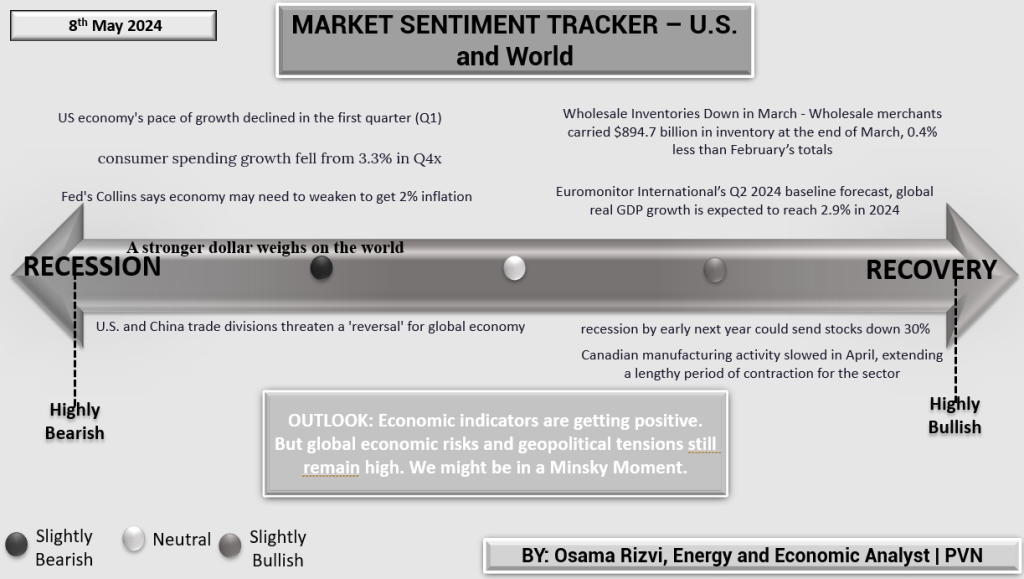

The Market Sentiment Tracker for the U.S. and global markets highlights a blend of caution and tentative optimism as of May 8th, 2024. The U.S. has seen a slowdown in economic growth in the first quarter, with consumer spending growth decreasing from 3.3% in the previous quarter. Despite this, there’s a nuanced positive shift with economic indicators such as wholesale inventories, which saw a slight decrease, implying better alignment with market demands. Global outlooks remain cautious with the IMF projecting a moderate global GDP growth of 2.9% for 2024. Challenges persist, notably with the strong dollar impacting international trade dynamics, potentially exacerbating trade tensions between the U.S. and China. This complex scenario suggests that while some recovery signs are evident, significant geopolitical and economic risks linger, which could destabilize the recovery trajectory and lead to a scenario akin to a Minsky Moment, where asset values can suddenly drop.

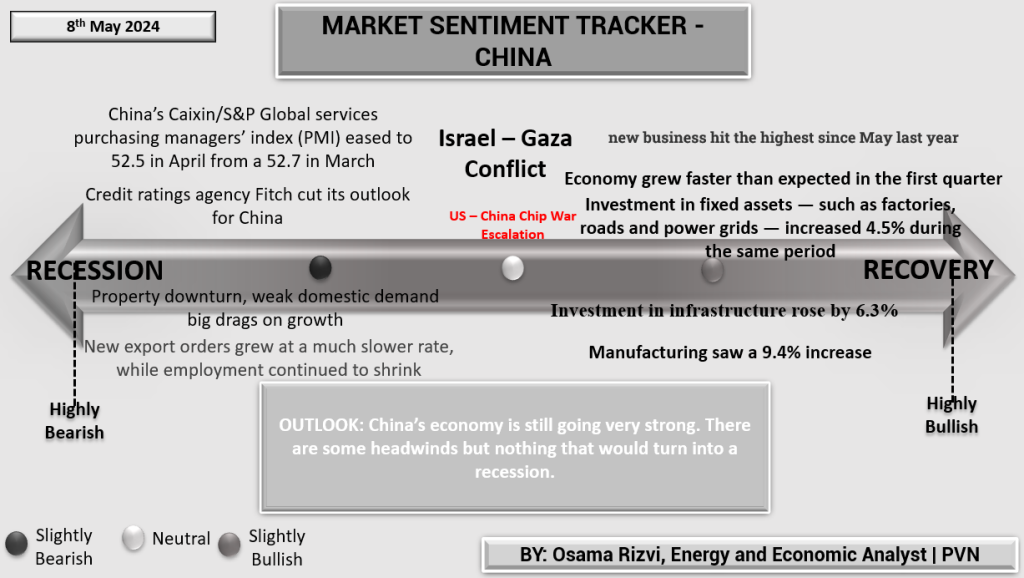

The Market Sentiment Tracker for China, as of May 8th, 2024, presents a nuanced landscape of the Chinese economy, balancing between signs of softening and robust growth. The Caixin/S&P Global Services PMI indicates a slight decline to 52.5, suggesting a marginal cooling in the services sector, yet remaining above the threshold that delineates expansion from contraction. This is coupled with Fitch’s recent downgrade of China’s credit outlook, reflecting concerns over sustained pressures.

Despite challenges like the property downturn and sluggish domestic demand that continue to be significant drags, there are areas of notable strength. Fixed asset investment in infrastructure, such as roads and power grids, rose by 4.5%, and the manufacturing sector surged with a 9.4% increase, signaling strong government backing and effective fiscal measures aimed at stabilizing economic growth. Additionally, while new export orders have decelerated, indicating potential issues in international trade dynamics, especially with ongoing U.S.-China tensions, domestic manufacturing vitality provides a counterbalance.

Overall, these indicators suggest that while China faces headwinds, particularly in property and exports, its comprehensive investment in infrastructure and manufacturing capabilities hints at a strategic alignment towards sustaining long-term growth, even as it navigates short-term challenges.