Navigating the global economy can be like reading a weather forecast for three different cities at once. We’ve got our hands on the latest Market Sentiment Trackers for the U.S., Europe, and China, each painting a unique picture of economic health. The U.S. shows signs of strain with manufacturing dips and housing market woes. Europe’s economy is treading water, facing energy crises and sluggish growth, while the UK dodges recession. China shines a bit brighter, balancing tech growth against trade tensions. This article will unpack these reports, breaking down the complex economic signals into straightforward insights, helping us understand what’s on the horizon for these economic powerhouses as we head into the year’s end.

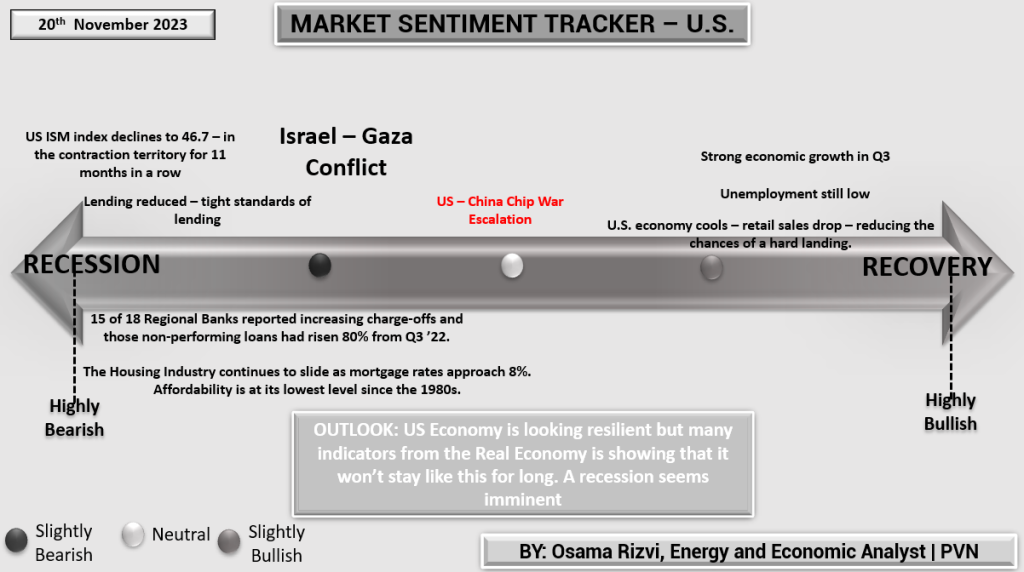

Analyzing the “Market Sentiment Tracker” for the U.S., we observe a confluence of economic indicators and geopolitical tensions that shape the current financial landscape.

Contraction Indicators:

- The ISM Index, a key barometer for manufacturing health, is below the 50-threshold at 46.7. This implies the manufacturing sector has been contracting for nearly a year, which can be a leading indicator of wider economic downturns.

- The tightening of lending standards is a defensive move by banks to mitigate risk, but it also restricts capital flow to businesses and consumers, potentially dampening economic activity.

- A marked increase in charge-offs by regional banks is alarming as it reflects deteriorating loan quality and could signal forthcoming stress in the banking sector.

- The housing market downturn, with high mortgage rates and low affordability, echoes the sentiment from previous recessions where housing led the downturn.

Geopolitical Strains:

- The Israel-Gaza conflict likely affects global energy prices and induces market volatility.

- The U.S.-China chip war escalation suggests further supply chain disruptions, impacting technology sectors and potentially leading to increased production costs and inflation.

Recovery Signals:

- Strong economic growth in Q3 indicates some resilience in the economy, potentially driven by consumer spending and business investments.

- The sustained low unemployment rate is a traditional sign of a strong economy, maintaining consumer confidence and spending.

Cautious Optimism:

The cooling economy, reflected by declining retail sales, could be a double-edged sword. It may prevent the economy from overheating and stave off inflationary pressures, but if demand wanes too much, it could precipitate a recession.

Final Outlook: The sentiment tracker suggests that while there are pockets of strength, significant risks loom. The juxtaposition of a cooling economy against a backdrop of geopolitical and financial stressors points to a fragile equilibrium. The analysis indicates the U.S. economy is in a late-cycle phase, where growth is slowing down and the risk of recession is increasing. As such, these indicators are a sign to be cautious with investments, focusing on diversification and hedging against potential downturns. It’s also a call for policymakers to be vigilant and possibly enact counter-cyclical measures to prevent a hard landing.

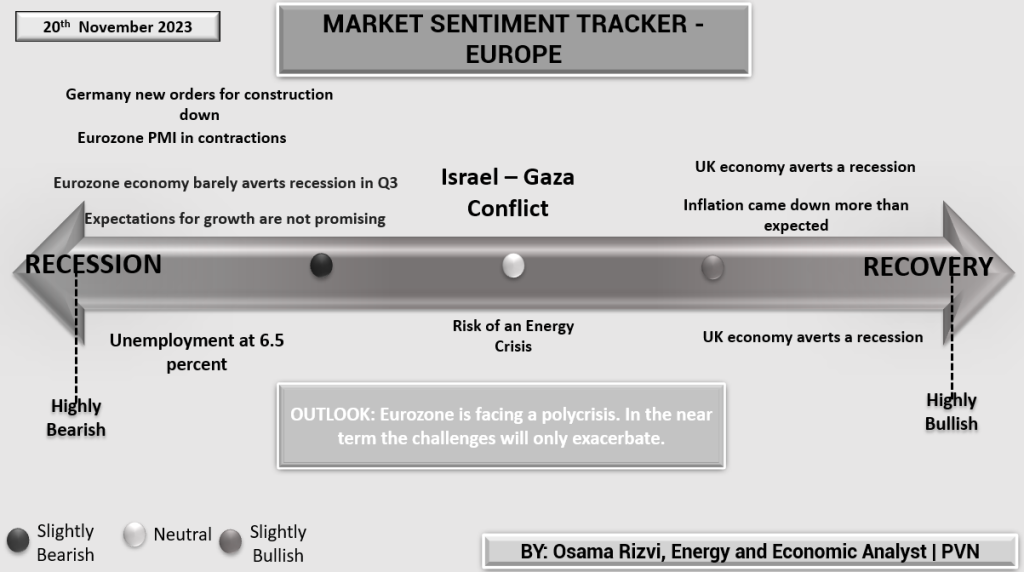

The bearish indicators suggest a challenging economic climate in the Eurozone:

- Germany’s construction sector is witnessing a downturn with new orders declining, indicating a potential slowdown in one of Europe’s largest economies.

- The Eurozone Purchasing Managers’ Index (PMI) is in contraction territory, signaling a decrease in manufacturing and service sector activity, typically associated with economic slowdown.

- The Eurozone narrowly avoided a recession in Q3, but the absence of promising growth expectations casts a shadow on future economic performance.

- A high unemployment rate of 6.5% further exacerbates the situation, reflecting lingering labor market weaknesses.

Moreover, the sentiment tracker underscores the risk of an energy crisis, which could be precipitated by geopolitical events such as the Israel-Gaza conflict or other external shocks, leading to heightened uncertainty and potential economic distress.

In contrast, a few positive signs emerge from the UK, which seems to have dodged a recession and is experiencing a more significant drop in inflation than anticipated, suggesting effective monetary policy measures and a resilient economy.

The overall outlook indicates that the Eurozone is confronting a poly crisis and that challenges are expected to worsen in the near term. These indicators serve as warning signals of potential economic hardship ahead, with specific attention needed on managing energy security and supporting sectors that are showing signs of significant decline. The tracker advises that investors and policymakers brace for a tough economic environment ahead, focusing on risk management and contingency planning.

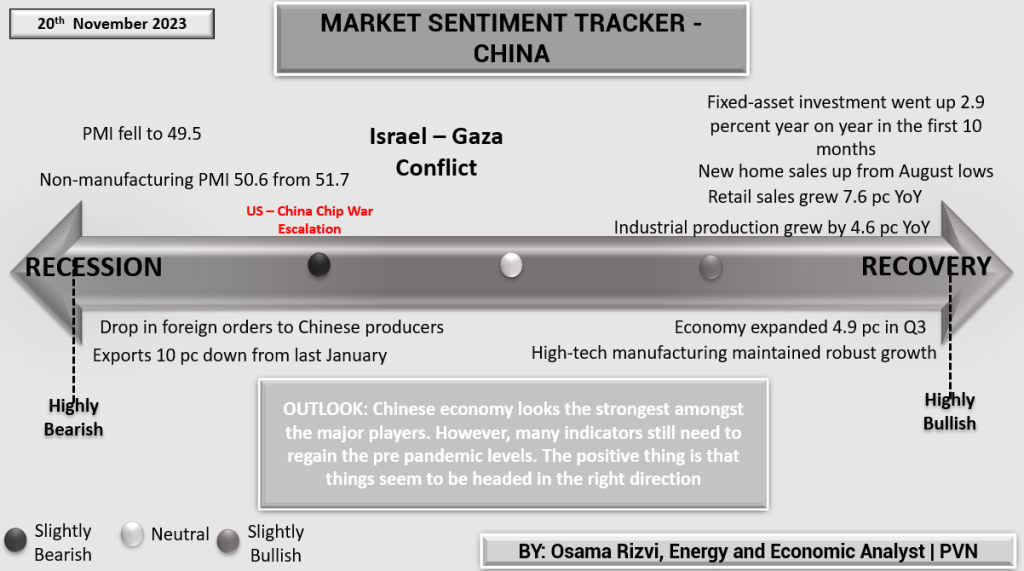

The “Market Sentiment Tracker” for China, as of November 20th, 2023, presents a nuanced picture of the Chinese economy with more potential of an upside than downside.

Recession Indicators:

- The PMI (Purchasing Managers’ Index) has fallen to 49.5, indicating a slight contraction in the manufacturing sector.

- The non-manufacturing PMI, although still above 50, has decreased from 51.7 to 50.6, suggesting a slowdown in the service sector.

- A decline in foreign orders and a 10 percent decrease in exports since the previous January underscore challenges in the external sector, likely exacerbated by the ongoing US-China chip war.

Recovery Indicators:

- Positive trends are evident in the fixed-asset investment, which has increased by 2.9 percent year-over-year in the first ten months, indicating confidence in long-term economic growth.

- A rebound in new home sales from August lows and a 7.6 percent year-over-year increase in retail sales reflect improving consumer confidence and spending power.

- Industrial production growth of 4.6 percent year-over-year and a 4.9 percent expansion in the economy in Q3 show robust economic activity, with high-tech manufacturing maintaining strong growth.

Overall Outlook: Despite some headwinds, the Chinese economy appears to be the strongest among major global players. While there are hurdles to regain pre-pandemic levels, the positive growth in consumer spending, investment, and high-tech manufacturing suggests that the economy is headed in a positive direction. The sentiment tracker, therefore, concludes on a cautiously optimistic note, indicating that while challenges persist, the underlying economic strength positions China on a recovery trajectory. It is safe to say that China’s economy is showing resilience with a potential for solid growth, but it is important to remain mindful of the risks posed by international trade tensions and domestic economic policies.