As an analyst observing the current dynamics of the oil market, it’s clear that despite escalating geopolitical tensions, particularly in the Middle East, oil prices have not surged as might be expected in such circumstances. This resilience in the oil market can be attributed to a range of factors that are tempering the potential impact of these geopolitical risks.

Firstly, it’s essential to understand that while the possibility of conflict escalation exists, most market participants are assessing the situation with a balanced view of all potential outcomes. The tendency to focus on worst-case scenarios, or “catastrophising,” as highlighted by John Kemp, can lead to an exaggerated perception of risk. In reality, the probability distribution of outcomes is much broader, and it’s crucial to consider the full range of possibilities.

The current situation in the oil market is a prime example of this. Despite the involvement of various regional players in the Middle East conflict and disruptions in shipping routes, the market has not reacted with a significant price surge. As of January 2024, Brent prices have actually decreased by $11-15 per barrel (14-16%), and Europe’s gas prices have dropped by 5-16 euros per megawatt hour (14-33%) since September-October 2023.

This market behavior suggests that traders are assessing the risk of a major confrontation that could disrupt oil and gas supplies as relatively low. This assessment is supported by the signals from key policymakers in Iran, Hezbollah, the UK, and the US, who have shown a preference for avoiding further escalation. While unplanned events can indeed trigger conflicts, the decision-making processes at the higher echelons often lean towards de-escalation or containment, making a full-scale confrontation less likely.

Moreover, the oil market has several “shock absorbers” in place. These include substantial commercial crude and fuel inventories, significant spare production capacity by OPEC⁺ and Saudi Arabia, and expected increases in crude output from U.S. shale and non-OPEC producers. With global consumption projected to grow by less than 1.5% in both 2024 and 2025, these factors provide a cushion against potential supply disruptions.

In conclusion, while the risk of catastrophic escalation that could disrupt oil production and shipping exists, it is currently viewed as a less-likely tail risk. The market is more focused on routine risks such as persistent inflation, interest rates, and sluggish economic growth. These factors, along with the aforementioned buffers, are keeping oil prices around their current levels, unless there is a significant increase in the probability of major escalation.

Global Economy

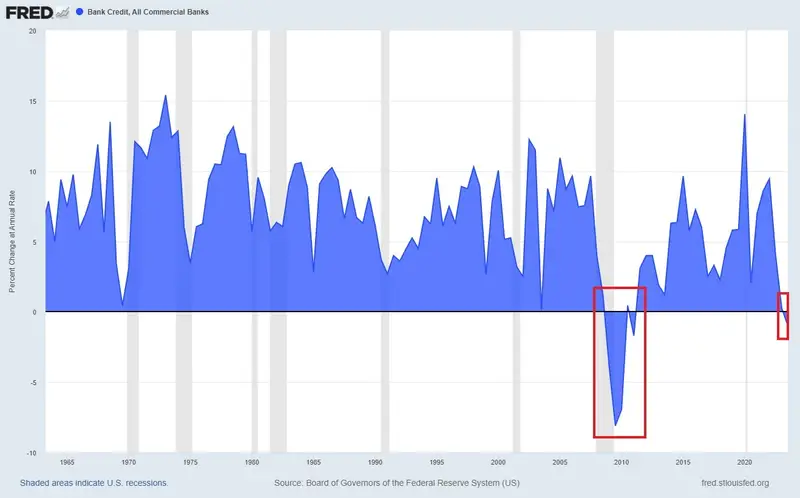

We will talk about this in detail next week but a concerning indicator regarding the health of world economy is a fall in bank credit for the first time (having reduced for three consecutive quarters) since Great Recession.