Industry Outlook and HAL’s Strategies

In our recent article, we have already discussed Halliburton’s (HAL) Q4 2023 financial performance. Despite the commodity price volatility and the current economic uncertainty, the energy operators choose oilfield service companies with high operational intensity. Due to the changing nature of the reservoirs in mature fields or offshore deepwater, demand for its services will likely rise. Also, the overall demand for traditional energy should increase, requiring advanced technology and a collaborative approach. This should drive demand for Halliburton’s products and services.

Halliburton’s North American business strategy has undergone structural changes, aiming to maximize value by changing the risk and return profile. Despite a lower activity level, its margins have been steady in the recent quarters. The rollout of its Zeus frac spreads and a strengthening well construction business have helped deliver a 20.7% operating margin in the C&P division in Q4. Its performance in international operations has been even better, with one of the highest revenue and operating margins in the past decade. It sees the improvement as a result of a multiyear investment in the international drilling business.

North American Strategy

HAL’s Zeus electric fracturing solution combines electric frac, automation, and real-time subsurface measurements. Such services have found steadfast demand in the US. The total number of Zeus frac spreads working in the field, and Zeus spreads contracted for 2024 delivery accounts for 40% of HAL’s total frac spread count. The company estimated that more than 50% of its frac spreads will be electric by 2025. As of now, its Zeus deliveries in 2024 will only replace existing fleets in North America without any net gain in number.

HAL expects “continued strong business” and stable activity levels in the North American market in 2024. It also expects the contracted fracs to increase. As a result, revenues can remain flat while operating margins can improve in this region. The company’s intelligent completions, multilateral solutions, and artificial lift can see increased demand because customers can produce, inject, and control multiple zones in a wellbore in offshore developments.

International Market Outlook

HAL estimates a “low double-digit” capex growth and sustained activity growth in the international energy market. However, the growth will likely have regional biases in favor of the Middle East/Asia region. In 2025, the company expects Africa and Europe to achieve above-average growth. Beyond 2025, the tender pipeline would ensure that the activity level can be sustained over the next decade as part of the multiyear upcycle.

Product-wise, the well-construction product line can outperform. HAL’s LOGIX autonomous drilling platform, which is used on iCruise, can benefit from this trend. In the Middle East and Latin America, its artificial lift products can see demand rising. Plus, its carbon capture and storage solutions, which have been drawing increasing investments worldwide, can also produce accelerated sales in new energy.

HAL’s Q1 forecast

In Q1 2024, Halliburton expects revenues from the Drilling & Evaluation division to decrease by 1%-3% while its operating margin can improve by 25 to 75 basis points. The Completion & Production division revenue can remain flat or reduce by 2% in Q1 compared to Q4. Operating margins in this segment can also decrease by 125 to 175 basis points.

A fall in North American onshore activity due to the typical seasonality is the primary driver for the topline shrinking in Q1. However, revenues from international operations can grow by “low double-digit” following HAL’s profitable growth strategy.

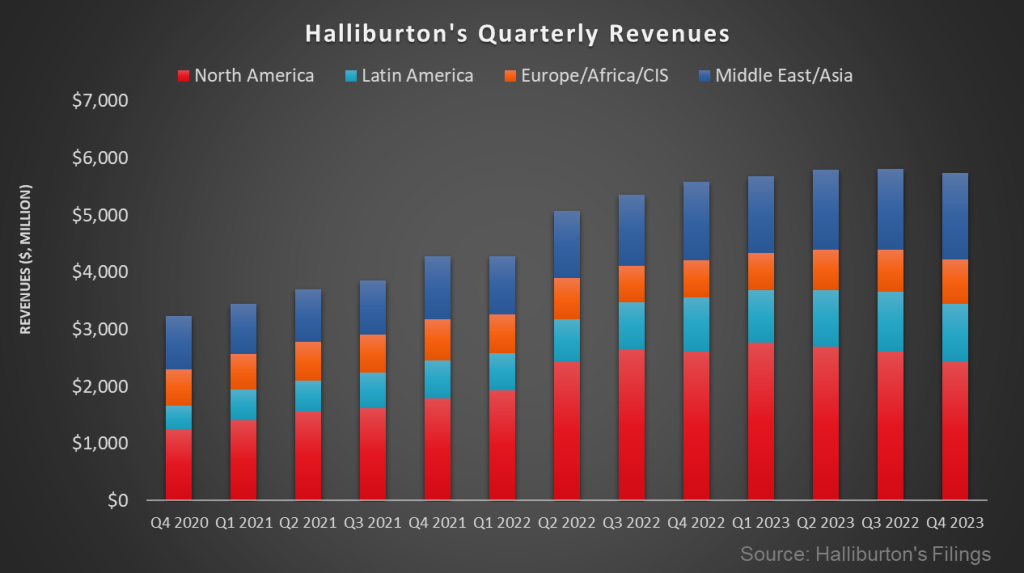

Key Q4 Metrics

We already discussed HAL’s Q4 2023 financial performance, cash flows, and balance sheet in our Halliburton: Q4 Take Three article. Quarter-over-quarter, revenues in the company’s Completion and Production decreased while revenues in the Drilling and Evaluation segment increased. The C&P segment also achieved one of the highest operating margins since 2008.

HAL’s cash flow from operations and free cash flow increased remarkably in FY2023. It generated ~$2.07 billion in FCF in FY2023. The company’s FY2023 capex totaled $1.4 billion, 60% of which was deployed to international and offshore markets. In FY2024, it expects to allocate a similar percentage of its capex to these operations. It also expects its capex-to-revenue to remain unchanged at 6% in FY2024. During Q4, it repurchased ~$250 million of common stock. It also repaid $150 million of debt during the quarter. A healthy FCF generation allowed HAL to carry out share repurchase and debt repayment programs, resulting in lower leverage in FY2023.

Relative Valuation

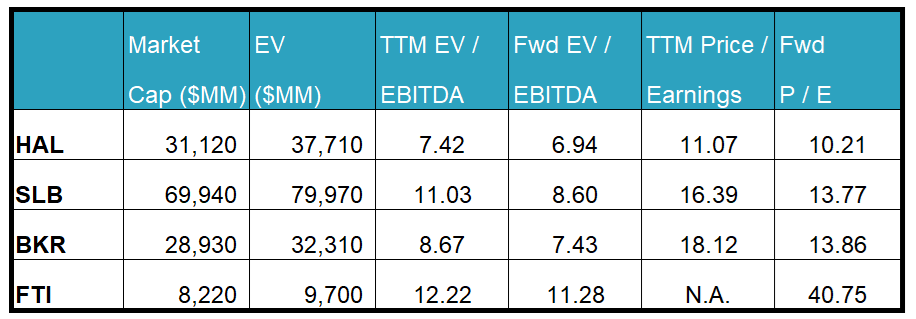

Halliburton is currently trading at an EV/adjusted EBITDA multiple of 7.4x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 6.9x. The current multiple is lower than its five-year average EV/EBITDA multiple of 11.2x.

HAL’s forward EV/EBITDA multiple contraction versus the adjusted current EV/EBITDA is less steep than peers because the company’s EBITDA is expected to increase less sharply in the next four quarters. This typically results in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is lower than its peers’ (SLB, BKR, and FTI) average. So, the stock is reasonably valued versus its peers.

Final Commentary

HAL aims to maximize value by changing its risk and return profile. The operating environment is changing following the shifting nature of the reservoirs in mature fields and offshore deepwater. It will continue to build fracturing equipment under long-term contracts and invest in differentiated technologies. The rollout of its Zeus electric frac spreads and its increasing share in the frac spread mix are cases at this point. So, despite uncertain demand in the near term, the company’s operating margin in the C&P division has recently been resilient.

We also expect improvement in the international drilling business due to a multiyear investment cycle. Internationally, a robust tender pipeline would ensure that the activity level can sustain over the next decade in regions like the Middle East and Latin America. Carbon capture technology is another area where HAL can excel. With steady cash flows, shareholder returns through share repurchase while its leverage can continue to fall. The stock is reasonably valued versus its peers at this level.