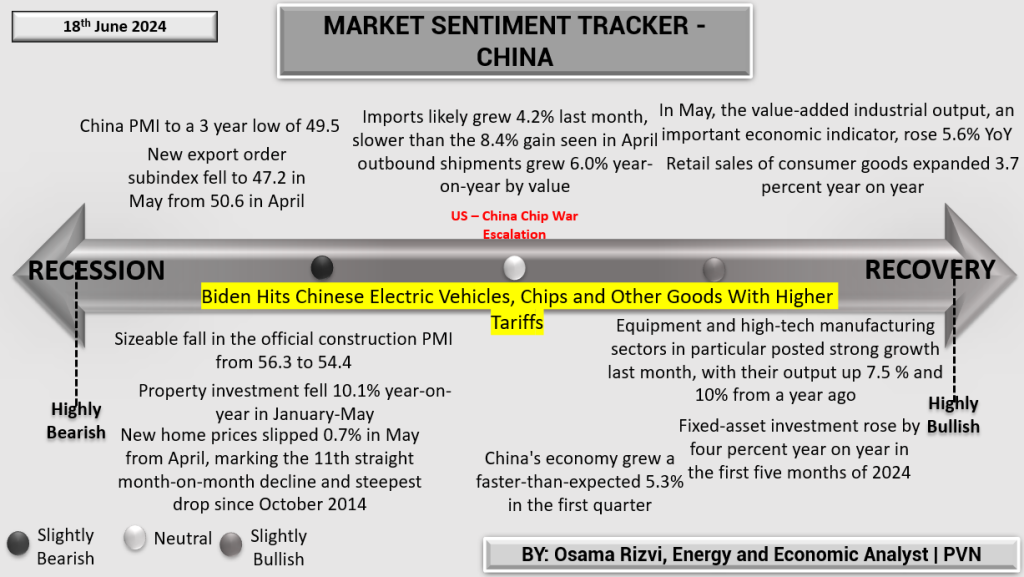

The Market Sentiment Tracker for June 18, 2024, indicates a mixed outlook for the U.S. and global economy. According to recent data, 80% of the world population is expected to experience slower growth compared to the pre-COVID decade. In the U.S., 46% of Americans view the economic conditions as “poor,” with only 22% describing them as “excellent” or “good.” This reflects a growing pessimism among the population. Global growth is projected to remain steady at 2.6% in 2024 before edging up to an average of 2.7% in 2025-26. Inflation is expected to moderate to 3.5% in 2024 and 2.9% in 2025, though the pace of decline is slower than previously projected. Business investment continues to rise, and wages are growing close to 4% annually, outpacing inflation.

Retail spending in the U.S. grew by only 1.3% in the first quarter of 2024, down from 5% in the third quarter of 2023, indicating a slowdown in consumer activity. Developing economies are projected to grow at 4% on average over 2024-25, slightly slower than in 2023. Corporate bankruptcies in the U.S. rose by 88% through April 2024, with nine companies worth $50 million or more failing this year, marking the fastest pace of large bankruptcy filings since the pandemic. Global interest rates are likely to remain high by historical standards, averaging around 4% over 2025-26, roughly double the average from 2000-19. This high rate environment, coupled with inflation and slower growth, presents significant challenges for both businesses and consumers. The overall market sentiment remains highly bearish, with persistent headwinds affecting economic stability and growth.

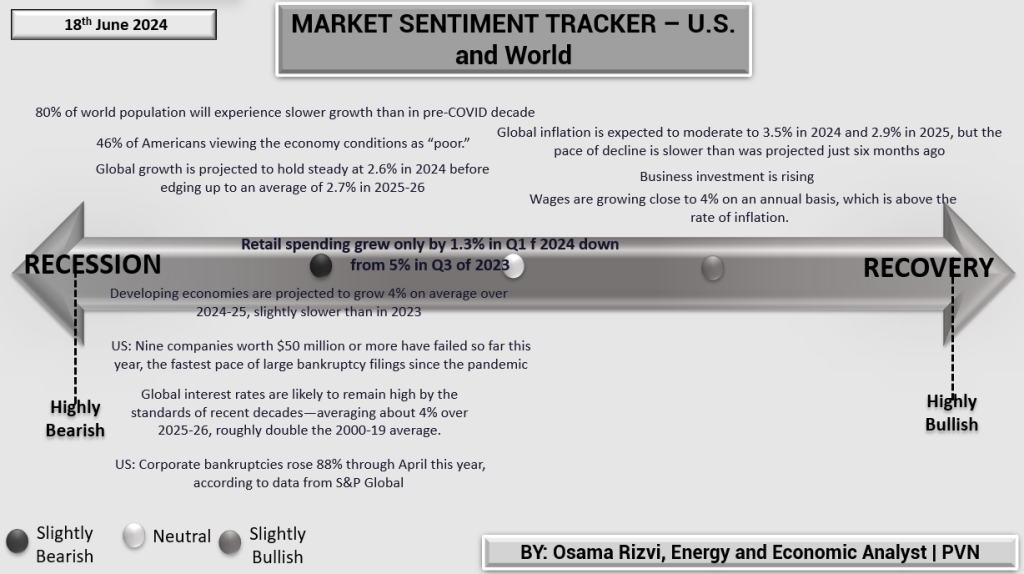

Story for Europe remains the same – some positive, some negative developments. The UK’s GDP remained flat in April, following a 0.4% month-on-month rise in March, reflecting stagnation in economic growth. Meanwhile, German inflation increased in May, driven by higher service prices, contributing to broader inflationary pressures within the region. The HCOB Eurozone Services PMI Business Activity Index fell to a two-month low of 53.2, signaling a slowdown in business activity within the services sector. Despite these challenges, the EU saw a 0.3% increase in its gross domestic product (GDP) quarter-on-quarter, with seasonally adjusted GDP rising by 0.4% in the euro area and 0.5% in the EU, indicating modest economic growth.

Headline eurozone inflation remained unchanged at 2.4% in April, showing persistent inflationary concerns. Gross fixed capital formation decreased by 1.5% in both the euro area and the EU, reflecting reduced investment activity. On a more positive note, household final consumption expenditure increased by 0.2% in both the euro area and the EU, suggesting resilience in consumer spending. The European Central Bank (ECB) slashed rates, aiming to stimulate economic activity and combat inflation. The rate of inflation in selling charges eased to a six-month low, indicating some relief from inflationary pressures. Government final consumption expenditure remained stable in the euro area and increased by 0.1% in the EU, highlighting steady public sector spending. Exports increased by 1.4% in the euro area and by 1.0% in the EU, reflecting strong external demand and contributing positively to economic growth. Overall, the Eurozone’s economic outlook remains cautiously optimistic, with growth driven by consumer spending and exports, despite persistent inflation and investment challenges.

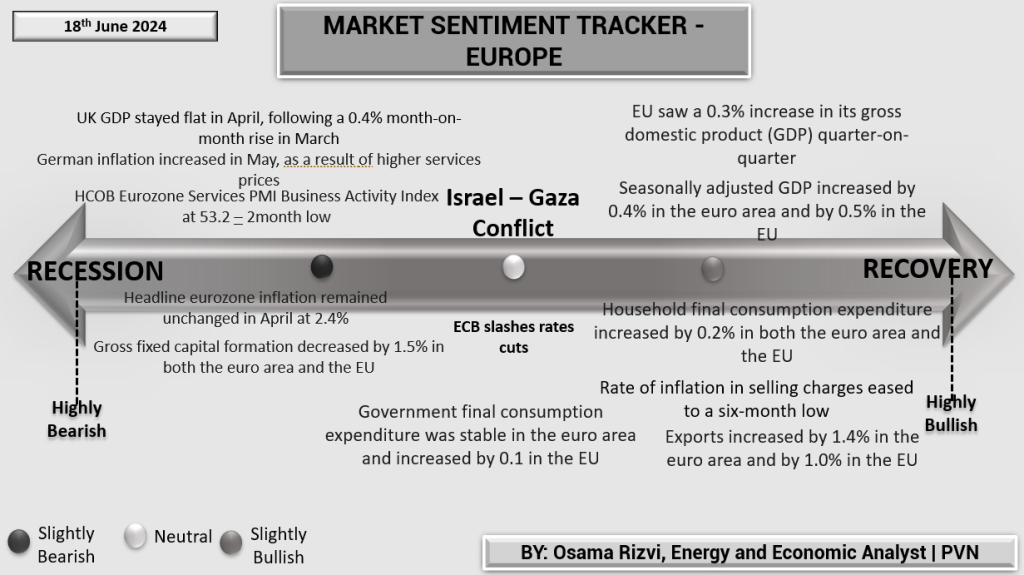

China presents a positive picture overall.

The China Purchasing Managers’ Index (PMI) has fallen to a three-year low of 49.5, indicating contraction. New export order subindex also dropped to 47.2 in May from 50.6 in April, suggesting weaker international demand. Imports likely grew by 4.2% last month, slower than the 8.4% gain seen in April. However, outbound shipments increased by 6.0% year-on-year by value. In May, the value-added industrial output rose 5.6% year-on-year, an important economic indicator showing positive growth. Retail sales of consumer goods expanded by 3.7% year-on-year, reflecting steady domestic consumption. The official construction PMI experienced a significant fall from 56.3 to 54.4, highlighting a slowdown in construction activities. Property investment declined by 10.1% year-on-year in January-May, and new home prices slipped 0.7% in May from April, marking the 11th consecutive month-on-month decline and the steepest drop since October 2014.

Despite these challenges, certain sectors showed robust growth. Equipment and high-tech manufacturing sectors posted strong growth last month, with output up 7.5% and 10% from a year ago, respectively. Fixed-asset investment rose by 4% year-on-year in the first five months of 2024. China’s economy grew by a faster-than-expected 5.3% in the first quarter, driven by strong industrial output and resilient domestic consumption. The outlook remains cautiously optimistic despite external pressures, such as the US-China chip war escalation and new tariffs on Chinese goods. The economy’s ability to adapt and grow in key sectors signifies resilience in the face of global challenges.