Completion Operation Outlook

We have already discussed STEP Energy Services’ (STEP) Q3 2023 financial performance in our recent article. Here is an outline of its strategies and outlook. STEP has established expertise in spudding coiled units at great depth. In 2024, the company expects completion activity to pick up pace as higher energy prices lead to higher capex in the upstream industry.

In Canada, STEP expects a slowdown due to budget exhaustion and the typical seasonality. It strategically shifts its coiled tubing units from south to north to relegate the pricing concerns. On top of that, a higher share of smaller Canadian fracturing jobs can adversely affect its results. So, although coiled tubing utilization in this region can stagnate over the next couple of months, in 2024, activity can accelerate. The increased activity growth can emanate from the Trans Mountain oil pipeline and the Coastal Gas Link natural gas pipeline completions. Because these are long-term projects, STEP’s management activity coiled tubing activity to improve in 2024. Also, it expects to gain market share because of its robust service quality and reach.

US Market Outlook

In the US, STEP will look to maintain its presence to support increased LNG activity in US natural gas basins. In Q4, its outlook remains choppy as the US onshore drilling activity fell. In 2023, the US rig count dropped by 20% until now. At the same time, the US frac spread count increased by 10%, reflecting the growth in completion activity in recent months. However, the frac equipment remains oversupplied, resulting in a soft spot market pricing. Despite that, STEP’s coiled tubing units remained highly utilized. In the final two months of 2023, utilization can fall, though.

Current Projects

In the US, where STEP runs four Tier IV pumps, it plans to add a dual fuel kit. It is also upgrading a Canadian Tier II pump to Tier IV dual fuel, which will be completed in Q2 2024. After completing the ongoing projects, the company will have nearly 68% of its total horsepower coming from Tier IV dual fuel technology. As volumes increase, the benefits of scale will add to the financial results. For more information on its ongoing projects, please read our previous article.

A Brief Performance Analysis

Our short article discussed STEP’s year-over-year topline increase in Q3 2023 in Canada but a fall in revenue in the US. Its adjusted EBITDA also decreased following the weakness in energy prices. In Canada, fracturing saw a 12% year-over-year increase in revenue as sand intensity per well rose. In coiled tubing operations, fires and flood affected results in Canada.

On the other hand, fracturing revenue was down 30% year-over-year in the US as frac spread utilization fell sequentially. Some clients sourced their own sand, leading to lower revenue and margin for STEP. However, the amount of sand pumped daily increased following higher average pumping hours. The US coiled tubing revenue also increased in Q3.

Cash Flows And Debt

STEP’s cash flow from operations increased by 46% in 9M 2023 compared to a year ago. As a result, its free cash flow increased by 66%. The company’s fleet reinvestment (gross CapEx versus long-term depreciation of significant assets) is estimated to be one of the best in Canada.

It has reduced its FY2024 capex plan to $60 million from the FY2023 capex plan of $105 million. It reduced net debt by 22% in Q3 from Q2. As of September 30, 2023, STEP’s leverage (debt-to-equity) was 0.25x better than that of many peers.

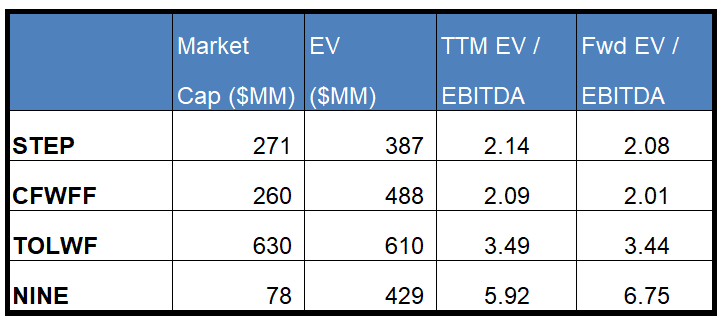

Relative Valuation

STEP is currently trading at an EV/EBITDA multiple of 2.1x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is nearly unchanged.

STEP’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA contrasts its peers because its EBITDA is expected to increase mildly versus a slight fall in EBITDA for its peers in the next year. This typically results in a small premium in the EV/EBITDA multiple compared to its peers. However, the stock’s EV/EBITDA multiple is lower than its peers’ (CFWFF, TOLWF, and NINE) average. So, the stock is undervalued versus its peers.

Final Commentary

STEP is looking forward to the renewed growth of activity in Canada, particularly those emanating from the Trans Mountain oil pipeline and the Coastal Gas Link natural gas pipeline completions. Because these are long-term projects, STEP’s management activity coiled tubing activity to improve in 2024. After implementing the fleet upgrading projects, nearly 68% of its total horsepower will come from Tier IV dual fuel technology. In the US, it will look to maintain its benefit from increased LNG activity in the natural gas basins.

However, the company faces some near-term challenges, too. Utilization can fall due to the typical seasonality. A higher share of smaller Canadian fracturing jobs can adversely affect its coiled tubing utilization. In 9M 2023, cash flows increased remarkably. So, it lowered its FY2024 capex plans. On the other hand, it reduced net debt, resulting in favorable leverage. The stock is undervalued versus its peers.