As we delve into the current state of the U.S. economy, it’s evident that there’s a significant disconnect between public perception and reality. Despite an aggressive interest rate hike campaign by the Federal Reserve, the economy remains robust. Unemployment is at historic lows, real wages are on the rise, and GDP growth is above trend. Wall Street reflects this strength with a booming tech sector, historically low equity volatility, and record-high stock market indices.

Yet, public sentiment tells a different story. Recent surveys, including a Reuters/IPSOS poll, indicate that Americans remain pessimistic about the economy, with many favoring former President Donald Trump’s economic approach over President Joe Biden’s. This disconnect is largely influenced by inflation. Although inflation has significantly decreased from its post-pandemic peak of nearly 10%, the lingering effects continue to shape public opinion.

A closer look at wage growth offers some insight. According to the Economic Policy Institute, real hourly wages for the lowest 10% of earners grew by 12.1% between 2019 and 2023, while the top 10% saw just a 0.9% increase. Despite these gains, public anxiety about inflation remains high. A study from Harvard University highlights the deep-seated concerns that inflation brings, impacting financial well-being and exacerbating inequality.

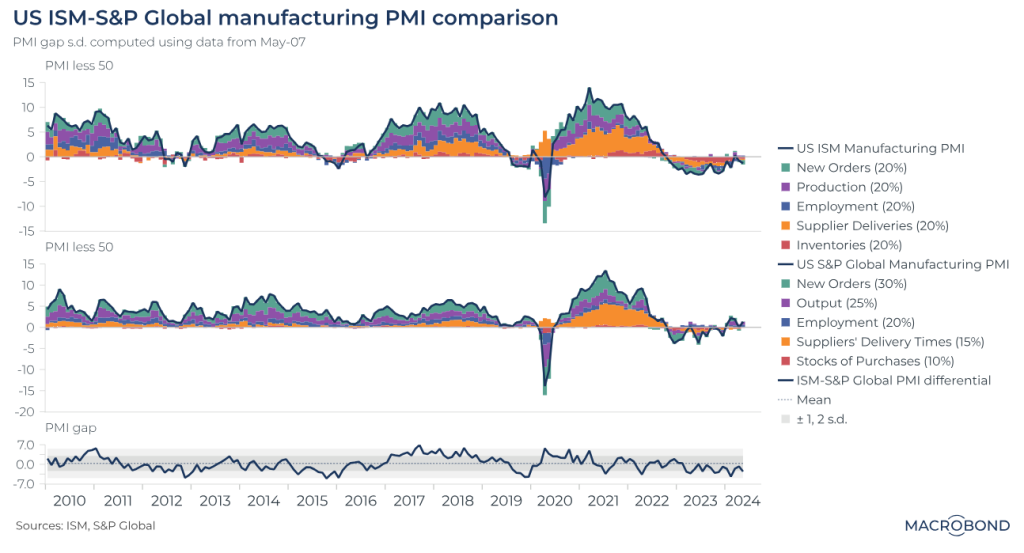

Source: Macrobond

Political polarization and misinformation, often amplified by social media, contribute significantly to this skewed perception. A Brookings Institution study points out that biased sources of information lead to widespread misbelief that the U.S. economy is in recession, despite evidence to the contrary.

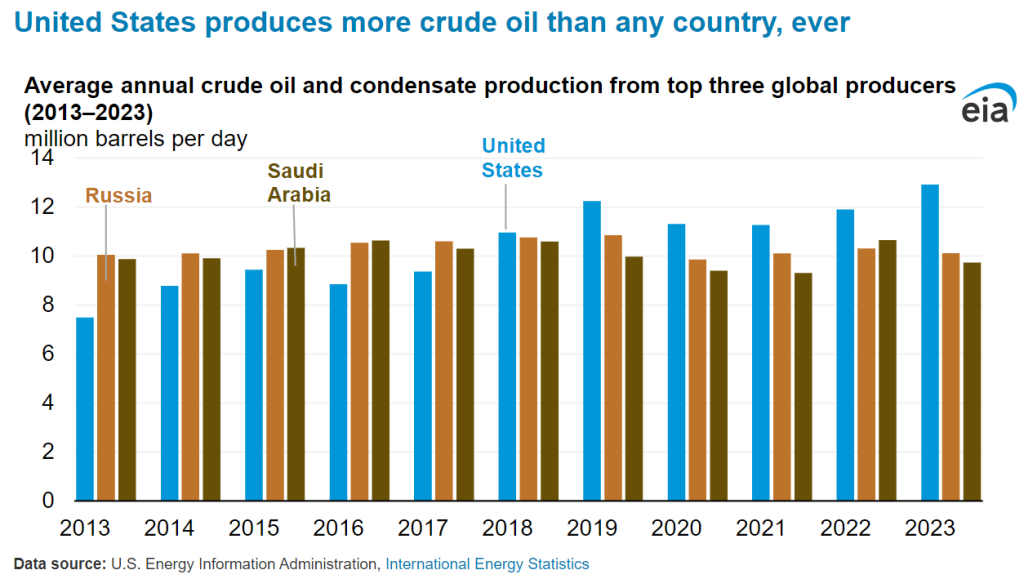

Turning to the U.S. oil industry, recent trends reveal a potential decline in production driven by a wave of mergers and acquisitions. The Federal Reserve Bank of Dallas’ survey indicates that over 50% of shale executives foresee a decrease in domestic crude output if the consolidation trend continues. This reduction in exploration and production investment is concerning, with the number of active drilling rigs at its lowest since early 2022 and frack crew deployment halved compared to six years ago.

The Energy Information Administration (EIA) projects a modest increase in oil production for 2024, estimating a rise of about 310,000 barrels per day. However, the recent $250 billion in shale sector takeovers suggests that significant surprises in production increases, like those seen in previous years, are unlikely. OPEC+ is closely monitoring these developments, given their potential impact on global oil supply dynamics.

For investors, the current economic environment suggests opportunities in sectors that benefit from low unemployment and rising wages, such as consumer goods and technology. However, the persistent inflation concerns indicate a cautious approach towards fixed-income investments.

In the oil industry, the projected decline in production due to mergers and acquisitions suggests potential upward pressure on oil prices in the medium term. This could create opportunities in energy stocks and commodities but also pose risks for industries dependent on stable energy costs. Policymakers need to address the reduction in exploration and production investment to ensure long-term energy security and price stability.