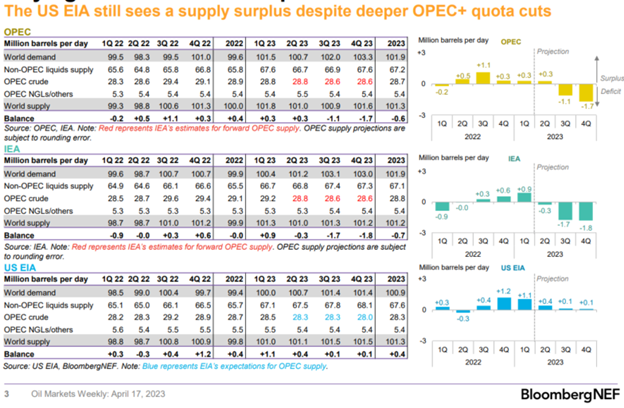

The major agencies have adjusted their estimates for supply/demand of crude following the OPEC+ cut. Even with the adjustment, we are still going to see a pretty balanced 2023, which is tighter vs initial estimates. The tighter assessment makes sense following the broad reduction in supply, but the question now shifts to underlying demand as margins implode for refiners. The biggest demand drivers are hurting, and the questions shifts back to: “Was OPEC+ smart to make the cut because they saw it coming or was the reduction in the supply the driver?” There is probably truth in both statements, but Saudi keeping OSPs elevated is a much bigger problem for refiners. The crunch on margins has been our biggest concern, especially on Asian refiners.

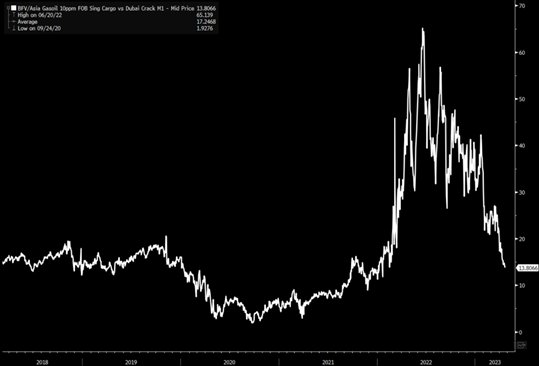

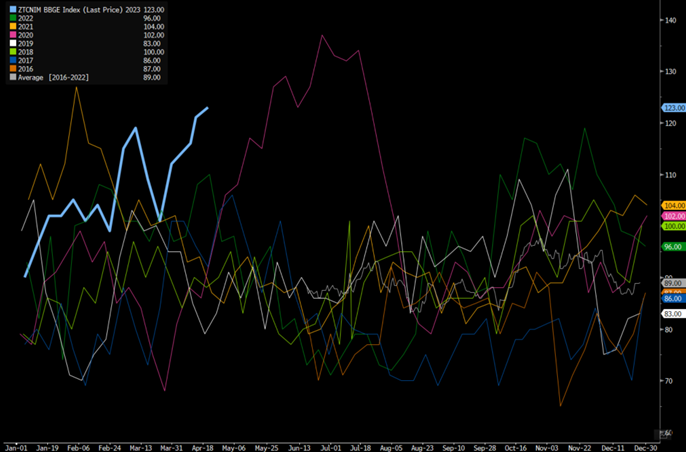

We have been consistent with our biggest concern being the Asian diesel (gasoil) crack spread. The below chart puts into perspective just how big the hit has been, and the pressure continues to the downside. We don’t see much support for crack spreads in the near term, and as gasoline (light distillate) storage remains at record levels- the pain will only persist. There has been a big increase in exports of Chinese product into the market that has depressed cracks further. It has been a straight move down with little pause even as Chinese refiners reduce runs in April and likely May.

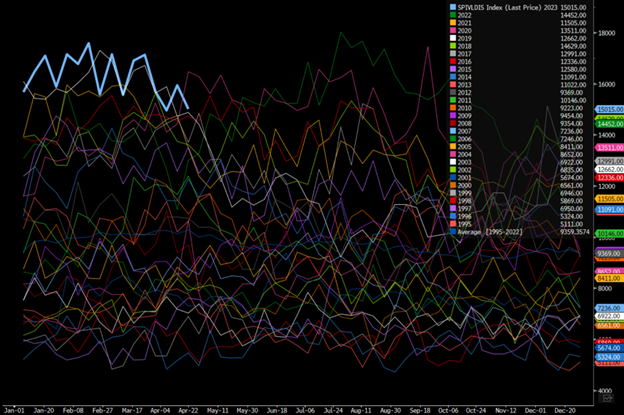

The below chart looks at Singapore storage of Light Distillate, and you can see how it remains at record setting levels on a seasonal basis. It just recently dipped slightly below 2020, which was expected as some buying picked up ahead of the Eid holiday. Even with a major Muslim holiday, we don’t see inventories dipping by much as flows continue to move into the market. This just highlights that the gasoline crack isn’t coming to save the refining complex, and they are forced to rely heavily on the middle crack spread.

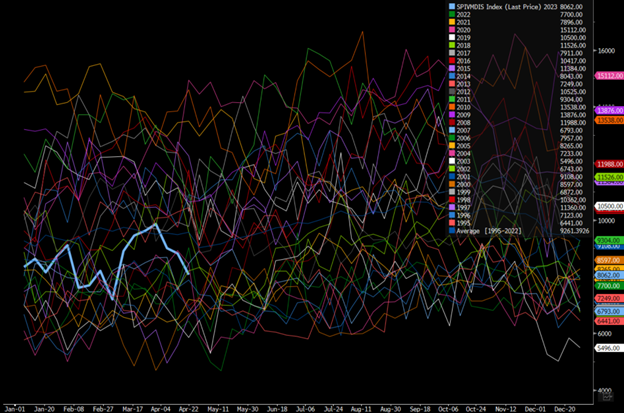

Singapore storage of middle distillate remains on the low end, but it’s still above 2022 levels with more pressure coming from the economic slowdown as well as Russian and Chinese exports. Storage levels have moved back towards 2022 levels, but we are heading into Ed so a drawdown of storage is normal. Following the holiday, there is usually a period of builds, which will drive builds back to the seasonal average.

The confidence in that view stems from flows originating from Russia, China, and builds/spreads in Fujairah. Here is a good quote summarizing the builds in Fujairah and the driver behind deteriorating spreads: “Stocks of middle distillates, including diesel and jet fuel, increased by 945,000 barrels or 37.9% on the week to 3.439 million barrels. The East of Suez gasoil complex remained under pressure April 18, weighed by supply-side fundamentals. Brokers pegged the front-month Singapore gasoil time spread at plus 20 cents/b during intraday trading April 18, narrowing slightly from a more than 19-month low of plus 21 cents/b at the Asian close April 17. The spread was last narrower at 20 cents/b on Aug. 31, 2021, S&P Global Commodity Insights data showed. “Asian demand is stable but the market is not good with more gasoil in the region,” said an Asian refinery source. Asian gasoil traders said Persian Gulf- and Indian-origin gasoil cargoes were being directed to the region, driven by poor East-West arbitrage economics. The possibility of incremental volumes adding to Asia’s supply weighed on the market.”

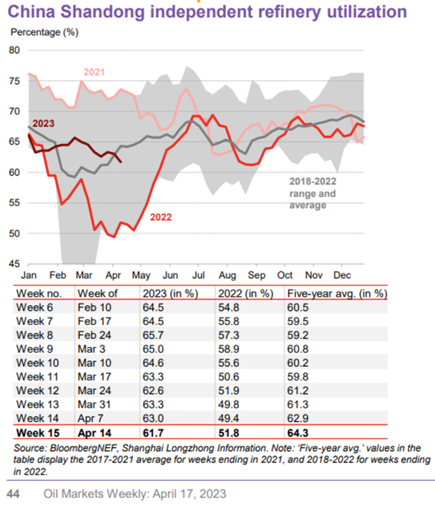

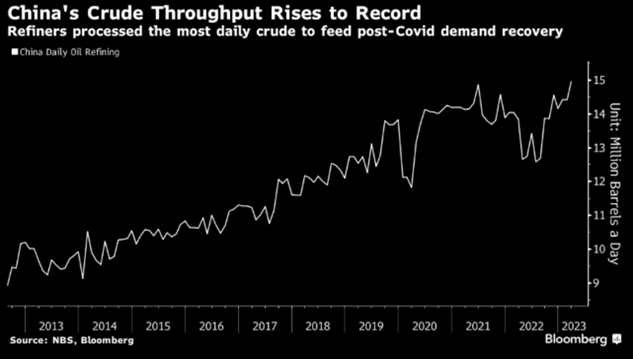

Chinese refiners hit records in March, but a lot of that was a push ahead of planned downtime in April and beginning of May. We assumed that Chinese teapots were going to maintain runs, but they have also pulled down some of their utilization rates. Our view was that activity would flatline at around 63%, but we had a bit of a drop to around 60% that should be the floor. The state-owned refiners are the biggest driver of the slowdown after having the big push. There is still a sizeable amount of the export quotas remaining, which will be used to balance out storage throughout April-May.

The below chart shows the level of activity that occurred during March in China. While some of this will be consumed locally, a large chunk of it will find its way into the market driving down spreads further.

“However, an uptick in seasonal maintenance in April and May points to refiners reducing process rates in those months. A total of 62.4 million tons of capacity was under maintenance as of April 13, compared with 39.3 million tons two weeks earlier, according to OilChem.” There has already been a sizeable reduction in April, with some of that carrying over to May- not the full amount, but enough to move us back to a seasonally “normal” level.

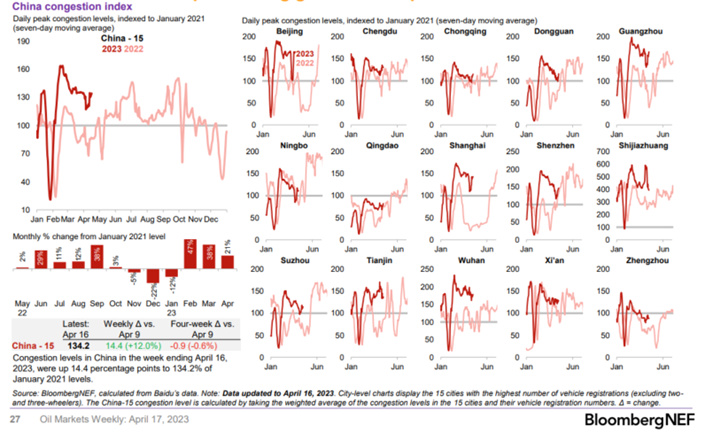

Chinese demand has remained stable on the diesel front with a nice pop in gasoline that was mostly expected following the end to zero-COVID policy. Our expectation has been an increase above 2022 that would ebb and flow along seasonal norms- just at an elevated level. So far, that has played out, which we don’t see changing over the next few months. It will be important to see how China’s labor day plays out when it comes to travel and spending to see how close to normal we will be.

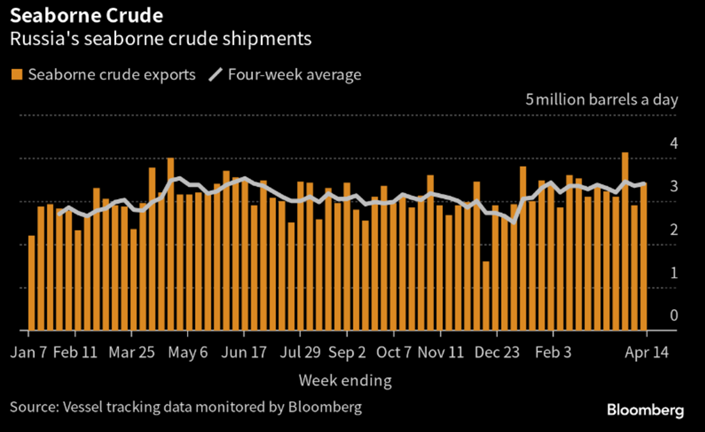

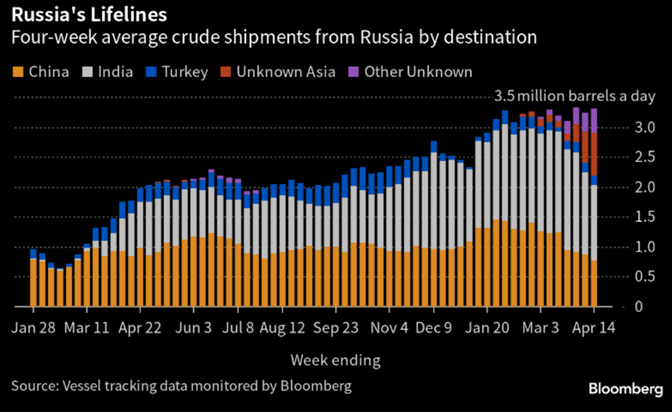

The shifts in the crude market continue as additional Russian cargoes push into the Asian region. Most of the below flow is heading into China and India with a larger portion slated as “unknown Asia.”

China remains a major buyer of crude as they take advantage of the steep discounts of Russian crude. We have seen Russian cargoes coming in at steeper discounts over the last few weeks, which is helped further by a fall in shipping rates. The biggest problem right now is seeing Chinese buying of Middle East and WAF volumes falling while they are at a record setting pace of buying based on imports of supertankers.

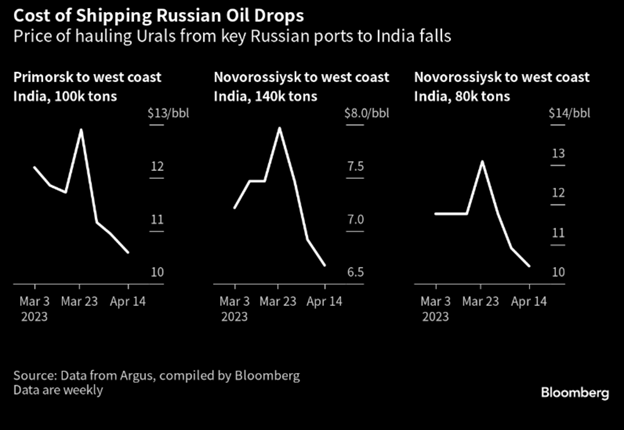

Even as more crude heads into the Asian markets, the cost to move it is diminishing in a signal that there are more ships available and some softness in demand is emerging. India remains a large buyer, but the cost to move the barrels is falling that will also help some of the refining margins for those companies that import Russian crude.

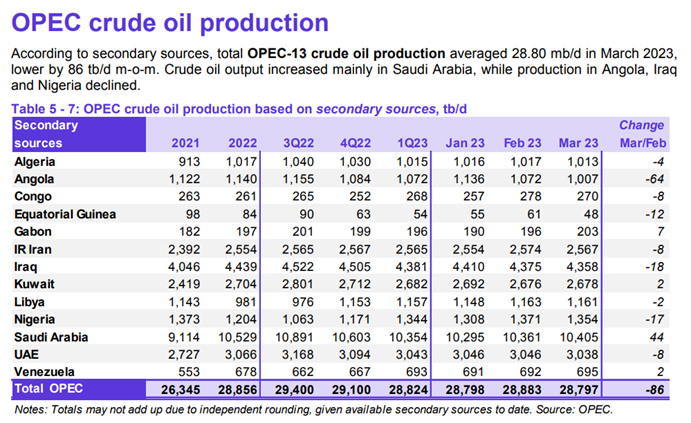

As Russian flows continue, it’s important to look at OPEC production for March and what the “cuts” in May will look like as the voluntary reductions should take effect. Production had a small step down in March that was driven primarily by Angola and Nigeria, which is another signal on demand weakness. We have been documenting how prices keep falling in the WAF region, and given the current volumes sitting in the water- we see physical price pressures persisting.

Angola still has 3-4 crude cargoes left to sell out of the 35 scheduled for May loading, according to traders with knowledge of the matter.

- The figure has eased from 4-6 as of April 14

- The next trading cycle started earlier this week with the release of the June program

REPUBLIC OF CONGO

- Between two and three consignments out of eight of the Republic of Congo’s Djeno grade are still yet to find buyers

- That’s little changed from April 14

- NOTE: Djeno’s next program for June is due around April 24

NIGERIA

- Nigeria still has a significant amount of May-loading crude looking for a final destination, but the tally is unclear because it’s not yet known how many shipments will be affected by Exxon Mobil’s force majeure on loadings from Qua Iboe, Erha, Usan and Yoho crude, traders said

- 30 Nigeria cargoes for May were unsold as of April 6; 41 were scheduled in total

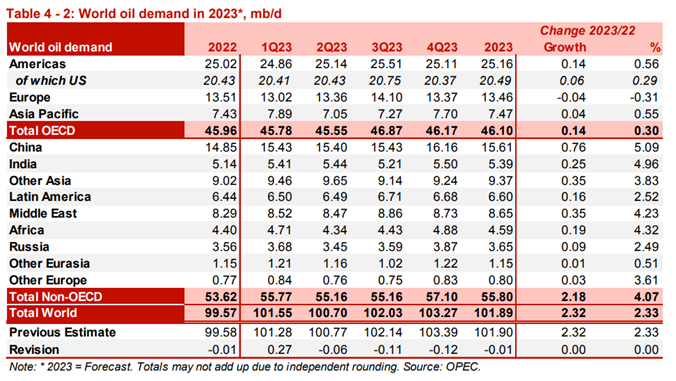

Another key aspect of the OPEC report is their expectation of demand. They have reduced some of the demand estimates, but still see over 103M barrels of demand in the 4th quarter of 2023. Given the economic pressures, we don’t believe that we will hit these levels. This will result in net builds for the year, but nothing as large as we were initially expecting. Because of the OPEC voluntary cuts, it has driven up prices and reduced broader demand as it puts pressure on crack spreads. As demand wanes, it will force refiners to cut runs further and create a broad miss on demand as we progress throughout the year. OPEC+ is putting a lot of faith in summer driving and activity, but we remain cautious on demand.

The supply side is also complicated by the loss of Kurdistan flows through Turkey by way of the Ceyhan pipeline. “Iraq needs to resolve billions of dollars in financial claims with Turkey before resuming oil exports via a Mediterranean port, threatening more delays in bringing almost half a million barrels a day back to the market. On Tuesday, Iraqi Prime Minister Mohammed Shia Al-Sudani said he hoped flows of the country’s crude from Ceyhan could restart this week after being blocked by Turkey in late March. But while Baghdad has struck a temporary deal with officials from Iraq’s Kurdish region to get the oil moving again, it’s yet to get Turkey’s approval. Ankara will likely want to negotiate an international legal ruling that it owes Iraq $1.5 billion related to past exports from Ceyhan. “This could drag on for months,” Robin Mills, founder of Dubai consultancy Qamar Energy, said. “The sticking point is the Turks.” The Turkish government didn’t immediately respond to a request for comment. The dispute is hurting Erbil and Baghdad alike, with oil worth hundreds of millions of dollars having been held back. While small in the context of the global market, it’s also another disruption for traders already grappling with OPEC+’s decision to cut production again and an outage in Nigeria.”

Turkey and Iraq have a lot to work out, which will keep flows tight into Europe and support U.S. exports into the region.

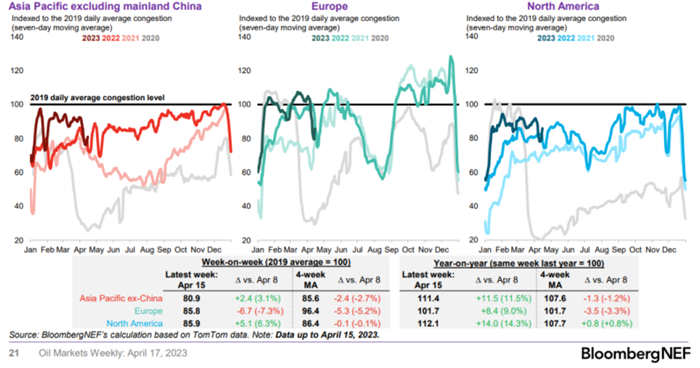

Just as an example, when we look at gasoline demand around the world- we are seeing a broad reduction. As we have been saying, we believe gasoline demand in Asia and North America will remain well off “normal”, which is made worse by the sizeable drop in global distillate demand.

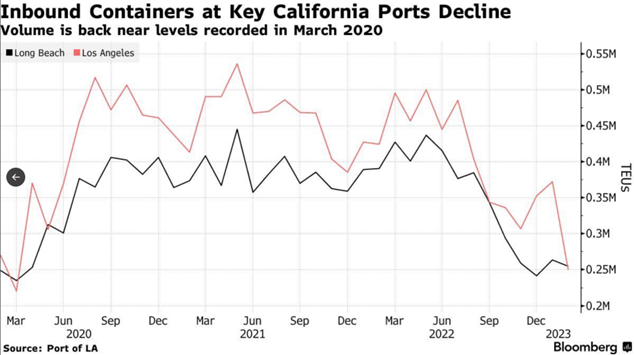

Distillate pressures will remain as economies face more headwinds as inflation persists and underlying manufacturing flows are reduced. When we start looking at global trade flows, the concerns only grow when considering crack spreads and Russian/Chinese flows. Volumes of product into the U.S. is dropping to the beginning of COVID levels and have no dropped through 2019 indicating more pain ahead.

When we turn to shippers, we can see that the demand indicators for the next few months point to more pressure on global trade.

The reduction in demand, which we are seeing globally based on export/import data, is also driving down basic rates.

The reduction in volumes in driving down rates across multiple shipping types, and helps to drive home the weakening economy.

Even as the economy slows, we aren’t seeing prices fall in commodities to the same degree because of the broader supply shortfalls. We have them in grains as well as crude to a degree driven by OPEC+ cuts. Russia had no choice to reduce their flows as their storage is maxed out and access to pipelines are diminished.

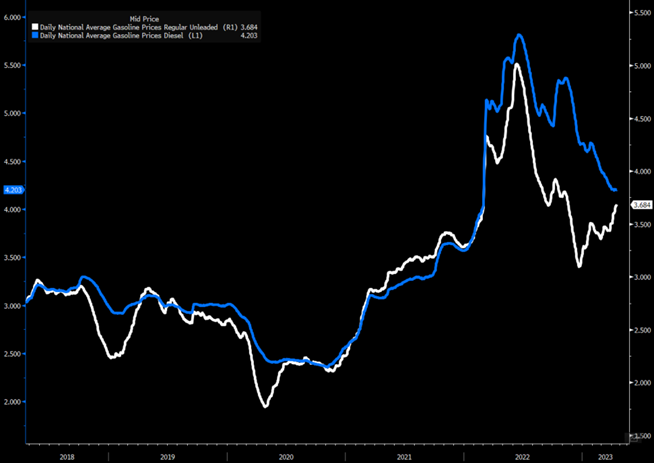

The shifts are causing a problem on gasoline pricing- especially in the U.S. which will also hinder underlying demand heading into the summer months. A significant amount of gasoline is still “trapped” in Europe, and as shipping rates drop- it will unlock more flows from Europe into the U.S.

Russia is also sending more product into traditional U.S. export markets, which will push more U.S. product into Europe. This is going to cause a sizeable drop in U.S. exports of gasoline and diesel, and we are starting to see more cracks in the European markets.

Part of Europe’s benchmark diesel futures curve shifted into a more bearish structure.

- ICE Gasoil futures from July to October are now in a contango pattern

- NOTE: A contango structure is when prompt contracts are cheaper than those for delivery at a later date

It’s all just more support around the weakness in the economic backdrop.

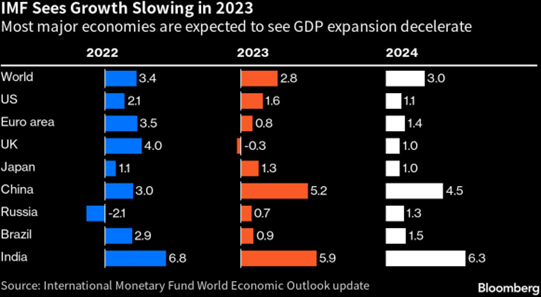

The IMF has begun reducing their growth estimates, and we believe they will continue walking back GDP numbers throughout the next few months. Inflation is remaining sticky around the world, which is causing Central Banks to maintain their hawkish stance. We still believe that the IMF is too aggressive on their growth, but we do agree with their view on 2023 into 2024. They are showing limited growth y/y, which is something that is very likely given the strain on the underlying economy.

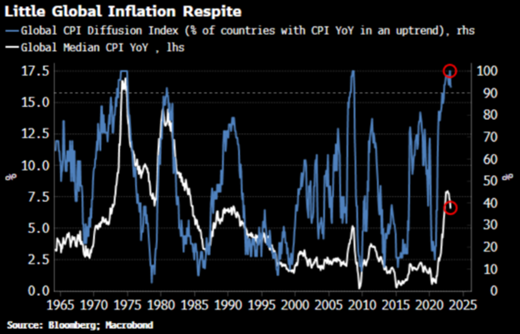

One of the biggest overhangs in the market remains inflation that will keep central banks active in the market. Inflation around the world is still pinned at highs- especially when you look at core inflation. This isn’t adjusting anytime soon as commodity prices are elevated around the world. The amount of liquidity that has been in the market since 2008 only intensified as it expanded in 2020. Driven by liquidity fears, it’s near impossible for Central Banks to remove money at the same rate it’s injected. This is I think a pivotal fact that was missed by many of the “Experts” that discussed ZIRP and perpetual QE. We are seeing it play out around the world by triggering an inflation spiral.

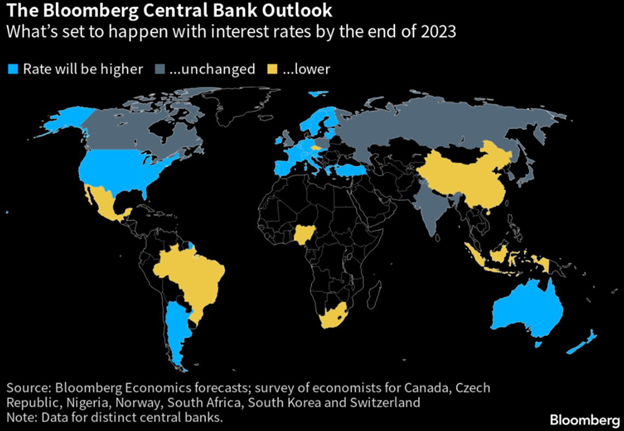

The hawkish stance of Central Banks is going to keep global liquidity depressed and drive down credit impulses. As credit impulses stay low, the movement of money (velocity of money) through the system will stay hindered in a big way. This will impact CAPEX, investment, hiring, and all other corporate activities depressing global growth.

When we look at the largest countries in the world, many of them are still in a rate rising cycle with little to slow their rise in the near term. Inflation will be the biggest factor that will keep rates pushing higher.

The below chart puts into perspective the rate rising cycle, but we disagree with the “dovish” stance of the PBoC. If the data is even half right (which is probably the case), there is no reason for the PBoC to stimulate or cut rates further. Their goal has been to reduce liquidity and pull a ton of excess from the market that has been flooding their markets for the last 20 years.

Our stance on the PBoC could change over the next few months as more credit risk expands in China, and manufacturing/construction/ infrastructure spending struggles. Right now- the expansion in the country is being driven internally as external factors show more pressure forming. We don’t believe the GDP figures- let alone the beat- but based on our data, the country did expand in Q1.

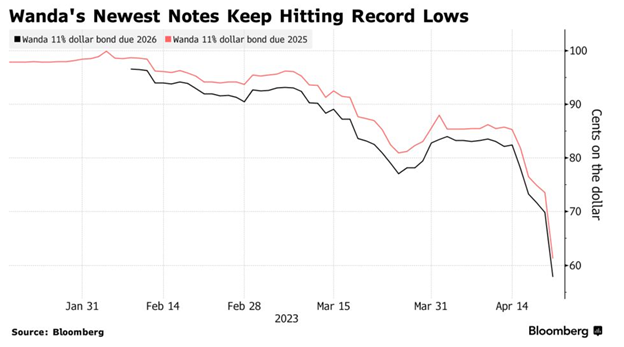

We have been highlighting since last year (Feb 16th to be exact) that the debt bubble in China was popping, and here is the latest balloon to pop. “Dalian Wanda Group Co. has become the latest source of angst in China’s credit market, with dollar bonds of billionaire Wang Jianlin’s conglomerate sinking to distressed levels just months after they were issued. This week’s plunge occurred as investors brace for a potential surge in cash outlays by the group. Wanda and its units could face the equivalent of $1.9 billion in principal and interest payments on loans and public bonds, including put options, the rest of this year, according to data compiled by Bloomberg.”

This is just another issue impacting the credit problems that stem from everything within China- ranging from international exposure through the Belt and Road Initiative (BRI) to local real estate.

I think this sums up the questions surrounding the Chinese data release:

China’s stats bureau released the Q1 GDP results on Tuesday.

The headlines:

- The economy expanded 4.5% y/y in Q1, compared with 2.9% y/y in Q4 2022 and 3.0% in 2022 as a whole.

- GDP in Q1 was up 2.2% on a seasonally adjusted basis versus the previous three months.

Break out the champagne: The print smashed expectations for 4.0% y/y growth.

But…we’re not sure such celebrations are merited.

- In fact, the GDP data and corresponding econ numbers leave us unsure about a whole host of things.

Riddle me this: If the economy is recovering, why is corporate spending growth still so weak?

- FAI increased 5.1% y/y in the first quarter of 2023 – the same rate of growth for 2022 as a whole.

At first glance, it seems that strong household spending explains the discrepancy:

- Retail sales rose 5.7% y/y in Q1, versus a 0.3% y/y decline in 2022.

- In March, sales jumped 10.6% y/y.

But other data suggest households are still under considerable financial pressure:

- Urban household income increased by only 2.7% y/y in real terms in Q1, versus 1.9% in 2022 and 5.0% y/y in 2019.

- The urban unemployment rate remains stubbornly high. It was 5.3% in March, compared with 5.5% at the end of last year.

There was also a disconnect between government stimulus and weak industrial production:

- Infrastructure investment continued to growth at a decent clip, increasing 10.8% y/y in Q1 and 9.9% y/y in March.

- But value-added industrial output growth was up only 3.0% y/y in Q1 versus 3.6% in 2022.

Get smart: The absence of an across-the-broad recovery as China reopens raises questions about its sustainability.

Bottom line: This is not a slam dunk economic recovery.

Now we can pick it apart with different data points:

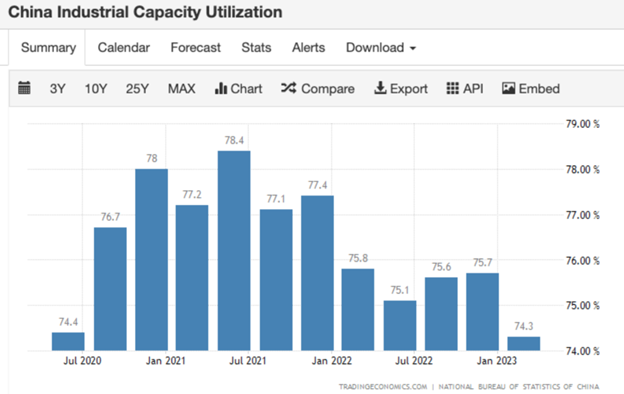

“The industrial capacity utilization rate in China fell to 74.3 percent in the first quarter of 2023 from 75.8 percent in the same period a year earlier. This was the lowest level since the March quarter of 2020” via @tEconomics So China’s industrial capacity utilization *fell* ~2% y/y but manufacturing component of GDP grew 2.8% y/y (and construction grew 6.7% y/y)?” The below chart (from the Chinese Government) directly contradicts the view that industrial capacity expanded, and when you compare it to y/y- it DEFINITELY didn’t expand.

When we compare the official Chinese data with China Beige Book, you can see confirmation of the decline in the manufacturing sector. It has essentially been a straight down trajectory since Q3’21.

So China’s industrial capacity utilization *fell* ~2% y/y but manufacturing component of GDP grew 2.8% y/y (and construction grew 6.7% y/y)?

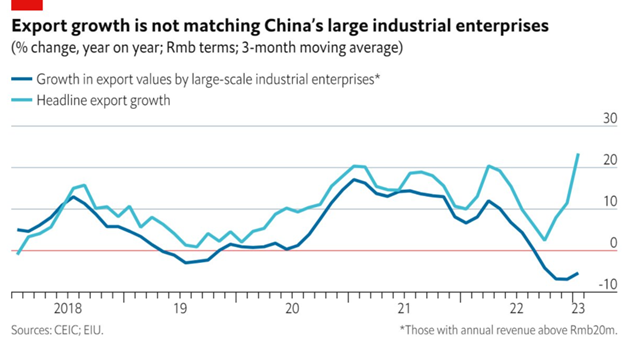

Another little caveat is the question around export capacity. We have been discussing how their exports have struggled based on ship movements, imports, and new orders. PMI data (both official and Caixin) support our beliefs that everything has been weak on the manufacturing and export front. The data for “growth in export values by large scale companies” supports our view, yet the headline export growth number EXPLODED. Does this mean that small companies increased their exports exponentially? If they did, they didn’t have their AIS transponders on when they sailed away from the Chinese coast.

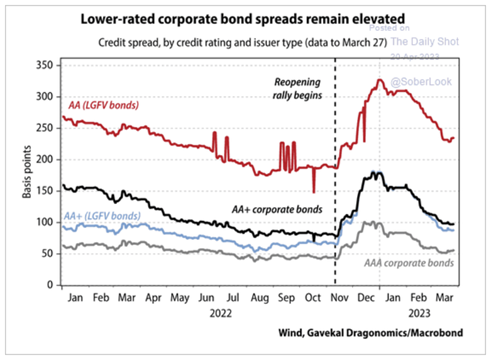

There also remains a broad concern around their debt as bond spreads remain elevated, and the current Wanda struggle will NOT help the situation. If the recovery was screaming, why aren’t spreads tightening?

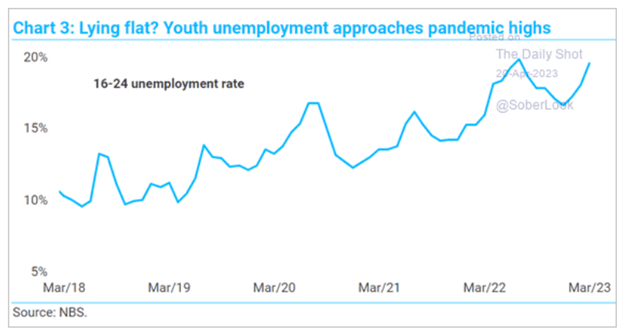

Another layer of concern is the expansion of unemployment in the country. If everything is recovering, why is unemployment pushing back to peak COVID levels in a critical part of their employment pool?

We aren’t saying that China contracted, but we find it hard for them to hit estimates- let alone beat them.

The below is just another grouping to show it isn’t just China that has seen pressure mounting on the economic backdrop.

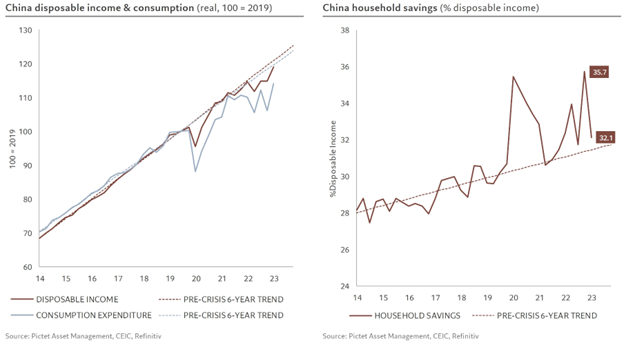

There is a broad slowdown around the region- especially on imports, which are a key bellwether for export and internal expansion. “Big upside surprise w/ China’s Q1 GDP today. Lots of attn to exports, production, retail… but avg imports only at 0.2% yoy (Rmb terms). Been saying this for a while, but China’s re-opening looks self-contained; it isn’t (yet?) providing a boost for its (goods) trading partners.” A big part of the story was the turnaround in spending as more money was pulled out of savings and used for consumption. “The strong recovery in Chinese consumption in Q1 (>30% q/q ann.) is partly due to an increase in household disposable income (>14%) and a reduction in the savings rate of some 3.5% of income.”

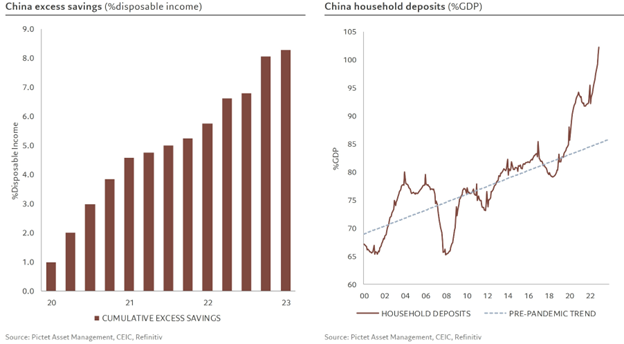

Even with the expansion of spending, excess savings remains well above average. We expect it to remain elevated as real estate losses weigh on the health of the consumer. Over 68% of Chinese consumers have some sort of exposure to the real estate market, and when you layer the losses with excess savings- consumers are still underwater by 20%. “Interestingly, the savings rate is still above trend, implying that households have still not drawn on their excess savings accumulated during the pandemic and have continued to increase their bank deposits… apparently still preferred to financial markets.”

The below breakdown on property sales and real estate puts into perspective how the overhang remains, and we don’t see it improving in the near future.

Fixed investments in real estate are also pushing lower, which makes it difficult to see how this bottoms out and expands in 2023. It could trough here- but that doesn’t guarantee expansion in any way.

Another fun issue is the slowdown in infrastructure investment as stimulus is reduced following a surge into more sub-optimal projects.

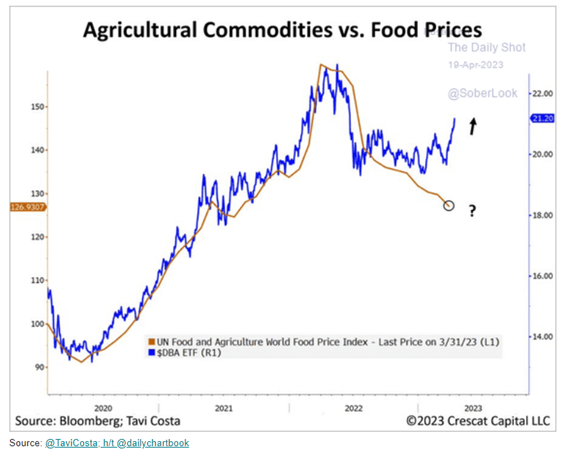

On a separate note, food prices are being pressured higher and have deviated from the UN data that is on a lag. We believe that the tightness in the food market is going to keep prices elevated and put more pressure on global markets. It will keep inflation elevated and stress governments that are already struggling to maintain subsidizes.

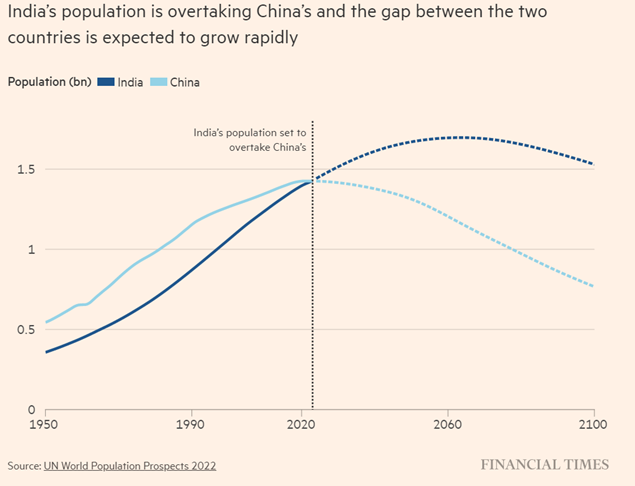

A broader pivot will be the shift in demographics.

This is going to be an important point as the difference expands over the next decade as the shifts draw more deals and volume into India. India has always been “more friendly” to the West and an enemy to China. India-China have always been at odds for thousands of years, which isn’t something that will pivot anytime soon. I think it’s important to listen to my first segment of the Economy show where I talk about these inner workings and how it benefits the dollar over the long term. More Fun to Come!