The global oil markets are witnessing significant shifts as rising Russian seaborne exports and increased production from OPEC+ members reshape the supply landscape. The resurgence of Russian crude exports and the uptick in OPEC’s production levels raise questions about the sustainability of the current OPEC+ production quotas and potential fissures within the alliance.

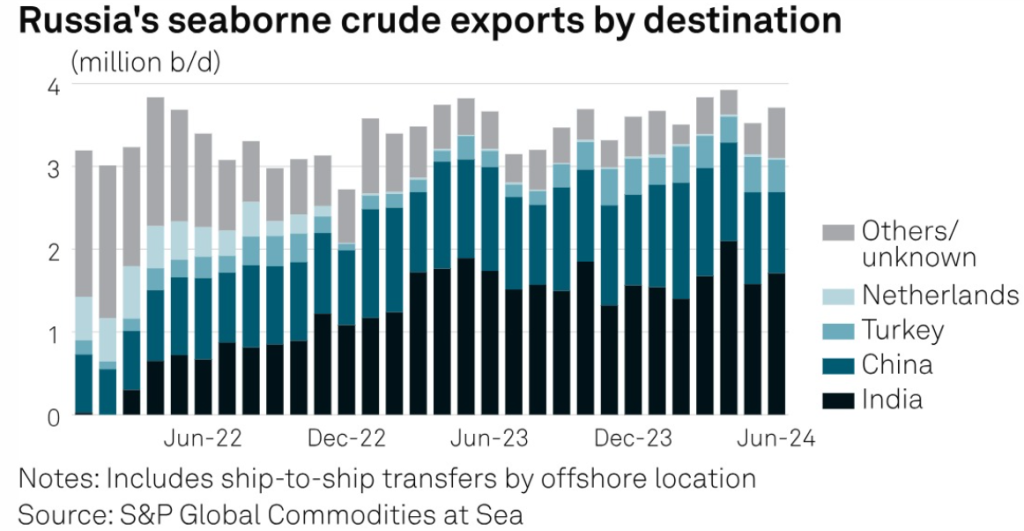

In June, Russian seaborne crude exports climbed by 5% from May, reaching an average of 3.71 million barrels per day (b/d), up from 3.52 million b/d the previous month. This increase comes despite Moscow’s commitments to adhere more strictly to its OPEC+ output target. The rise in exports was primarily driven by an uptick in shipments of Urals crude from Baltic and Black Sea ports, as well as the recovery of key oil terminals like Primorsk and Kozmino after disruptions. India’s appetite for Russian crude surged, with an additional 130,000 b/d flowing to Indian ports, even as exports to China dipped to a 10-month low of 980,000 b/d amid seasonal maintenance at Chinese refineries.

This increase in Russian exports contrasts with the OPEC+ pledges, highlighting a potential rift within the alliance. The situation is further complicated by the recent sanctions imposed by the EU and the US on Russia’s largest shipping company, Sovcomflot, and several of its tankers, which have yet to significantly impact the overall export volumes due to the utilization of a shadow fleet bypassing price caps.

Meanwhile, Russian oil product exports fell by 9% in June despite the restoration of damaged refining capacity. Seaborne loadings of diesel, fuel oil, naphtha, and other refined products averaged 2.18 million b/d, a substantial decrease from January levels. This decline was led by a reduction in exports of naphtha and VGO, although gasoline exports rebounded to 150,000 b/d following the lifting of a temporary ban on exports. The overall drop in product exports underscores the fragility of Russia’s refining infrastructure in the face of continued drone strikes.

On the other side of the equation, OPEC’s oil production continues to rise, driven by higher outputs from Nigeria and Iran. In June, OPEC’s crude oil production reached 26.7 million b/d, an increase of 70,000 b/d from May. Nigeria, Africa’s top oil producer, ramped up its production by 50,000 b/d, striving to recover from years of underperformance. Iran, exempt from OPEC+ cuts, matched its five-year high output of 3.2 million b/d. However, the internal dynamics within OPEC reveal growing tensions. Iraq, the second-largest OPEC producer, reduced its output by 50,000 b/d but still exceeded its OPEC+ quota. The collective production from the nine OPEC members bound by the pact was 280,000 b/d above the implied target, primarily due to Iraq’s overproduction.

Adding another layer to the global oil demand dynamics is that the world’s largest oil importer, China, is flashing a warning about demand and crude prices. The number of supertankers headed for China dropped to the lowest in almost two years, with only 86 tankers indicating China as their next destination over the coming three months, down from 91 last week. This marks the lowest weekly tally since August 2022. The outlook for Chinese demand in the second half of the year is showing signs of softness, potentially providing a headwind for crude prices. Concerns include a slower-than-expected return of refineries from seasonal maintenance, softer purchases from key suppliers in July, and a potential drop-off in monthly import volumes. In contrast, the number of tankers headed for the US dipped slightly, while the number of vessels sailing for Angola increased, reflecting Angola’s efforts to boost exports after leaving the OPEC+ group. A total of 546 vessels signaled future destinations, indicating a diverse and shifting landscape in global oil trade routes.

The increasing production levels in OPEC and Russia’s growing seaborne exports suggest a potential oversupply in the market. This scenario could undermine the current equilibrium achieved through OPEC+ production cuts and lead to price volatility. The rise in Russian exports, despite pledges to cut, may prompt other OPEC+ members to reconsider their production strategies. This could lead to a breakdown in compliance with the agreed quotas, potentially destabilizing the alliance. The declining number of supertankers heading to China signals potential weakness in demand from the world’s largest oil importer, which could exert downward pressure on global oil prices. If Chinese demand continues to soften, it could offset the impacts of increased production and exports from OPEC+ and Russia.

Looking forward, the key question remains whether OPEC+ can maintain cohesion in the face of these divergent production trends. The alliance’s ability to enforce compliance and manage internal dissent will be critical in determining the stability of oil prices. As the global economic landscape continues to evolve, the interplay between geopolitical tensions and market fundamentals will shape the future of the oil markets. The coming months will be crucial in determining whether OPEC+ can adapt to these changes and maintain its influence over global oil markets.