Frac’ing Outlook

We discussed our initial thoughts about Patterson-UTI Energy’s (PTEN) Q1 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. The company’s management believes that the current environment for pressure pumping has weakened compared to a few months ago due to weather disruptions, resulting in reduced utilization. Demand for dual fuel frac spreads remains high due to lower fuel costs. As of date, eight of PTEN’s 12 frac spreads are dual-fuel capable. By the end of 2023, it plans to convert the ninth spread, increasing the total frac spread count to 13.

In Q2, the management expects revenues from pressure pumping to decline by 5%, and the adjusted gross margin in this segment can dip by 17% in Q2. Due to the cost associated with refurbishing old pumps, the company is considering converting old equipment to Tier 4 instead of modifying the Tier 2 pumps. These dual fuel kits will get a premium because of the benefit for the E&P as they burn natural gas instead of diesel. High grading of the industry rigs replaces the lower-spec SCR and mechanical rigs. Also, it brings better cost-benefit because the upgrade portion confines to a dual fuel kit, which is a smaller portion of the capital. The company’s margin will also improve as the number of dual-fuel frac spreads increases.

PTEN’s Drilling Outlook

The drilling and completion market appears benign after natural gas prices continued to drop over the past several months due to lower demand in Europe. Despite the uncertainty, capital discipline and current crude oil prices would keep the drilling and completion activity steady. In this environment, when activity diminishes, PTEN’s management plans to focus on profitability and cash flow with its Tier 1 super-spec rigs.

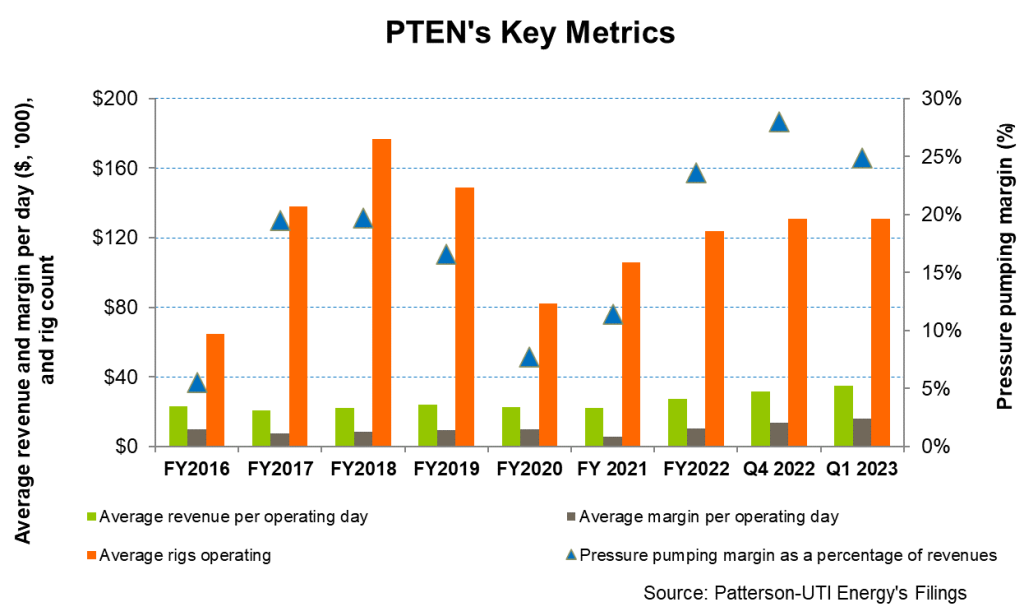

Overall, the company’s rig count may decrease marginally in the near term. Pricing, however, can gain traction as the old contracts with low prices expire, and new contracts are signed at higher pricing. In 2H 2023, PTEN’s rig count can increase, driven by higher crude oil-led activity. You may read more about the company in our article here.

New Technology

PTEN has recently used mud motors to drill complex U-turn wells, which enabled clients to drill 10,000-foot laterals within a single 5,000-foot section. Its mud motors and Mpower MWD systems reduced the number of trips, improving operator efficiency.

US And International Rig And Margin Outlook

In Q1, PTEN’s average rig count was 131 in the United States. It expects an average of 79 rigs operating under term contracts during Q2 and an average of 53 rigs in the next 12 months. In Colombia, it expects contract drilling profitability to improve as contract renewals at higher prices would offset a slight decline in the rig count. Here, the average adjusted rig margin per day is expected to increase by $1,000 in Q2 over Q1.

Analyzing The Q1 Drivers

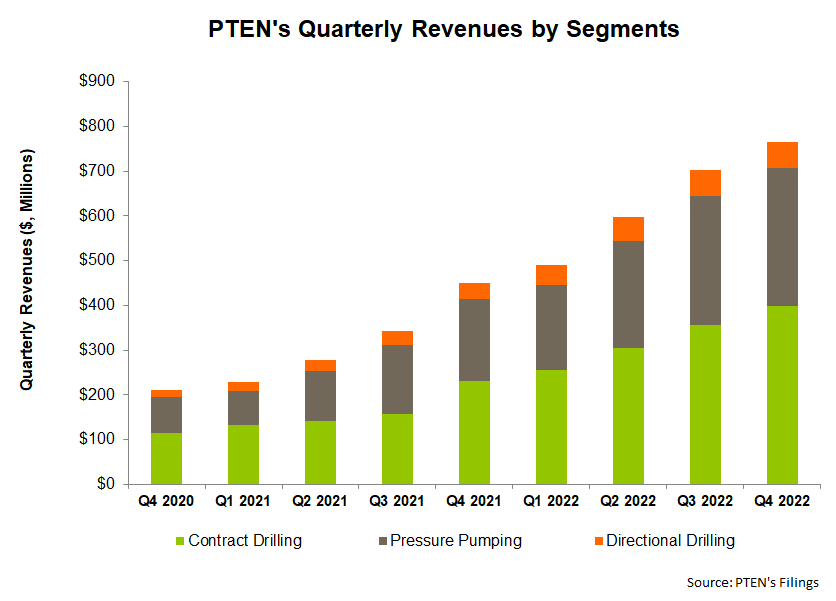

As discussed in our short article, PTEN’s revenues in the Contract Drilling segment increased in Q1 2023, while its revenues from the Pressure Pumping and Directional Drilling segments declined. The average adjusted rig margin per day in the US also increased in Q1. Renewal of rig contracts to current rates led to a revenue rise. On March 31, 2023, its term contracts for drilling rigs in the US provided $890 million of future day rate drilling revenue, up from $830 million a quarter ago. It plans to reactivate six rigs throughout 2023, all currently contracted.

Capex And Leverage

In Q2, PTEN revised its FY2023 capex guidance. But it would still be 17% higher than FY2022. Contract drilling capacity would cost ~$290 million, or 57% of its FY2023 capex budget. We have already discussed its cash flows in our post-earning article.

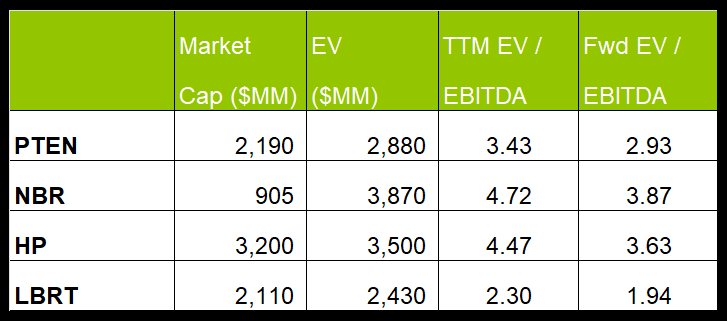

PTEN’s liquidity was $738 million as of March 31, 2023 (excluding working capital). Its debt-to-equity (0.51x) is much lower than its competitors (NBR, HP, and LBRT). Given the debt level, we think the company is relatively free from financial risks.

Relative Valuation

PTEN is currently trading at an EV-to-adjusted EBITDA multiple of 3.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 2.9x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 8.7x.

PTEN’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than peers because its EBITDA is expected to increase less sharply than its peers in the next year. This typically results in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is lower than its peers’ (NBR, HP, and LBRT) average. So, the stock is reasonably valued versus its peers.

Final Commentary

With about two-thirds of its frac spread count being dual-fuel capable, PTEN will continue to increase its share of fuel-efficient old equipment to Tier 4 pumps. The company’s margin will improve as the number of dual fuel frac spreads increases. Introducing new techniques and technologies, its mud motors and Mpower MWD systems have helped operators enhance drilling efficiency. In Q1, renewing rig contracts to current rates increased revenue. However, following the natural gas price’s weakness, the company’s rig count may decrease marginally in the near term.

However, the drilling and completion market has lost some steam after natural gas prices plummeted over the past several months due to lower demand in Europe. Also, the cost of upgrading the frac spreads can weigh on its margin in Q2. The company is relatively free from financial risks due to its debt level and liquidity. The stock is reasonably valued versus its peers.

<div

class=”ihc-locker-wrap”><div class=”ihc_locker_6″><div

class=”lk_top_side”>

</div><div

class=”lock_content”><h2 style=”text-align: center;

line-height: 24pt;”>

To unlock the content you

need a <a href=”https://primaryvision.co/subscription-plan/”>

Premium</a> or <a

href=”https://primaryvision.co/subscription-plan/”>Enterprise</a>

Account!</h2>

<div

class=”lock_buttons”></div></div></div></div>