A recession or no recession? That is the question these days keeping everyone on their toes. The economic indicators coming out of major economies are conflicting at best. As always, we take a look at the weekly developments in those economies.

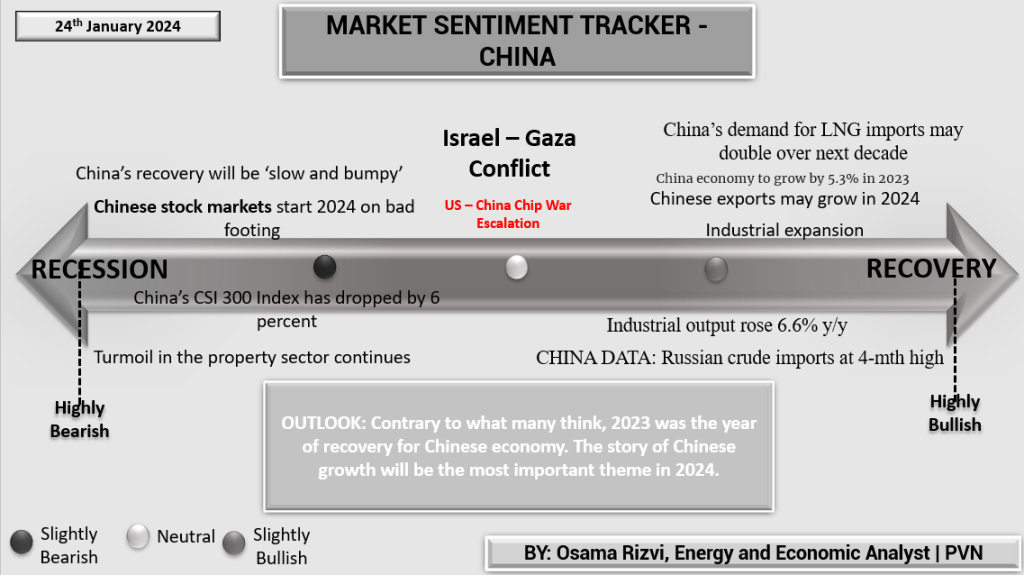

The U.S. Market Sentiment Tracker on January 24th, 2024, presents a landscape of economic resilience tinged with caution. The NY Fed’s Manufacturing Survey hits a low unseen since May 2020, while banking credit contraction marks a first since the Great Recession, echoing investor concerns of a 75% chance of recession this year. Despite these indicators, the U.S. job market appears robust, with jobless claims at a 16-month low and the addition of 216,000 jobs in December. Global economic growth forecasts by the IMF and OECD are modest at around 2.9%. Analyst Christophe Barraud projects confidence in the U.S. economy’s performance through 2024, even as manufacturing showed little change in the latter part of 2023. The outlook is one of careful optimism, recognizing the mixed signals and the uncertainty they project for the future.

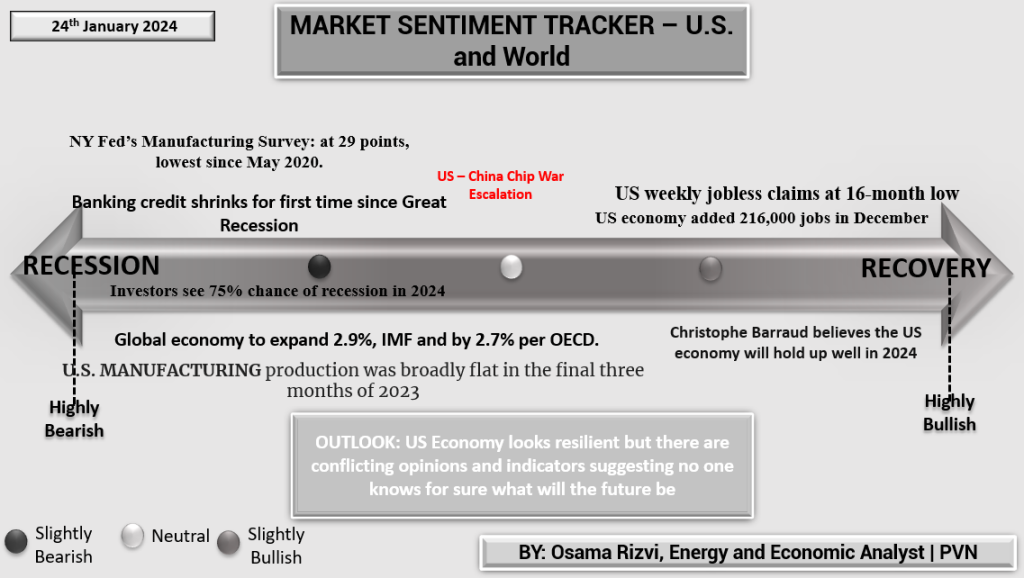

Europe’s Market Sentiment Tracker for January 24th, 2024, indicates continued economic headwinds. Germany is amidst train strikes, compounding the nation’s path towards a two-year recession, while the European Central Bank signals a cautious approach to rate cuts, reflecting in consumer sentiment which is waning across the EU. Labor challenges and stringent budgets in France further darken the regional outlook. Inflation has risen modestly, offering a slight breather. Despite these issues, there’s a hint that the Eurozone may be nearing a turnaround point. Nonetheless, the overall sentiment leans towards a protracted period of economic recovery, with past crises still casting long shadows over Europe’s 2024 prospects.

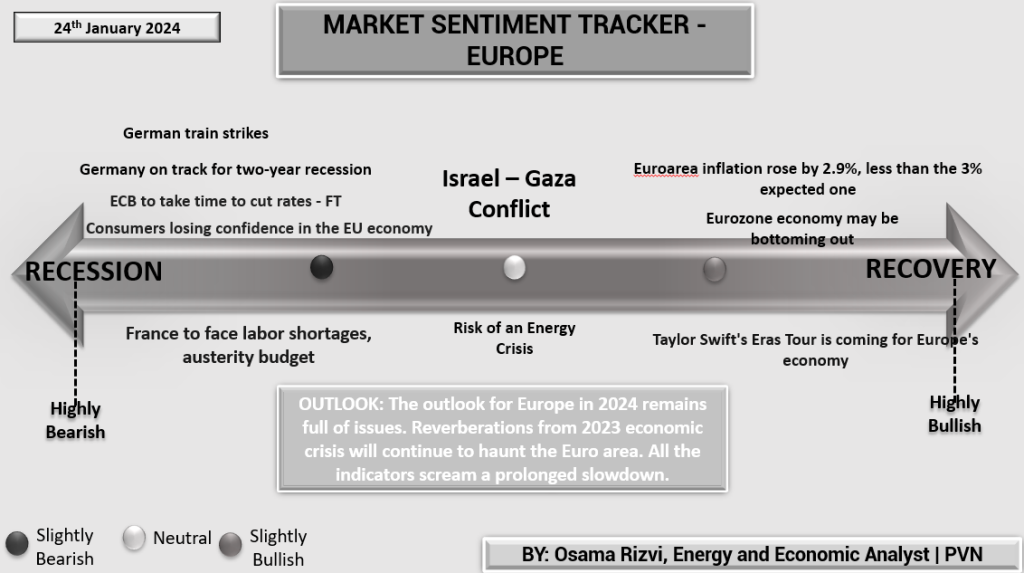

China’s Market Sentiment Tracker for January 24th, 2024, signals a challenging start to the year. The economy faces a ‘slow and bumpy’ recovery trajectory, with the stock market beginning on shaky ground as the CSI 300 Index sees a 6% drop. Persistent issues in the property sector cast a shadow over domestic stability. Despite these concerns, there is growth on the horizon: industrial output has increased by 6.6% year-over-year, and there’s an anticipated boost in LNG demand, with imports projected to double over the next decade. Furthermore, Russian crude imports are at a four-month high, reflecting China’s diverse energy sourcing amidst global tensions. The outlook for 2024 suggests that, contrary to the bearish sentiment, China’s growth story will be a central theme, underscoring its significant role in the global economy.