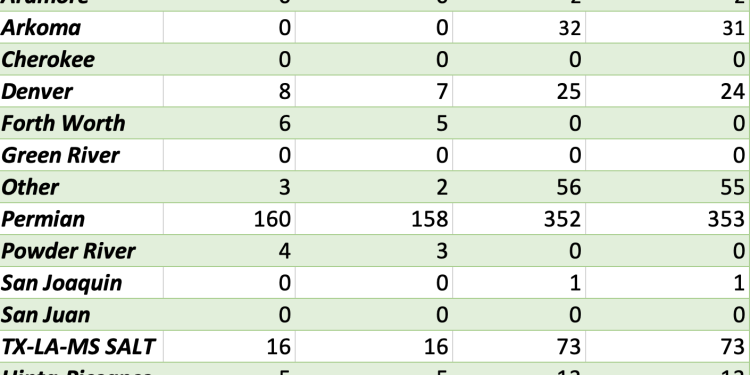

The drop in frac spread counts is inline with our expectations for a slowdown for Easter/ Spring Break. We are going to stay within a range of 285-295 over the next few weeks, until we get to the back end of May. As we move into June, the trend will move to 295-305 as we progress into the summer push.

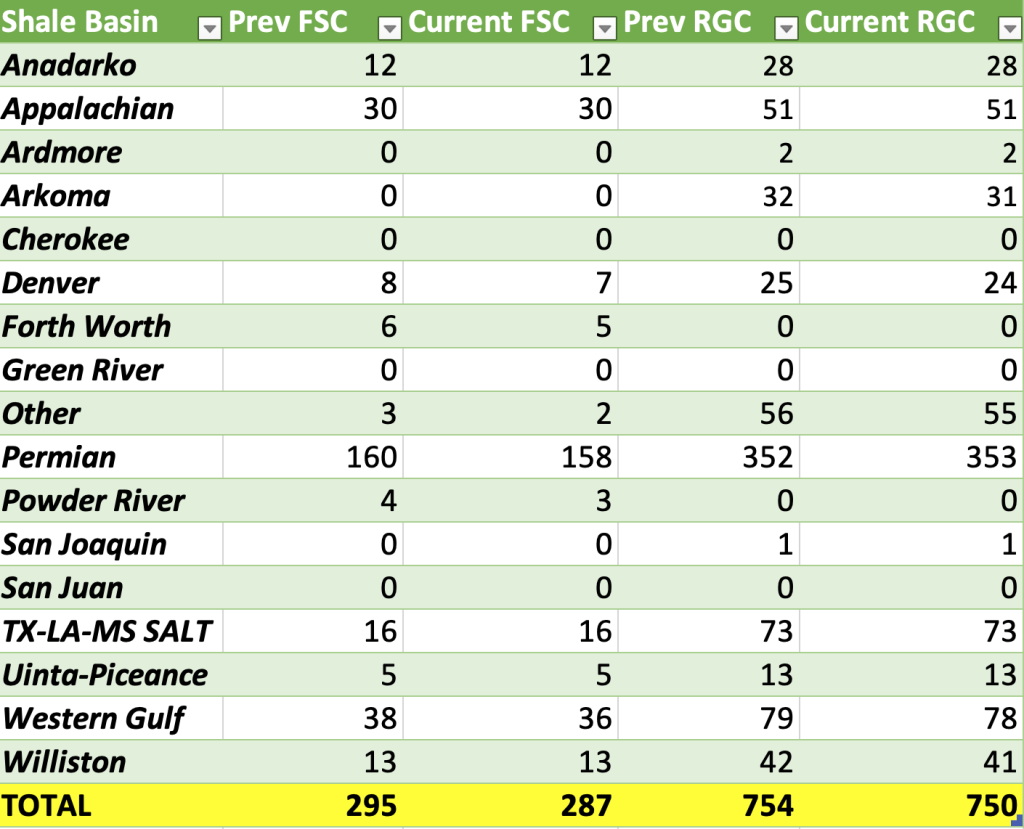

Saudi Arabia announced a voluntary cut in crude production along with other producers within OPEC+ on Sunday. The planned reductions are set for May-Dec 2023 with the following breakdowns:

Exports and general flows will be the important piece of how effective the productions cuts are having to the market. Kurdistan is currently in final negotiations to bring back the 400k a day that has been cut, so at the moment, they are producing “below” the current size of the cut. Iraq’s semi-autonomous Kurdistan region said it has reached an agreement with the federal government to resume oil exports through Turkey this week, after a legal spat pushed up crude prices. “Following several meetings between the Kurdistan Regional Government & Federal Government, an initial agreement has been reached to resume oil exports through Ceyhan this week,” Lawk Ghafuri, the KRG’s head of foreign media affairs, said in a tweet.” This is why exports are going to be so important to see how each region meets these voluntary cuts. Iraq agreed to 211k a day reduction, but Kurdistan brought that down by 400k and they are already producing below quota. “The actual reduction in supply may be smaller than the advertised volumes of around 1.6 million barrels a day, assuming that OPEC+ sticks with current reference levels for the cuts. Most OPEC+ members, like Iraq and Kazakhstan, are already producing significantly below their present quotas as they contend with under-investment and operational disruptions, and so may not need to make further curbs. RBC’s Croft estimated the cuts would amount to about 700,000 barrels a day from the core OPEC group.”

Is this against current production levels or using the OPEC+ quota as the benchmark? There are two clear ways to take this news:

- This is a bullish setup where OPEC+ led by Saudi Arabia is looking to protect the “$70 Brent Put” where prices will be supported to keep crude above $75.

- This is bearish because OPEC+ is seeing demand diminish, and they are trying to get in front of the drop in demand to protect price and keep storage “normal.”

Either way- this will keep Brent range bound over the next few weeks as the market digests the impacts of the cut, and how new economic data shows activity. We believe the back and forth put us back in the trading range of $82-$87 Brent. If Brent can break above $85, it should have a straight run to $87, but right now there is a lot of resistance at this $85 level. Our view is that we get Brent stuck around $85 and drift back down to the $82-$83 range but not moving any lower in the near term.

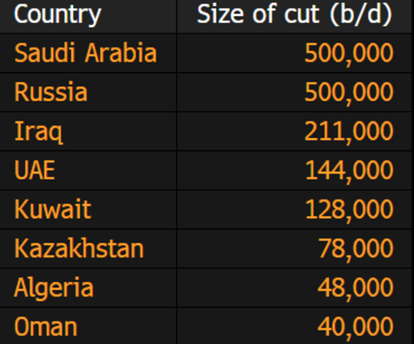

One of our more important bellwethers for crude demand has been floating storage especially in the Middle East and West Africa. The trend has been moving in the wrong direction pushing WAF physical prices lower.

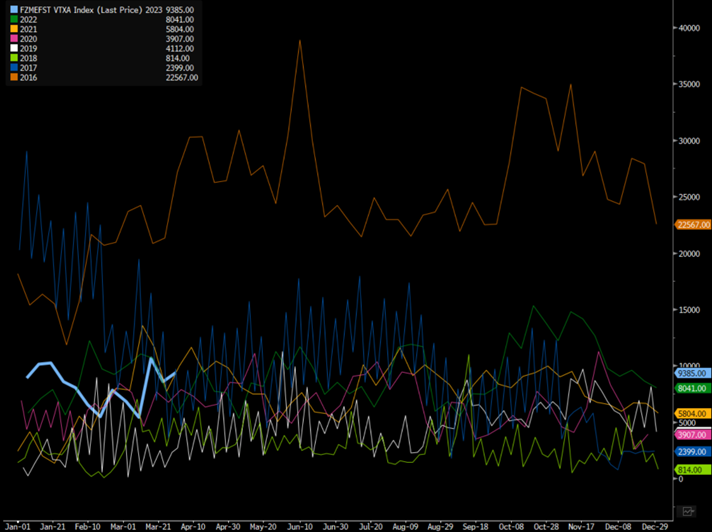

The Middle East floating storage remains at elevated levels seasonally speaking with 2016 much worse due to the OPEC price war that was kicked off at the end of 2014. The below chart looks at the Middle East floating storage market.

Middle East Floating Storage

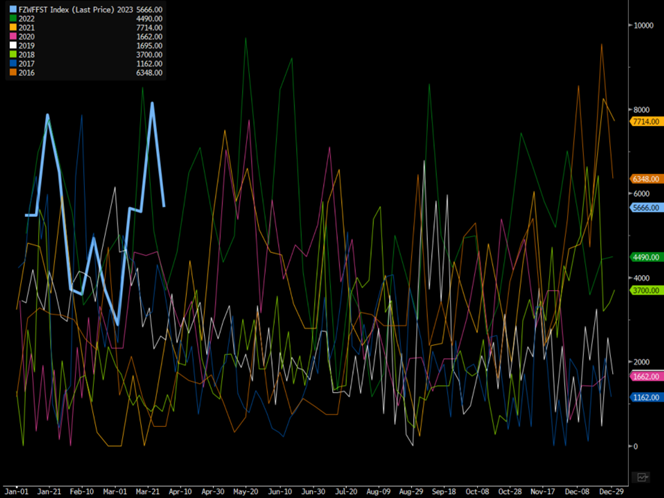

While the Middle East runs high, West Africa is showing very elevated levels at a seasonal record and still at the high end when we look at any other period throughout the last nine years.

West Africa Floating Storage

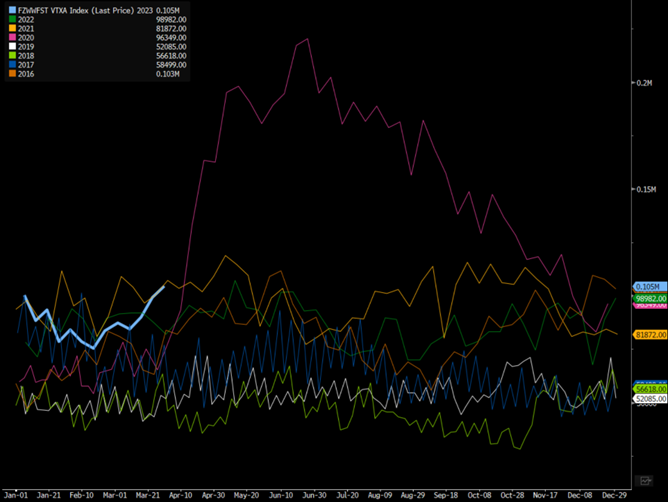

Crude in transit remains at all time highs with total global floating storage pushing back to levels not seen since 2021. The below chart showing floating storage has moved back to a near record, and could have been a bigger input for Saudi Arabia to lead a voluntary crude production cut.

Global Crude Oil Floating Storage

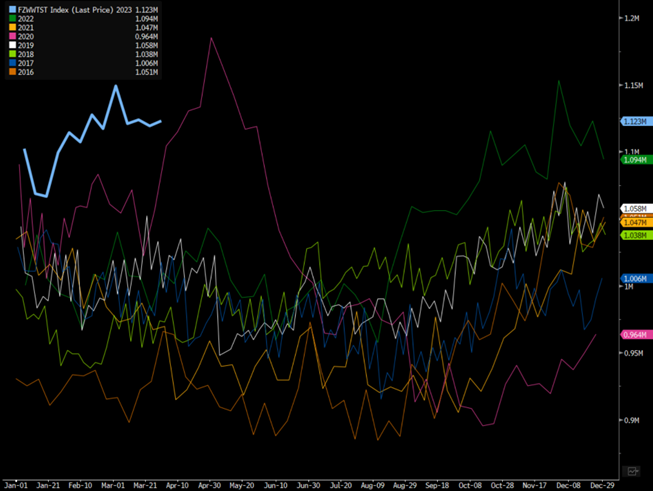

We have described many times how “crude oil in transit” is good leading indicator for “crude oil in floating storage.” Now that we have a big spike in floating storage- the hope would be to see a decline in crude in transit as the cargoes transition from moving to stationary- waiting to offload. Instead, we actually have crude oil in transit edging HIGHER even as we have floating storage moving back to 2021 levels. OPEC+ has wanted to keep crude prices above $75, and given the amount of crude sloshing around, making a sizeable cut for an extended period of time offered some protection. By KSA taking additional barrels out of the market, the hope is to absorb some of this floating storage, and reduce the number of cargoes on the water.

Global Crude Oil in Transit

For example, Nigeria is still struggling to find buyers for its oil as strikes at French refineries and seasonal maintenance at plants elsewhere in Europe curb demand. Little Nigerian crude traded last week, with more than 20 shipments for April loading still hunting for buyers, according to traders specializing in the West African market. That’s similar to 10 days ago, when 20 to 25 of the cargoes — holding 1 million barrels of oil each — were on the market.

It will take time to see if this strategy works as economic pressures build, but we are confident that while we wait for new economic data sets- crude prices will remain in their previous trading ranges- Brent sitting between $82-$87.

By pushing crude prices back up, it will support inflation around the world as diesel and gasoline prices find a small bid or at least a floor limiting price reductions. We already expected the Fed to keep raising rates by another 25bps in the next meeting, and this announcement will support that decision given the new numbers. With another bump in pricing, it will put renewed pressure on Emerging Markets that have struggled already to manage inflation while managing the slowdown in economic activity.

Here is a good quote “capturing” the unknown: “The last time OPEC+ drew criticism for an unexpected production cut, its approach was ultimately vindicated. The supply reduction of 2 million barrels a day agreed in October pre-empted a soft patch in global demand. Oil stockpiles built steadily in the months that followed, suggesting there could have been larger price declines without the curbs. This time around, the producer group’s move has been spurred in part by a deteriorating global economy and banking crisis, two things closely linked to high inflation and rising interest rates.”

Here is another “fun” twist: as prices stay elevated it will reduce demand further, which is already a problem when looking at diesel and gasoline. The decision to cut production can reduce the potential for a slump in pricing and big build in storage if a full-blown recession hits later in the year. But it also increases the chances of a short-term crude price spike, which would stoke the inflationary forces that have wreaked such havoc in the global economy.

The current economic and crude backdrop continues to resemble the 1970’s with inflation, supply limitations, and economic headwinds on multiple levels. There have already been some additional reductions in GDP estimates following the reductions, and we believe it will likely get worse as the consumer struggles further.

The stress on countries is growing- especially their economies- as we received another example of Japan breaking with the rest of the G7 and EU27 by purchasing Russian crude above the price cap. Countries are going to struggle resisting discounted crude as prices move higher, inflation remains elevated, and economic activity deteriorates.

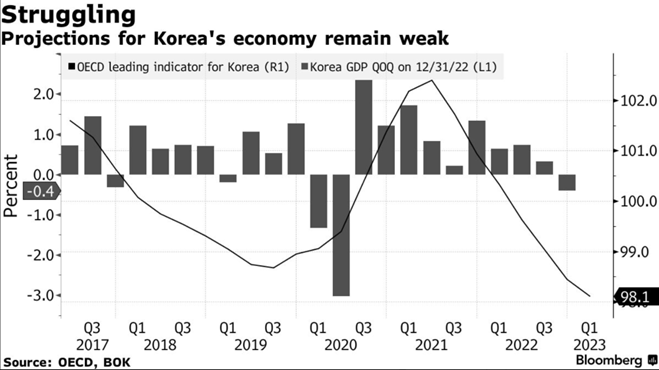

When we turn to global manufacturing, there have been some surprises to the downside on manufacturing PMIs, exports, and new orders. China was the most recent to post slightly disappointing figures that fell below expectations, but the biggest concern is the contraction reported in new export orders.

The official manufacturing PMI reports 51.9, which is better than the Caixin 50, but even with the better headline number- “New Export Orders” also underwhelmed. A key leading metric on both indexes showed deteriorating that is consistent with the trade data (export/import) we are seeing on a global level.

On the Chinese non-manufacturing PMI, it’s important to look at the sub-components that are showing a mix of data points. Construction and government spending is supercharging the PMI while household/consumer spending remains underwhelming. The interesting note is that the government is also supporting the construction spending, which makes it harder to believe the rally is sustainable in the longer term.

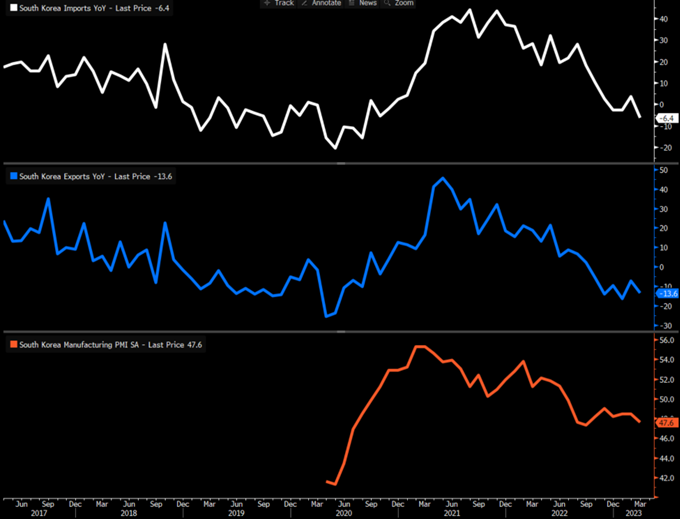

South Korea saw a similar problem with March exports falling 14% marking the 6th straight month of negative data. Exports to China also suffered the largest drop in over 14 years at a decline of 33%. Imports, a key bellwether for future flows, also posted a decline of 6.5% showing more pressure not only internally but in their export orders as well. On the positive side, exports were expected to be worse, but the trend is moving in the wrong direction for this important global trade indicator.

Here is another indicator for the economy that is an important indicator for growth in the region.

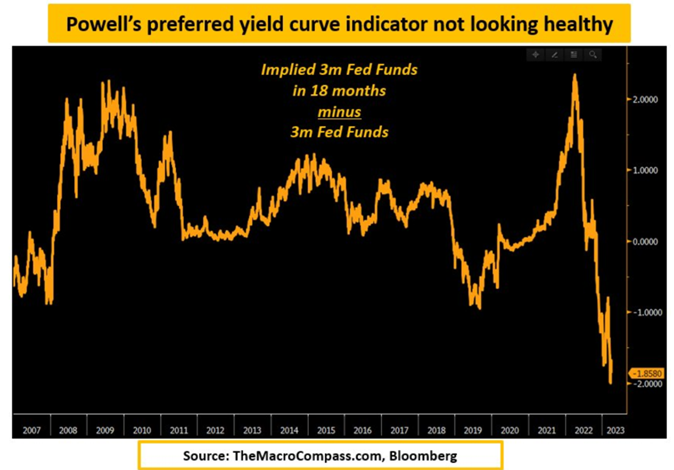

In the U.S., there has also been a fairly broad based slowdown in the market with consumers indicating less spending through the summer months- as we discussed in our most recent reports. Powell has shifted over time the yield curves that he deems “important” because remember when Powell dismissed yield curve inversions because his ”preferred indicator” was not inverted yet? Well now the one he has indicated is the “most important” has gotten completely run over with more pressure to the downside as the market digests the OPEC news.

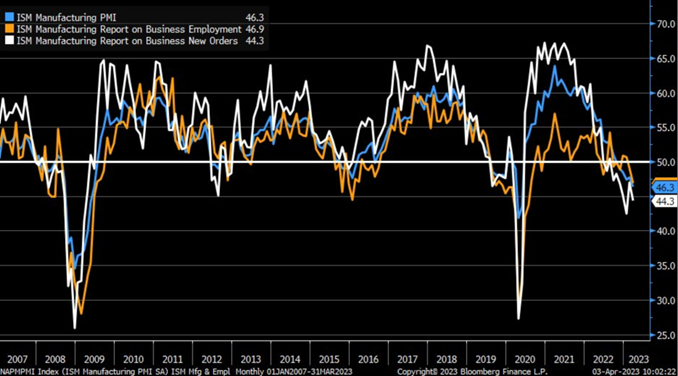

The most recent data on the manufacturing front in the U.S. took another shift lower- especially the important “New Orders” moving deeper into contraction. March ISM Manufacturing at 46.3 vs. 47.5 est. & 47.7 in prior month; new orders down to 44.3, prices paid back into contraction at 49.2, and production edged slightly higher (but still contracting at 47.8) … employment fell further into contraction (lowest since July 2020).

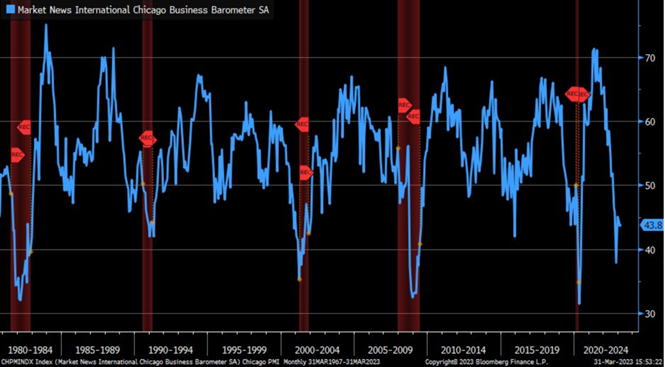

The regional Fed data continues to signal recessionary backdrops with growth either falling further or stagnating in contraction territory. “Chicago PMI has struggled to regain some momentum to upside; hasn’t yet made it out of contraction and continues to hover near recessionary territory.”

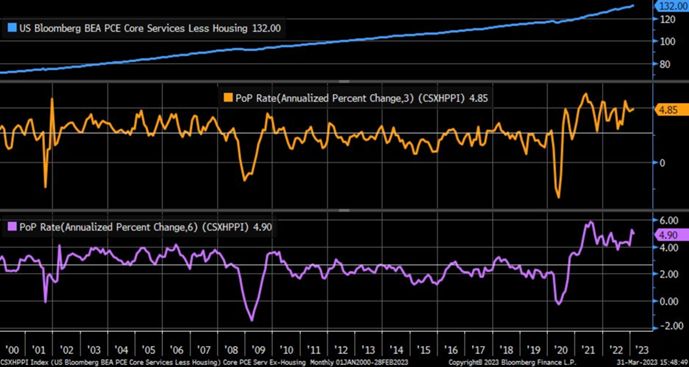

Even while the data looks recessionary, we have very sticky inflation with little help coming from the OPEC+ voluntary cuts. The Fed also prefers to look at the PCE Core Services ex-housing, but it’s looking problematic for a potential “pivot” on many metrics: 3-month annualized % change (orange) ticked up to 4.85% while 6-month annualized % change (purple) moved down to +4.9%.

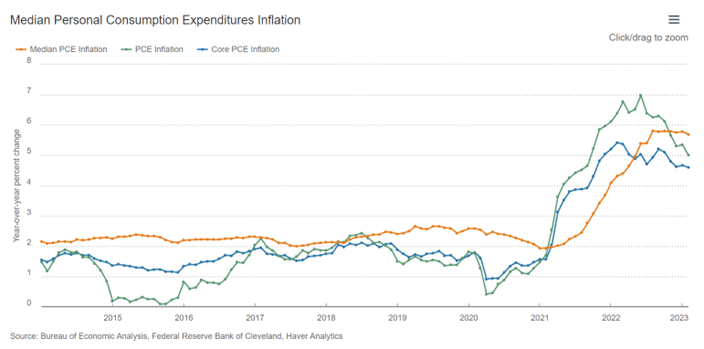

When we look at it a slightly different way, Median PCEW and Core PCE Inflation has flatlined with some new indicators pointing to a small bounce.

The data is pointing to more stickiness as well as a bit of an increase in the “problematic” areas- including core PCE, core CPI, and service inflation. All of this just points to inflation being FAR from transitory and more rate hikes needed (and not just in the U.S.) to stay in front of inflation.

This is translating into more pressure in the shipping/trucking world with another round of pressure creeping into the market now.

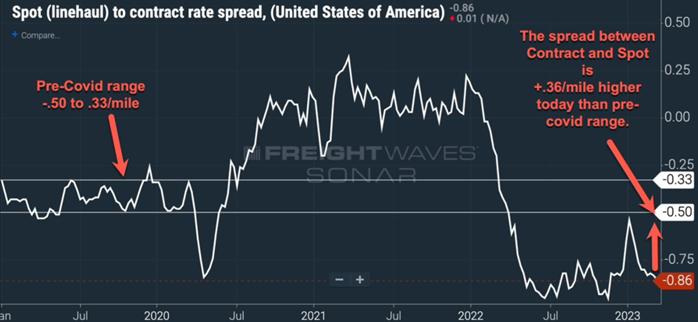

Here is a great breakdown from Craig Fuller regarding the state of the trucking market: “With tender rejections so low, spot rates are unlikely to trend up. What does this mean for trucking contract rates? Since trucking capacity between contract and spot is fungible, the spread tells us what we should know about the direction of contract rates. Contract rates and spot rates should trade within a tight range. Spot rates “pull on contract rates.” If spot rates are much higher than contract rates for a few months, it will “pull up” contract rates. If spot rates are much lower than contract rates, it will pull down spot rates. Over time these rates should trade within a tight range. Removing fuel surcharges entirely from both indices, we can see that the spread pre-covid was in a range of -.33 to -.50/mile. In other words, pre-covid, it was $.33 to $.50/mile cheaper to move a truckload in the spot market versus contract. Today, that spread is $-.86/mile. As long as this spread is so wide, shippers will continue to look to the spot market for capacity solutions and carriers will want to replace any spot loads with contract rates, even if they are cheaper than they have historically bid contract rates at. Eventually, this should converge within a historical range. This is RFP award season, meaning that shippers are going to place contracted freight with carriers that bid closer to the spot rates they are currently paying. Truckload carriers should prepare for a brutal bid season. Shippers are going to claw back most of the COVID contract rate gains.”

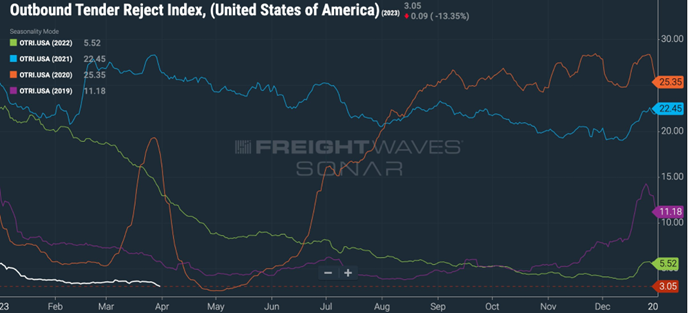

As tender rejections increase, we are getting more pressure especially as 2023 is setting up to be WORSE than 2019- which was a TERRIBLE year for trucking.

In 19′ the drop in activity was called a “trucking bloodbath”, as excess capacity flooded into the market in the wake of the ELD mandate. Now, 2023 looks to be worse, as tender rejections are on verge of dropping below 3% (now 3.05%) with the low achieved in 2019 being 3.86%.

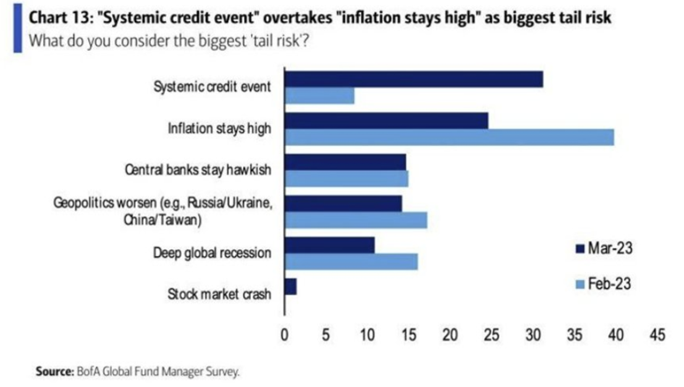

As the economy slows, the fear around a credit crunch grows with little the Fed trying the “lend” liquidity into the market without conducting “outright” QE. There are still significant pockets of liquidity, but it’s getting locked up in the overnight markets without much movement through the system. The slowdown in the money supply, which is needed to reduce rampant liquidity, is becoming a much bigger gear as we progress through the year.

In our view, the Fed will be unable to pivot for fear of making the same errors as in 1978, and as we have highlighted, their failure to raise rates and stop QE in ’21 and ’22 has put themselves in these dire straits. The long term health of the economy requires them to hold strong, but the political winds are shifting and they will be faced with growing backlash. The below is a quote from an article I wrote back in Feb of 2021 that I think sums up where the Fed sits: “We have been in a world stuffed with liquidity and central bank easing since 2008, which is now setting off a chain reaction of rising rates. Central banks need perpetual motion to keep the merry-go-round operation and a buyer of last resort . . . they are losing both. The game isn’t over yet, but we are seeing the implications of what a bubble in everything looks like, and the fragile nature of the underlying economics. We are nearing the end of the circus: CHAIR POWELL: “[Lower interest rates] make it cheaper to borrow, they do raise asset prices, including the value of your home. But for people who are really just relying on their bank savings account earnings, you’re not going to benefit from low interest rates.” The activity from the Fed has driven inequality to all new heights, with wage compression everywhere and asset prices flying. People have scrambled to get involved, but at the risk of losing everything in the GameStops and other meme stocks. The coil continues to get wound and the spring is loaded. Bubbles have been inflated around the world, and because we are all so interconnected, the dominos are in place. A failed auction is just around the corner. That could be a bid-to-cover below 2 approaching 1, or a straight-up failed auction, where a key country fails to sell the full amount of debt being offered. This means no more spending . . . this means austerity . . . higher taxes . . . it means money is no longer free. The party’s over!”

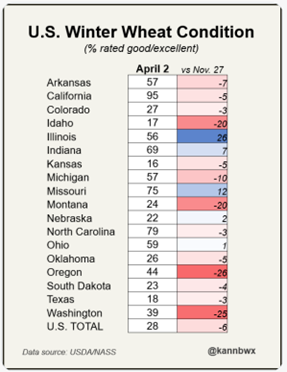

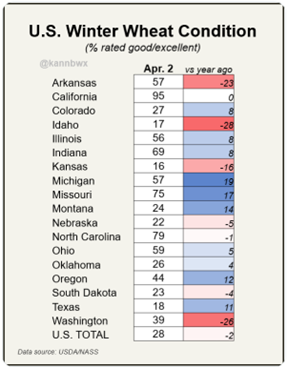

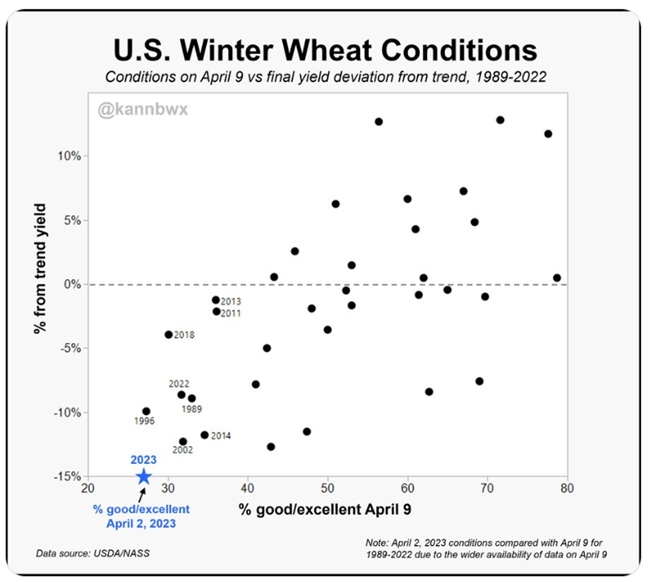

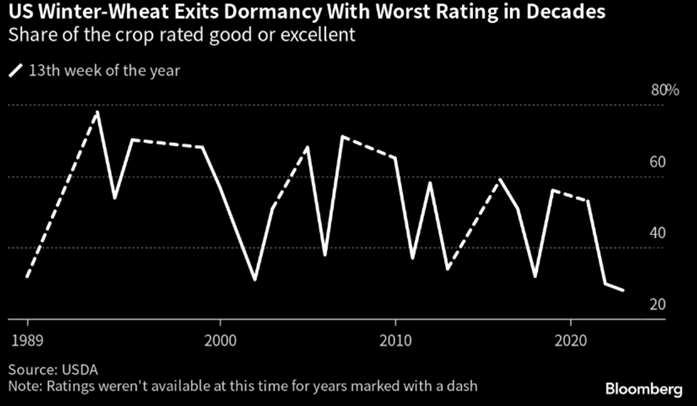

The food situation continues to deteriorate around the world with crop estimates being reduced around the world- especially in wheat. Wheat is a staple crop for many emerging markets globally, and a change in yield will have significant impacts to price and availability. The U.S. is a key exporting nation, and we have racked up one of the worst conditions in our recorded history. No matter how you look at the data- this year’s crop is shaping up to be worse than last year- which was one of the worst on record. To put that into perspective, 28% good/excellent is the second worst condition going back to 1987.

The bigger concern for the world is the shift we are seeing across core crop yields that are struggling driven by weather shifts. Driven by over farming, soil degradation, and other impacts- yields have been disappointing around the world while the global population keeps moving higher. The food supply chain is getting stretched, and we need to come up with meaningful solutions to drive yields higher while keeping prices low for the farmer. Inflation for the farmer has shifted higher across interest rates, seeds, fertilizer, diesel, and other input costs that will be passed down to the consumer. This will increase stress for the consumer, and if the farmer can’t afford the same amount of seeds or fertilizer as “normal”- yields will be directly impacted.

Russia’s invasion of Ukraine only made the situation worse with falling yields (inability to plant) as well as barriers to get product to market. The most recent supply chain issues are Louis Dreyfus, Viterra, and Cargill no longer exporting Russian grain starting July 1st. To put this into perspective, from July 2022-March 2023 these three traders shipped a total of 14% of Russian wheat. You might say- well this is taking money away from the war effort, which is accurate, but it also takes more grain out of the market and stresses an already tight market.

One of the largest buyers of global wheat, Egypt, is struggling to manage their food supply following shortages and currency problems.

Egypt’s wheat imports in the season that runs through June are seen at 10.5m tons, USDA’s Foreign Agricultural Service says in a note.

- That trails the latest official USDA estimate for 11m tons and would be the second-lowest of the past 10 years

- Decrease is due to the fallout from the war in Ukraine and an ongoing foreign currency crunch

Egypt has announced they have wheat stocks that are sufficient for 2.3 months- which puts into perspective how tight their market currently is at the moment. The market is unlikely to get much better with drought gripping some of the U.S.’s key winter-wheat growing regions for months, including Kansas and Oklahoma. Soil moisture levels are becoming more vital with crops resuming growth as spring sets in. The poor US weather presents a setback to rebuilding global supplies, as other key growers also face challenges. A historic drought ravaged Argentina’s crops, Russia’s war in Ukraine has forced farmers to reduce plantings, and Canada is facing a dry spell at the start of its spring-wheat growing season. Still, growing conditions are largely good in the European Union.

I just want to stress the underlying decline of U.S. winter wheat conditions that have experienced lower highs and lower lows- a terrible trend as the world runs tight on food.

Europe has seen some increases in the same period, but the broad shortfalls in the world means that the additional EU cargoes will do little to address the shortage. A lot of these additional cargoes are also going to North Africa, which is leaving Southeast Asia and other African nations short on availability.

The European Union’s soft-wheat exports in the season that began July 1 reached 23.1m tons by April 2, compared with 21.5m tons a year earlier, the European Commission said on its website.

- Leading destinations included Morocco (3.58m tons), Algeria (3.38m tons) and Nigeria (1.97m tons)

- EU barley exports were 4.52m tons, compared with 6.33m tons

- Corn imports stand at 21.2m tons, against 12.3m tons

Canada is another important producer for global wheat and canola markets, and their issues are stressing the system further. “A dry spell is parching Canadian farmland when growers most need moisture to plant the wheat and canola crops that help feed the world. Parts of the Canadian Prairies have experienced the second-driest start to a year in 45 years, said David Streit, senior meteorologist at Commodity Weather Group. Swaths of key spring wheat regions including Alberta, Saskatchewan and Manitoba have received less than 60% of average precipitation since Sept. 1, according to Canada’s agriculture ministry.”

Russia could add new fears to the market if they don’t renew the Black Sea trade deal that allows passage of Ukraine vessels along a set route. As Finland officially joins NATO- Russia could get rid of the deal in retaliation for the new NATO member.