Brent is following the trading range path we laid out once Saudi Arabia and Russia committed to keeping their voluntary cuts through year end. The trading range was shifted higher to $88-$96 with some clear areas of resistance. We outlined the first level of resistance at about $92 with the next level hitting $94. The market hit $94 early today and has quickly paired back to the next layer of support. Demand continues to be a broad issue when we look across the crude complex.

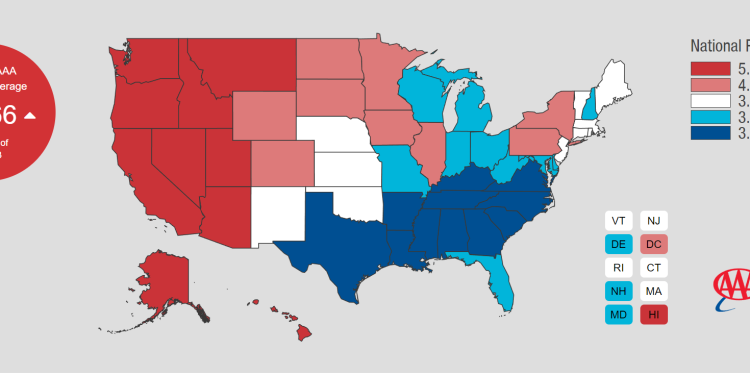

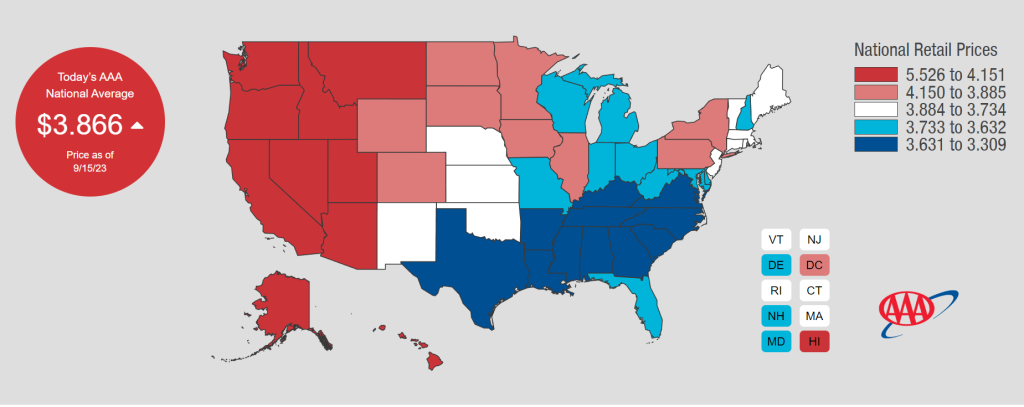

There is always a seasonal aspect to the drop in demand, but the move lower in gasoline and distillate is much greater versus normal reductions. It follows what we have been highlighting when it comes to consumer pressure on gasoline and diesel. The pressure grows as gasoline prices continue to push higher even as we “officially” end summer blend as of today. Based on the elevated price of crude holding firm, we don’t see a meaningful adjustment lower in the near term, which is another layer of pressure on the consumer as we will discuss shortly regarding near- and medium-term inflation.

This content is locked

Login To Unlock The Content!