Ann-Louise Hittle, the Vice President of Oil Markets at Wood Mackenzie, says that the next OPEC+ meeting’s decision will depend on where oil prices are at the time. If prices remain in the $70s per barrel, the group may consider an additional production cut beyond the current one in place. Hittle predicts that the price decline following the SVB developments is likely temporary unless the US economy goes into recession, which would drag global economic growth slower than the outlook for a 2.2 percent gain in global GDP for 2023. Senior Global Analyst at RANE, Matthew Bey, says that OPEC is not likely to make any significant moves at its April meeting, but a decline in oil prices over the last week increases the possibility that OPEC+ will consider deeper production cuts later this year.

The 48th Meeting of the Joint Ministerial Monitoring Committee (JMMC) is scheduled to take place on April 3, and the 35th OPEC and non-OPEC Ministerial Meeting is scheduled for June 4. OPEC reaffirmed its commitment to the declaration of cooperation, which extends to the end of 2023, at the 47th JMMC meeting held on February 1 via videoconference.

I’ll stop here. Looking forward to seeing you all on Monday Macro View tomorrow! Happy Reading!