The U.S. economy is currently experiencing a period of uplift, attributed to reduced inflation, a proliferation of job openings, and consistent consumer expenditure, fostering a renewed sense of confidence among economic enthusiasts. There’s growing speculation that the U.S., being the world’s premier economy, might circumvent an imminent recession, especially with recent political moves aimed at preventing a government shutdown and thereby upholding a degree of short-term stability.

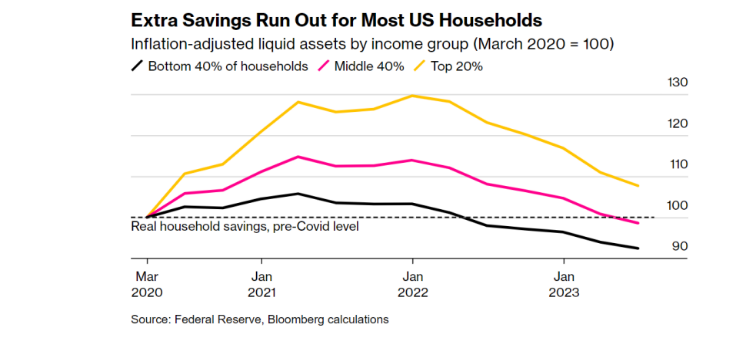

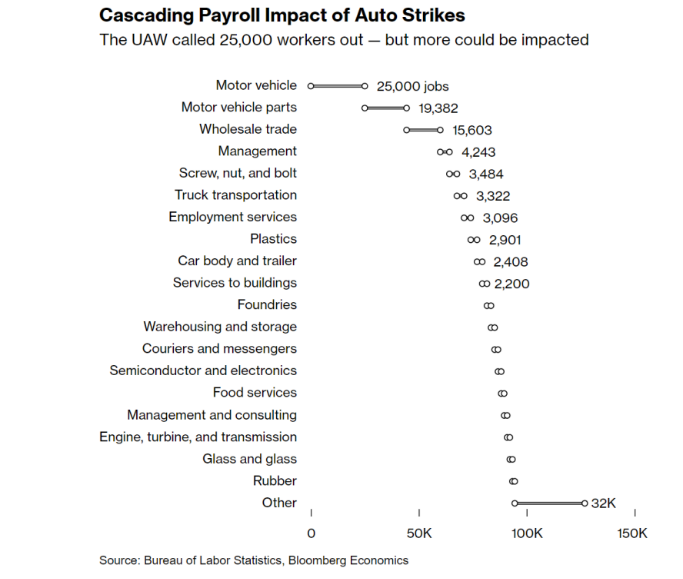

However, past patterns remind us that an economic high often precedes downturns. A closer examination of present economic trajectories suggests that the U.S. might not stand on as robust a foundation as presumed. For example, the automotive sector, a cornerstone of U.S. manufacturing, is already facing potential labor disruptions. Coupled with upcoming student loan repayment deadlines and the ever-looming threat of government closures, the nation’s GDP growth could face headwinds in the ensuing months.

It’s worth noting that accurately forecasting recessions is inherently challenging. Most economic predictions rely on linear forecasting, drawing from current trends, which inadequately accounts for the erratic nature of economic downturns. While the present-day figures on unemployment seem to signal economic stability, unforeseen shifts could quickly set the U.S. on a recessionary trajectory.

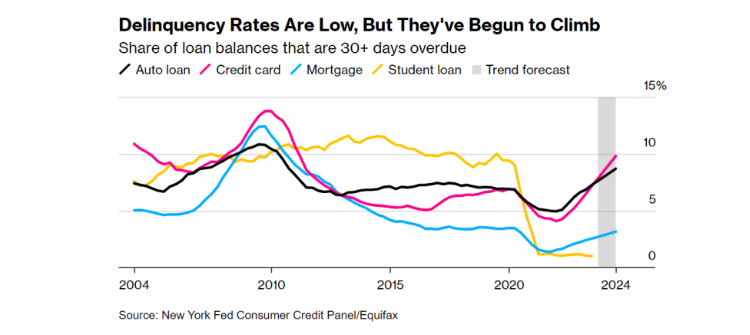

Compounding this scenario are the Federal Reserve’s recent interest rate increases. While some sectors like equities and manufacturing might momentarily withstand such fiscal measures, the wider economy, especially the employment sector, could experience extended repercussions. The full effects of the rate adjustments initiated in early 2022 may not be entirely felt until late 2023 or perhaps 2024.

Externally, the U.S. confronts a series of global economic hurdles. China, the world’s runner-up economy, contends with a housing sector dilemma. The Eurozone appears to be stalling, and the prospect of a U.S. government shutdown remains, with each week of inactivity potentially detracting from the nation’s annual GDP growth.

From an energy perspective, the oil market is a vital component that demands attention. Historically, oil price surges have been a consistent harbinger of economic setbacks. As oil prices ascend from their recent nadir, American families are likely to face financial strain, which could curtail consumer spending.

To sum up, while certain segments of the U.S. economy display robustness, there are multiple signs advocating prudence. A blend of domestic hurdles, international economic developments, and policy shifts may place the U.S. on a recessionary path. As an analyst, I acknowledge the possibility of a measured descent; however, the interplay of these various elements might nudge the economy towards a downturn.