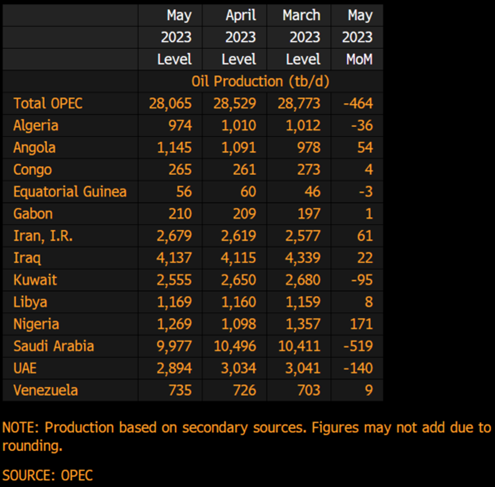

The energy markets continue to swing around following the OPEC+ agreement at the beginning of June. Our view has always been that OPEC (aka KSA) wants brent to average around $75-$76. Saudi is willing to take actions to ensure prices stay within that range for as long as possible. OPEC+ is fighting against a still weakening global economy that is reducing the demand for refined products while Russia and Iran have increased exports to their main buyers. When we look at May, you can see that all the cuts were driven by Saudi, UAE, and Kuwait while all of the other regions had small increases. Nigeria had some force majeures and planned downtime, which reverse in May with some additional increases coming in June. Angola has also slowly increased their production levels further through the June loading period. All of these regions had room to push production higher because they are well below their quotas, while Russia still exports records amount of crude and refined products.

We have said from the beginning it’s very important to look at exports as well as production because you can have a country reduce production but still maintain flows into the global market. Russia is the perfect example because they have had to reduce production as refiners, storage, and export infrastructure is overwhelmed. So, while they probably did “cut”- it wasn’t by choice, and the reduction by no means signifies a slowdown in exports.

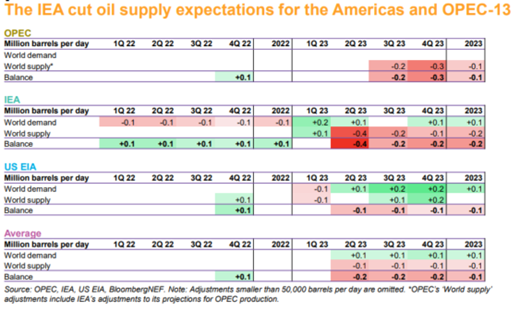

When we look at the OPEC+ deal, there are some key nuances when we evaluate the impacts.

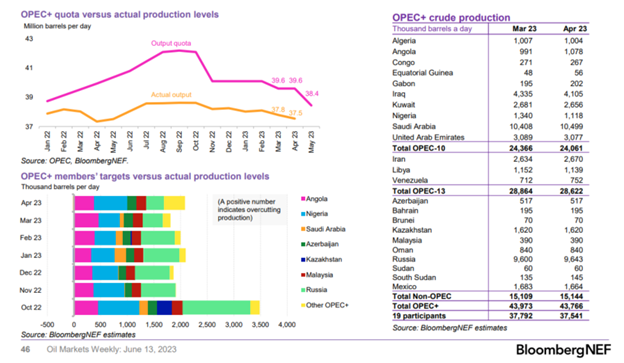

- Saudi will reduce July production to 9M barrels a day- which works out to about 1M barrel a day drop.

- OPEC will extend the cuts into 2024

- The caveat with the 2024 “cut”- it just brings the current Russian, Nigerian, and Angolan targets inline with current output.

- UAE is allowed to raise production in 2024.

For those that have been reading our insights, we have been talking about UAE, and their underlying relationship with KSA and OPEC. There was an extended fight between KSA and UAE to increase their quota back in July 2021. We said that this was going to be the first of several increases they were going to push for as the UAE expanded capacity. I didn’t think KSA was going to expend this much political capital to get additional cuts. I believed that the “additional cuts” would come in Oct, which would have been much closer to commentary made by UAE. Instead, Saudi wanted to jump ahead of some slowdowns to protect price and was able to assemble an agreement. If we get a further deterioration in demand, will KSA continue to cut production on a one-off basis?

“Saudi Arabia will make a deep cut to its output in July on top of a broader OPEC+ deal to limit supply into 2024 as the group seeks to boost flagging oil prices. Saudi’s energy ministry said the country’s output would drop to 9 million barrels per day (bpd) in July from around 10 million bpd in May, the biggest reduction in years. “This is a Saudi lollipop,” Saudi Energy Minister Prince Abdulaziz told a news conference. “We wanted to ice the cake. We always want to add suspense. We don’t want people to try to predict what we do… This market needs stabilization”.” I just find it funny that they discuss “stability”, but in the same vein want to “add suspense” and “don’t want to be predictable.” Those are counterintuitive, making it difficult to create a stable price.

This is why we always discuss general trading ranges with brent sitting in the $73-$77 range with some extensions into $72 or $78, but those are typically just carried by underlying momentum. The goal is to home in on the $75 level when it comes to brent. WTI will see some support as the U.S. grades are officially adopted into the brent contract helping to close the spread of $5 to about $2.

The below chart helps to visualize some of the shifts in underlying production. I think it does a good job of showing the difference between output quota vs actual quota. “In addition to extending the existing OPEC+ cuts of 3.66 million bpd, the group also agreed on Sunday to reduce overall production targets from January 2024 by a further 1.4 million bpd versus current targets to a combined of 40.46 million bpd. However, many of these reductions will not be real as the group lowered the targets for Russia, Nigeria and Angola to bring them into line with actual current production levels. By contrast, the United Arab Emirates was allowed to raise output targets by around 0.2 million bpd to 3.22 million bpd.”

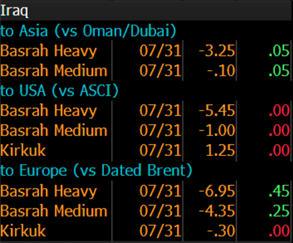

Iraq was also supposed to be part of the initial cut, but with the shutdown of the Ceyhan pipeline- they are still below their allotment. Turkey and Iraq are supposed to begin negotiations on Monday to reopen the pipeline and begin flowing product into the Med once again.

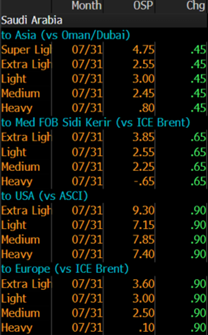

There was a broad view (mine included) that KSA would at least reduce OSPs (official selling prices) given the pressure it will cause on refiners. Instead, they just gunned things higher across the board. The increase into U.S. is at a record with similar near records into other regions.

A very important one is always Light into Asia, which is below 2022- while still being at the second highest level in 10 years. It shouldn’t be a surprise to see a shift in buying, which has already started with three Chinese majors slashing their July loadings from Saudi term volumes by a combined 10M barrels.

This opens up an opportunity for Iraq and UAE to undercut some pricing, and it will help pull additional barrels from WAF. U.S. exports slowed slightly, but we believe this is temporary and will bounce as we head into July. WAF, Russia, and U.S. are natural replacements for the loss of Saudi barrels, so the key to watch will be WAF and ME floating storage.

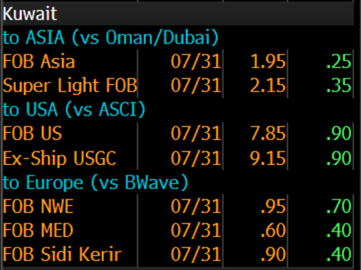

When you look at Murban, you can see some benefits in comparison to KSA values. This will help move more UAE volumes, which was their goal when they created free floating contracts. It allows them more flexibility to be competitive even as KSA and Kuwait increases underlying prices.

Middle East Murban Crude Abu Dhabi Retroactive OSP

Even though Kuwait increased prices, you can see it is still slightly better than KSA- but not to a degree that it will attract more nominations.

On the other hand, when you look at Iraq and UAE there is opportunity to see some additional flows heading into the market.

It will be important to see how much Middle East floating storage changes throughout July because it still remains elevated vs where KSA would like it to be.

When we look at the Middle East floating storage, it’s also important to consider places that aren’t captured in the above data set. “Supertankers holding more than 20 million barrels of Saudi Arabian crude are clustered off Egypt’s Red Sea coast, the most since the depths of the worldwide pandemic in 2020, data from Vortexa showed.” “The last time Saudi crude floating storage volumes were above current levels was in Q2 2020” when levels hit 30 million barrels “but that was amid a wider rise in floating storage volumes and a strong contango structure supporting the activity,” Jay Maroo, Vortexa’s head of market intelligence and analysis for the Mideast and North Africa, wrote in a note on Friday. There is a game being played right now, and we discussed that the previous OSPs were going to keep buyers away in May and June. These ships could just be moving unsold crude into onshore storage that could be sold into the European markets. “Ain Sukhna is the starting point for the SUMED pipeline, which runs to a crude storage and loading terminal at Sidi Kerir on Egypt’s Mediterranean coast. The facilities are part-owned by several Middle Eastern oil producing countries, including Saudi Arabia, which is the biggest user of the system. Eight of the 10 ships anchored off Ain Sukhna are Saudi-owned, according to vessel tracking data monitored by Bloomberg.”

I don’t see Europe as a big buyer, instead, KSA is taking this opportunity to refill some of the storage sites that have been drawn down over the last few months. If you look at KSA storage, they have reduced some of their commercial storage, and this could be an opportunity to refill some strategic areas. In the past, KSA has used recessions and periods of slow economic growth to replenish storage.

The question remains on when Iraq’s 400k or so crude starts flowing through the Ceyhan pipeline again. This would push into the Med and provide any relief from tightness created by the loss of Middle East barrels. The ramp up would be quick following an agreement and would soften the blow in July.

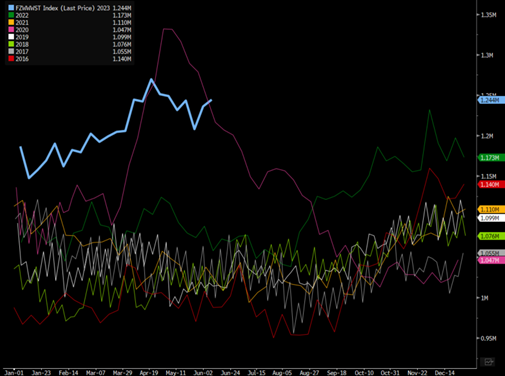

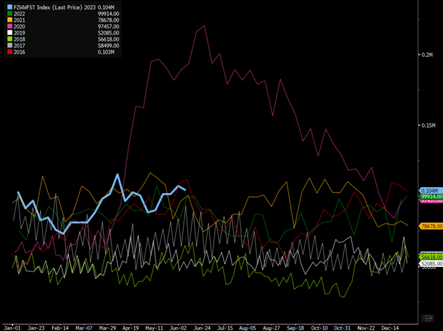

There is still a significant amount of crude on the water, which will remain at record levels driven by Russian flows. The chart below puts into perspective just how much crude is sloshing around the open waters.

While a large part of it is “in-transit”, we still have a very elevated amount of crude in floating storage. The below chart of floating storage shows that the only times higher were 2020 and 2016- so essentially a pandemic and Saudi price war. If China reduces purchases (as they normally do in July) and given the amount of crude in floating storage, will the KSA cut of an additional 1M barrels be enough? What happens if summer demand plays out the way we expect and not the way the market expects? Our view in that gasoline demand in the U.S. is about 400k-500k barrels below seasonal norms as distillate (diesel) demand remains well below the 5-year average. It’s important to note that this is something playing out around the world and NOT just in the U.S.

Demand is always a moving target, but the margin of error between builds and draws is so small any minute shift in demand can have drastic impacts.

We have already seen some declines in West African floating storage last week, but it will be important to see if we get additional movement in the near term. So far, physical prices have paused their decline but haven’t seen any near-term strength.

So far the pace of sales for Angolan cargoes are fairly in-line with the average:

- Fewer than five cargoes of Angolan crude are left to find buyers out of 40 scheduled, according to traders

- Compares with 6-10 unsold shipments as of June 9

Some oil tankers are avoiding Nigeria following tax discrepancies: “At least two oil tanker owners are staying away from Nigeria after several companies received backdated tax bills totaling millions of dollars. Multiple businesses received demands from Nigeria’s Federal Inland Revenue Service, according to a member notice by industry group Intertanko seen by Bloomberg. They cover the period from 2010 to 2019 and range in amount from $400,000 to $1.1 million per vessel. In aggregate, some claims reach tens of millions of dollars.” This could slowdown some sale from Nigeria, in the near term, but will likely be cleared up quickly. Let’s just say- “Shakedowns” aren’t uncommon in the physical crude world.

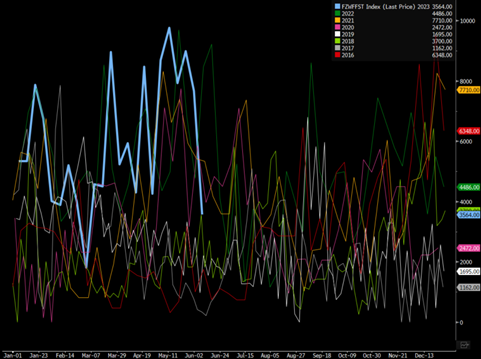

While flows continue to shift, it’s important to note what normally happens to Chinese crude imports in July. End of June to mid-July are normally the slowest periods of buying for China. The below chart shows the supertanker flows heading into China. China has been pulling in a significant amount of crude over the last few months from Russia and a growing number from Iran. We believe that China flows and purchases will follow seasonal slumps, but still outperform vs historics as they capitalize on Russian exports.

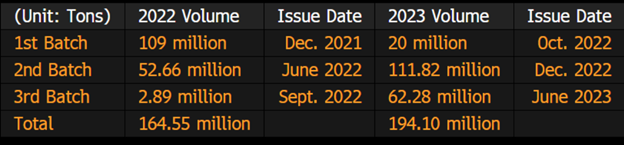

Chinese refining activity as an aggregate has increased as they brought on more assets, but utilization rates have been under pressure as local demand remains soft. There was a sizeable shift in China import quotas, but given the amount of crude signaling the region and floating storage levels- it was already bound to happen.

“China’s Big Crude Import Quota May Be Bright Spot for Oil Demand

- Independent refiners, traders get 62.28 million tons of quota

- Nation’s processing capacity has risen on new, large plants

China issued a large amount of crude-import quota in its third batch for 2023, a positive sign for an oil market facing demand concerns.

Beijing gave refiners and traders an allocation of 62.28 million tons, according to people with knowledge of the matter. That took the total quota this year to around 194 million tons, 18% more than the equivalent three batches in 2022 when virus restrictions sapped Chinese demand.

Oil is lower this year, in part due to a slower-than-expected economic recovery in China after the end of Covid Zero. A sustained boost in consumption could underpin higher global prices. The nation’s processing capacity has expanded in recent years with the addition of large, new independent refineries.

I will go through more Chinese data weakness a little later, but we see additional slowdowns that doesn’t bode well for more growth. Shandong refinery utilization rate had a counter seasonal decline and is falling below our expectations of hitting 64%.

There hasn’t been a meaningful increase in refined product demand within China. Everything is tracking pretty much inline with 2022, and when you look at utilization rates- activity outpaced last year. This resulted in more product sitting in storage, and is a fundamental reason the export quotas have also been pushed higher by China. It’s always important to factor in the import and export quotas as total volumes adjust. China is bringing on more refining so will require more imports, but this also results in additional exports impacting the utilization rates of refiners throughout Asia. So as China imports more oil and exports more product- others will reduce runs and therefore reduce their crude demand. This is why we focus so much on underlying storage in Singapore and flows to ensure we are capturing the complete picture.

The world has a significant amount of gasoline in the market, and it will keep pressure on crack spreads as demand remains below “normal.” Asia and North America continue to disappoint to the downside, and given the pressure on the consumer growing- we don’t see things improving anytime soon.

Kuwait and Saudi Arabia have also brought more refiners online, which reduces the amount of crude for sale but increase product in the market. Since 2014, the Middle East and Asia have pivoted to exporting the “higher value” molecule instead of allowing others to make gasoline and diesel. This has pulled some crude off the market- especially medium and heavy sours. While I don’t see a massive spike in pricing, it doesn’t mean that the crude grades won’t start to trade and widening differentials- especially light vs heavy. This will be a key shift in the market that will only get worse as we have highlighted since 2014 with the view “Crude Quality Matters.” The U.S. and many of the refiners built since 2014 are complex facilities that require a heavy slate of crude. The lack of exploration of heavy crudes will leave many refiners bidding over the same barrels.

In the meantime, Europe still has the second most amount of gasoline in storage (only 2020 higher), and you have Singapore with a record amount of light distillate. Diesel cracks had a massive bounce this past week even as storage continued to build. It’s important to note that diesel/distillate normally builds this time of year, so the pace of the builds will be key to track. PADD 1 (East Coast) in the U.S. will remain well below average, but we have seen some normalizing moves in Europe and some meaningful improvement in Singapore. This wasn’t enough to slow down the strong bounce in crack spreads: 1st chart is US and 2nd is Asian gasoil. There were strong bounces across the board that will provide support for refiners in the near term, but we don’t see this as a sustainable move going forward. The economic data and storage levels don’t support a continued rally, but they also don’t support a collapse. It will likely move back to the mid-year lows and hold there until we get to Sept/Oct. I initially expected to see US diesel cracks head closer to $20 and

The pressure point in the U.S. will come as exports continue to slow, demand remains sluggish, and refinery activity picks up (storage). The key piece for the U.S. will be PADD 3 (Gulf of Mexico) as distillate gets pushed back onshore and can’t find a home in the market.

Singapore will hinge on industrial activity and exports from China. We already have industrial activity/manufacturing in contraction with rising export quotas from China.

None of this happens quickly but will develop throughout July/August and will put us in a very precarious situation heading into September. This is why the KSA “voluntary” cuts may last a bit longer than just one month. I think the UAE was right to believe the “right” time to assess the situation was October, but they could be seeing some bigger breakdowns in economic activity that we are seeing as well. Especially when you consider the seasonality on buying from China.

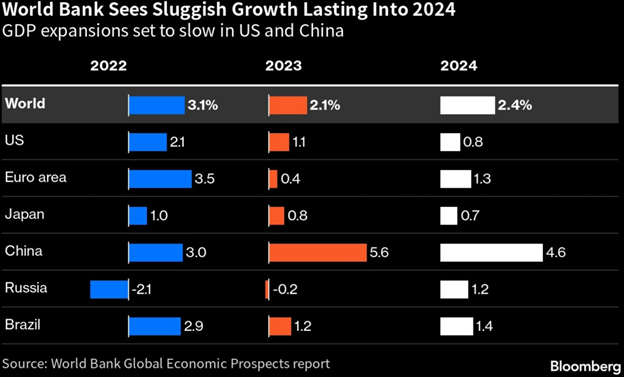

Now is a good time to talk about global growth and some of the issues that are plaguing the underlying markets. It’s interesting to see the World Bank raise their 2023 estimates while Europe enters an “official” recession, and China talks about stimulus to pick-up a slowing economy. The one consistency that I agree with between the IMF and World Bank is the sluggish growth expanding into 2024. “The WorldBank has revised its estimate for 2023 growth from 1.7% (in January) to 2.1% … 2024 growth has been cut from 2.7% to 2.4% … this year, China leads with 5.6% growth estimate; Russia lags with -0.2%.” I think both agencies are under-estimating elevated rates and inflation- none of which are falling any time soon.

I do agree with the view that some of the EM rates are done rising, but I don’t see any meaningful pivot in rates over the rest of this year or in at least Q1’24. Every nation dumped so much liquidity into the market throughout the last 2.5 years- it’s near impossible to undo that damage so quickly. The situation is only made worse with commodity supply limitations and broader food shortages.

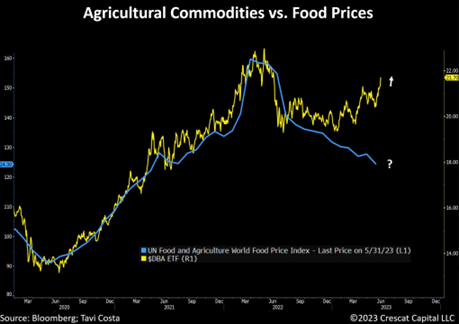

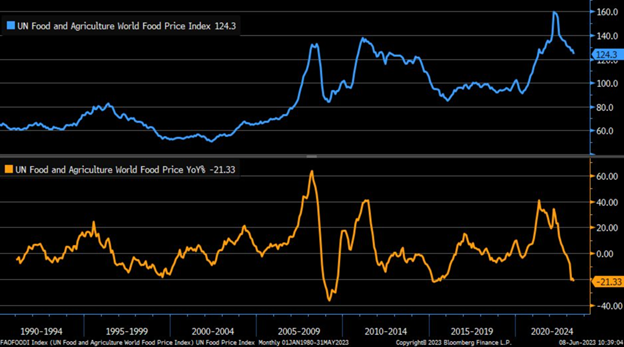

The food situation doesn’t get recognized the way it should as the flows from the Black Sea dwindle and scorching temperatures impact yields. Agriculture prices have spiked back up while UN Food prices have normalized a bit. Agricultural commodity prices are sharply moving higher again, suggesting that food prices are poised to follow suit. This is a big problem for EMs that rely so heavily on imports.

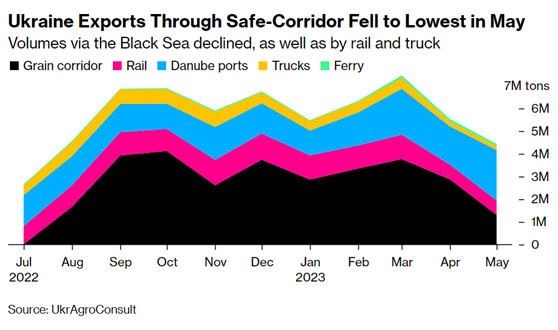

The movement of grain exports from the Black Sea has continued to fall even though it was renewed for another two months. We have said repeatedly to look at the movement of ships and NOT what the headlines say. The below chart puts into perspective just how much as dwindled over time. While I agree with the below quote regarding some benefits from South America- it is starting to be overshadowed by the heat striking the U.S. and damage to the Chinese wheat crop. Here is a quick update on Chinese wheat from Trivium. Based on what I have heard, the water caused a significant amount of rot on both harvested grain as well as what was left in the field.

That’s why we’ll be watching closely as the harvest wraps up in late June.

- As of writing, about 80% of wheat area has been harvested – that’s roughly on par with last year’s timeline.

- Typically, the ag ministry (MARA) releases an estimate of yield and quality shortly after the wheat harvest is declared complete.

Why it matters: China is the world’s largest wheat grower, and last year it was the biggest wheat importer too.

- A clear estimate of this year’s wheat harvest will clarify potential impacts on farmers, food prices, and global grain markets.

Don’t forget: Beijing considers wheat (along with rice) as critical to food security, and top leaders are already jittery about overreliance on imported agricultural commodities.

- A serious crop failure would only intensify those fears.

South American grain exports are set to overshadow Black Sea shipments this year as doubts grow over an UN-backed Ukraine deal and international traders cut commercial activities in Russia, a top executive with major commodities group Cargill said. The Black Sea grain deal, which allows the safe passage of grains through three Ukrainian ports, was extended on May 17 for two months – a shorter time than expected. “The corridor is definitely not performing as it was at the beginning,” Jan Dieleman, president of Cargill’s ocean transportation business, told Reuters. “It’s more focused on the smaller (ship) sizes now … I do think that with some quite big crops in Brazil, you might also see some of the demand being switched out of the Black Sea into Brazil at some point, on corn, for instance.” Record production of both corn and soybeans in Brazil in the current 2022/23 season has led to strong demand for vessels in South America. Dieleman said if the Black Sea grain corridor deal ended, the price impact would be less “simply because it is a smaller (export) programme already”.

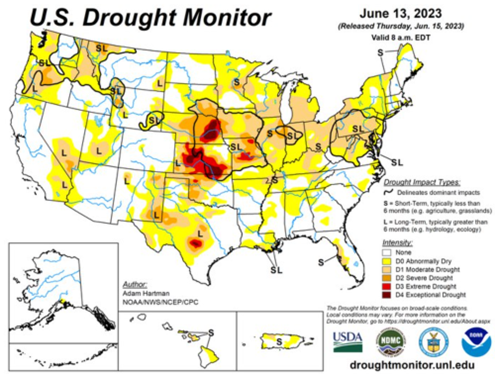

The drought in the U.S. is striking the heart of corn and soybean regions that are pushing down yield expectations.

The above chart puts into perspective just how stressed some of these regions are within the U.S. This is all happening as we have a strengthening El Nino that will reduce moisture in pivotal growing regions throughout India, Southeast Asia, and Brazil.

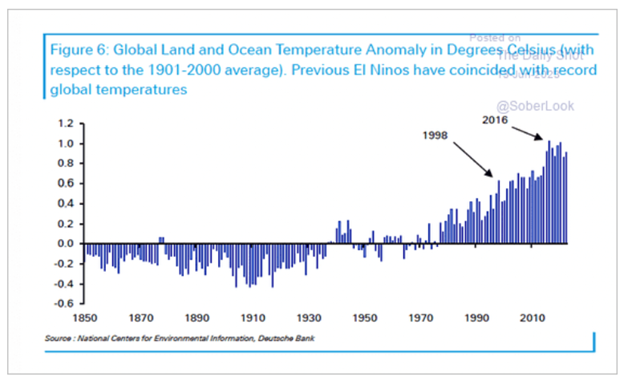

These areas are responsible for a significant amount of rice production, and you can see that El Nino events impact prices as harvest dwindles.

El Nino is also a major factor when impacting global temperatures and setting records, which create more extreme weather events also hurting grain yields.

These are all problems when you look at any of the current food situations and global cost of living. Even with a “reduction” in the UN Food and Ag world price, you can see we are still above prices that created the “Arab Spring.” When you factor in current futures prices, we are going to get pushed higher over the next few months putting more pressure on economies.

Emerging Markets are also seeing a drop in general imports that signifies softer growth. For those that watch the Econ show, I always discuss the importance of monitoring imports as they are leading indicators for exports and local demand. Based on the below countries, global growth as stated by the IMF and World Bank are overstated.

In the interest of time, I will send out another round of insights next week covering China and U.S. data because there is a lot to cover- especially when we look at wages and inflation impacts. I hope everyone has a great weekend!

Kuwait and Saudi Arabia have also brought more refiners online, which reduces the amount of crude for sale but increase product in the market. Since 2014, the Middle East and Asia have pivoted to exporting the “higher value” molecule instead of allowing others to make gasoline and diesel. This has pulled some crude off the market- especially medium and heavy sours. While I don’t see a massive spike in pricing, it doesn’t mean that the crude grades won’t start to trade and widening differentials- especially light vs heavy. This will be a key shift in the market that will only get worse as we have highlighted since 2014 with the view “Crude Quality Matters.” The U.S. and many of the refiners built since 2014 are complex facilities that require a heavy slate of crude. The lack of exploration of heavy crudes will leave many refiners bidding over the same barrels.

In the meantime, Europe still has the second most amount of gasoline in storage (only 2020 higher), and you have Singapore with a record amount of light distillate. Diesel cracks had a massive bounce this past week even as storage continued to build. It’s important to note that diesel/distillate normally builds this time of year, so the pace of the builds will be key to track. PADD 1 (East Coast) in the U.S. will remain well below average, but we have seen some normalizing moves in Europe and some meaningful improvement in Singapore. This wasn’t enough to slow down the strong bounce in crack spreads: 1st chart is US and 2nd is Asian gasoil. There were strong bounces across the board that will provide support for refiners in the near term, but we don’t see this as a sustainable move going forward. The economic data and storage levels don’t support a continued rally, but they also don’t support a collapse. It will likely move back to the mid-year lows and hold there until we get to Sept/Oct. I initially expected to see US diesel cracks head closer to $20 and