This installment of the Market Sentiment Tracker looks at the two largest economies of the world and tries to highlight further signs of an upcoming slowdown.

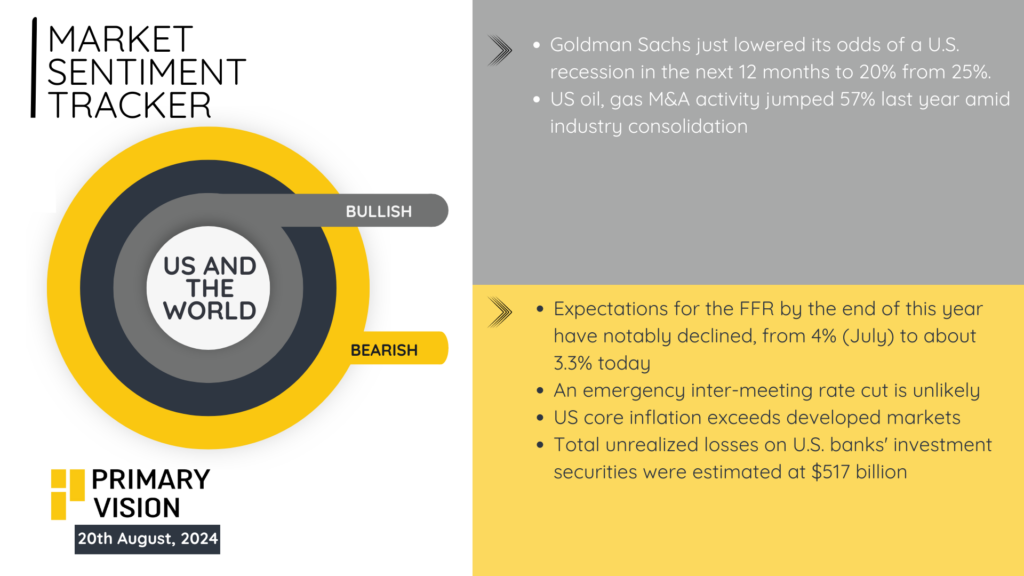

Goldman Sachs has trimmed its recession odds for the U.S. to 20% from 25%, reflecting slight optimism. In the energy sector, M&A activity jumped 57% last year, driven by consolidation. On the flip side, expectations for the Federal Funds Rate by year-end have dropped from 4% in July to about 3.3%, highlighting market uncertainty. Despite growing concerns, an emergency rate cut remains off the table. U.S. core inflation continues to outpace other developed markets, putting pressure on consumer spending. Additionally, U.S. banks face significant challenges, with unrealized losses on investment securities estimated at $517 billion. The data paints a picture of cautious market sentiment, balancing between potential growth and ongoing economic risks.

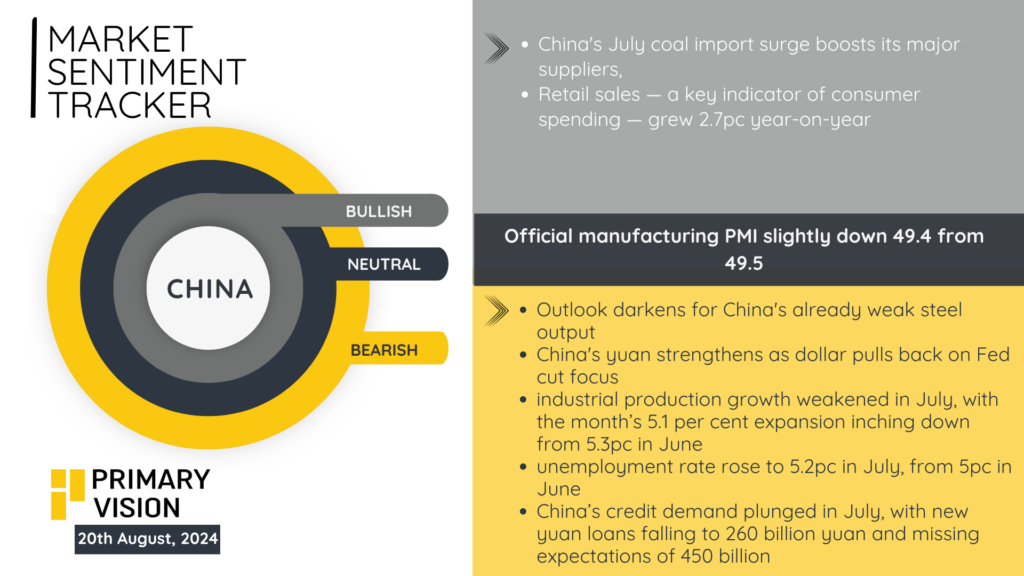

China’s economic outlook appears increasingly challenging. While coal imports surged in July, boosting major suppliers, the broader picture is less encouraging. Retail sales, a key consumer spending indicator, grew by 2.7% year-on-year, reflecting moderate demand. However, the industrial sector shows signs of strain, with production growth slowing to 5.1% in July, down from 5.3% in June. The official manufacturing PMI dipped slightly to 49.4, indicating continued contraction. The unemployment rate edged up to 5.2% from 5% in June, highlighting rising labor market pressures. Credit demand also plummeted, with new yuan loans falling sharply to 260 billion yuan, missing expectations by a wide margin. Despite a stronger yuan as the dollar retreats on Fed speculation, China’s economic landscape is under significant stress, particularly in its steel and manufacturing sectors. This data suggests the economy is struggling to maintain momentum amid weakening internal and external demand.

All eyes on Jackson Hole now which will set the tone for the rest of the year!