Key Summary

Diamondback Energy’s announcement of the agreement to acquire Endeavor Energy Resources for $26 billion in a cash-and-stock deal marks a major consolidation in the US shale oilfield. The combined entity will become the third-largest oil and gas producer in the Permian Basin of West Texas and New Mexico, trailing only Exxon Mobil and Chevron. The deal is expected to close in the fourth quarter, with Diamondback stockholders owning 60.5% of the combined entity and Endeavor owning the rest. Following the news break, FANG moved up by 9.7% in Monday’s trading.

Operational Rationale And Production

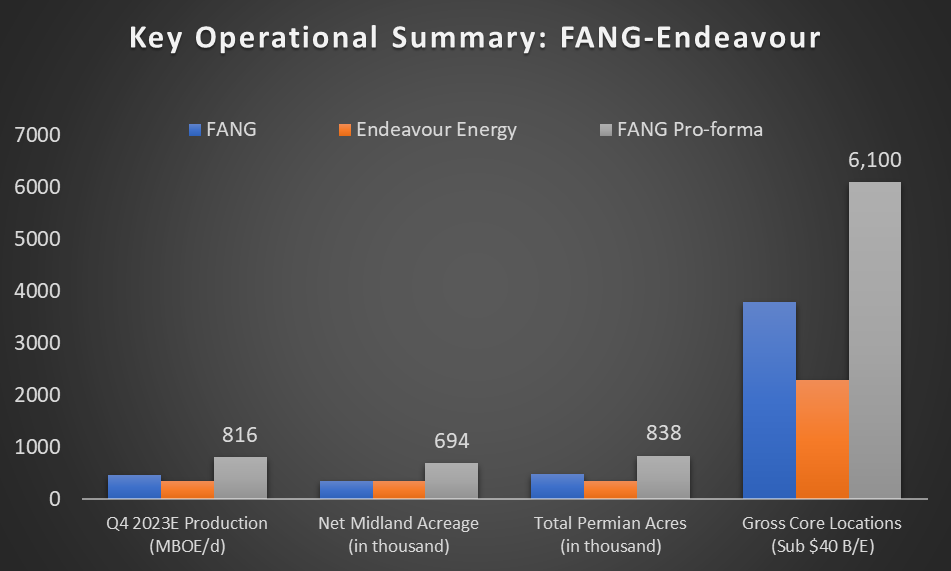

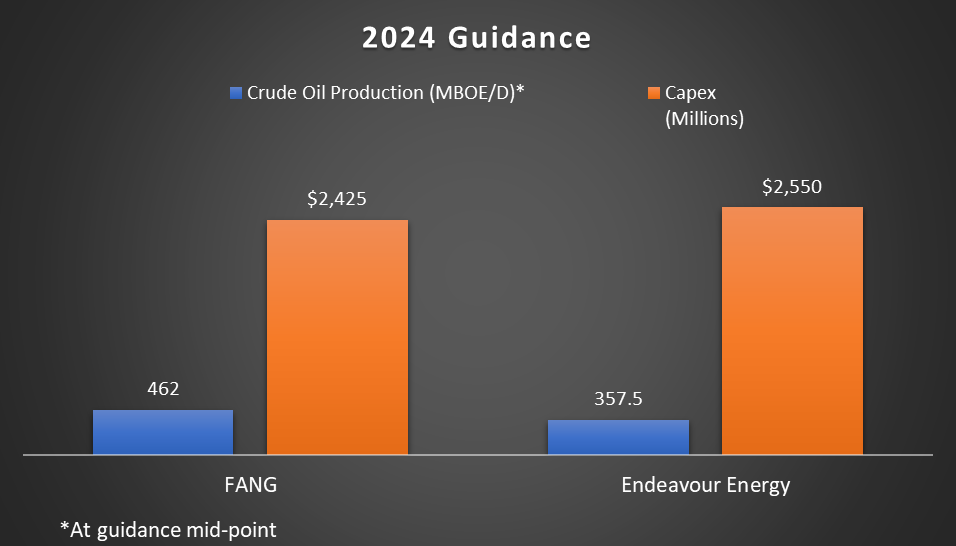

The combined company is expected to pump 816,000 barrels of oil and gas per day. Endeavor’s operations cover about 350,000 net acres in the Midland portion of the Permian. The management expects to produce 357 thousand barrels of oil equivalent per day (MBOE/D) in 2024. It operates in Midland Basin’s six core regions, including Glassrock, Martin, Howard, Midland, Reagon, and Upton.

Diamondback, in comparison, is expected to produce ~462 MBOE/D in 2024, slightly higher than its current production. So, these companies’ production (on a daily basis) is expected to remain relatively unchanged compared to 2024. Based on their resources, the combined entity will have longer laterals and larger pads, which can mitigate parent/child degradation and maximize resource recovery. FANG and Endeavour have more than 15,000 laterals and shared infrastructure, which can lead to potential mineral and midstream value creation.

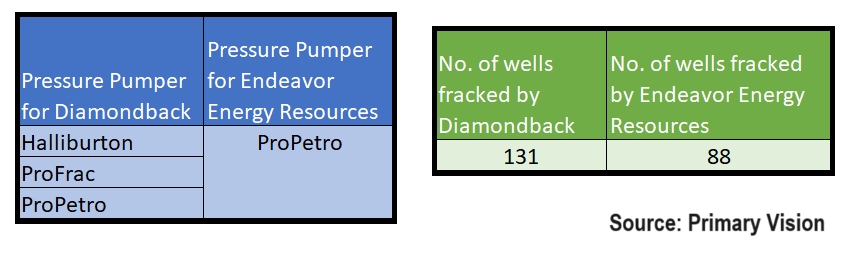

At Primary Vision, we estimate that Diamondback fracked 131 wells in 2023 versus Endeavour’s 88 fracked wells during the year. FANG employed Halliburton, ProFrac, and ProPetro to undertake their fracking activities, while Endeavour placed the fracking jobs with ProPetro for its wells during the year.

Where Do Synergies Come From?

The combination of businesses is expected to yield annual synergies of $550 million. By 2025, it can produce ~10% free cash flow per share accretion. The combination can also benefit from a multi-zone co-development strategy consisting of longer laterals and larger pads. Diamondback’s low-cost structure (calculated as Drilling & completion capex per lateral foot) should reduce the pro-forma company’s cash operating cost by 5-10% per BOE in 2025.

According to estimates provided by FANG, Diamondback and Endeavor results have been Permian best in class over the past couple of years. FANG’s Simul-Frac technology has led to doubling lateral foot completions per day per crew since 2019. Simul-Frac is a completion technology used by Diamondback Energy.

Cash Flows And Finances

Despite the large cash component involved in the merger deal, Diamondback is expected to maintain a strong balance sheet due to its relatively low debt-to-capital ratio of 23%. However, starting Q1 2024, Diamondback will reduce its expected return on capital to at least 50% of FCF from 75% of FCF announced previously. This reflects FANG’s intention of increasing financial flexibility and repaying debt added through this combination. Its near-term objective is to reduce pro forma net debt below $10 billion.

Relative Valuation

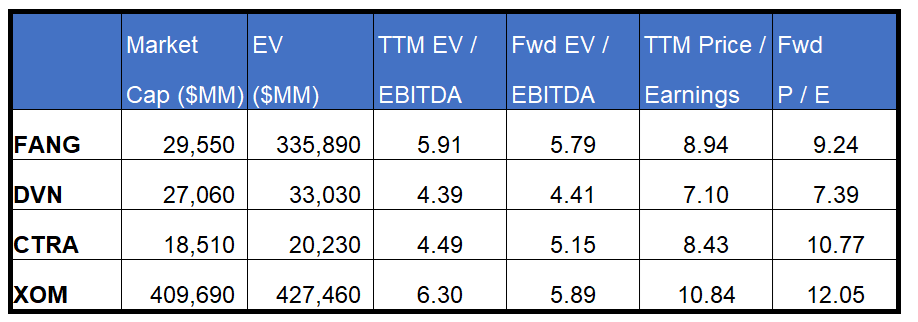

FANG’s forward EV/EBITDA multiple is expected to contract versus the current EV/EBITDA. The contraction is in contrast to its peers, for which the multiple is expected to rise. This implies that FANG’s EBITDA is expected to rise as opposed to a fall in EBITDA for its peers in the next year.

This should typically result in a higher EV/EBITDA multiple for FANG. The company’s EV/EBITDA multiple (5.9x) exceeds its peers’ (DVN, CTRA, and XOM) average. So, FANG appears to be reasonably valued compared to its peers. FANG’s current EV/EBITDA multiples are at a discount compared to their past five-year average.

What Does The Deal Imply?

If the acquisition goes through, the combined company will be one of the few pure-play Permian oil producers. The deal is part of a broader wave of consolidation in the basin to boost production and secure future drilling inventory. We recently saw similar deals in the Permian, including Exxon’s (XOM) acquisition of Pioneer (October 2023). The acquisition solidified XOM’s presence in the Permian and added 6,300 net high-quality well locations in the Midland sub-basin through the PXD acquisition. On January 11, natural gas producers Southwestern Energy (SWN) and Chesapeake Energy (CHK) announced a merger deal. The Permian basin in the US has been a hotspot for deals. Given the current spree for M&As, some analysts foresee only a handful of “supermajors” in the United States, focused on the Permian and the economic Tier 1 inventory for oil production.

Diamondback and Endeavor’s well-entrenched Permian Basin operations should already have a head start because of shared infrastructure and similar strategies, e.g., multi-zone co-development strategy. Diamondback can deploy its SimulFRAC completion technologies in Endeavour’s wells, reducing completion cycle time. The DC&E costs (the cost of Drilling, completing, and equipping a well on a per-foot basis) can also significantly decline the combined entity. As costs fall, margins can improve, leading to a bump in cash flows. Higher cash flows, in turn, can allow for rapid debt reduction. However, Diamondback’s shareholder returns can decline as its plans of returning free cash flow to stockholders have reduced from its earlier commitment to reflect increased financial flexibility and debt paydown. In any case, two companies with similar geographic concentration and operational traits should benefit from their combined Endeavor in a shale basin that continues to produce at one of the highest rates in the US.