Completion activity took another leg down today by ten driven by the Permian, Appalachia, and Eagle Ford. We see another move lower albeit a smaller one as we head into Memorial Day weekend. Even with the shift in Permian activity, we are still at record levels and will remain at the high end of historical completions in the region. The bigger issue will remain natural gas activity, which won’t see much of a bounce in the near term.

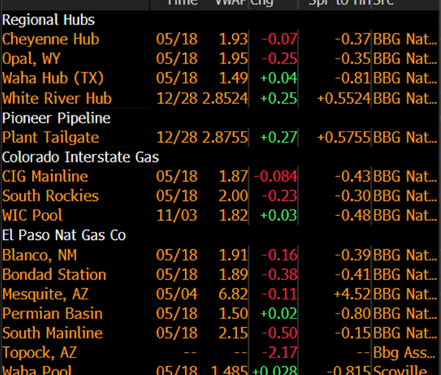

Natural gas drilling is going to remain under pressure as oversupplies remain in specific locations. While everyone will quote Henry Hub, it doesn’t mean that companies get that pricing. Instead, they are beholden to their region price points that will keep realizations limited. The prices going into Waha are the most important right now because that is the pricing metric for many of the Permian producers. “Waha Pool” has gone negative several times so far the last few weeks, and there is a strong likelihood we will see more negative pricing. Once you factor in shipping costs, the negative netbacks to the E&P only keep moving lower. For most, natural gas is not the target for the Permian so as long as WTI sits at $72 (and realistically above $65) many of the E&Ps won’t blink. Natural gas specific E&Ps were MUCH faster to adjust production vs pervious years (lets call it a decade of hard lessons), which we expected to be the case. Many of the E&Ps have highlighted their focus on cash flows and balance sheet strength, which meant as HH prices hit $2 activity would drop. We were also heading into shoulder season, so now as activity slows and we head into summer- pricing should strengthen. We don’t expect near-term prices to get to a level to bring back dry gas activity, so it will help support prices above $2.50.

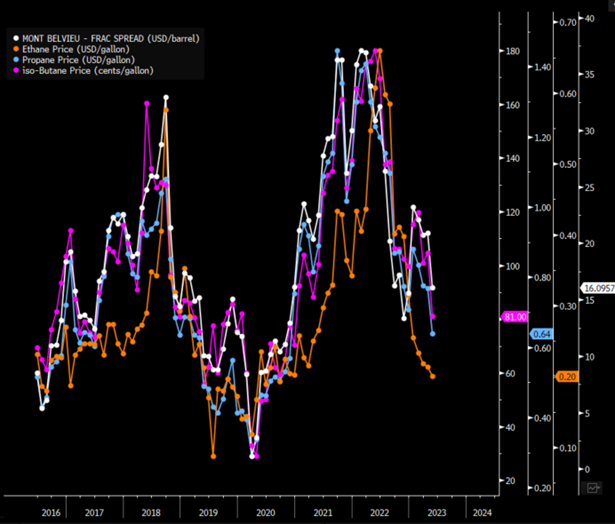

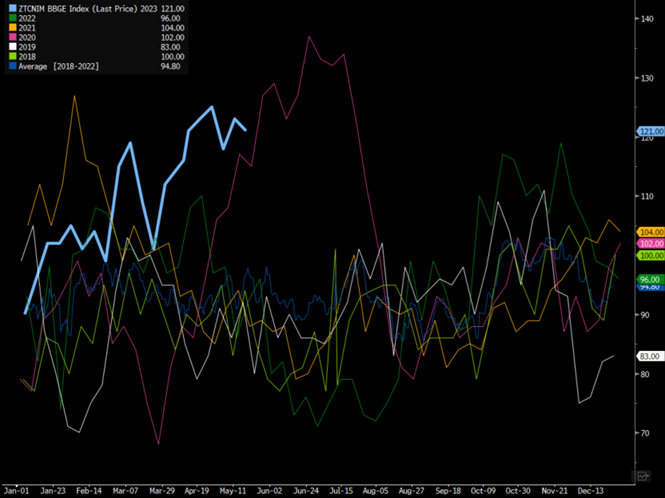

The pressure in the natural gas market has already pushed dry gas producers to slow operations, and the reduction in activity has spread to some of the wet gas producers as well. We expect to see natural gas liquids (NGLs) pricing remain range bound even as local demand stays very weak. The below chart helps highlight how NGLs are still elevated versus other years with large storage builds. The difference this time around is the new export infrastructure and elevated global demand. This will help slow the downside slide of pricing and put a bit of a floor in pricing. Even with the underlying pressure of supply, we still have the broad NGL “frac spread” sitting well above average when we look back to 2016.

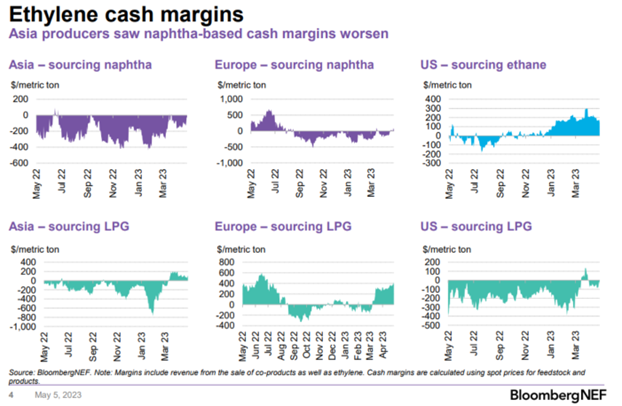

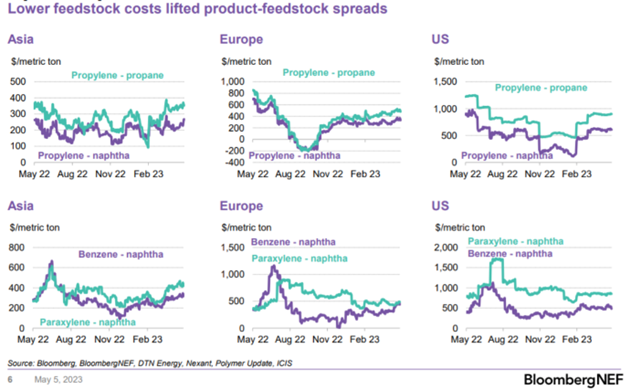

The support will be driven by robust exports as global demand grows, and our prices support buying against international competitors. As KSA reduces production, it limits the amount of LPG they can produce keeping the global market firm and supporting more U.S. exports. When we look at margins, LPG flowing into Asia and Europe still has fairly strong margins as naphtha (condy) margins worsen. This is helping support additional buying of LPG vs condy into these two key markets.

When we evaluate another set of data, you can see that U.S. LPG still competes well on a global basis. These margins haven’t adjusted abroad, but you can also see the weakness in U.S. chem margins. This is going to keep U.S. demand soft, but the European/Asian margin will keep LPG and ethane flowing off the U.S. cost at a record setting pace.

On the crude side, we still hold to the stickiness of Brent at $75 with the range being $73-$77. The price will trend towards $75 even as the global slowdown in demand continues to gain steam. The market is holding out hope for summer driving, but the builds in refined products (globally) and sizeable floating storage will keep prices pressured to the downside. The physical crude market continues to deteriorate, which will keep a lid on prices and pull the market lower over the next 6 weeks or so.

The builds in Singapore, Europe, and Fujairah are showing the cracks in demand- especially along the gasoline/light distillate front. Gasoil/middle disty has seen faster builds in Fujairah and Europe- which will lead to additional increase across Singapore. Russia continues to dump refined products into the Asian markets, which will keep crack spreads under pressure.

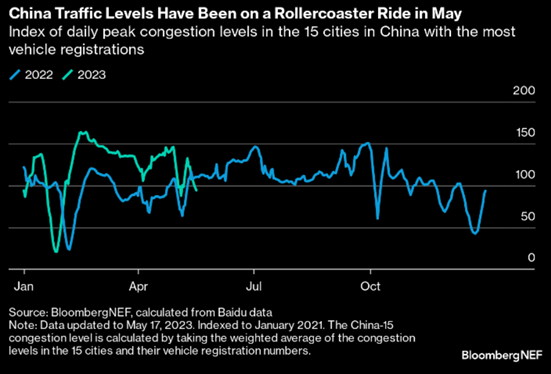

One of our biggest focuses has been the demand in China. Our view has been (and remains) that the “revenge” consumer spending is now behind us, and we will see driving remain at current levels. The comps in 2022 will get easier as we go through the year driven by the broad lockdowns that occurred last year. Now that people are moving back into their daily routines, we expect the rise in activity to moderate to seasonally normal levels.

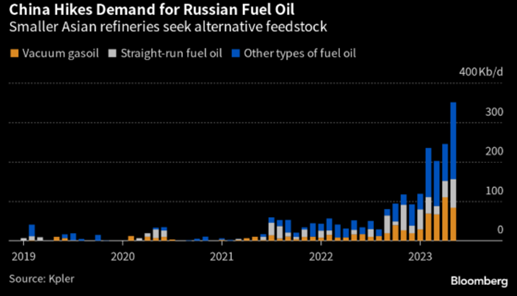

The problem for China going forward is the broader slowdown that is impacting their economy. The recent slew of economic data is not supportive of additional demand across any of their refined products. This will keep exports elevated and keep pressure on Asian refiners. China is also buying a significant amount of feedstocks such as VOG and other fuel oils because of the steep discount for the Russian products. Iran is also sending more crude into the market as they import more refined products from Russia and export more crude.

China is taking advantage of the situation by pulling more crude while they increase refined product exports. The trend for crude purchases and shipments will keep moving lower over the next few months, which will be a problem for a physical crude market already struggling to clear.

West African light sweet crudes struggled to find buyers as competition from cheaper Russian cargoes eroded their Asian market share, IEA says in monthly oil market report.

- India only took about 5% of West Africa’s crude exports in 1Q, down from around 15% before the invasion of Ukraine, IEA says

- China’s share fell from 35% to 25%

- French refinery strikes and influx of US crude supply to Europe also limited WAF sales to that region

- The end of the strikes at Exxon Mobil terminals offshore Nigeria also added more supply

- These factors combined kept a lid on spreads – Bonny Light declined by 64c/bbl versus North Sea Dated in April to -28c/bbl, Brass fell by $1.27/bbl to -$1.11/bl

- “Heavier sweet Angolan crudes were more resilient, supported by robust Chinese demand as refinery activity responded to stronger gasoline cracks and the end of maintenance”

- Cabinda added 28c/bbl vs North Sea Dated to +$1.58/bbl; Girassol +9c/bbl to $2.11/bbl

Commercial use of South Africa’s oil storage hub picked up in 1Q, with 4.9m bbl arriving at the terminal during the period, the IEA said, citing Kpler data.

- “The deliveries into storage appear to be West African barrels struggling to find buyers East of Suez (due to cheaper Russian crude) while Atlantic Basin refiners undergo maintenance”

- Biggest inflow of crude from Nigeria at 2m bbl, followed by Angola with 1.9m and 900k from Ghana

- Preliminary data show another 3.1m bbl in April

- To date, no crude shipments from the terminal have been observed: IEA

- IEA will account for net crude oil imports at Saldanha as non-OECD stock changes until the local refinery is restarted

PLATTS:

- Unipec offered 950k bbl of Angola’s Olombendo for June 22-23 loading at 25c/bbl less than Dated Brent: person monitoring window

- Decreased from +35c/bbl on May 15

TENDERS:

- Pertamina purchased one cargo each of Nigeria’s Qua Iboe and Bonga grades as well as one shipment of Angola’s Girassol

- Standard volumes are about 950k-1m bbl for each of the cargoes

- Also a 300k-bbl parcel of Cameroon’s Kole variety

- In the tender that closed on Friday, Pertamina looked to secure more supply for July arrival after snapping up four other cargoes for July earlier this month

WAF JUNE SALES:

- All of Angola’s shipments for June loading have been placed, aside from a couple of potential re-offers: traders

- Declines from 6-7 unsold out of 32 scheduled as of May 12

- July’s trading cycle started earlier this week

- Between 18 and 20 cargoes of Nigerian crude for June loading are still searching for buyers

- That’s almost half of the 41 shipments scheduled according to programs compiled by Bloomberg

- Compares with 25 unsold on May 12

- That’s very slow for this point in the cycle, given that July’s Nigerian schedules have already started to emerge Friday, traders said

- That’s almost half of the 41 shipments scheduled according to programs compiled by Bloomberg

- One cargo of Republic of the Congo’s Djeno grade is still open

- Unchanged from May 12

- The next Congo program is due around May 24

PLATTS:

- Gunvor sold Forties to Vitol for June 10-12 at Dated flat, FOB: trader monitoring Platts window

- Traded price is the lowest since Feb. 23

- Compares with +20c for Gunvor’s previous offer on Wednesday

The above data helps to highlight the problems that remain in the market when we look at physical crude flows. When we turn to the global economy, we see even more pressure swirling as the consumer struggles and industrial activity heads lower again. Libya is also looking to take production a bit higher with a target of 1.3M barrels a day, which is unlikely- but we do see 1.1-1.2M barrels by year end as very doable.

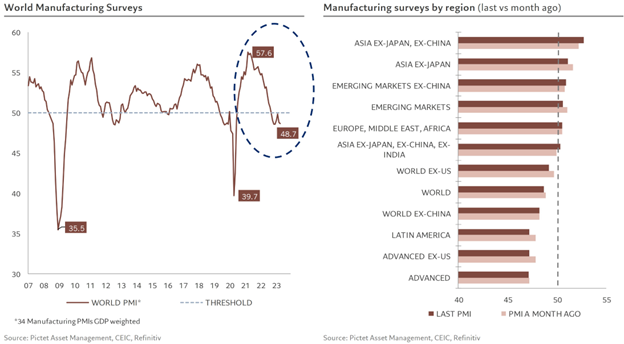

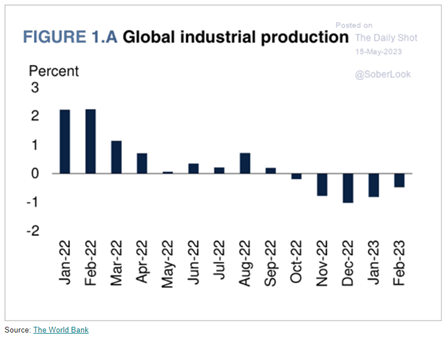

When we turn to the global economy, the industrial sector remains in a difficult spot with more pressure coming down the road.

- April global manufacturing PMI was down two tenths of a point to 48.7, below the 50 threshold for the 8th consecutive month

- EM Asia ex-China is one of the only regions to accelerate over the month (+0.5pt to 52.7)

- 30% of countries stay in expansion (>50) of which 9% are slowing down and 21% are accelerating, Thailand the most

- 18% are recovering, including the US & Japan √ 52% deteriorating, Italy the most

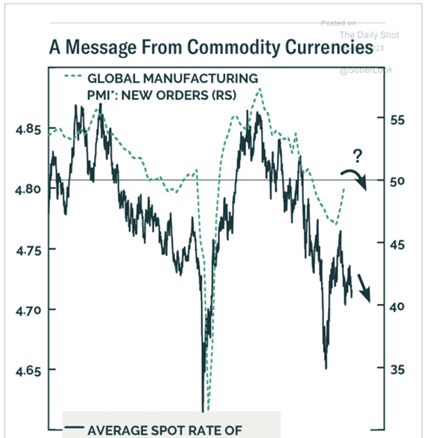

When we use some other data points, we get a very similar picture for the health of the manufacturing industry.

The slowdown in the industrial sectors is starting to hit the emerging markets in a much bigger way as rates remain elevated and inflation stays sticky on a global level.

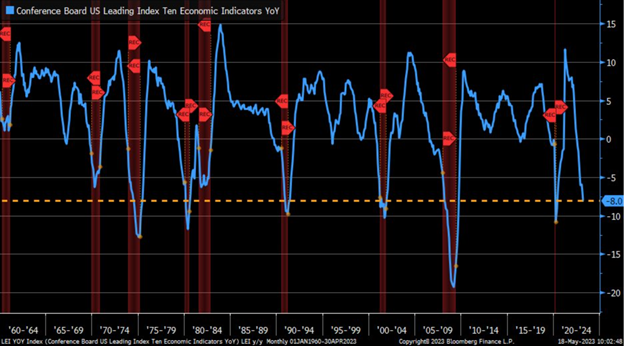

The U.S. economic pressure is still center stage as leading indicators still show cracks as inflation stays sticky. “Leading Economic Index from Conference Board fell by -0.6% m/m in April, taking year/year trend further into negative territory … -8% decline consistent with prior recessions going back to 1960s.”

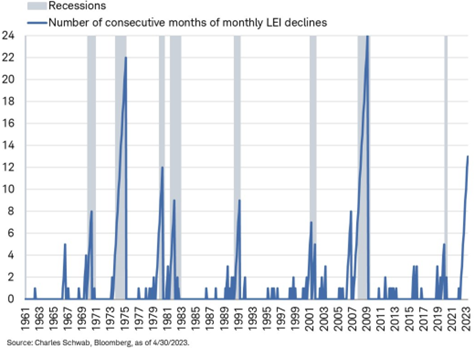

Here is another way to look at the data: “April marked 13th consecutive month of monthly contractions for Leading Economic Index from @Conferenceboard … going back in history, only two recessions have reached at least 13: those that started in 1973 and 2007.”

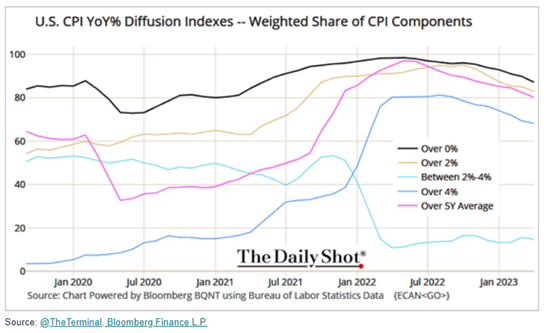

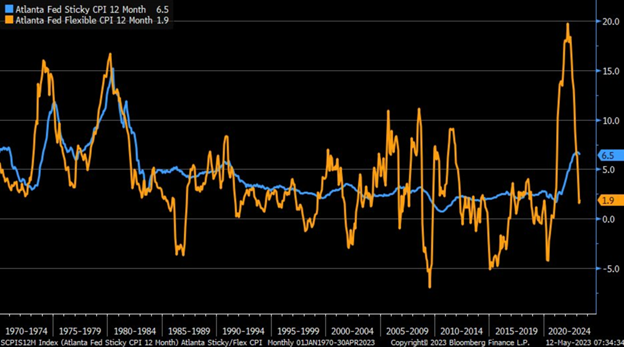

Even as the pressure on leading indicators mount, inflation pressure is still persistent across large parts of the economy. There is still broad pressure on pricing with over 75% of products in the market showing inflation over 4%.

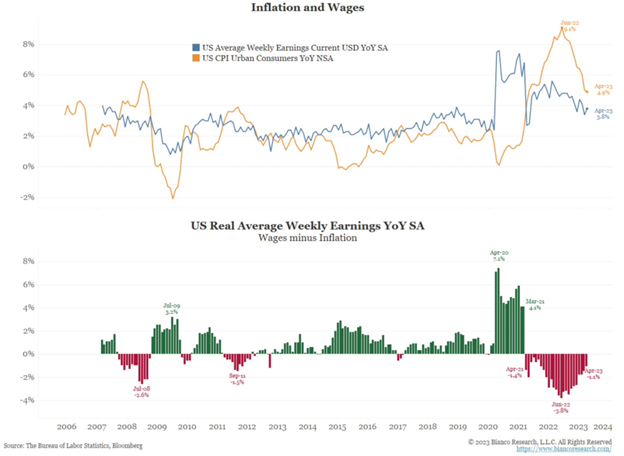

Real wages have been firmly negative for the last 25 months, and there is little chance that changes over the next several months. Sticky inflation shows no signs of adjusting meaningfully lower as wages are starting to crack and rollover at a faster rate. This will eventually pull down inflation, as employment costs drop but it won’t be quick given the labor market backdrop.

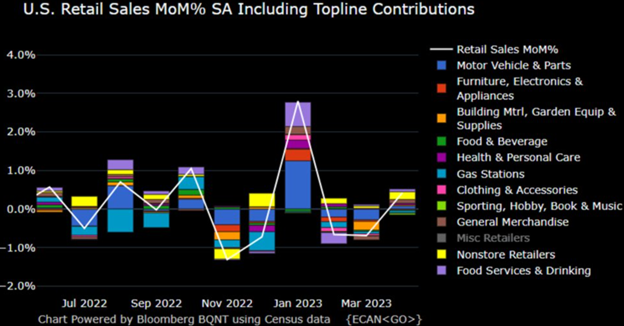

These issues are finally bleeding into U.S. retail sales, which have been resilient until the end of March. Our view was that retail sales really peaked at the beginning of March, and have been rolling over throughout that time period. The data below supports that view, and as we head into key buying season with Summer travel- seasonally speaking things will get worse.

“April retail sales +0.4% m/m vs. +0.8% est. & -0.7% in prior month (rev up from -1%); sales ex-autos +0.4% vs. +0.4% est. & -0.5% in prior month; sales ex-autos & gas +0.6% vs. +0.2% est. & -0.5% prior…control group (matters for GDP) sales +0.7% vs. +0.3% est. & -0.4% prior.

“Looking at retail sales in year/year % change terms, gain in April was slowest since May 2020. Trend in retail sales continues to soften, with 6-month % change down into negative territory as of April though not yet in clear recessionary territory.”

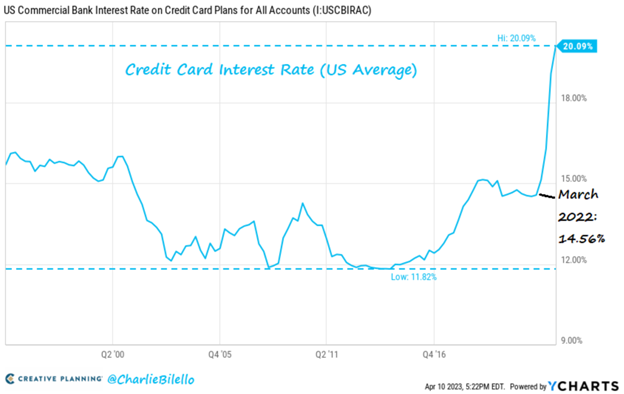

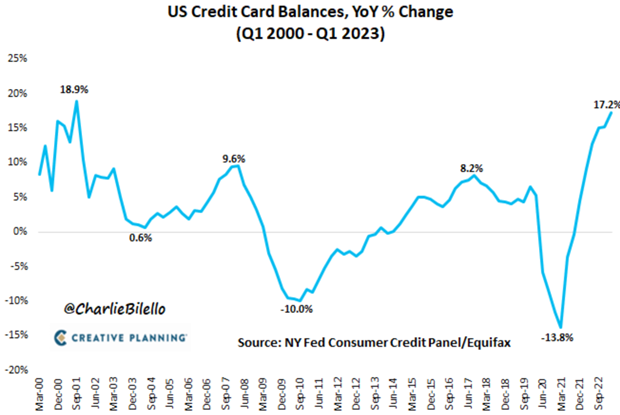

The pressure on spending is also driven by the pain in credit card balances and rising interest rates. Credit Card balances in the US increased 17% over the last year, the biggest spike since the 2001 recession. The highest credit card rate is now well over 25%, while the average interest rate on US credit card balances has crossed above 20%. “With data going back to 1994, that’s the highest rate we’ve ever seen, and is 5.5% above the rate from just a year ago.”

This is all happening as we have the U.S. wage tracker taking another leg down with some additional pressure coming.

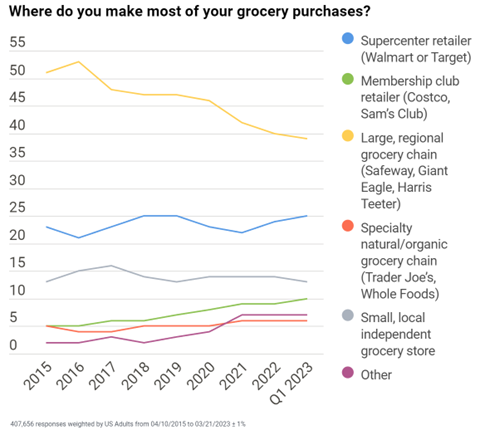

The type of stuff people are buying is also shifting as we see more pivots on grocery purchases. There is a bigger drive to supercenters and away from regional chains.

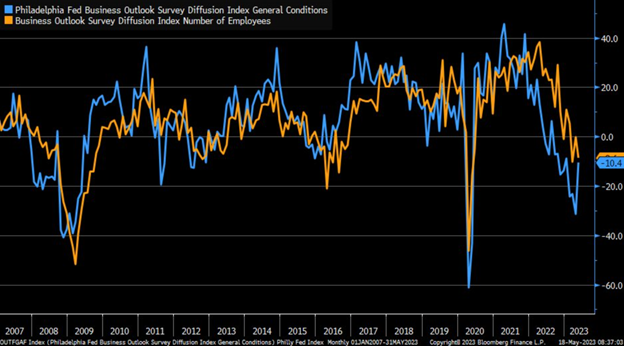

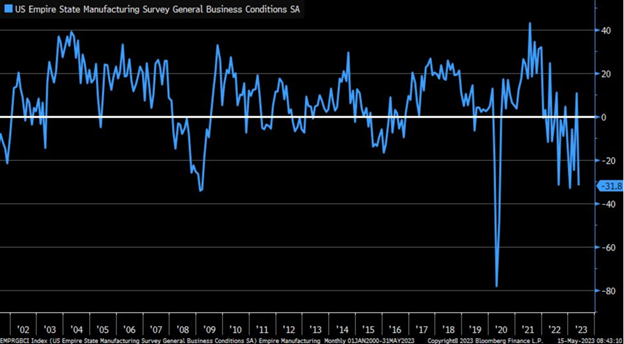

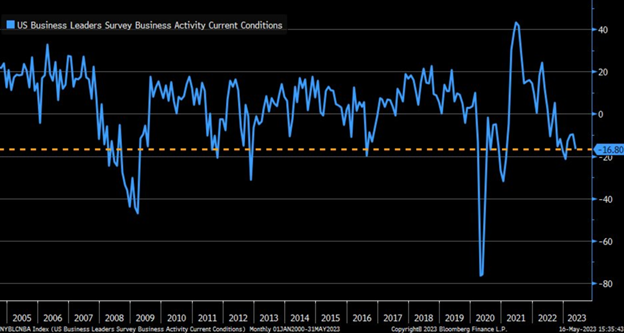

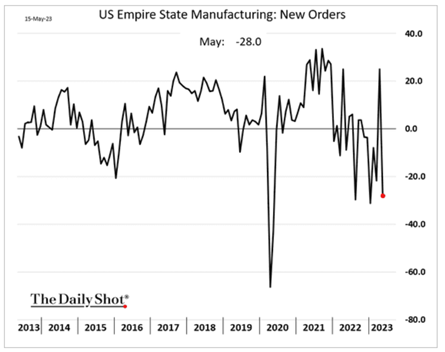

The leading indicators are also showing a much broader contraction from the Empire and Philly Fed.

“May philadelphia fed Index up to -10.4 vs. -20 est. & -31.3 prior; new orders improved from -22.7 to -8.9; prices inched higher along with delivery times; shipments still contracting but moved a touch higher … employment moved lower into contraction.”

We saw prices move HIGHER (inflationary) as new orders remained in contraction while still improving a bit. This projects another round of slowdowns in the national number.

The Empire number had a big “make-up” number: “Huge drop in May Empire Manufacturing Index, down to -31.8 vs. -3.9 est. & +10.8 in prior month; new orders sank to lowest since January; prices paid ticked higher, average workweek moved up (but still contracting), and employment also ticked higher (still contracting).” Another mixture of inflationary data mixed with slowing data.

The service side didn’t show any improvement either- “Services business activity metric from New York Fed rolled back over in May to -16.8 vs. -9.8 in prior month … employment ticked higher along with prices paid, prices received, and capital spending … 6-month outlook for business activity popped back into expansion”

The leading indicators are showing more pressure while expectations for some additional activity has improved. This makes sense if you consider new orders have been in contraction for an extended period of time, so eventually orders will improve to keep goods available for consumers. It doesn’t mean we get this huge explosion of activity, but a more stable environment in a contracting backdrop.

We are just not seeing a meaningful pivot lower in prices because everything is still expanding with more price pressure. Sticky inflation has barely budged as we start to see flexible inflation strengthening again.

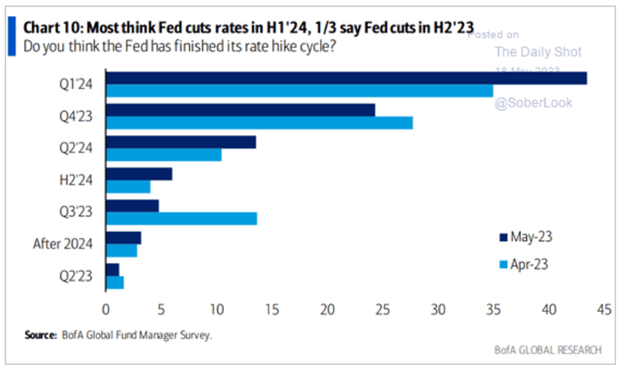

The backdrop in the market supports another .25bps hike, but at the moment, we believe this will be the last hike for the next 12 months. We don’t see a drop in rates until Q2’24 at the earliest, which is becoming a more accepted view according to BofA. Nice of people to FINALLY join our view! The data was always there supporting it… just people ignoring it.

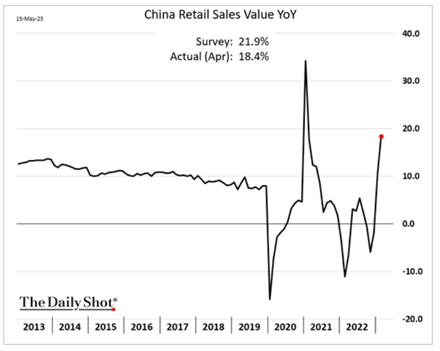

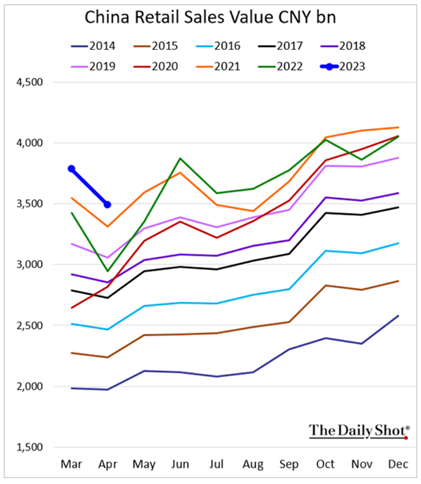

China is showing more and more cracks as we have been highlighting after missing estimates by a wide margin even with very easy comps.

On Tuesday, China’s stats bureau published the monthly econ data for April.

The headlines:

- Retail sales rose 18.4% y/y in April, up from 10.6% growth in March.

- Fixed asset investment (FAI) rose 3.6% y/y in April, down from 4.7% growth in March.

- Value-added output at industrial firms rose 5.6% y/y in April, versus a 3.9% increase in March.

While the growth rates look impressive, they are flattered by the economic disruption from COVID lockdowns the same time last year.

In fact, April’s data missed expectations across the board:

- Retail sales, industrial value-added output, and year-to-date FAI all fell short of consensus forecasts.

Our take: China’s economy continues to be stuck in a two-tier recovery. Consumption is recovering reasonably well, the rest of the economy less so.

- The m/m increase in retail sales adjusted for seasonal distortions was 0.5% in April.

- FAI fell 0.6% m/m.

- Industrial value-added output decreased 0.5% m/m.

Consumption-led growth in China is what economists have been calling for, for years – but if this doesn’t boost business activity and jobs, it will soon fizzle out.

For this reason, falling private investment and high graduate unemployment concern us:

- Private FAI dropped 0.2% y/y last month, despite falling 0.9% y/y in April 2022.

- Graduate unemployment last month hit a record high of 20.4%.

Get smart: Officials have held back on any big policy moves as they assess the shape of the post-pandemic recovery.

- We’re expecting more aggressive intervention during the remainder of Q2 to support the economy.

A big issue for the CCP is the slowing consumer as they fall back into a routine with much less spending power driven by real estate losses.

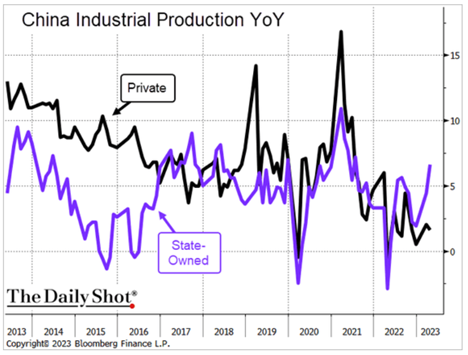

The CCP is trying to drive changes across the consumer and industry, but given the limitations on stimulus- it’s near impossible to do both. Another key issue- the CCP is focusing more on SOEs and NOT private companies, which will hinder expansion further. Here is a great breakdown of the issues the CCP faces. I fully agree with this backdrop, and It sums up beautifully what I have been saying for over 2 years now:

“China is determined to increase its international competitiveness in the manufacturing and industrial sectors, especially as part “of an ambitious plan to upgrade the nation’s hi-tech industries”, in the words of this SCMP article. The Ministry of Industry and Information Technology, for example, “announced in February that more than 90,000 small businesses would be nurtured – via financial incentives – to help them join the nation’s advanced manufacturing army by the end of the year.” The article notes that “the country is also accelerating supportive policies in areas such as 5G, artificial intelligence, bio-manufacturing and digital economy.” China’s main push is in technologies and industries that will allow it to increase workers’ productivity. This may make sense for the Chinese economy, assuming that the support and the associated direct and indirect subsidies are sustainable and productive overall for the Chinese economy, but it also has international implications. Industrial policies that subsidize manufacturers at the expense of households are also effectively trade policies, whether or not they are intended as such. To the extent that these policies increase production relative to demand (which they must when investment isn’t constrained by scarce savings), they result in rising trade surpluses, which in turn will increase that country’s global share not just of those industries, but of manufacturing overall. By definition this increase must come at the expense of its trade partners. This further means that those trade partners (in this case not just advanced economies, but also other large developing economies with manufacturing ambitions) must choose either to match the subsidies or to accept a decline in their share of global manufacturing. The point is that in economies in which investment isn’t constrained by scarce savings, and so increases in savings must be exported, export and manufacturing subsidies are effectively beggar-thy-neighbor policies that reduce overall global demand. In that world, unfortunately, countries must increasingly choose between rising trade barriers or rising domestic debt. Until now they have mostly accepted rising debt, but in the future, I think we should expect rising trade barriers.”

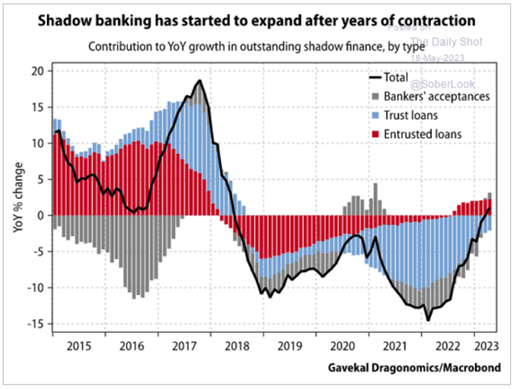

The lack of support from the CCP or PBoC for the private sector has brought back to life shadow banking, which has been a target for reduction. This further complicates the goals of the CCP trying to stimulate the economy.

Inflation also rose much less than expected, and many key provinces posted declines- which supports more slowdowns in domestic activity. “China’s CPI grew 0.1% y/y in Apr, vs expected 0.3% gain, previous 0.7% rise. Seven Chinese provincial regions saw CPI growth turn negative in Apr, showed local govt data. Shanghai’s CPI fell 1.1% y/y, the fastest among China’s 31 provincial-level regions, vs 0.9% growth in Mar.”

So you have Xi talking about supporting industry, but because of favoring SOEs- we expect to see more foreign investment (FDI) dropping off.

The big bifurcation between SOEs and Privates is already growing, and we expect it to only get worse from here.

All the while- property investment keeps trending worse, and it’s unlikely to pivot as the losses remain in the sector.

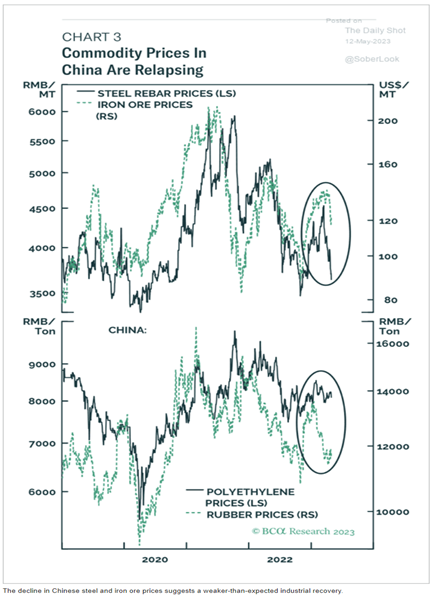

The pressures in China have broad implications when we weigh them against commodity prices. As China activity follows the rest of the world, it will leave more commodities in the market- putting pressure on prices. We expect to see more exports of steel, refined products, rebar, and others from China as we have also seen their demand for metals also decline.

Just to pull this back out to the global level, you can see that the PMI data and global new orders are rolling over. This reduction of broad activity is going to pull commodities lower over time, but not to the degree in the past as supply is also hindered.

In general, we see global manufacturing taking another leg lower, and it will pull down the global economy. We are already seeing the consumer (finally) slowing as manufacturing moves further into contraction. Mixed with elevated rates and tighter credit standards globally- we see way more downside to global growth estimates.