Completion Operation Outlook

We have already discussed STEP Energy Services’ (STEP) Q1 2024 financial performance in our recent article. Here is an outline of its strategies and outlook. STEP’s efficiencies improved with higher intensity well completions in Canada during Q1. It deployed six frac spreads in Q1, which also saw an increase in operating days. In this region, its hydraulic fracturing utilization improved significantly, from 69% a year ago to 83% now. The company’s coiled tubing, ancillary pumping, and fluid services also improved. Its fluid pumping services added the tenth coil unit to the fleet.

In the US, the fracturing spread count was reduced to two in Q1 compared to three earlier. Despite that, improved operating efficiency and better cost management led to higher profitability. Proppant pumped increased by 27% from a year earlier, although operating days decreased. The company faced challenging weather conditions in the US in the southern and northern basins. In Q1, it reactivated one coiled tubing spread. Now, with 22 coiled tubing spreads, it has one of the largest fleets in North America.

Emission-related Update

STEP has been upgrading its asset base to Tier 4 dual fuel capable systems because operators prefer systems that reduce diesel consumption. The company estimates that its systems can displace up to 85% of diesel consumption. During 2023, it is estimated to have displaced 26.7 million liters of its client’s diesel with natural gas. During Q1 alone, it displaced 17.5 million liters, leading to substantial savings and emission reductions for the energy producers.

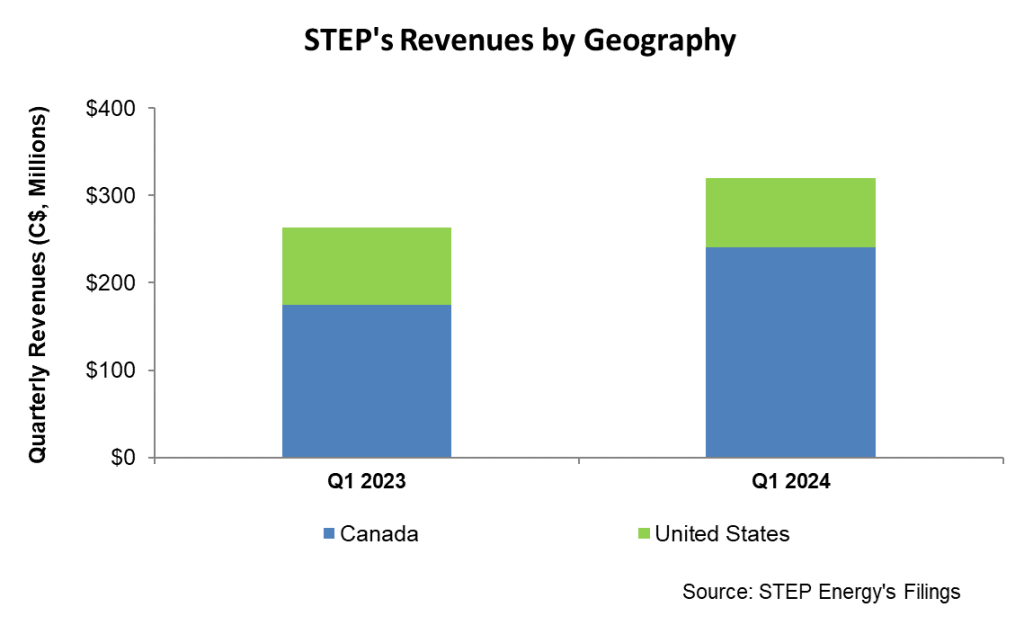

Geographic Performance Analysis

Given the US energy market’s volatility, STEP started transferring some fracturing equipment back to Canada a couple of quarters ago. This supported its strategy of a high utilization model as it allocates resources to the basins that keep the fleet highly utilized. However, the company’s medium to long-term outlook for the North American energy sector remains positive because of LNG infrastructure projects. Although the company’s pricing in Canada took a beating in Q1, it mitigated the effects through better cost management and utilization. So, its adjusted EBITDA margin in Canada increased to 30%, up from 13% in Q4.

In the US, it continued to deploy two active fracturing fleets, consistent with the previous quarter but down from a year ago. Inclement weather conditions in both the Southern and Northern operating basins affected utilization in the US. Despite that, the adjusted EBITDA margin was 16%, up from 9% in Q4.

Cash Flows And Debt

STEP’s cash flow from operations decreased by 78% in Q1 2024 compared to a year ago. As a result, its free cash flow turned negative in Q1 2024. Higher working capital build-up in Q1 was consistent with the typical seasonality pattern. Also, higher utilization led to a higher accounts receivable balance in Q1. In Q2, the company expects working capital requirements to fall. Higher working capital also led to an increase in its debt balance in Q1 compared to Q4 2023.

Debt reduction remains a core focus of STEP. It expects debt balance to reduce throughout the rest of 2024. As of March 31, 2024, STEP’s leverage (debt-to-equity) was 0.29x, higher than the 0.24x recorded on December 31, 2023. Year-to-date, the company repurchased ~1.5 million shares at an average price of $4.16 per share, which aligns with its current price. So, management views the current price as being aligned with fair value.

Relative Valuation

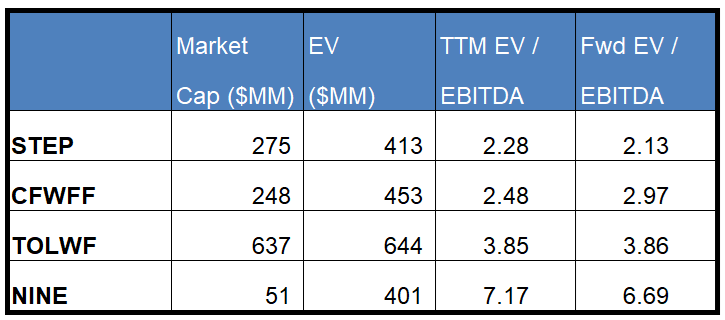

STEP is currently trading at an EV/EBITDA multiple of 2.3x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is lower, at 2.1x.

STEP’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA contrasts with its peers because its EBITDA is expected to increase versus a slight fall in EBITDA for its peers in the next year. This typically results in a premium in the EV/EBITDA multiple compared to its peers. However, the stock’s EV/EBITDA multiple is lower than its peers’ (CFWFF, TOLWF, and NINE) average. So, the stock is undervalued versus its peers.

Final Commentary

In Q1, STEP deployed six frac spreads in Canada, and its frac utilization improved significantly. In the US, on the other hand, its frac spread count has reduced over the past year. Its challenges in completion activities primarily lie in the southern and northern basins. Its coiled tubing, ancillary pumping, and fluid services have been performing well. STEP has one of the largest coiled tubing fleets in North America.

It has transferred some fracturing equipment back to Canada because its US operations faced challenges, primarily in the Southern and Northern operating basins. Even Canada faces pricing concerns. Despite that, the company’s operating margin improved due to robust asset utilization and cost control measures. a couple of quarters ago. Also, the company’s cash flow concerns became evident in Q1 2024. It expects to resolve its working capital woes and reduce net debt by the end of the year. The stock is undervalued versus its peers.