A Strategy Analysis

Our short article discussed our initial thoughts about KLX Energy Services’ (KLXE) Q3 2023 performance a few weeks ago. This article will dive deeper into the industry and its current outlook. In Q3, the US rig count dropped by 9%. The crude oil price has remained relatively firm. The energy price strength will drive higher returns for the operators. KLXE’s management estimates that the drilling market is close to a bottom and will likely bounce back in 2024. KLXE will benefit from a lean cost structure, additional asset capacity, and a technological edge when the recovery occurs.

The company also launched new products, including KLX vision completion tools. According to its estimates, the KLX phantom dissolvable plug resulted in a 5x increase in units sold in Q3. Also, during Q3, it commercialized KLX Oracle SRT (Smart Reach technology) – a downhole drill-out tool that synergizes with its coiled tubing and through tubing offerings. With efficiencies and differentiated performance, KLXE’s utilization and margin will be positively impacted.

Pricing Strategy

During Q3, KLXE saw “low to mid-single-digit percentage” pricing fall in some completion-oriented service lines. However, in some other service lines, it maintained its pricing. As the company kept the overall pricing steady, maximized utilization, and controlled costs, its operating margin remained stable despite the decrease in market activity.

FY2023 and FY2024 Outlook

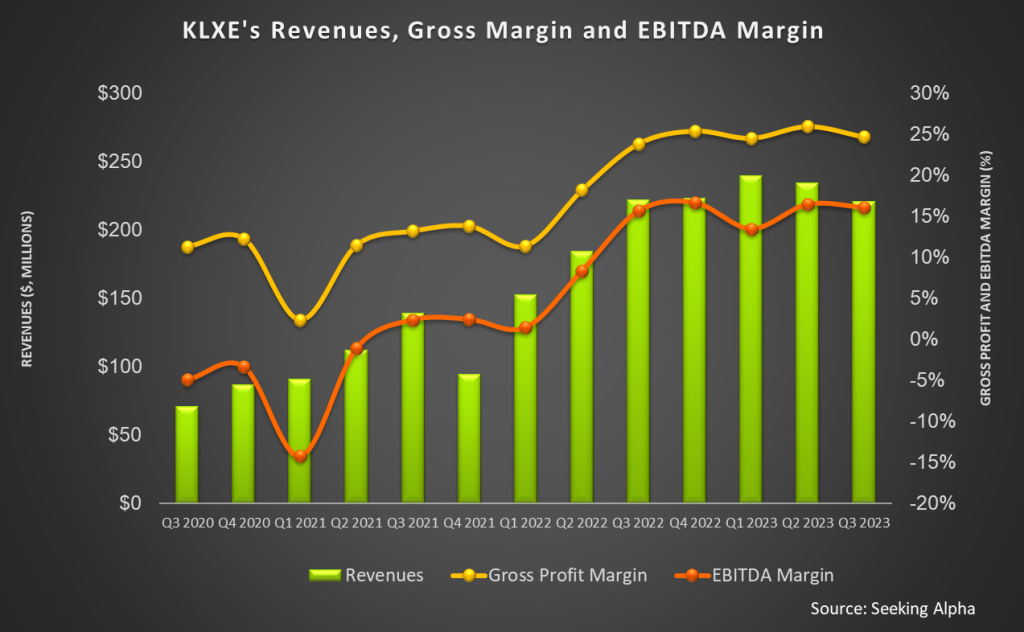

In FY2023, steady pressure pumping asset utilization and pricing will drive its margins and free cash flow. As a result, KLX’s adjusted EBITDA will remain nearly unchanged compared to FY2022. It also expects strong free cash flow generation in 2023 that will continue in 2024.

Recently, KLXE entered into a 12-month frac contract with a leading operator, which will pave the way for developing the company’s third frac spread in mid-Con. Currently, it operates two frac spreads in this region. It has also launched an integrated P&A offering in the Rockies. Plus, it plans to take delivery of two new fully electrified wireline units in Q4, which will enhance its electric completion equipment capabilities. The company’s various offerings can become a differentiator in technological advancements as operators set their 2024 budget.

Q3 Performance Drivers

Our short article discussed KLXE’s year-over-year topline decrease in Q3 2023. In Q3, the share of revenues from the Rockies increased from 28% in Q2 to 35% in Q3 following its ability to rotate additional assets and crews to the basin. The share of Northeast/Mid-Con decreased to 30% from 35% in Q2. However, readers might want to remember Rockies performed better in Q3 than the other quarters due to the improvement of its in-basin product service offering. The company’s revenues from rentals, coiled tubing, and directional drilling increased in this region during this period. Completions-focused activity accounted for 51% of its Q3 revenue.

Cash Flows And Debt

KLXE’s cash flow from operations increased significantly in 9M 2023 compared to a year ago. Although capex increased, its FCF also turned positive. The cash flow improvement reflects higher revenues and better working capital management. Its FY2023 capex budget exceeds the FY2022 capex by 40%. Most of the capex would support ongoing operations, and the remaining would be for reactivation equipment related to rentals, frac rentals, directional drilling, and wireline business.

Although it reduced net debt by 4% from Q2, as of June 30, 2023, KLXE’s leverage (debt-to-equity) was high, at 5.9x, due to low shareholders’ equity. As of September 30, the company’s liquidity was $155 million.

Relative Valuation

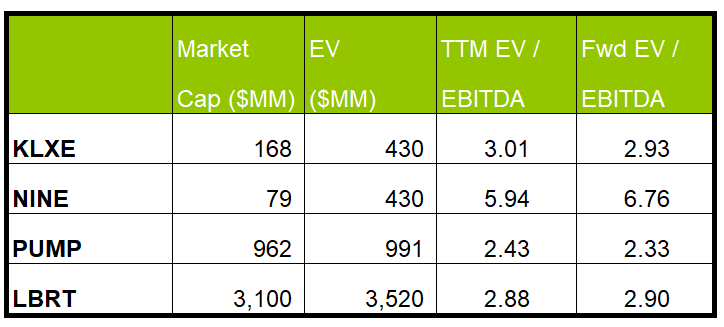

KLXE is currently trading at an EV/EBITDA multiple of 3.0x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is lower.

KLXE’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA contrasts with its peers because its EBITDA is expected to increase versus a fall in EBITDA for its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is lower than its peers’ (NINE, NEX, and LBRT) average. So, the stock is undervalued versus its peers.

Final Commentary

In Q3, KLXE introduced innovative products in completions work like phantom dissolvable plug and Oracle SRT in downhole technology. These products saw a tremendous rise in sales. We expect KLXE’s asset utilization and margin to improve substantially in the coming quarters. The company also plans to deploy a third frac spread in Mid-Con. Plus, delivering two new fully electrified wireline units in Q4 will enhance its capabilities. During Q3, its revenue share from the Rockies increased because of the improvement in its in-basin product service offering.

As drilling and completion activity appear to be heading towards a recovery, KLXE’s outlook brighten in 2024. So, the company’s cash flows improved significantly in 9M 2023. However, the company’s low shareholders’ equity will continue to make its balance sheet inherently risky. The stock is relatively undervalued versus its peers.