E-frac’ing Update

In our short article, we discussed our initial thoughts about ProPetro Holding’s (PUMP) Q1 2024 performance a few days ago. This article will dive deeper into the industry and its current outlook. Continuing with its initiatives to increase the share of electric frac, it has deployed three FORCE electric fracs, with a fourth prepared to be deployed by Q2-end. It also has seven Tier IV DGB dual fuel fleets operating.

Recently, PUMP signed an agreement with ExxonMobil to provide the FORCE e-frac services and Silvertip’s wireline and pump-down services. The agreement involves the delivery of two FORCE electric frac fleets in 1H 2024, along with the option of a third fleet deployment in early 2025. The company sees strong demand for its electric equipment. So, it will continue transitioning its Tier II diesel equipment to the FORCE electric equipment to minimize capital cost and derisk its earnings performance over the long term.

Frac Utilization And Outlook

In Q1, PUMP’s effective frac spread utilization increased to 15 after falling to 12.9 a quarter earlier. The company’s gross margin and adjusted EBITDA margin inflated by 400 basis points and 750 basis points, respectively, from Q4 to Q1. A majority of the improvement can be attributed to the rise in utilization. In Q2, the company expects frac spread utilization to stabilize at 14-15 spreads. The deployment of electric fracs from the XOM agreement will likely keep utilization and the company’s financial performance steady in Q2.

PUMP’s strategy of transitioning from legacy equipment to next-generation assets has required an aggregate investment of approximately $1 billion that it has used to recapitalize its frac spreads. So far, it has transitioned over two-thirds of its frac spreads to next-generation equipment. It has lowered emissions through natural gas substitution. So, the company has a differentiated offering that supports a premium customer base, next-generation equipment (electric fracs and dual-fuel Tier IV pumps), and operating density in the Permian basin. Going forward, the company can reduce capex through reinvestment. This will help generate free cash flow and its capital allocation approach in 2024. You can also read PUMP’s acquisition strategy in our previous iteration here.

Capital Allocation Strategy

In May 2024, PUMP’s board authorized an additional $100 million increase in its share repurchase program. So, its total repurchase now amounts to $200 million. It also extended the program through May 31, 2025. Over the past year, the company has repurchased approximately 8% of our outstanding common stock. The strategy reflects the management’s confidence in ProPetro’s continued earnings growth and free cash flow generation.

Q1 Results And Financial Metrics

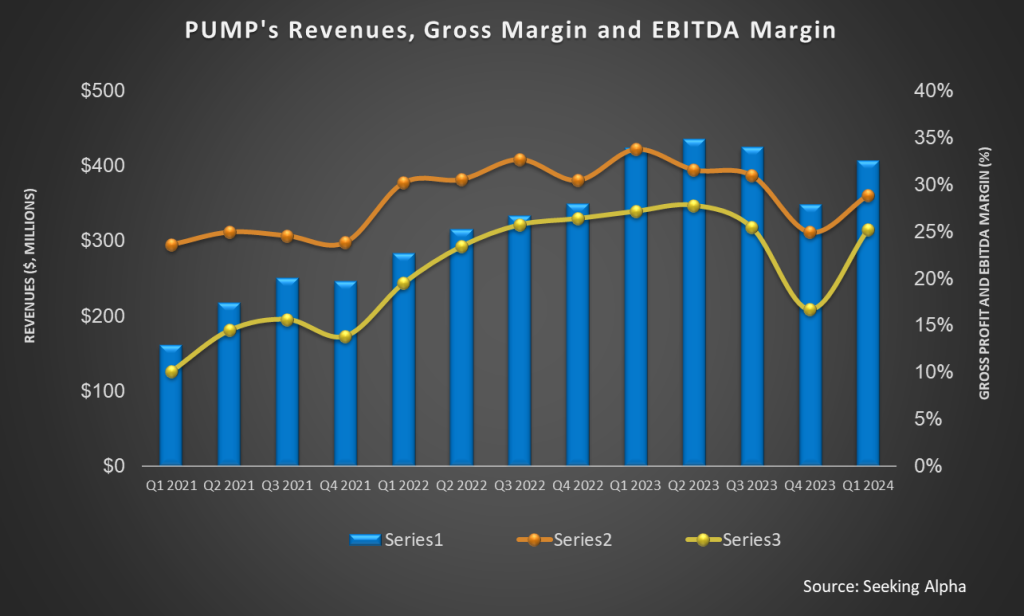

As we discussed in the Q1 earnings article, year-over-year, PUMP’s revenues from the hydraulic fractioning segment increased by 18% in Q1 2024, while revenues from the Wireline segment increased by 21%. Improved hydraulic fracturing and wireline utilization primarily caused the topline and the EBITDA to shoot up in Q1.

PUMP’s cash flow from operations increased modestly (by 2%) in Q1 2024 compared to a year ago. Its free cash flow turned positive in Q1 2024. However, its capex guidance points to significantly lower (39% down) capital expenditure in FY2024. The company’s debt-to-equity remained unchanged at 0.05x as of March 31, 2024.

Relative Valuation

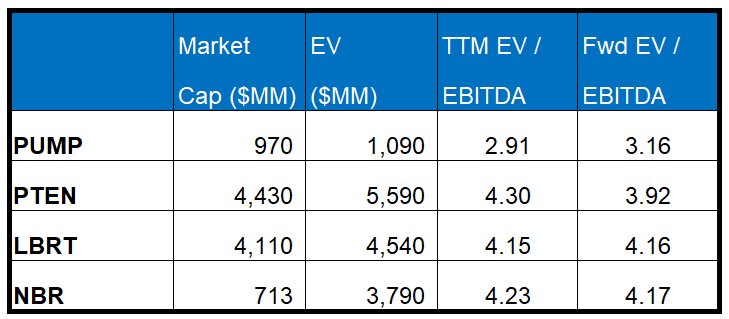

PUMP is currently trading at an EV/EBITDA multiple of 2.9x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.2x. The current multiple is below its five-year average EV/EBITDA of 4.6x.

PUMP’s forward EV/EBITDA multiple expansion versus the current EV/EBITDA is in contrast to its peers because its EBITDA is expected to decrease compared to a rise in EBITDA for its peers in the next year. This typically results in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is lower than its peers’ (PTEN, LBRT, and NBR) average. So, the stock is reasonably valued versus its peers.

Final Commentary

At the end of Q1, PUMP deployed three FORCE electric frac spreads, with a fourth prepared to be deployed by Q2-end. Its electric frac deployment recently received a boost following the agreement with ExxonMobil to provide e-frac services and Silvertip’s wireline and pump-down services. Its effective frac spread utilization also improved in Q1.

So far, it has transitioned over two-thirds of its frac spreads to next-generation equipment. The company’s medium-to-long-term outlook appears strong with robust next-generation equipment (electric fracs and dual-fuel Tier IV pumps) and operating density in the Permian basin. However, the transitioning costs can affect its operating margin in the next few quarters. Expect capex to decrease gradually, leading to an improvement in free cash flow. The stock is reasonably valued compared to its peers.