By Mark Rossano (Originally published Mar 12th, 2021)

In mid-February, President Biden stated that the U.S. would be willing to return to the JCPOA (Joint Comprehensive Plan of Action) if Iran resumes compliance under the agreement. Iran struck back by saying they would only re-enter discussions if the U.S. and EU dropped the sanctions first—ahead of any initial talks. Iran announced in January that they would begin enriching uranium and restricting IAEA members into the country. In March, the U.S. and EU again tried to get Iran to cooperate with the International Atomic Energy Agency with regards to their nuclear activities. They followed the statement by launching a barrage of missiles, drones, and rockets against assets in the region—with the most recent one being against a U.S. military convoy supply.

Iran is currently doing its best to stay relevant in the Middle East, but when looking at the full picture of the region, it’s clear that these attacks are not coming from a point of strength—rather, the opposite. Iran is facing a major internal conflict between the populace and the ruling party. When the JCPOA was first enacted, sanctions were removed from Iran, which provided a cash windfall. But they spent the money on proxy support instead of internally on the local economy, which created a great deal of strife within the country as locals didn’t see the economic or financial benefit of the deal. This has become a major point of contention and has increased the divide within the country as the populace believes the regime “squandered” the money. Iran continues to be impacted by sanctions squeezing the balance sheet and limiting crude production and total exports. The pressure is pushing the country closer to a regime change, with a presidential election coming on June 18th. Their political future is nearly impossible to predict, but a major shift will most likely happen over the next 24 months. It’s doubtful that any negotiations with Iran will take place ahead of the election, but to show strength and solidarity with their proxies, attacks will remain prevalent throughout the region.

What is the JCPOA?

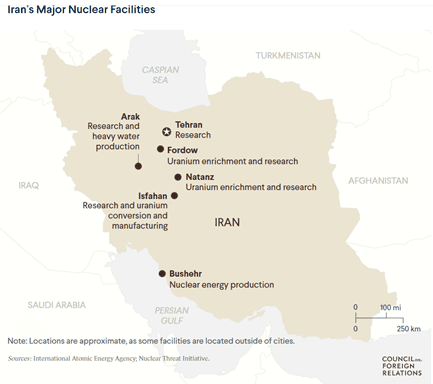

In July 2015, Iran signed the JCPOA deal agreeing to dismantle most of their nuclear program and permit facilities to be inspected regularly in exchange for a lifting of sanctions—unlocking billions in frozen assets and allowing Iranian oil to be sold internationally. When the terms went into effect in January 2016, Iranian crude production went from 2.8M barrels a day to 3.83M barrels a day, and stayed at that level until President Trump removed the U.S. from the agreement and reinstituted sanctions on the country. The biggest controversy of the initial deal was that it failed to address the development and testing of ballistic missile systems. During Obama’s administration, Iran tested several ballistic missile systems, causing a growing call to expand the limitations put on the country or exit the deal altogether.

When the U.S. officially withdrew from the JCPOA in May 2018, crude production in Iran dropped off quickly, but that doesn’t mean they stopped selling. They have always been very good at “clandestine” ways of moving crude through Iraq (shared fields/pipelines through Basra), ship to ship transfer, and utilizing their own tanker fleet. For these reasons, the below numbers are likely lower than what is making it to market since the sanctions were reinstated. But the additional risk of selling against sanctions also means that Iran sells their crude at steep discounts vs. the stated physical market. If a company or country is caught, the ships will lose their ability to sail, and governments, officials, and corporations will face sanctions and fines. Most shipping insurance in the world is denominated in U.S. dollars, and with Iran restricted from utilizing USD, they have to come up with other means to transact. They have created deals with countries that have the central banks posting the collateral on insurance and transacting in a different currency outside of the USD universe. The lack of USD in the Iranian markets and terrible balance sheet have pushed their unofficial inflation rate up to 67% on the year. This pressure impacts the local populace—it weakens their buying power and increases activity in the “black market,” bringing necessary goods to steep mark-ups. Regardless of how you look at it, the Iranian people lose on all fronts—and with many of them identifying more with reformist values and relations with long-term trade partners (like Europe and India), it means that those from the hardliners are losing significant support by the day.

Iran Oil Production

At the beginning of this week, Iran launched a barrage of missiles and drones at Saudi Arabian oil assets—this comes in the wake of a string of rocket attacks against U.S. and coalition forces within Iraq. While Iran seems to be putting on a show of strength, mounting internal pressure and the external noose tightening is actually putting them in a place of weakness. Israel has been striking Iranian assets and their proxies at will across Syria, while the U.S. has struck key structures in Syria and Iraq. Israel just struck another Iranian vessel carrying products to Syria, which is a tactic they use to disable ships importing illegal goods into the region. The pressure was ratcheted up again after Saudi Arabia responded by striking facilities in Yemen linked to the Iranian-backed Houthis. The regime is facing a growing crisis as protests have intensified in the Saravan, Sistan, and Baluchistan province. The Sistan-Baluchistan province is a semi-autonomous region along the Pakistan border, and has always been a problem for the Iranian government. It makes sense that as the regime appears to weaken, fringe areas will start to test boundaries—with the most recent uprising resulting in the destruction of police and IRGC facilities. Protests have continued to spread across all major cities and provinces as the country faces the fallout of economic sanctions. Employees are striking in greater frequency as wages and benefits either haven’t been paid or back pay is still “forthcoming.” As issues arise internally, the Iranian regime responds by projecting power and support of proxies, which takes money, equipment, and manpower. Iran needs to maintain their standing along the Shia Crescent, as Israel and the GCC (Gulf Cooperation Council) nations hit supply lines and embedded Iranian assets. But they will continue to be met with resistance. Just recently, the U.S. was accompanied by Israeli, Saudi Arabian, and Qatar aircraft as they flew B-52s across the region to show “solidarity” in deterring Iran. The below chart shows the “Shia Crescent” that is being squeezed as countries within the region unite against a common threat.

Generational dynamics are at work in the GCC nations as the younger generations are more open with their beliefs and views, even opening relations with Israel (who have proven highly effective at striking Iran and their proxies). This is a key reason why geopolitics shift over the course of decades—because it is closely tied to the generational cycles that underpin countries, alliances, and enemies. Israel has formalized diplomatic relations with four Arab League countries: Bahrain, UAE, Sudan, and Morocco. (When I was in the UAE in 2010, if you had an Israeli stamp in your passport, you weren’t allowed into the country.) It is also important to notice that Israel flew with KSA and Qatar in the recent U.S. B-52 flyover, even though they don’t have “formal” diplomatic relations with them. This is something that would have been impossible even three years ago. Qatar was subject to GCC sanctions in 2017 over their relationship with Tehran, but the embargo has officially come to an end as of January 5, and diplomatic and economic relationships have been re-established. Qatar and Iran share several oil and gas fields in Persian Gulf, which created a need to work together to share royalties. Qatar has been looking to expand their liquified natural gas capacity, so they needed to work closer with Tehran to structure new deals. These conversations kept going even after the JCPOA was re-instated and led to additional pressure within the GCC, which has now been overcome. So now you have four entities (and one old friend of Iran) flying a saber-rattling mission . . . and we didn’t think Iran was going to try to respond?

You may be asking, I thought Russia and Iran were allies in Syria? How can Israel strike in Syria given the anti-missile/aircraft barrages of S-200s, S-300s, and S-400s? The reason is: Russia doesn’t care if Israel hits Iranian-backed positions as long as they don’t touch Russian assets. According to reports, Russia was fully aware of the recent U.S. mission, and per the agreement, did nothing to stop the attacks. Russian soldiers operate the more advanced systems and allow Israel (and most recently, the U.S.) to hit assets within their “controlled” airspace. But why would Russia not protect Iran? Aren’t they on the same side in Syria? Yes and no. Yes, they have both been fighting alongside Al-Assad in Syria, but Russia wants to be the top dog, so why not let Israel and their OPEC+ allies hit Iranian targets. It helps weaken a potential political threat within Syria and the Middle East.

The constant attacks and sanctions are causing the Iranian regime to run short on money (and time!) as the populace continues to turn against them. The death of Qasem Soleimani eliminated the head of the IRGC (Iranian Revolutionary Guard Corps) Quds Force who was a mastermind behind terrible (and HIGHLY successful) tactics within and outside their borders. He is responsible for the deaths of many U.S. soldiers and Iranian civilians while in power. Soleimani was an enemy to many, but his whereabouts and movements were typically clouded in mystery—the Quds Force is a clandestine unit. But intelligence has been leaking like a sieve from Iran as high-value targets continue to be eliminated. Most recently, Mohsen Fakhrizadeh (a top nuclear scientist) was killed by assassins using a remote machine gun. This is a man who has a constant security detail and whose movements are a state secret due to the importance of their nuclear program. There have been a barrage of similar “attacks” throughout last year (the map below highlights some of the more recent incidents). All of these attacks have attempted to minimize civilian casualties but hit at regime-owned and operated companies and facilities. It is clear that local Iranians are now emboldened to strike out against a repressive regime.

The Iranian people have carried out many protests over the years, but they have always been met with violent suppression (many of them led by Soleimani). The brutal tactics have only built up more resentment across the region. The populace has been turning away from the regime over time, but the shooting down of the Ukraine flight in July 2020, the handling of COVID19, and the new deal with China have pushed people beyond their breaking point. Iran and India have been friends and allies for over a 1000 years, and part of the China deal stipulated that India had to be “expelled” from current and future deals with Iran. India has built refiners specifically for their crude and has deals in place to build roads, rails, ports, and oil and gas exploration that was temporarily paused (but not stopped) when the U.S. sanctions came back into play. The U.S. even turns a blind eye to some shipments of Iranian crude heading into India. After the Ukraine plane was shot down, the local Iranians stopped walking on Israeli and U.S. flags that were painted on the ground, with some even getting rid of them all together—symbolically showing that they were no longer eager to “trample on” and disrespect these countries. The U.S. also set up humanitarian aid through the Swiss Embassy during the COVID19 pandemic to show solidarity and support for the local populace.

The mounting pressure internally has pushed the Iranian regime to lash out with the recent attacks on coalition forces in Iraq, KSA assets, and an Israeli ship. Iran’s balance sheet is under pressure, which pushed President Rouhani to sign a deal with China agreeing to inject $400B of Foreign Direct Investment over 25 years into Iranian O&G and petrochemical businesses. They also agreed to invest in their banking, telecommunications, ports, railways, and other projects (many of them already had deals with India). This new deal allows China to deepen their military cooperation through joint exercises, research, weapons development (ummm . . . JCOPA?), intelligence sharing, and other integration metrics. China has been increasing their purchase of Iranian crude at a steep discount, especially with new refiners and petrochemical facilities starting up within China that require the type of oil Iran produces. China has been given an opportunity to gain a footing in the Middle East, which is a place they have tried to increase influence through Belt and Road investments. Over the last several years, Iran has become an integral part of the BRI, and even after calls to shut down travel with China due to COVID19, Iran was the last country to react. This caused Iran to be one of the hardest hit nations at the outset of the pandemic, and created even more animosity between the regime and the local Iranians. The biggest concern now is the delivery of advanced ballistic missile capacity to Iran, which so far has been limited to older generation technology. This is just another (among many) point of contention between the U.S. and China, but we have already covered that extensively in two previous articles.

President Biden must remain firm in deterring attacks against U.S. and allied assets in the Middle East. While it is important to strike back to show force, we must avoid any civilian casualties by not striking within Iran. It would be a huge error to deter the populace’s shift away from the regime, especially as intelligence is leaking out in the U.S.’s favor. They are losing influence as the noose tightens around their borders and protests increase throughout Iranian provinces. Geopolitical moves are measured in decades, not single years, with nothing ever moving in a straight line, but the hardliners don’t have the support of the locals or the international community. We have considered Iran a friend and ally in the past, and if the Iranians continue their current path, we will one day again soon. Those from the ’79 revolution are old, dead, or losing influence—now is the time to press.