The global economy is under a microscope as recent data reveals a landscape fraught with both resilience and potential pitfalls. The U.S. economy, while somewhat shielded from the immediate impacts of higher interest rates due to its financial structure, still faces significant challenges. Contained levels of private sector leverage and long-term fixed mortgage rates offer some insulation, but the Federal Reserve’s rate hikes continue to permeate through the economy. This passthrough is critical to understanding when the current macroeconomic cycle may turn.

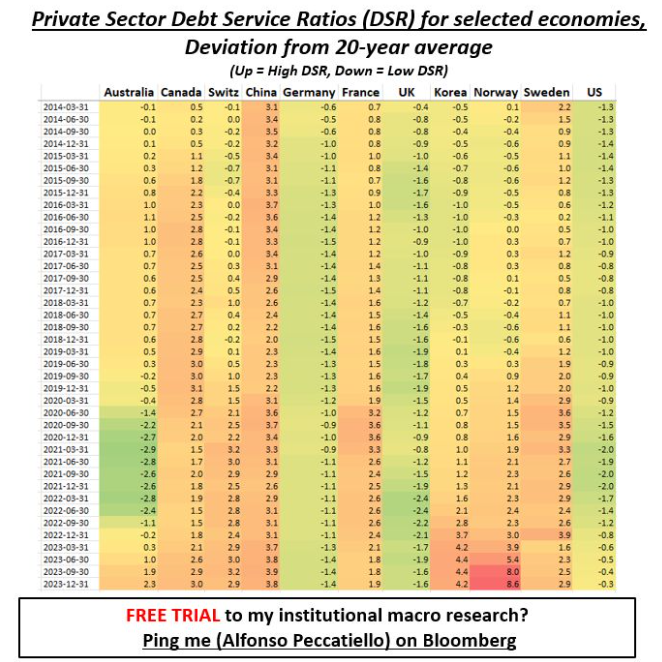

Debt service ratios (DSR) have emerged as a key indicator of economic health. They measure the share of income that households and corporations must allocate to debt servicing costs. Higher DSRs mean less disposable income for consumption and investment, which can slow economic activity. Rapid increases in DSRs are a red flag, indicating that central banks’ rate hikes are significantly impacting the real economy. The U.S. shows a relatively contained increase in DSR, suggesting some resilience amidst global economic uncertainties. However, other economies are not as fortunate.

Recent data from Alfonso Peccatiello underscores this point. The U.S., with its unique financial structure, experiences a limited increase in DSR even in the face of rate hikes. In contrast, economies with high private sector leverage and a significant proportion of floating rate loans are more vulnerable. The rate of change in DSRs is crucial, with rapid increases signaling impending economic distress. The table provided by Peccatiello highlights economies under pressure, suggesting that something might break sooner rather than later, but it may not be where most expect.

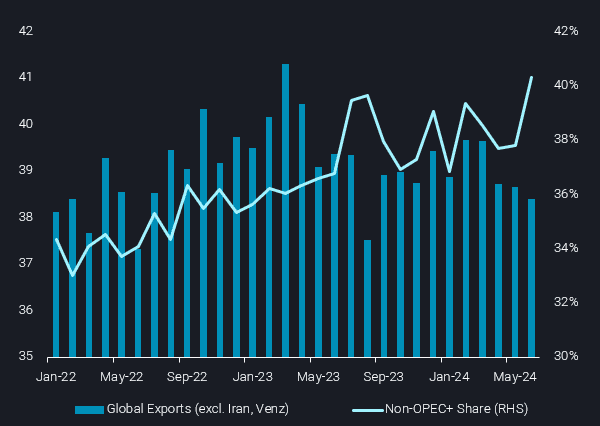

Turning to the global oil markets, Paula Munger provides a sobering analysis. June saw a decline in global crude and condensate seaborne exports, falling to 38.5 million barrels per day (mbd), the lowest since August 2023. OPEC+ countries, particularly Saudi Arabia, experienced significant reductions in exports, with Saudi exports dropping by 600,000 barrels per day. Meanwhile, non-OPEC+ countries increased their market share, with U.S. exports rising by 290 kbd. This shift underscores changing dynamics in global energy supply, where non-OPEC+ countries are playing a more substantial role, compensating for reduced exports from traditional OPEC+ leaders.

Saudi Arabia’s June export total of just under 5.6 mbd represents the lowest in nearly a year. This decline is driven by reduced shipments to key Asian markets and highlights the challenges faced by OPEC+ in balancing market supply without undermining prices. The planned increases in OPEC+ supplies scheduled to begin in October 2024 are now under scrutiny. Current market dynamics suggest that these increases may not be feasible without destabilizing oil prices.

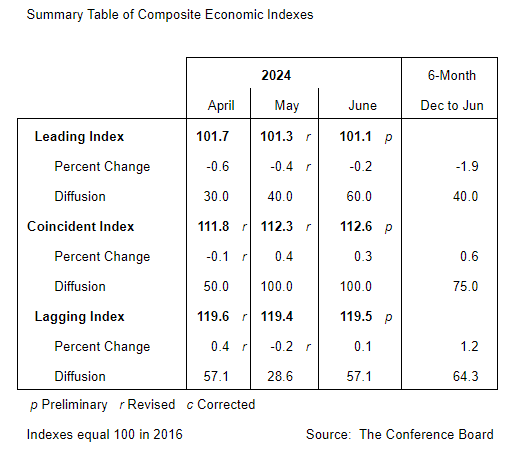

In the U.S., the Leading Economic Index (LEI) from the Conference Board signals potential slowdowns. The LEI decreased by 0.2% in June to 101.1, indicating a possible deceleration in economic growth. Over the past six months, the LEI has fallen by 1.9%, reflecting widespread weakness among leading indicators. This decline, though less severe than the previous six months’ 3.8% drop, still points to a cautious economic outlook. The GDP growth forecast for the third quarter has been revised down to an annual rate of 1%, a significant slowdown compared to the first quarter’s 1.4% growth and the previous year’s fourth-quarter 3.4%.

Despite these headwinds, some economic indicators in the U.S. have shown resilience. For June, six of the ten components of the LEI increased, including average weekly manufacturing hours, building permits, a leading credit index, new orders for capital and consumer goods, and stock prices. The Coincident Economic Index, measuring current economic conditions, rose by 0.3% to 112.6, driven by increases in industrial production, nonfarm payrolls, personal income, and sales. This suggests that while forward-looking indicators point to a slowdown, current economic activity remains relatively robust.

The intricate interplay between these various factors paints a complex picture for the global economy as we approach 2025. The narrative of an imminent recession continues to be fueled by these multifaceted economic signals. As economic analysts, it is crucial to provide actionable insights to policymakers and businesses, enabling them to navigate these challenges proactively. The global decline in seaborne exports, coupled with rising DSRs in various economies, underscores the importance of monitoring these indicators closely.

The current economic landscape requires a nuanced understanding of the underlying dynamics. The resilience of the U.S. economy, despite higher interest rates, offers some optimism. However, the vulnerabilities in other economies, as highlighted by the DSR data, cannot be ignored. The shift in global oil market dynamics, with non-OPEC+ countries gaining a larger market share, further complicates the outlook.

In conclusion, while the U.S. shows signs of resilience, the global economy faces significant challenges. The rapid increases in DSRs in various economies, the decline in global seaborne exports, and the cautious signals from the LEI all point towards a potential slowdown. As we look towards 2025, the key question remains: will these signals culminate in a global recession, or can policymakers and businesses adapt to navigate these turbulent times? The answer will depend on how effectively these complex dynamics are managed in the coming months.