ExxonMobil Touted To Acquire Pioneer

Several reports by news agencies suggest that ExxonMobil (XOM), the largest crude oil producer in the US, is holding talks with Pioneer Natural Resources (PXD) to acquire it. PXD is one of the top energy producers in the Permian Basin. PXD’s market capitalization is approximately $50 billion against XOM’s $436 billion. Reports suggest that the deal would be valued at $60 billion, which indicates that it would pay a significant premium per location. Over the past five days, PXD’s share prices have gone upwards by 4.6%, while XOM has shed 8.2% of its value in the stock market.

PXD in Permian

PXD is the third-largest oil producer in the Permian basin after Chevron and ConocoPhillips. The anticipated acquisition would strongly solidify XOM’s presence in the Permian — the most prolific US oilfield region. According to analyst estimates, PXD owns 6,300 net high-quality well locations in the Midland sub-basin, equating to ~20 years of drilling activity. This would lengthen XOM’s oil-weighted shale producers.

PXD has the largest contiguous Permian Basin acreage position. In Q2 2023, PXD’s crude oil production amounted to 369 MBOPD (or 717 mboepd). It has recently raised its FY2023 oil production guidance to 364 MBOPD from its earlier guidance of 357 MBOPD. Its average rig count in FY2023 is 23-25. The average MBO per lateral length has also increased over the past three years due to extended lateral length productivity. This has resulted in an industry-leading well inventory in North America.

XOM In Permian

ExxonMobil produced about 620,000 boed in the Midland and Delaware basins in the Permian. In this region, XOM maximizes value by developing a high-quality contiguous acreage position. Based on scale and technology, it drives value with multi-well pad corridors and cube development. It also increases resource recovery through the use of proprietary technology. The company’s cumulative wells have the longest laterals and have one of the lowest days on well.

So, if combined, the large amount of contiguous acreage would allow XOM to maximize drilling and hydraulic fracturing scheduling efficiencies. Also, it will optimize water usage, recycling, and transport operations. Plus, it can minimize the number of truck trips.

What’s The Rationale?

Adding net acreage has proved to be difficult due to various policy and regulatory changes in recent times. In February, the US administration accused XOM of achieving excessive profits at the expense of consumers. So, the potential deal can attract political and regulatory scrutiny. The current Biden administration promised on the campaign to end or restrict new federal leasing, but US courts have blocked it from doing so. Recently, the government has unveiled a five-year offshore oil drilling plan for three sales in the Gulf of Mexico, which is quite low compared to the past average.

Inorganic growth, i.e., through merger and acquisition activity, has been the preferred route for the producers. Investors have started to put a premium on companies that minimize capital expenditure on new and costly drilling and instead return cash to shareholders. This preference has left energy producers with fewer options. One accepted path for expansion is acquiring companies to replenish the dwindling number of prime drilling sites. For XOM, adding volumes from acquisition to feed its downstream operations like refineries and chemical crackers likely makes more sense than ramping up its rig count.

Exxon has been no stranger to big-ticket deals. In July, it acquired Denbury Resources for $5 billion. However, the proposed PXD deal falls in a different league and would be the most significant since XOM’s acquisition of XTO in 2009 for $41 billion. PXD, too, has had its share of M&As in recent years. In 20221, it bought Parsley Energy and Double Point Energy (a private operator) for deals worth a combined $11 billion.

What Can Go Wrong?

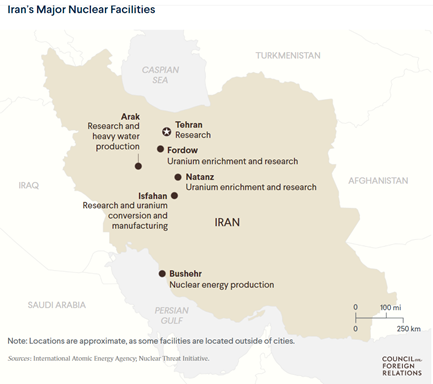

One of the critical factors for these deals to go through profitably is the crude oil price, which is interlinked with these companies’ valuation. So far, crude oil prices have been steady in the past few months. However, geopolitics is tricky. For example, Russia’s invasion of Ukraine triggered an initial price hike, followed by a sharp fall over concerns about a global economic slowdown and reversed again on OPEC production cuts. The current crisis in Israel can trigger another fall or cause volatility. So, as sensible as it goes, both parties can call the deal off if the situation demands.

<div

class=”ihc-locker-wrap”><div

class=”ihc_locker_6″><div class=”lk_top_side”>

</div><div

class=”lock_content”><h2 style=”text-align: center;

line-height: 24pt;”>

To unlock the content you

need a <a href=”https://primaryvision.co/subscription-plan/”>

Premium</a> or <a

href=”https://primaryvision.co/subscription-plan/”>Enterprise</a>

Account!</h2>

<div

class=”lock_buttons”></div></div></div></div>