Oil Markets Turn Bullish

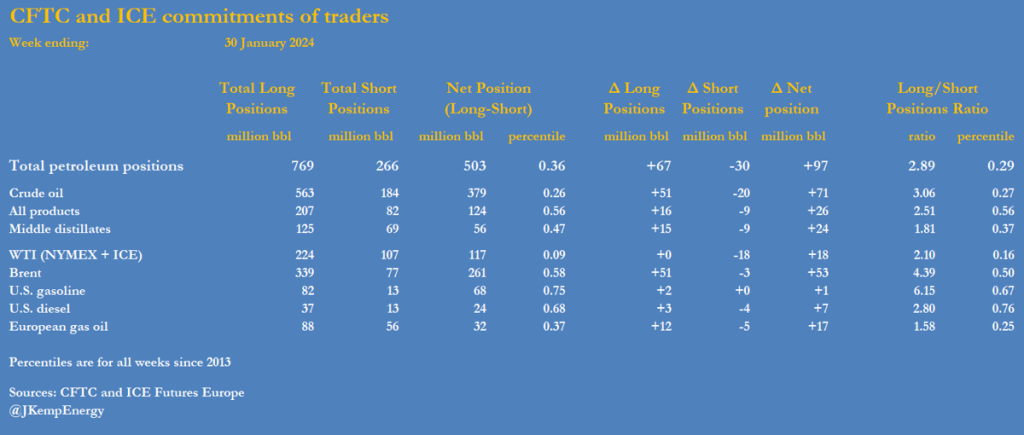

In the oil markets, there’s a noticeable shift towards optimism as the global economy shows signs of improvement. At the end of January, investors eagerly increased their stakes in petroleum, driven by the anticipation of an economic upturn and concerns over tanker security near southwestern Arabia.

Notably, hedge funds and money managers added a whopping 97 million barrels to their portfolios in key petroleum futures and options contracts in just one week, marking a significant bullish movement. This trend, which has seen a total increase of 296 million barrels since mid-December, highlights the growing confidence in oil as a valuable asset amidst global economic recovery and geopolitical tensions.

Saudi Arabia’s Strategic Oil Preservation

Saudi Arabia is taking a long-term view on its oil resources, signaling a strategic shift to ensure oil remains a cornerstone of its wealth for future generations. This approach reflects a broader understanding of the finite nature of oil reserves and the importance of sustainable management. By capping its oil production at a maximum sustainable capacity of 12 million barrels per day, Saudi Arabia is not only adhering to its legal obligations but also making a clear statement about its commitment to future generations. This move underscores the kingdom’s evolving stance on oil production and its implications for global markets.

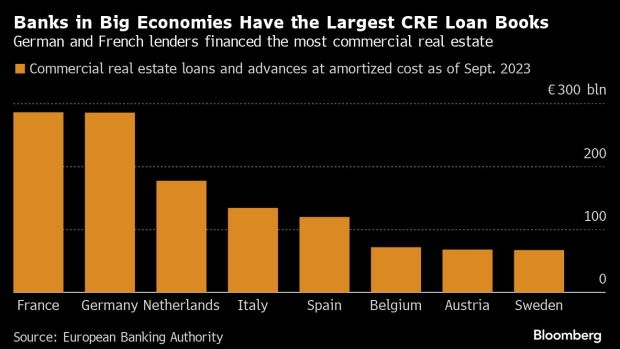

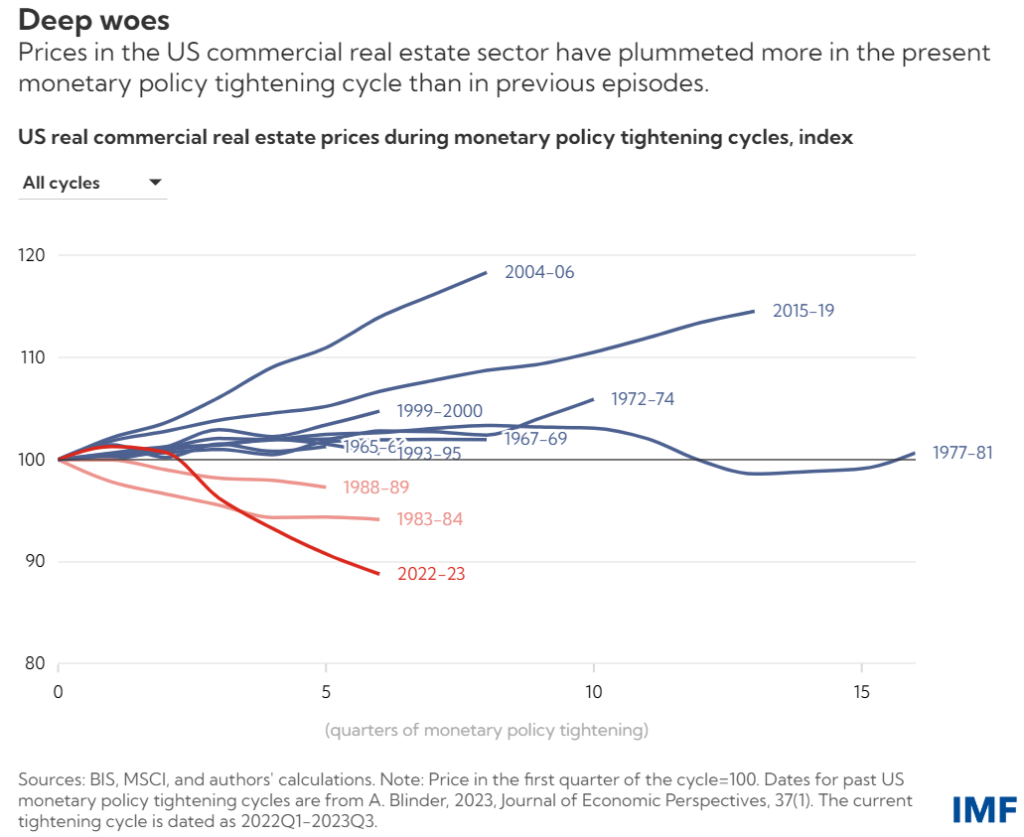

ECB’s Real Estate Risk Warning to Banks

The European Central Bank (ECB) is raising alarms over the potential risks banks face from the commercial real estate sector. With the market experiencing a downturn, exacerbated by rising interest rates and shifts in work and retail behaviors, the ECB is urging banks to better understand and manage these risks. Failure to do so could lead to higher capital requirements, a move aimed at safeguarding financial stability. This focus on commercial property risks highlights the ECB’s proactive approach to addressing vulnerabilities in the banking sector and ensuring that banks are prepared for potential losses in this asset class.

Global Economy: A Mixed Outlook

Despite the uncertainties surrounding war and geopolitics, the global economy has demonstrated remarkable resilience. The International Monetary Fund (IMF) remains optimistic, highlighting the potential for significant savings and environmental benefits through the phasing out of energy subsidies. However, the economic landscape is not without its challenges. The IMF’s cautious optimism is tempered by the ongoing conflicts and their economic repercussions. Meanwhile, Deutsche Bank’s revised forecast, which no longer anticipates a U.S. recession in 2024, reflects a broader sentiment of cautious optimism in the face of cooling inflation and a balanced labor market.

Markets are confused so are the analysts. We don’t know where we are headed. But one thing is for sure that everything isn’t that hunky-dory. I personally believe that this is a new economic era where spending has become less interest rate sensitive and that we might not see them reducing to level that many expected (expect). Time will tell.