This week’s Market Sentiment Tracker takes a look at the recent and latest economic developments in US, Europe and China. Most of the things remain the same but tracking it every week gives you a sense of direction – witnessing the buildup.

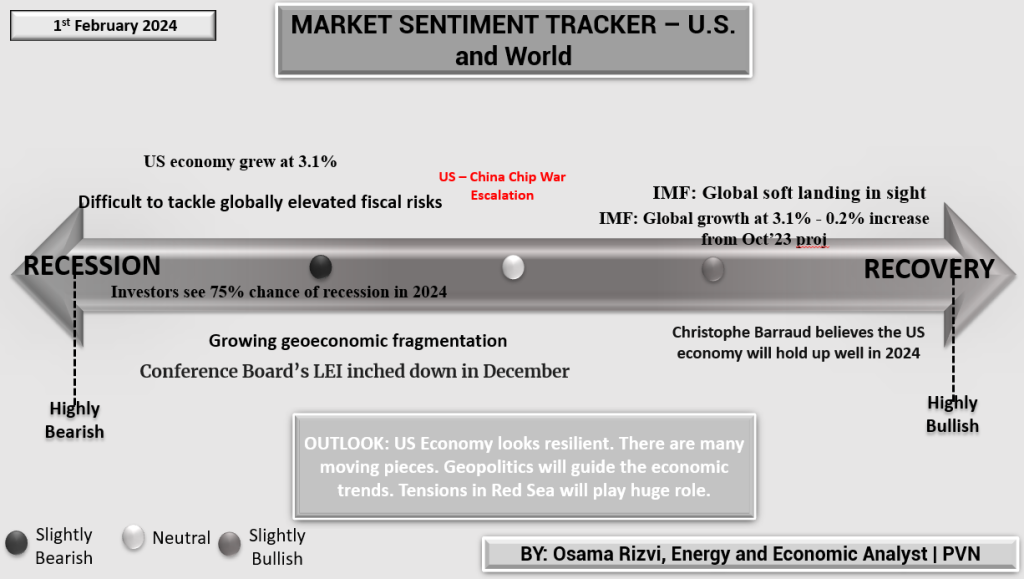

In the U.S., growth has hit 3.1%, a reassuring figure that masks the anxiety simmering beneath. Investors are biting their nails with a three-in-four chance of a recession looming on the horizon. The tug-of-war with China over tech supremacy isn’t making the journey any smoother. But there’s a glimmer in the distance: global experts predict a gentle economic touchdown instead of a crash landing.

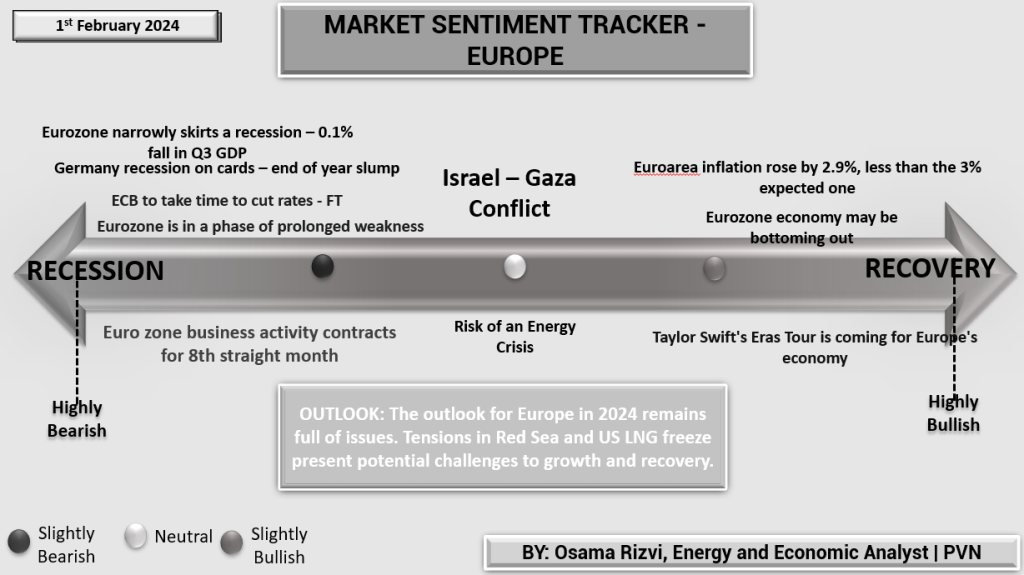

Over in Europe, the economic ship is in choppy waters. Germany might be steering toward a two-year slump, and across the continent, wallets are snapping shut as consumer confidence wanes. The European Central Bank is walking a tightrope, slow to slash rates, while inflation has eased up just a tad—not enough to pop the champagne, but it’s something.

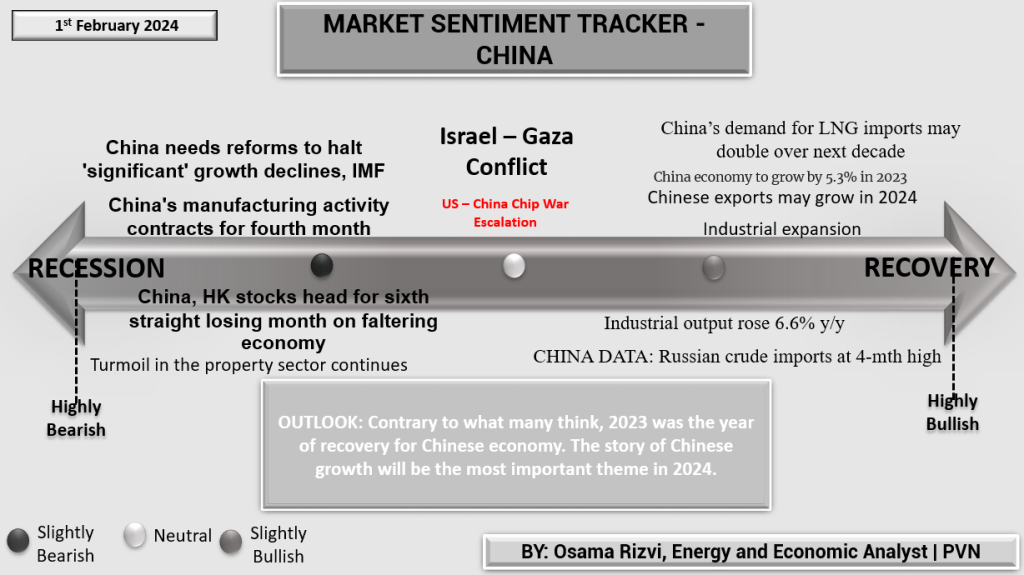

Then there’s China, where the economic engine is sputtering, and the stock market isn’t doing any favors. But China’s massive appetite for LNG and its factories churning out more goods offer some solace. The journey to prosperity is bumpy, but there’s fuel in the tank yet.

So, the global economic story of early 2024 is a mixed bag—a little bit of optimism here, a dash of caution there. It’s a reminder that even when the waters seem still, currents can shift beneath the surface.