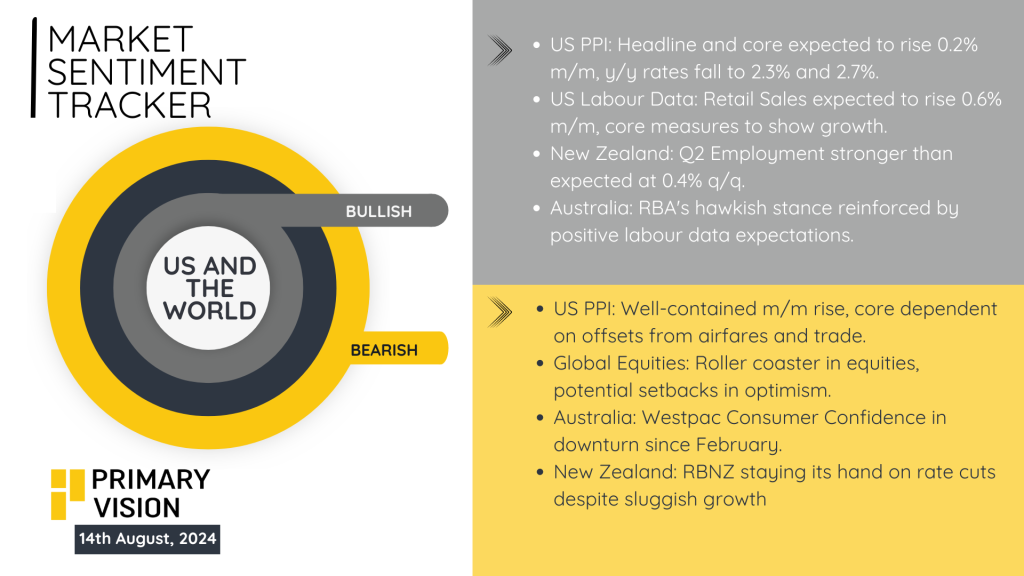

US and the World

In the U.S., the Producer Price Index (PPI) is set to rise by 0.2% month-over-month, with year-over-year rates expected to ease to 2.3% and 2.7%. Retail sales are projected to increase by 0.6%, indicating steady consumer spending. New Zealand’s employment data for Q2 surprised on the upside with a 0.4% quarterly gain, reflecting resilience in the labor market. Australia’s Reserve Bank remains committed to a hawkish policy stance, bolstered by strong labor data, although consumer confidence continues to wane, with Westpac’s index in decline since February.

However, global markets face persistent challenges. U.S. equities are on a roller coaster ride, reflecting uncertainty as economic signals remain mixed. Australia grapples with weak consumer sentiment, and New Zealand’s central bank is cautious on rate cuts, despite lackluster growth. The data paints a picture of a global economy walking a fine line between sustained recovery and looming recession.

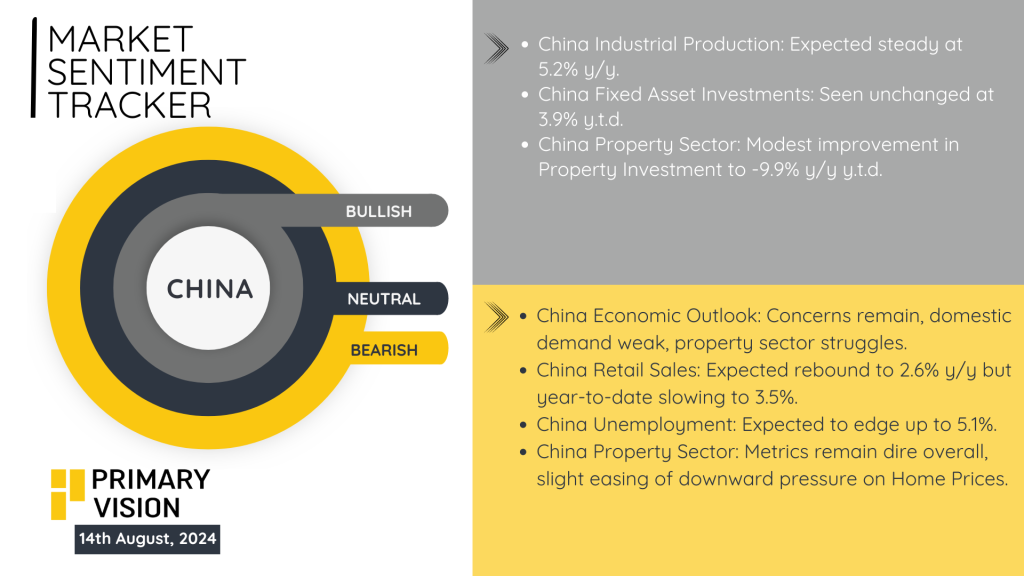

China

China’s economic outlook continues to face significant challenges. While industrial production is expected to remain steady at 5.2% year-on-year, concerns persist over weak domestic demand and ongoing struggles in the property sector. Retail sales are anticipated to rebound slightly to 2.6% year-on-year, but the year-to-date growth is projected to slow to 3.5%, highlighting the ongoing softness in consumer spending. Unemployment is expected to tick up to 5.1%, further reflecting the subdued economic environment.

In the property sector, metrics continue to be dire overall, though there is a modest improvement in property investment, with a slight easing in the rate of decline to -9.9% year-on-year year-to-date. Despite these small signs of stabilization, the broader challenges facing China’s economy suggest that more robust measures may be needed to support growth and address underlying weaknesses.

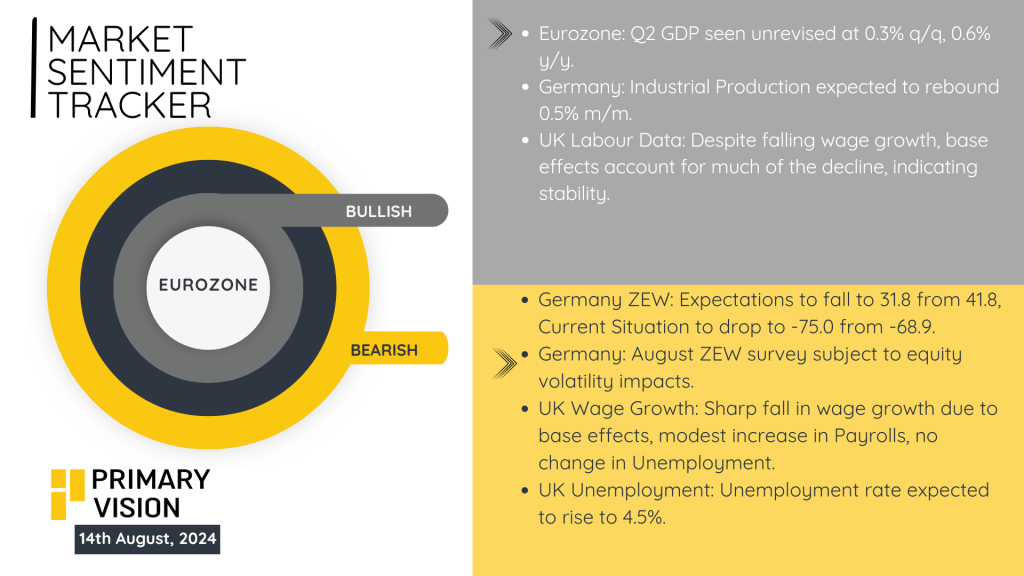

Eurozone

The Eurozone’s economic outlook remains mixed. The second quarter GDP is expected to stay unchanged at 0.3% quarter-on-quarter and 0.6% year-on-year, with Germany’s industrial production anticipated to rebound by 0.5% month-on-month. However, the upcoming ZEW survey for August raises concerns, as expectations are projected to fall significantly from 41.8 to 31.8, with the current situation index dropping from -68.9 to -75.0. This dip reflects the volatility in equity markets and the underlying economic uncertainty.

In the UK, wage growth is expected to see a sharp decline due to base effects, although payrolls are forecast to show a modest increase. Despite the fall in wage growth, the unemployment rate is predicted to rise to 4.5%, signaling ongoing challenges in the labor market. Overall, while there are pockets of resilience, the broader economic landscape in the Eurozone and the UK appears to be under pressure.