KLXE Looks At A Steady Q3: In Q2, KLX Energy Services (KLXE) benefited from a shift in revenue mix towards the higher-margin Rockies segment. Also, the focus on higher-margin product service lines (Rentals and Tech Services, including Fishing) helped expand adjusted EBITDA margin significantly in Q2. Such geographic and product service line diversification and extended reach in technologies and services will likely keep its revenues and EBITDA margin resilient in Q3 despite the pressure on completion activity in the market. Read more about KLXE in our recent article here.

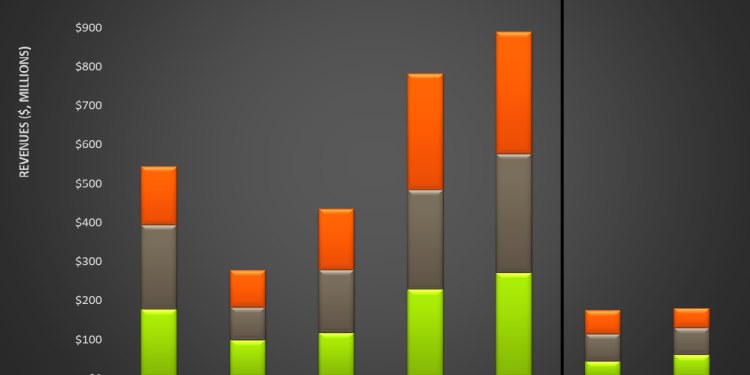

Revenue And EBITDA Margin Expanded In Q2: Quarter-over-quarter, KLXE’s revenues in the Rocky Mountains increased the most, by 35% in Q2, while its operating income turned significantly positive (profit of $10.5 million) compared to a loss a quarter earlier. A normalized production and intervention activity level contributed to the higher operating profit level. Northeast/Mid-Con., on the other hand, saw an 18% revenue fall, while its operating income turned to a loss in Q2. Reduced natural gas-focused activity, lower drilling, completion, and production offerings, and lower pricing hurt the segment result in Q2. KLXE’s adjusted EBITDA margin (company-wide) expanded significantly (by 810 basis points) from Q1 to Q2.

KLXE’s Cash Flows And Leverage: KLXE’s cash flow from operations and free cash flow turned positive in Q2 2024 compared to a quarter ago. Net debt increased by 15% since the start of the year. Due to a low shareholders’ equity base and a rise in net loss, its debt-to-equity increased to 29x as of June 30, 2024, from 7.3x by the end of 2023.

Thanks for reading the KLXE Take Three, designed to give you three critical takeaways from KLXE’s earnings report. Soon, we will present a second update on KLXE’s earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.