The crude markets bounced after hitting the technical low we pointed out last week. On the Brent side, $72 was our low point with an expectation of a hard bounce to $75. We believe crude is going to move back into a trading range of about $73-$76 as the narrative keeps bouncing between OPEC+ supply and global economic slowdowns. As concerns swirled (again) around regional banks, the economic fears were pulled forward sending crude straight down.

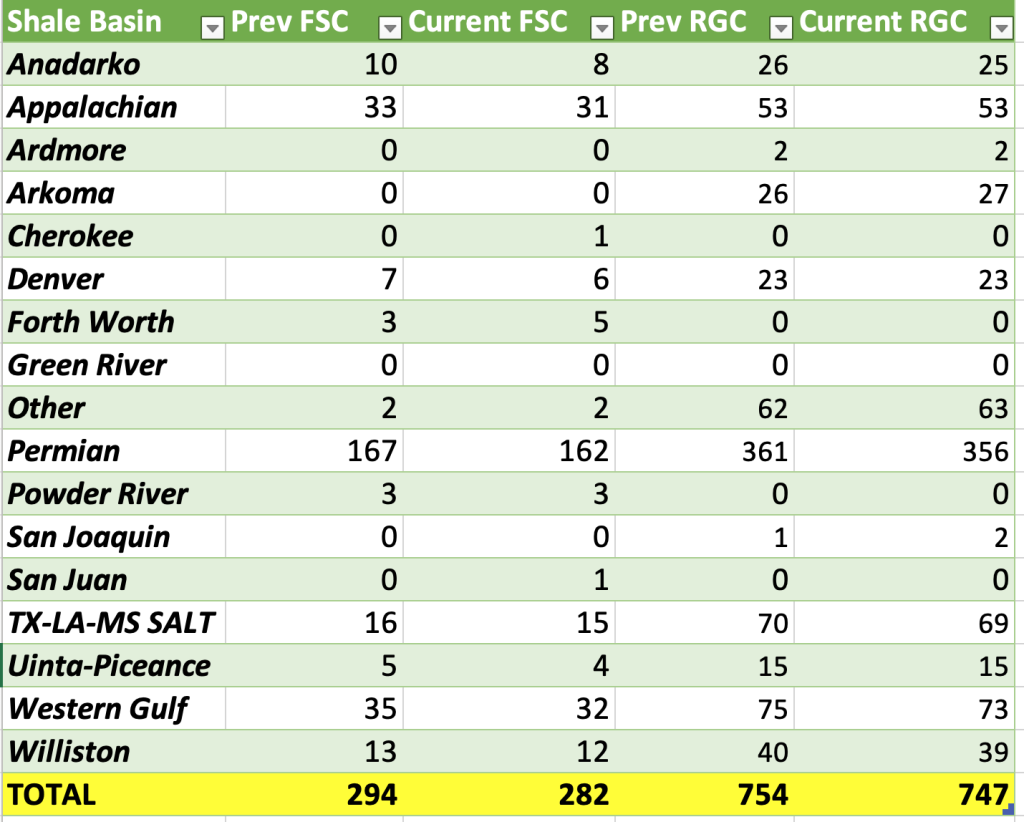

Even with the uncertainty, we don’t see much shift to our views of the U.S. completions market. This is one of your typical “moving days” as broad assets reposition for a bigger push post-Memorial Day. There is usually seasonal bounce as we get to the end of May and move into June, but you have to get the equipment in position prior to that move. We expect dry gas activity to remain depressed, but oily basins will attract more activity as we head into the summer. China bought a record amount of U.S. crude in March and given the elevated OSPs from Saudi- we don’t see a huge shift in Asian buying in the near term. Over the longer term, there will be pressure in Asian buying as economic run cuts come into play in June. The crude price deck will remain supportive of U.S. activity, and there will remain support in NGL purchases from the U.S. This keeps our current average range in the 285-295 range ahead of Memorial Day with a bump up to about 300 as we progress through June.

The Saudi’s disappointed the market with only a cut of $.25 to Asian light crude. The expectation was for a cut of about $.50, which they didn’t deliver to the market. They even increased prices into the Mediterranean and Europe, while maintaining near record pricing.

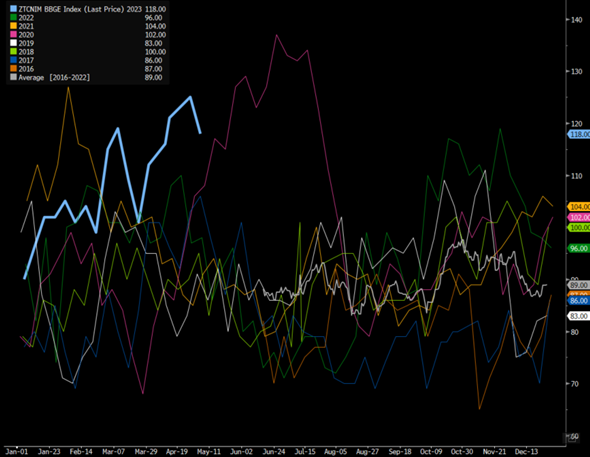

The below chart puts into perspective just how elevated their differential is against historics. This type of pricing isn’t going to entice anyone to pick up additional cargoes or anything above term volumes. At the end of the insights, we discuss current Chinese demand and how Golden Week will impact flows. Just a summary here- crude flows are already above 2019 levels and yet we still have a record amount of crude on the water and very elevated floating storage. So even with China absorbing a ton of crude, we haven’t see a spike in physical crude prices or clearing floating cargoes.

Middle East Arab Light Crude Saudi to Asia OSP Spread vs Average Oman/Dubai FOB

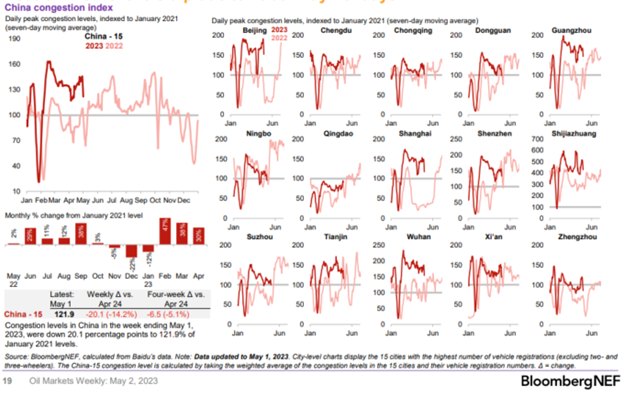

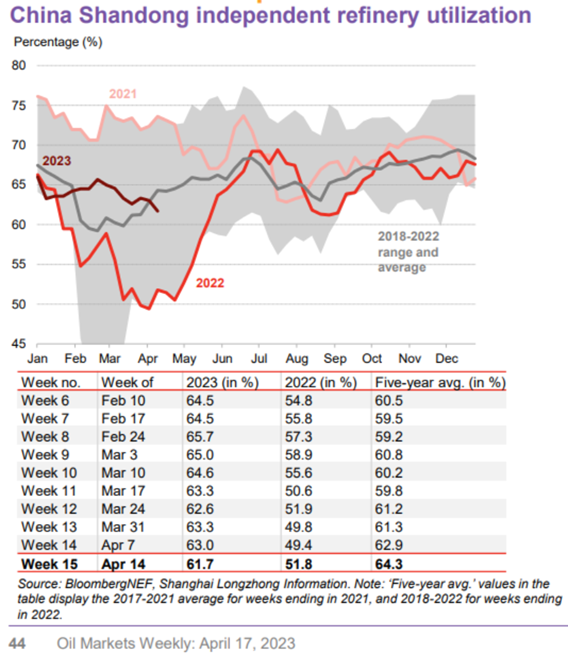

Chinese driving activity remained robust and dipped along seasonal norms, and right now refiners in China are operating at reduced rates. They are pulling forward a large part of their purchase, which is going to cause a bigger problem as we head into summer. There is a big expectation that this level of Chinese purchases will carry into summer, but that doesn’t look very likely at the moment. The important point to watch will be export quotas and Asian gasoil cracks. If China maintains current buying rates, we expect a big spike in export quotas depressing crack spreads and forcing other Asian refiners to reduce OR we will see a smaller export quota and a big step back in Chinese buying. This will be a very interesting dynamic to track as we progress through May.

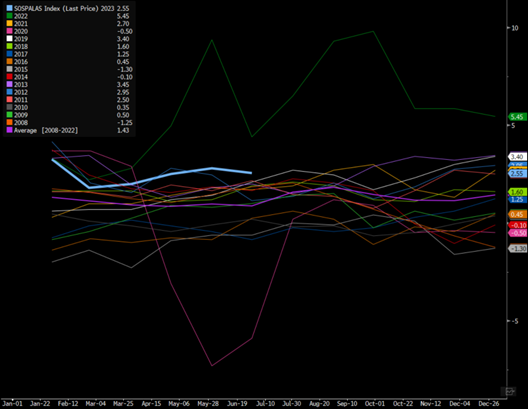

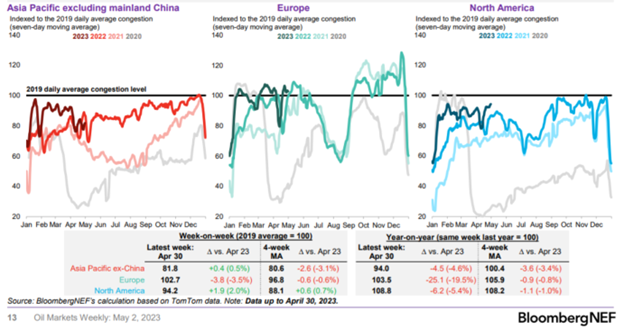

Global driving still remains depressed, and we are seeing some sizeable builds in gasoline around the world. Gasoil cracks still remain the key driver of refiner activity.

We have had some sizeable builds in Singapore and Europe over the last few weeks that remains a big concern as we head into summer. Gasoline/light distillate is either at a record or at 2020 levels while middle distillate/gasoil is moving back towards the “long term” average.

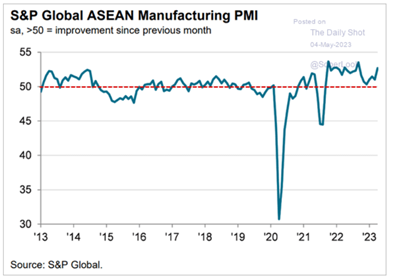

There was a bit of positive news coming from ASEAN manufacturing data showing some acceleration in activity. Seasonally, we normally get a bump but the important will be follow through, which we still don’t expect given rates.

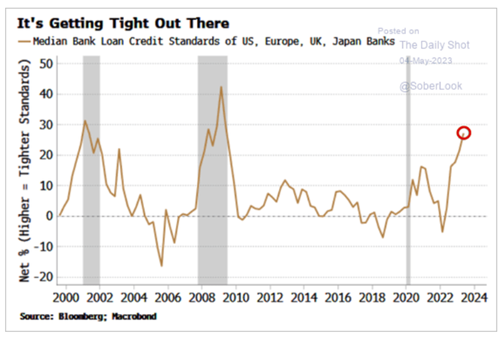

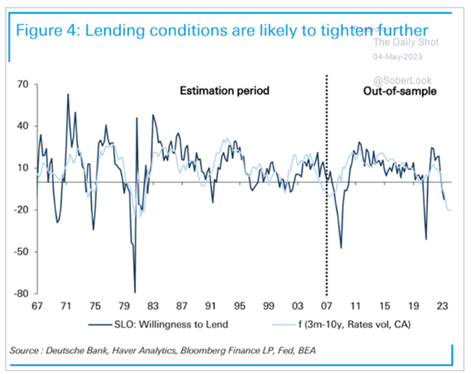

Here is an example of the tightness we are seeing in the market regarding credit standards… none of this is positive for borrowing, lending, corporate spending/investment, or just general economic activity.

As I explain further later on in this document, the leading indictors show that lending conditions are only going to get tighter. We agree with this view that banks will continue to tighten lending standards, which will only slow economic activity further.

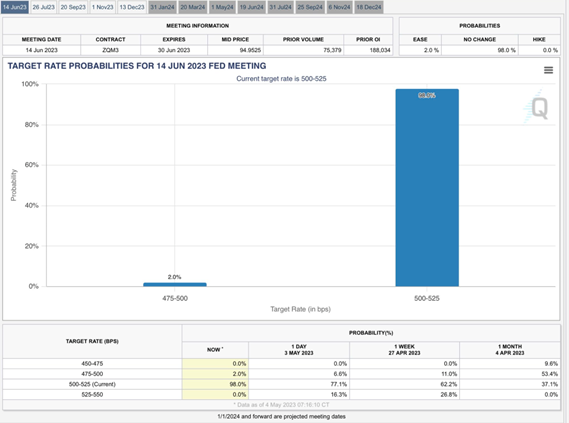

One of the biggest “surprises” that is going to be baked into the market over the next few weeks is the Fed raising rates another .25bps. Right now- the market believes the Fed does nothing in June, but as inflation data continues to run hot- I think another quarter point is very likely. This is why my base case is for another rate hike in June. Below gives you an idea of expectations: “Per CMEGroup FedWatch Tool, expectations are now 98% no change at June FOMC meeting (2% for rate cut).” People are so delusional- they actually think there could be a cut. I still think the market is underestimating the Fed’s resolve to keep rates elevated for an extended period of time even as more regional banks struggle. The banking sector stress is far from over- we will discuss this more next week.

Global economic data remains mixed with some bright spots and other warning signs, but it all still points to a broader slowdown. The problem is- it also supports an inflationary backdrop that will keep Central Banks either raising rates or at least maintaining the current rate hikes for much longer than the market expects.

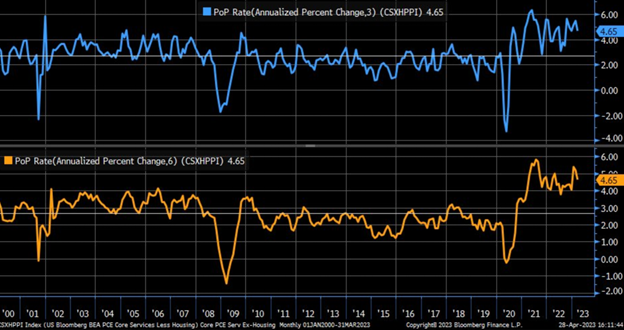

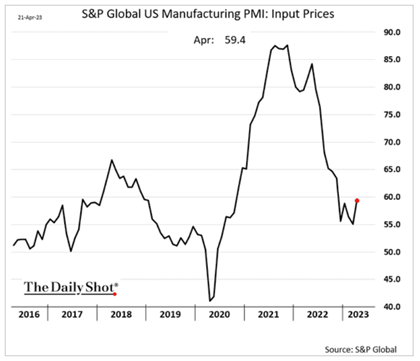

For those that have been following us, our base case has been sticky inflation and a staflationary backdrop impacting economic growth. We had a broad reacceleration of inflation in Q1’23 with more follow through so far in Q2’23. “Trimmed Mean PCE from Dallas Fed (year/year % terms) has reaccelerated since start of year … thru March, annual rate rose to +4.68%.”

Our view was that services were going to be the “stickiest” component of inflation, and it would impact the broad market more than manufacturing. Consumer spending and activity makes up about 70% of U.S. GDP with service spending making up about 75% of that number. This is why we spend so much time looking at different indicators impacting consumption, and how credit, income, and other factors will shift the broader consumer. “PCE core services ex-housing is starting to see its rates of change settle in a stickier range … both 3-month (blue) and 6-month (orange) annualized changes are at +4.7% (still fast relative to history).” This just shows that things impacting consumers still remains a broad problem that is far from abating.

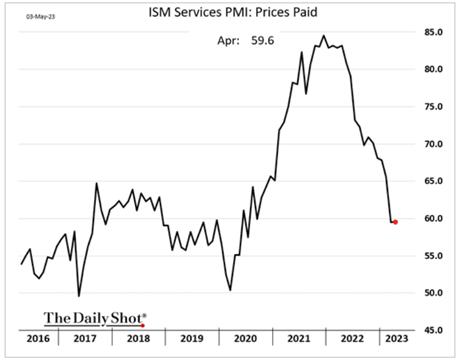

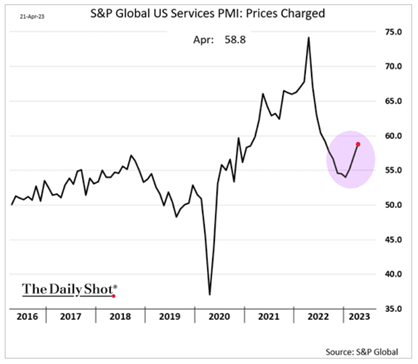

Here is a broad look at the most recent prices paid in ISM Services PMI- you can see that it’s still elevated against history and paused its decline. Instead, in leading indicators we see it starting to bounce a bit higher. We aren’t saying this is going to surge back to ‘21/’22 levels, but it won’t be going down much more from here keeping prices elevated and impacting consumers.

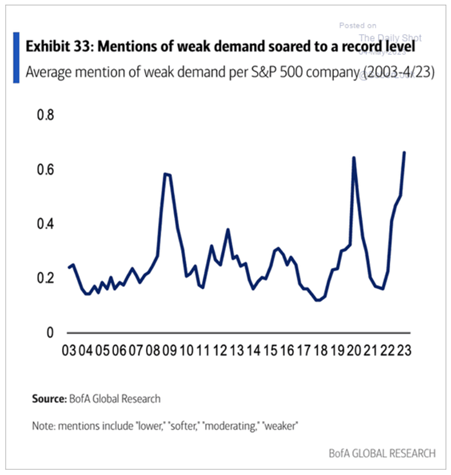

We are starting to see demand weakness creep into the market, but it has been very slow to materialize in a meaningful way. Trying to nail down the consumers spending habits is like trying to bottle happiness… everyone tries to do it but fails miserably. But we are starting to see companies talking about problems and mentioning them on the calls. We have highlighted how the “peak” in consumer spending was likely in March, and we could get some seasonal bumps but for the most part the pain only increases from this point. Due to the seasonal shift in spending, it just means that we won’t have a big “collapse,” rather a slow bleed until we get into the fall season.

What gives us the confidence that something like that is playing out? We look at the “type” of jobs being cut and what kind of spending/wage growth is occurring at the higher income bracket. “Lowest-earning Americans have experienced strongest inflation-adjusted pay growth … since 2020 real wages for bottom 10% of workforce have returned to pre-pandemic level; conversely, top 10% and average have taken substantial hit.” Broad wage growth is still moving in a positive direction, but it isn’t being originated from the top 10% of earners.

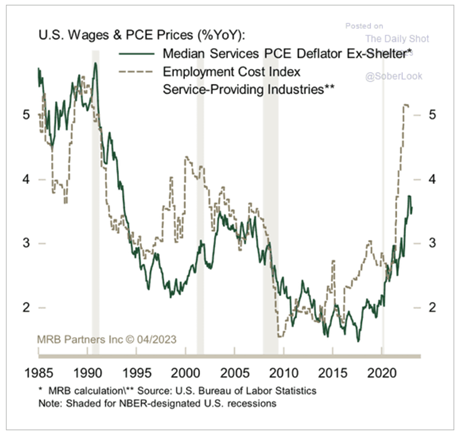

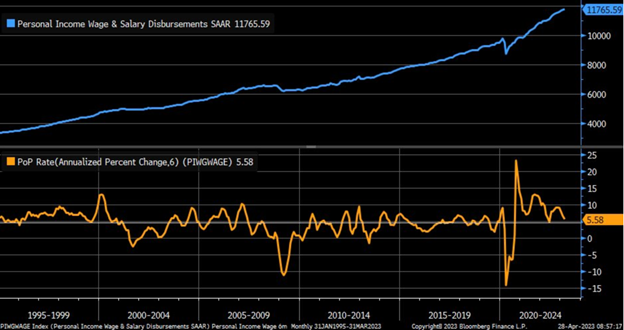

“Continued step down in wage and salary growth, but it’s a slow process … 6-month annualized change eased in March to +5.6%, which is down considerably from peak but just slightly above long-term average.” The pace of the rise is slowing, and a target of the Fed rate hikes is to “cool” wage growth. One of their main goals (even though it isn’t directly said) is to stop wage growth to avoid a “wage price spiral.” The way to do that is to increase rates, which will shrink corporate borrowing/CAPEX and result in some layoffs. It will also help bring down asset prices, which will trickle down into the cost of living. The Fed will make comments in passing, but won’t want to directly comment about driving down wages.

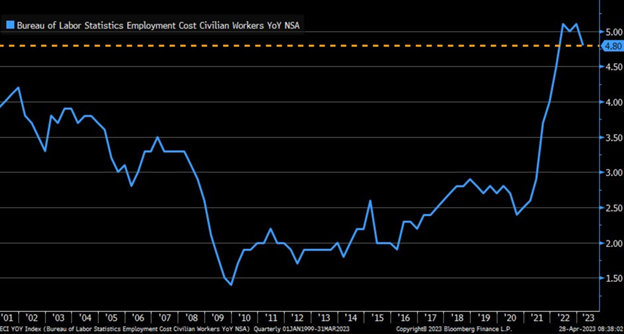

The problem they face is the continued strength in the labor market driven by reduced job participation rate, which is keeping the cost of employment elevated. “In year/year terms, Employment Cost Index eased a touch in 1Q23 to +4.8%, which is still hot relative to (a limited) history.” There are a lot of different ways to evaluate employment cost, but they all show them remaining stubbornly high.

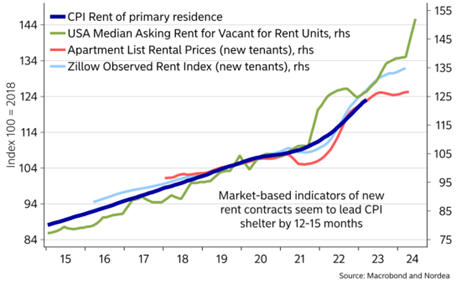

This elevated cost is another reason why inflation is going to remain stubbornly elevated. Another problem is the OER (Owners Equivalent Rent) that is still strong and actually re-accelerated last month. The Median Asking Rent jumped in Q1’23, which is a problem when you consider the weighting of housing. The OER is about 47% of the CPI calculation. This is just another sticky component that isn’t showing ANY signs of deflation… it’s barely even showing stagflation.

All of this results in inflation staying high, Fed raising rates, and other CBs staying the course on keeping rates elevated.

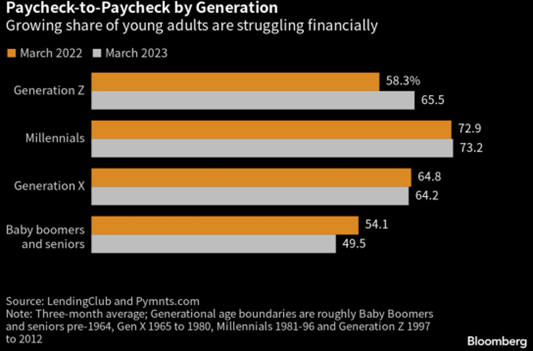

There are more and more people living paycheck-to-paycheck, and the consistent rise in prices is putting more pressure on their ability to spend. “Survey from Lending Club shows that 65.5% of Gen Z were living paycheck-to-paycheck as of March, up from 58.3% a year earlier … share is greater for Millennials (73.2%), but increase from prior year (+0.3%) wasn’t as dramatic.””

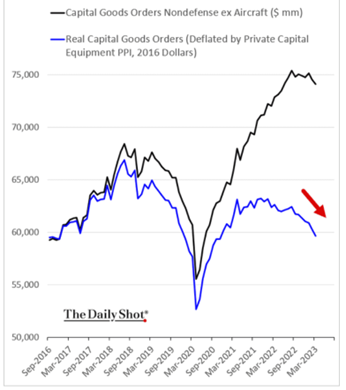

When we start putting all this data together, capital spending, rates, new export orders, employment costs, inflation… it all adds up to slower activity. Capital spending intentions over the next six months took another leg down, and when we look at capital good orders (adjusted for inflation) we are well below pre-COVID and seeing further degradation.

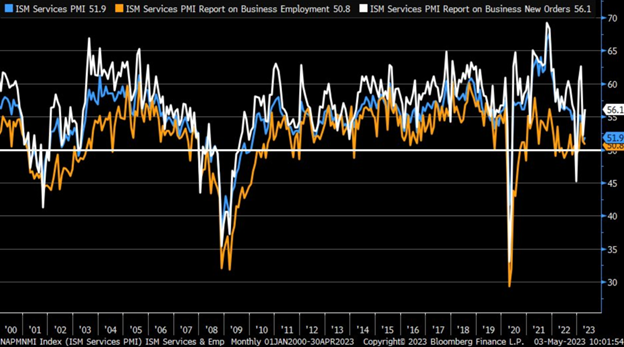

Another problem point is the elevated level of services in April that supports MORE inflation and not less.

“April ISM Services at 51.9 vs. 51.8 est. & 51.2 prior; new orders up to 56.1 vs. 52.2 prior; prices paid up marginally to 59.6; business activity fell from 55.4 to 52; supplier deliveries ticked higher but remain in contraction … employment ticked lower but still expanding.”

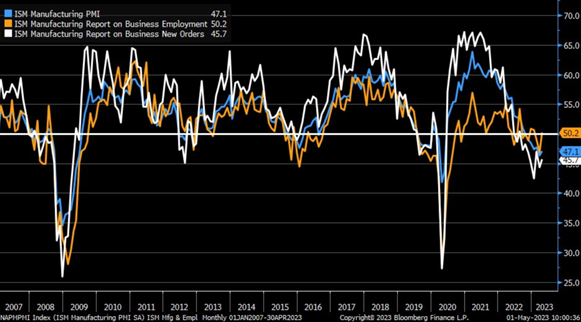

But as we have been discussing, the manufacturing side is still showing the reductions that will remain in contraction. “April ISM Manufacturing up to 47.1 vs. 46.8 est. & 46.3 prior; new orders up to 45.7 vs. 44.3 prior; prices paid up to 53.2 vs. 49.2 prior; production up to 48.9 vs. 47.8 prior … employment popped back into expansion for first time since January.”

When we marry this data with last week’s, you can see the inflation story doesn’t improve in April- after showing a re-acceleration in Q1’23.

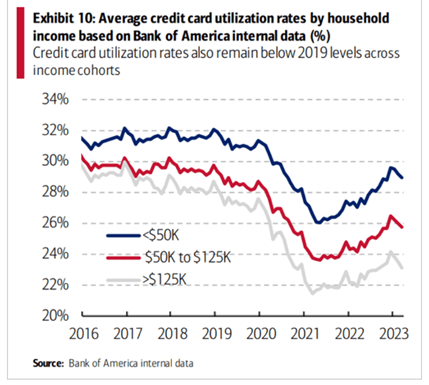

As we discussed last week, this becomes a bigger problem when we account for the slowdown in credit card activity. Utilization rates of credit cards have started to slow, and we don’t see this recovering in the near term. It will bounce around, but it won’t be reversing back to the levels we saw at the end of ’22 or beginning of ’23.

As utilization rates slow, we are seeing a BIG spike in delinquencies across credit cards. This is coming at a much lower utilization rate, which is helping to show the stress the consumer is under.

U.S. consumer credit rose again in March and topped estimates.

US March Consumer Credit Rose $26.5b; Est. Up $17b

Consumer credit in March rose 6.6% at an annual rate to $4.851t, according to the Federal Reserve.

- Revolving credit rose $17.6b to $1.240t

- Nonrevolving credit rose $8.9b to $3.611t

There are still a significant number of people relying on their credit cards, and as rates move higher, the delinquency rates will continue trending higher.

On a positive note, we did get a small increase in savings as a percentage of disposable personal income. “Personal savings rate ticked up again in March and is now at 5.1%, highest since January 2022.” It still is at a reduced rate, but a positive shift in the use of funds. It also points to additional reductions in spending as more money is kept in the bank. This lines up with growing consumers the consumer has for inflation remaining a persistent problem- as we have seen in the Conference Board and Univ of Michigan surveys.

As we turn to China, we want to look at golden week and how travel compares to last year. There was a positive jump in activity, but it’s important to put this into context as it relates to GDP growth.

Domestic travel recovered to pre-COVID levels over the first post-zero-COVID Labor Day Holiday.

Around 274 million people travelled domestically during the five-day holiday period, up 70.8% y/y, and 19.1% higher than in pre-pandemic 2019.

Domestic tourism revenue hit RMB 148 billion, jumping 128.9% y/y and 0.7% higher than in 2019.

Passenger journeys by rail, road, water, and air were estimated to have soared 162.9% y/y (Xinhua 2).

ICYDK: This all marks a HUGE improvement from the Lunar New Year holiday in January-February when travel increased by 75.8% y/y – but was still 47% lower than in 2019.

There’s great news for consumption, too (CCTV):

During the holiday, consumption-related sectors – including hotel and catering services – registered a 24.4% y/y increase in total sales revenue.

Get smart: This is obviously a positive turnaround, but tourism is hardly an economic recovery “heavy lifter.”

Before the pandemic, in 2019, tourism and related sectors contributed 4.56% to GDP.

In 2021, this had fallen to 3.96%.

Our take: We caution against viewing this splurge as a sign of a broader recovery in consumer sentiment.

The May Day travel boom has “revenge spending” written all over it.

Given we’re yet to see significant improvements in employment and household income, we’re doubtful about the sustainability of this spending spree.

There are some broader issues we see when it comes to “long-term” spending as it relates to Q2 and the rest of 2023. Income hasn’t recovered in any meaningful way, and we have some leading indicators showing more pain ahead.

Manufacturing activity has fallen back into contraction with new orders also coming in negative. They are “close to 50,” which is why it signals just general weakness but not a huge drop-in activity. It points to underlying weakness and not a surge in activity- especially as it relates to exports and GDP expansion. Manufacturing is a big part of China’s GDP, and we aren’t seeing anything that signifies a big turn around.

When we look at services for April, the data came in below estimates and highlights how we expected things to remain stronger on the service side BUT be BELOW what the market expects. The market continues to believe China is going to be much stronger vs what it will actually achieve.

The below chart puts into context travel during Golden Week.

BUT- if you compare 2019 to 2023 VLCC flows into China- we are ALREADY well over 2019. So we are already seeing flows setting seasonal records, which hasn’t been able to support physical prices. We still have a record amount of crude on the water and elevated levels of crude in storage- especially in WAF and ME. China has been front loading a lot of their buying, but it’s starting to tail off and given current refinery activity in China- we don’t see a big spike.