The crude markets have been struggling to break higher with brent moving back to the bottom of our range $77-$83. There is a growing concern about slowing demand, which has overwhelmed some of the bullish narratives that have hit the market. We’ve been adamant about the issues facing demand, but the market has been slow to accept a struggling global market. Here are some of the bullish setups that have yet to happen:

- Iran responding to the assassination of Ismail Haniyeh in Iran.

- Iran has stated they wanted to let the cease-fire negotiations play out before they responded. News reports have stated that the negotiations have broken apart in Egypt, which was always our base case.

- We have stated that Iran is struggling to stay relevant, and a response from them would be seen as “weak.”

- Israel has been rumored to launch a ground operation into Lebanon.

- This doesn’t seem likely at the moment because it would be predicated on the severity of the Iranian retaliation.

- Israel has been having success utilizing the air force and precision strikes.

- The Ukrainian military has continued to make headway in the Kursk region of Russia.

- Russia has also made headway against Ukraine in the Donbas.

- The issues will be ongoing, and it has so far led to additional refined product exports from Russia into the global market- especially Asia.

- Libya is another fluid situation with more restrictions on crude production reducing volumes in the Mediterranean. The political uncertainty stems from two key areas:

- The arrest warrant issued by Spain against Saddam Haftar promoted him to close El Sharara in response.

- The oil blockade is over Spain indicting Saddam Haftar for illegal weapons shipments found in Spain. The demand for Sharara field to stop was intended to get Repsol to pressure Spain to lift the indictment, which popped up in Italy last week when Saddam passed through passport control. I think he is concerned this is now a Europe wide arrest warrant, although Italy let him proceed.

- I don’t think the Haftar army wants a major war with Tripoli. So having patrols does not really add anything from their point of view, they got Sharara to shut down with phone calls. Of course, if the pressure does not work, their temptation may be to do actual damage to the field.

- This comes in addition to the arrest of the oil minister under the view of corruption.

- None of this is going to clear up soon, which will keep crude exports depressed.

- My belief is that Haftar wants to create a semi-autonomous region that accounts for 2/3 of the oil and 1/3 of the population.

- It looks like they are creating something similar to the Oligarchs in Russia.

- Venezuela protests continue to roil the country, but as long as the military sits on the sidelines- there won’t be much progress in either direction.

- Anti-Maduro protests continue to hit the country, and we don’t see that stopping any time soon.

- The last point is Russia’s losses in Africa. I don’t think there is enough appreciation of the Wagner failures in Niger and Mali.

- This is limiting their ability to influence politics and interests throughout Africa, Middle East, and Venezuela. They have tried to bring a bigger show of force into VZ and war games in Mongolia, but they are losing ground against Ukraine and Africa demonstrating their weakness.

- They are trying to remain active with Haftar, but I believe it will be in equipment only.

- Russia is also struggling to send additional equipment to Iran, which is showing the pressure points are broad.

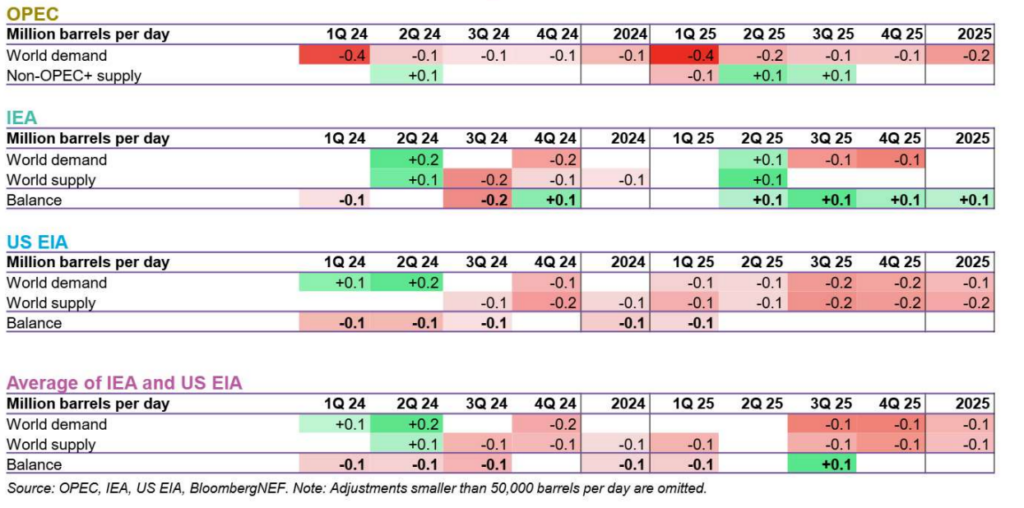

When we turn to crude balances, there are different agencies showing a stark difference in Q4. The EIA sees a broad shortfall in Q4’24 and 2025, which is similar to OPEC. The IEA is maintaining their oversupplied basis, and I think that is the likely scenario as demand remains VERY soft around the world. The supply side will remain stable as OPEC+ maintains their current curbs over the next several quarters.

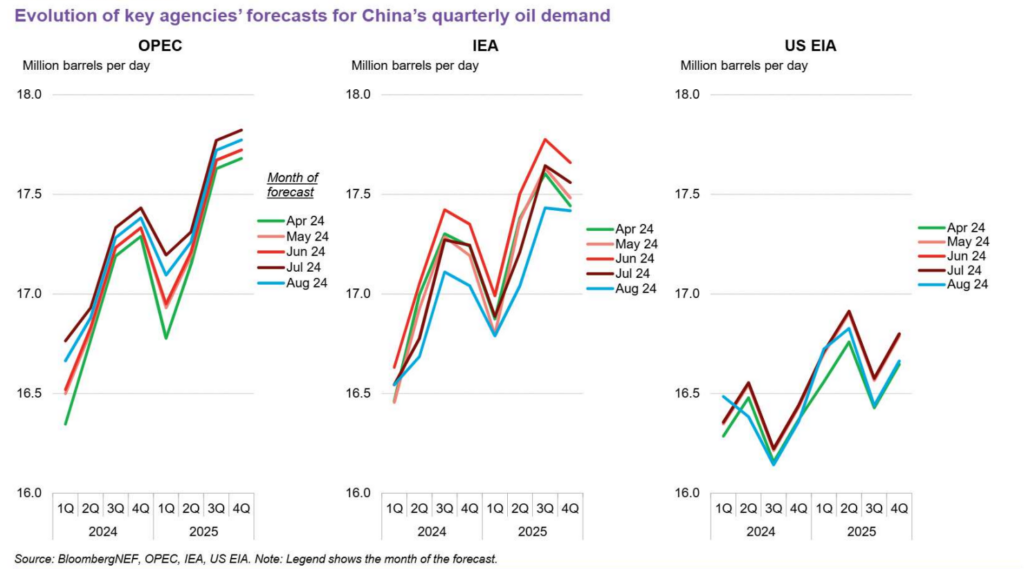

Many of the estimates are driven by a big recovery in Chinese demand, which is where I differ the most versus the “street.” The market has consistently gotten the Chinese economy and demand wrong, and I think it’s no different this time around. The below gives you an idea of the strength expected in 2025 even as global economic data only gets weaker.

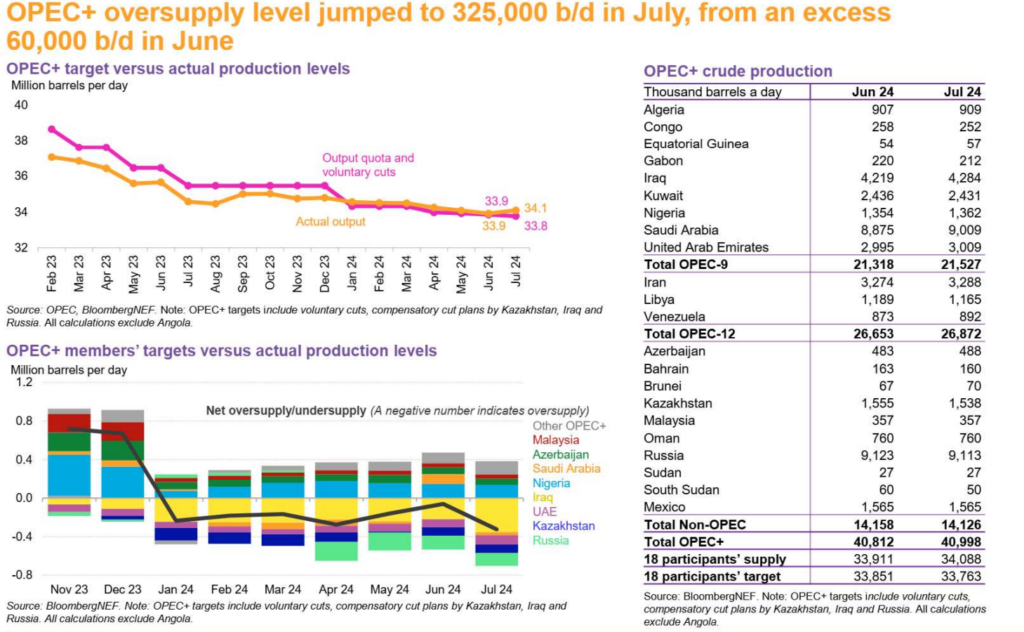

In the least shocking news, OPEC+ had an oversupply of 325k barrels a day last month, and we don’t see them ever being under or at the target. The reduction of Libya volume (excluded from the OPEC+ deal) will help with some balance, but usually when there is a broader supply issue- the UAE and/or Iraq increase their production/exports.

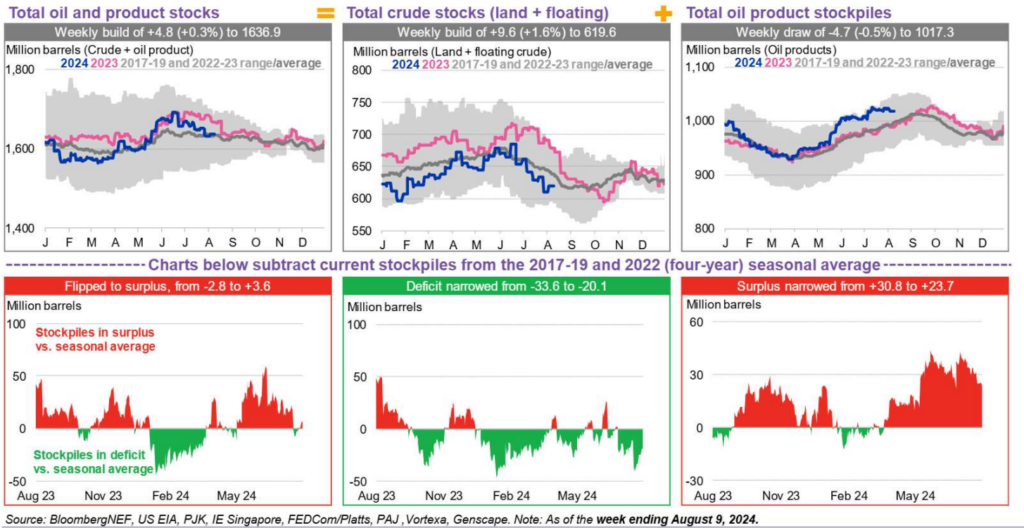

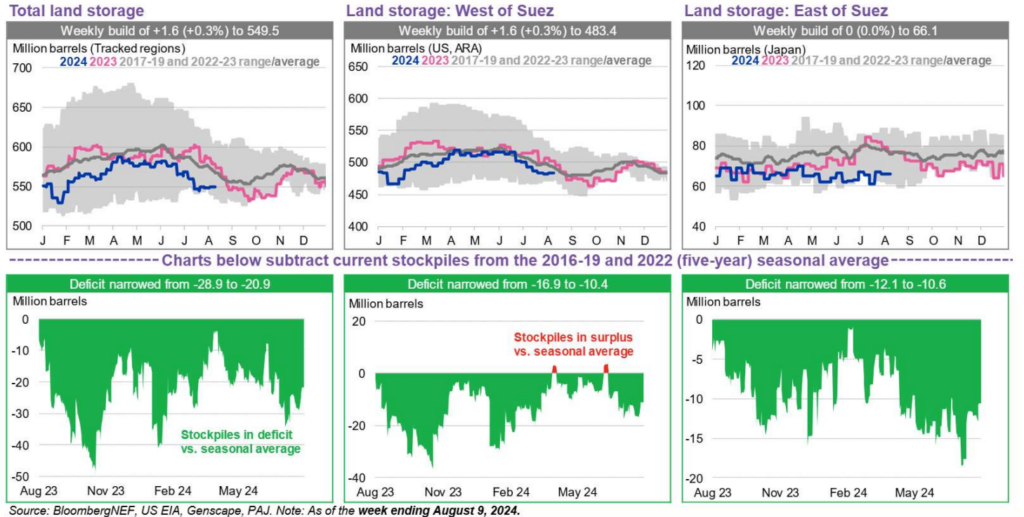

Total crude and product storage help at the seasonal average, and we will likely see builds start to accelerate as crude in transit is delivered and refined product demand stays sluggish. Refinery run rates have increased a bit around the world, which will help push refined product storage higher. It will remain below the historic peak, but it will stay above the 5 year rolling average.

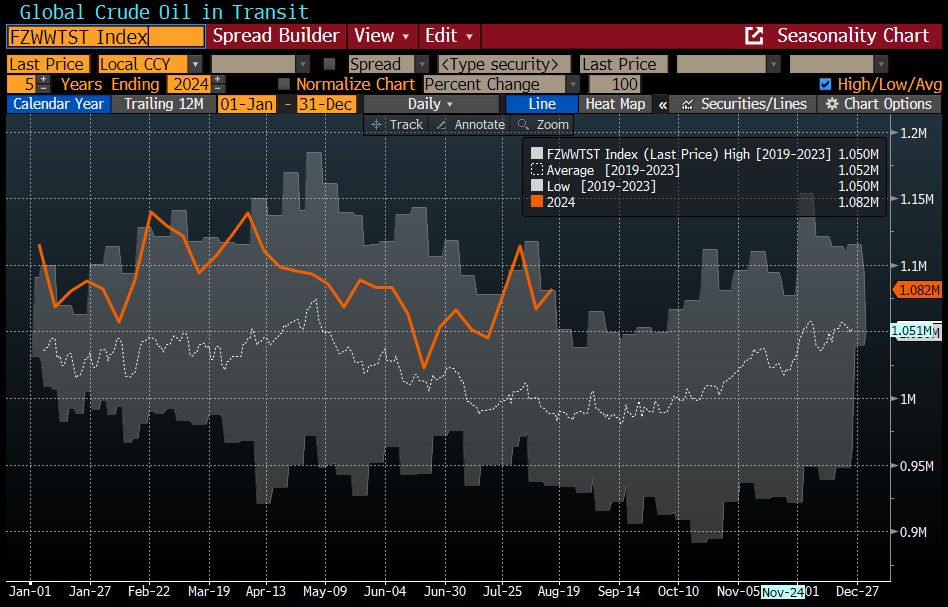

When we turn to onshore storage, the recent rise has corrected a bit as crude in transit remains elevated. Crude oil in transit remains at seasonally adjusted record highs, and these are cargoes that will show up at the coast- especially in Asia. These are cargoes that have left the North Sea, ME, and WAF and will replace onshore storage. There is always a timing delay between in-transit and offshore storage- don’t let the narratives drive investments.

We expect to see a steady increase over the rest of August and Sept of crude in storage- especially West of Suez.

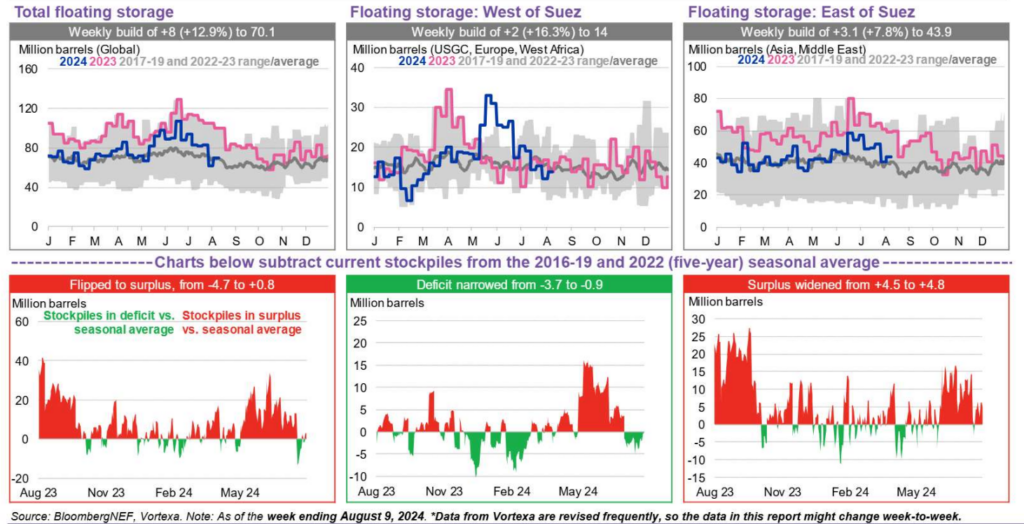

This will be driven by a steady rise of floating storage, which is currently understated. East of Suez is going to show an increase over the next few weeks as West of Suez stays fairly stable at the historical average.

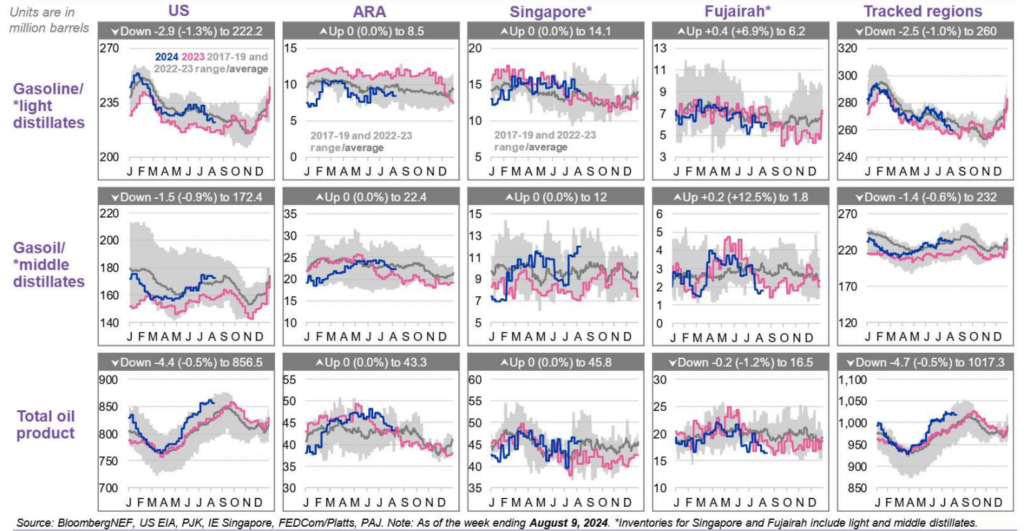

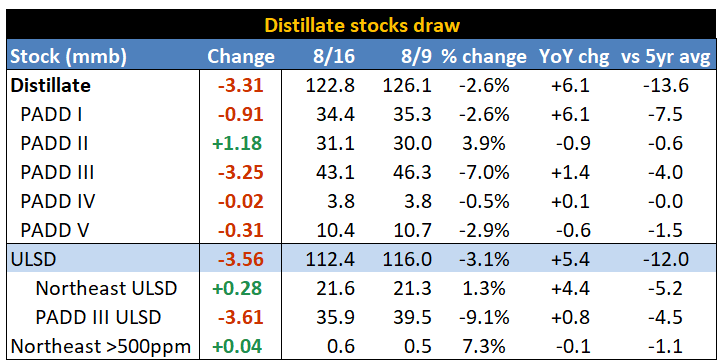

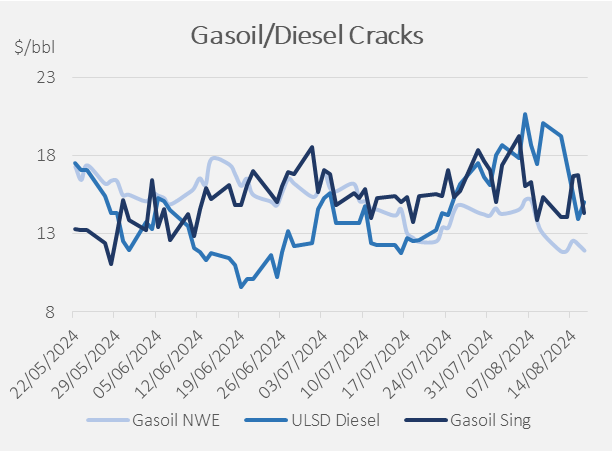

The biggest differentiating factor to the global refined product market is gasoil/distillate. We went from record lows around the world to near record highs- especially in Asia (Singapore). This points to more global economic weakness because diesel is still the fuel that powers the economy. There has also been additional supply that came to market from the Middle East and Russia dumping huge quantities into the market. The U.S. and Europe are showing another sizeable increase, and this is happening as gasoline demand remains very weak. Refiners have been targeting disty for the last four years, but now the disty crack isn’t providing the lift it once did.

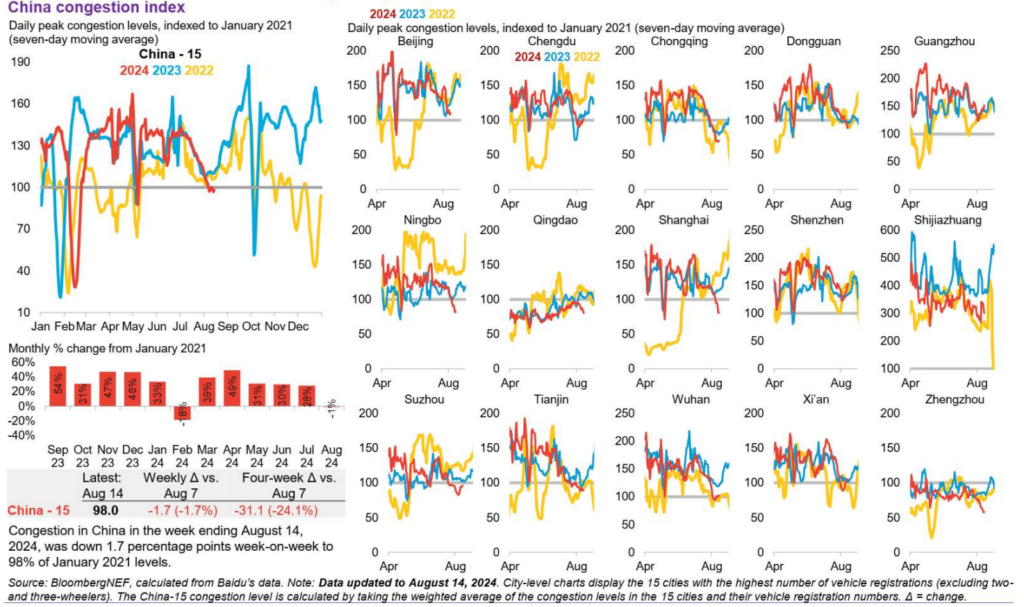

China saw a much larger decline driving activity, and well more than my expectation. There will definitely be a recovery, but at this rate it will be well below what was achieved in 2023. It speaks to the economic issues and slow consumer activity within the country. None of the data or proposed stimulus will be enough to change this direction in 2024 or 2025.

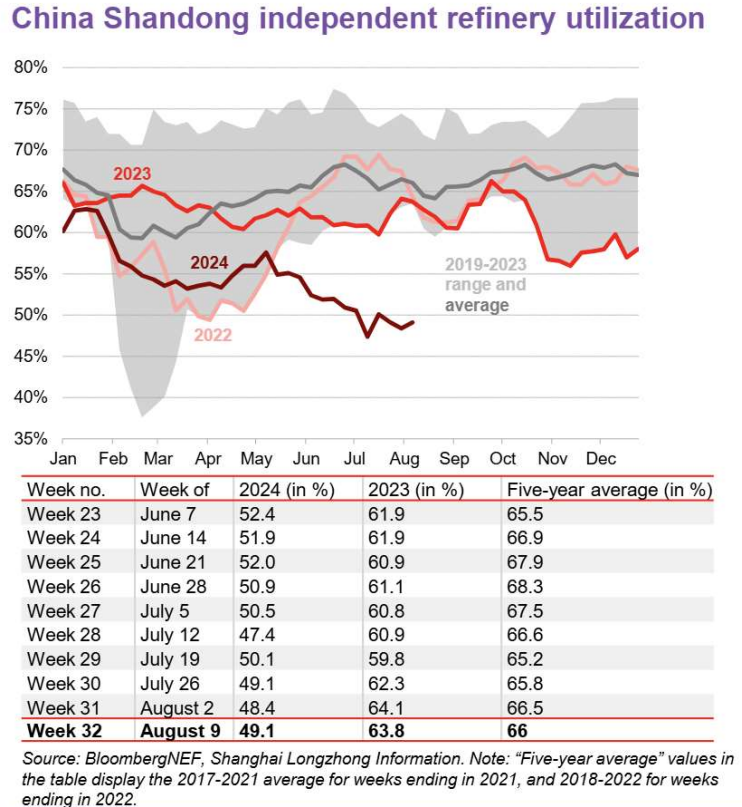

Refining activity in China reflects the issues we are seeing with their soft crude imports and domestic demand.

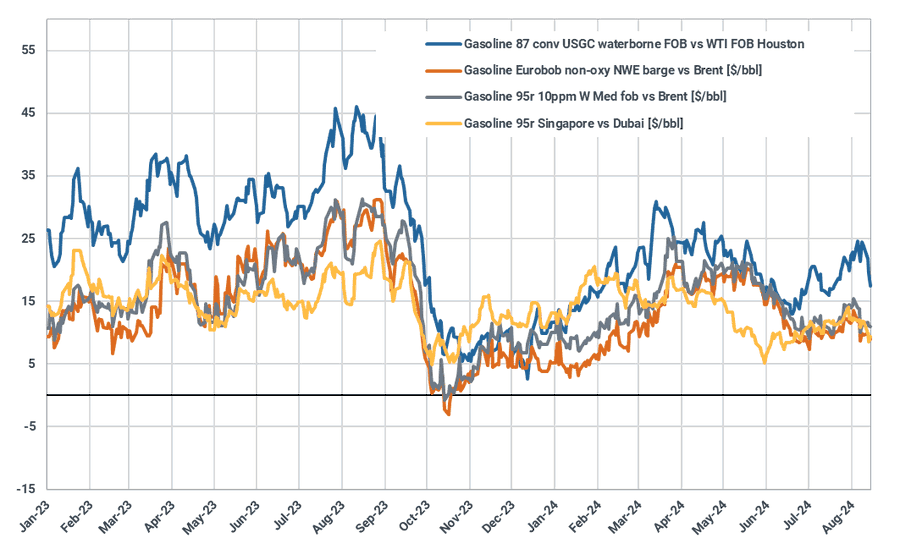

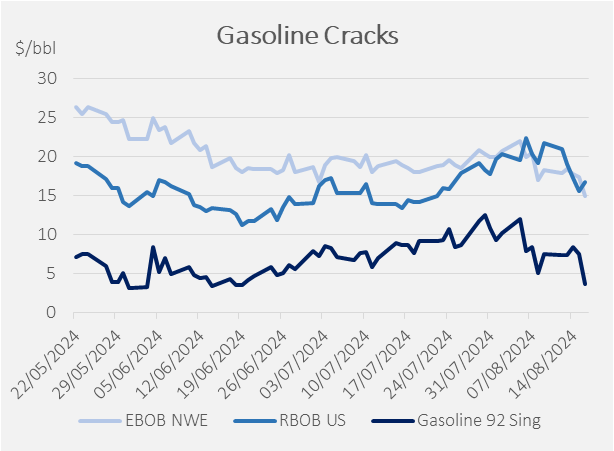

Global crack spreads are struggling driven by disty pressure, which we don’t see adjusting in the near term. Instead, we expect to see disty cracks hold here and gasoline cracks weaken as we head into September. This will pull down the whole complex.

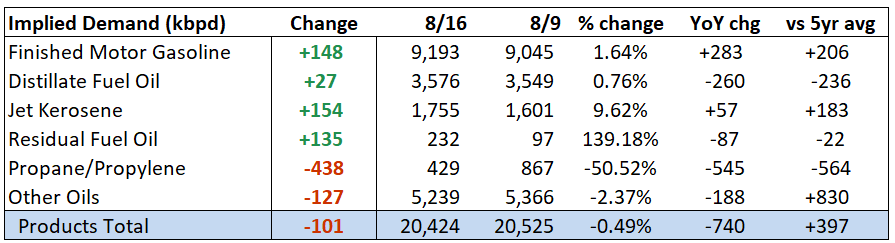

When we turn to the U.S., we had a strong EIA number, but it’s something that is temporary. “According to GasBuddy data, weekly (Sun-Sat) US gasoline demand rose 0.3% last week but was 1.1% below the four-week moving average.” The below gasoline data is a bit overstated, but it will fall back below 9M barrels a day- especially as many parts of the country begin school and vacations come to a close. This will result in more builds as refinery run rates increase for the end of August before we head into fall turn around season. Distillate had another very weak number, and there isn’t much support on the horizon.

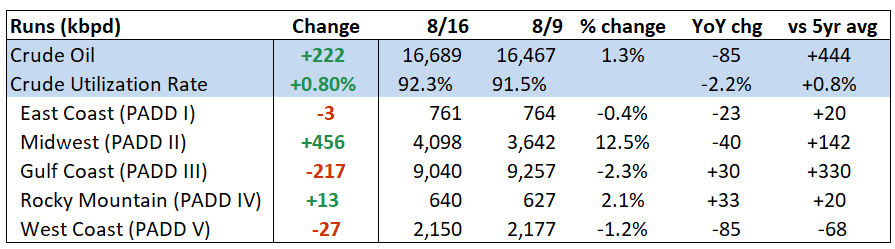

Crude posted a nice draw driven by PADD3 as exports held around 4M barrels a day and imports into the region stayed depressed. We see more imports over the next few weeks, but the loss of Libya crude into the Mediterranean will support our exports into Europe. The arb is still closed into Asia, which will volumes focused into Europe.

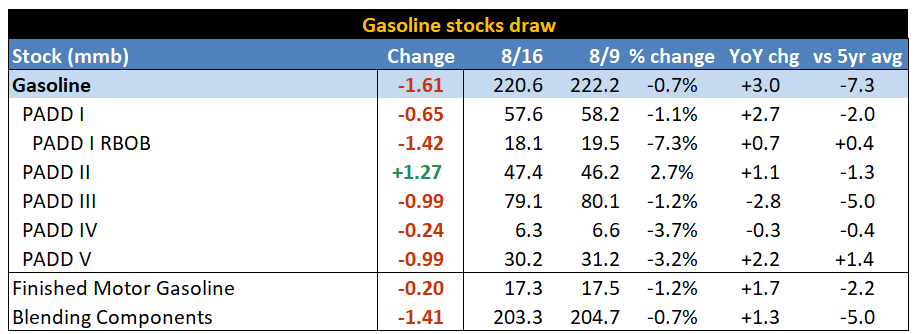

Gasoline storage dropped, but still remains above last year- and we see more increases as refinery runs recovered driven by PADD 2.

Padd2 refiners will continue to run hard as repairs are complete at XOM’s facility.

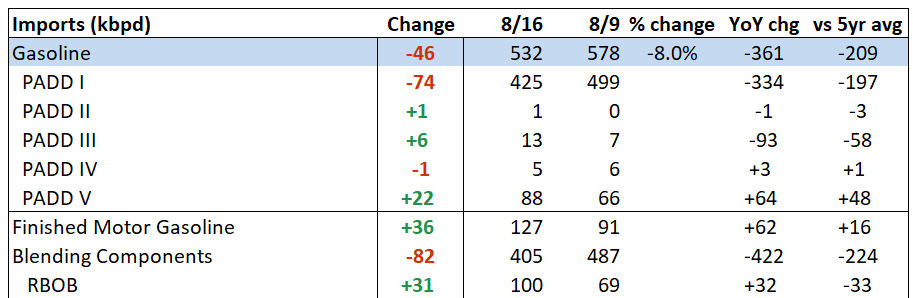

Gasoline exports stayed soft as the arb from Europe to U.S. was tight driven by day rates even as storage stays elevated in Europe. There will likely be an increase as we close out the summer and PADD 1 still has more than enough spare storage.

Distillate saw a drop, helped by a pick-up in exports as local demand remains soft. Refiners are trying to maximize crack spreads, but it’s getting difficult with the number of headwinds driven by economic pressure.

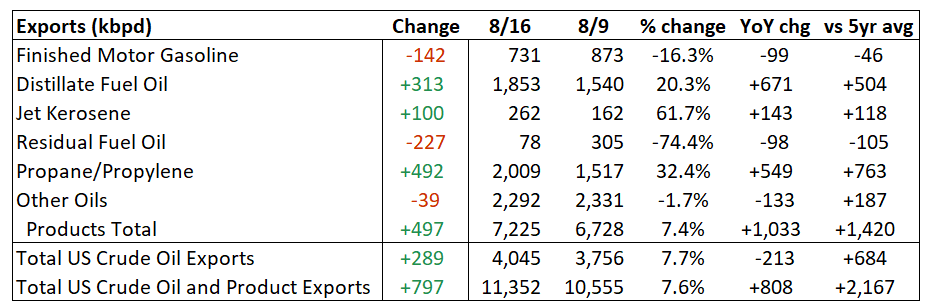

The below shows the export data from the U.S., and you can see a big surge in distillate. There have been relentless builds in Europe and Singapore, so the ability to keep pushing product in the market will be difficult. The U.S. is competing with the ME and Russia with the former heading into the Atlantic Basin while the later heads to Asia.

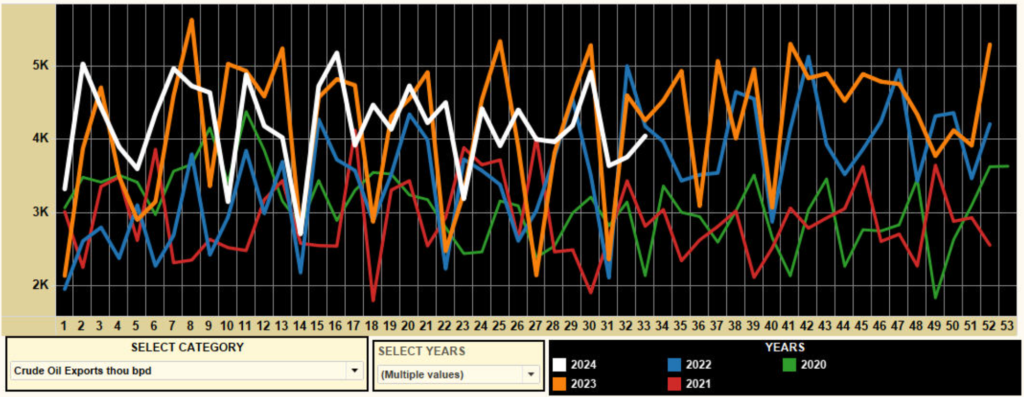

Crude exports will be very important going forward, and you can see we are below ’22 and ’23. It’s unlikely we close this gap given the tight/closed arb into Asia. The support into Europe is there, but it will be difficult given the current foundation.

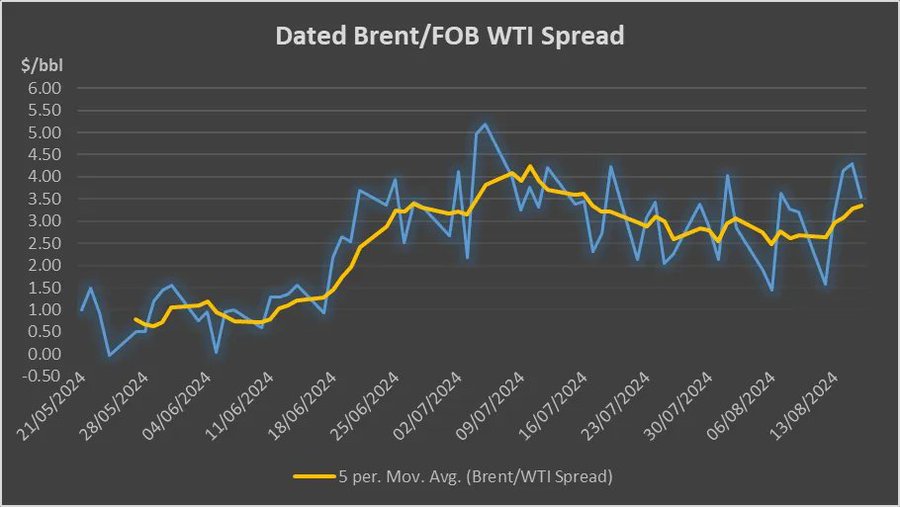

WTI Midland for delivery into Europe is still relatively cheap compared to competing grades, despite the recent rebound in TD25 rates. The cost of WTI deliveries needs to be higher and this is driving the strength of the overall Brent complex. It’s a kind of trickle-down effect, with the strength in the US contagious to the strength of other North Sea light crudes. On the physical side- WAF sales have been mixed with Angola finding some support with Nigeria slowing down once again: Term cargo allocations and spot cargo indications for Angola’s Sonangol are not yet out and September cargoes had likely sold out. Nigerian sales began to slow due to refinery maintenance in India. Forcados/Escravos offered Dated + $3.50, Qua Iboe/Bonny Dated +$2.80. WAF: The September Angolan programme has almost sold out. Angola plans to load 35 crude oil cargoes in October, up from 33 in September. Sonangol was still thought to have its September-loading Gimboa cargo last offered at Dated Brent minus $1.00.

The below chart puts into perspective just how gasoline has remained soft, and with distillate softening, the whole refining complex will struggle.

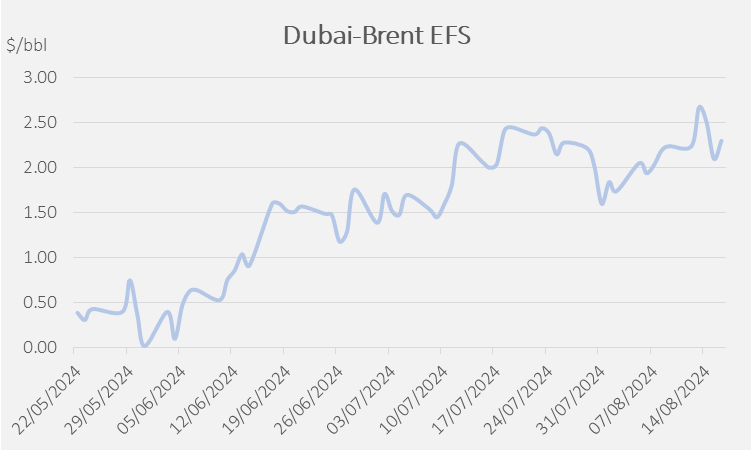

The physical market is showing some strength, but it’s very bifurcated depending on grade and location. The loss of Libya is supportive in Europe, which helped drive up some North Sea and brent structures, but Chinese/Asian demand is still a problem when we look at the broader market.

The current physical structure is very lopsided to the front side: “Steep backwardation in the Dated market makes long-haul shipments of Dated-linked crude uneconomical, as a cargo is effectively losing value while on water, traders expected the structure of the market to flatten this month as the upcoming EU maintenance season in Sept.”

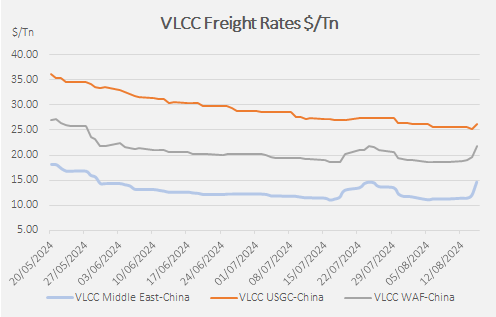

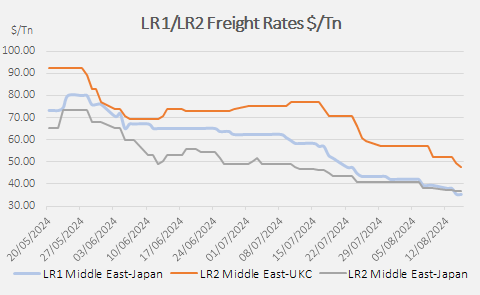

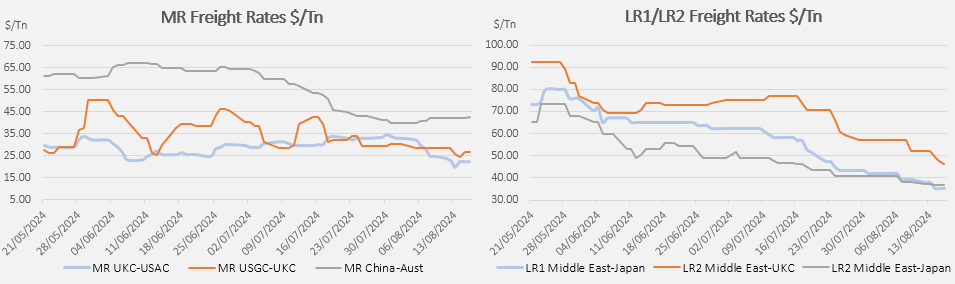

The freight rates are reflecting some of that near term strength while product tankers have softened in the same time frame. This is what helped move U.S. crude into Europe, and we expect to see the discounts in LR1 and LR2s pull more product from Europe into the U.S. and provide some additional support for disty flows from PADD 3 to Europe (which is a bit short lived here.)

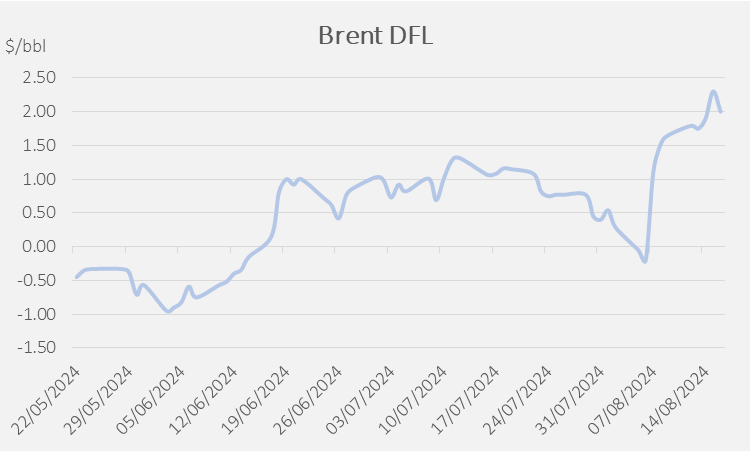

The majors have been pushed up pricing, which has caused a big move in DFL- but this has likely peaked and will continue to “weaken” over the next several days. Even as it weakens, it will still remain at a healthy premium especially compared to earlier this year.

As we mentioned earlier, the shift is very bifurcated with current pricing supportive of more purchases out of the ME.

Even as the front end of the physical crude market shows strength, the refining side is in a very different spot.

There is a lot of pressure in the refined product world which is going to make it very difficult for refiners to meaningfully increase runs or delay turnarounds. If anything, we should see turnarounds be pulled forward as cracks fall and refined products build.

On the clean side, the above rates help support our point that nothing is really moving anywhere. The builds keep rising around the world- especially in Europe and Asia.

The crude markets are in a very interesting position with some late-stage strength, but it doesn’t support a strong brent futures market as we head into the fall. Brent is going to struggle to break out of our range $77-$83. When Brent dropped below $77, it quickly bounced back to the low end, and we should get some near-term strength to get it back to $80. The broader overhang will remain the economic backdrop, and the problems that keep coming to the surface regarding the global consumer.

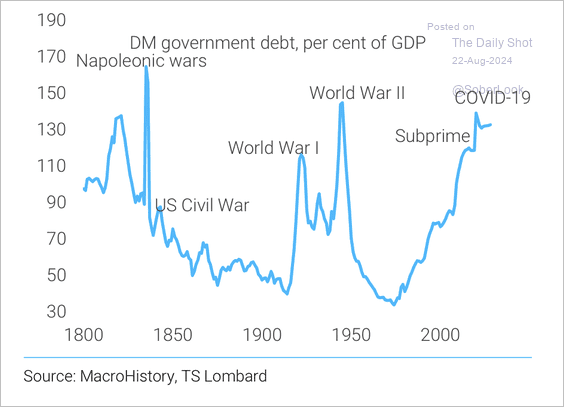

The U.S. isn’t the only country with a massive spending problem as most (if not all) developed countries run a significant deficit. The global market has a huge debt problem, and it’s a structural issue that will take years to work through; but this can ONLY happen if we’re willing to cut spending. There are two ways to adjust the below chart- cut spending or see a huge increase in GDP. Through the law of diminishing returns, we are throwing liquidity into the market well below a multiplier of 1. This means that for every dollar put into the market its generating less than $1 of economic power. So our deficit is creating an investment that can’t even cover principal let alone interest.

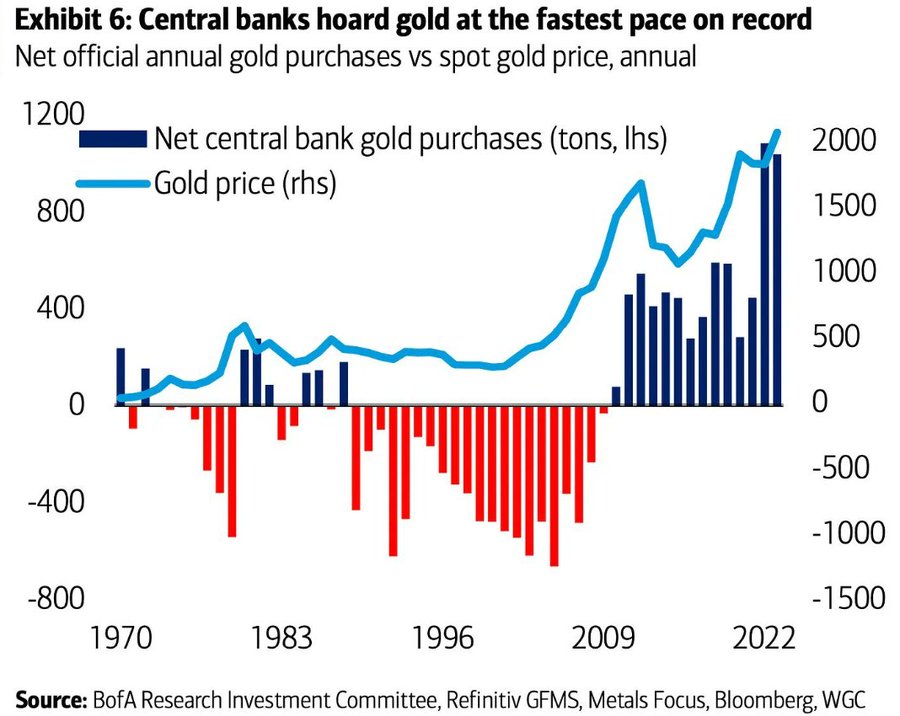

As the uncertainty grows, it isn’t surprising to see central banks turning to gold as a means of collateral. This has been at the base of support over the last 20 or so years, and it isn’t going to stop in the next few quarters. It has slowed, but as the spending remains robust and liquidity actually turns higher- it will keep CBs buyers.

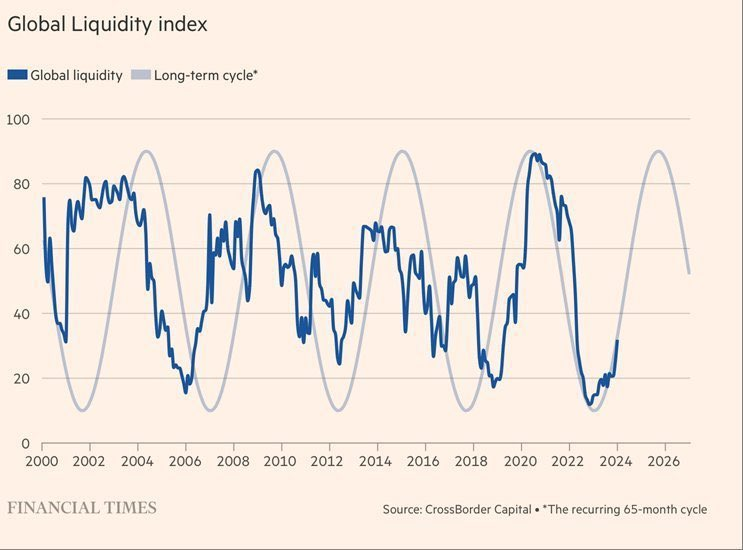

There is a growing push to see the Fed cut rates, but we are seeing a pivot higher in the global liquidity market, which is not something that should be happening in a “tightening cycle.” The U.S. has been one of, if not the largest provider of global liquidity.

This comes at the same time as U.S junk bond yields have fallen to the lowest in more than two years. The markets are NOT experiencing a shortage of liquidity, and a pre-mature cut would result in the second leg of an inflation spiral. I understand that there is a concern about jobs, but the bigger issue remains inflation with a large part being driven by fiscal spending. The U.S. has to issue another $1.3T in debt just to get to the fiscal year close.

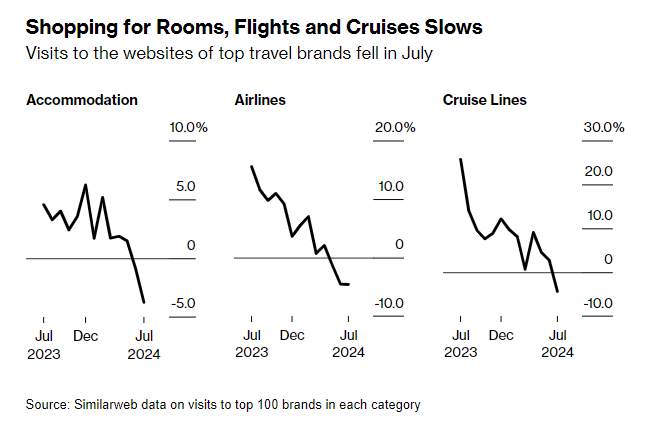

There’s finally been some pullback from the consumer, but we are already seeing a Fed and political push to adjust rates. A cut too soon is going to accelerate inflation. ravel demand is falling: Visits to websites of top Airlines and Cruise Lines brands declined by 4.6% and 4.4% in July, respectively compared to last year. At the same time, accommodation websites recorded a 3.7% year-over-year drop. Furthermore, the average trip length is down 14% year-over-year from 7.8 days to 6.2 days, on average. Moreover, Airbnb shares plunged on August 7th by the most in 2 years after the company warned of slowing demand for bookings. The drop in AirBnB is also showing that people who own several homes or bought homes just to rent them are going to struggle to manage the financing. We’ve seen bookings fall as well as rates, which is a bigger issue when considering maintaining their position.

Here is another look at the spending side of the equation:

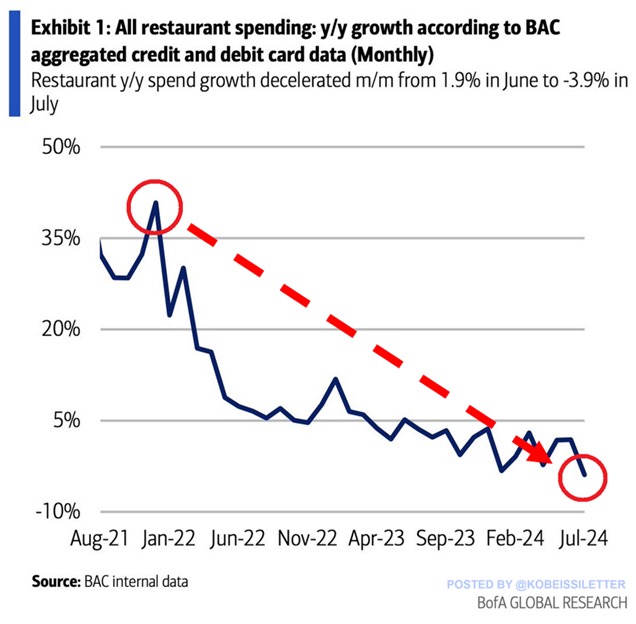

Another sign of weakening consumer spending: Restaurant spending fell 3.9% year-over-year in July, marking the largest decrease since 2020. This is a sharp reversal from the 1.9% increase seen in June. Food inflation is a major issue with fast food prices alone rising 31% over the last 4 years. All while over $2 trillion of excess savings have been depleted in 2 years, adding further pressure on consumer spending. Food away from home is now a luxury.

We’ve also started to hear rumblings of “price controls,” but we know all too well how these fail miserably.

Here is a great breakdown of how this works:

- The government announces that grocery retailers aren’t allowed to raise prices.

- Grocery stores, which operate on 1-2% net margins, can’t survive if their suppliers raise prices. So the government announces that food producers (Kraft Heinz, ConAgra, Tyson, Hormel, et. al.) also aren’t allowed to raise prices.

- Not all grocery stores are created equal. Stores in lower-income areas make less money than those in higher-income areas, as the former disproportionately sell lower-margin prepackaged foods (“center of the store”) instead of higher-margin fresh products like meat (“perimeter of the store”). Because stores in lower-income areas aren’t able to cover overhead (remember, even if their wholesale costs are fixed, their labor, utilities, insurance, and other operating expenses aren’t fixed… yet), grocery chains start to shut them down. Food deserts in rural areas and in low-income urban areas alike become worse.

- Meanwhile, margins for food producers are also quickly eroding. Their primary costs (ingredients, energy, and labor) aren’t fixed, and their shrinking gross profits leave less cash flow available to cover overhead, maintain facilities, and reinvest in additional production capacity.

- Grocery chains, which have finite shelf space, start to repurpose their stores (those they didn’t have to shut down, I should say) to sell more non-price-controlled items—everything from nutrition supplements to kitchenware to apparel—and less price-controlled food products. Your local Kroger or Safeway starts to look and feel more like a Walmart.

- Food producers stop making products with lower margins. Grocery chain start competing with each other to secure inventory. Since they can’t compete by offering stronger prices (remember, producers aren’t allowed to raise prices here, and, even if they could, grocery chains no longer have the gross profit to bear price increases), they compete on things like payment terms.

- Small grocery chains start to shut down entirely, or get sold to larger chains like Kroger. In addition to not being able to cover fixed costs, a major reason for this is because they can no longer reliably secure delivery of products, due to producers prioritizing sales to larger customers, which are able to leverage their stronger balance sheets to offer superior payment terms.

- Smaller food producers—which typically sell via distributors, rather than directly to grocery chains—start to go out of business. Because these producers have an additional step their value chains, and because they have lower volumes over which to spread their fixed costs, their cost structure is inherently disadvantaged compared to major food producers. When grocery stores aren’t able to raise prices, cutting product costs becomes all the more important, and deprioritizing purchases from smaller producers is an easy way to do so.

- As supply chains break down, lines start to form outside grocery stores every morning. Cities assign police officers to patrol store parking lots, and food producers draft contingency plans to assign armed escorts to delivery trucks.

- The federal government announces a program to issue block grants for states to purchase and operate shuttered grocery stores. The USDA also seizes closed-down production facilities.

- The government announces that prices for all key food costs—corn, wheat, cattle, energy, etc.—are also now fixed, to stop “profiteers” from gouging the now-government-operated food industry.

- Shockingly, the government struggles to operate one of the most complex industries on the planet. The entire food supply chain starts imploding.

- Communism, mass starvation, and the end of America quickly ensue.

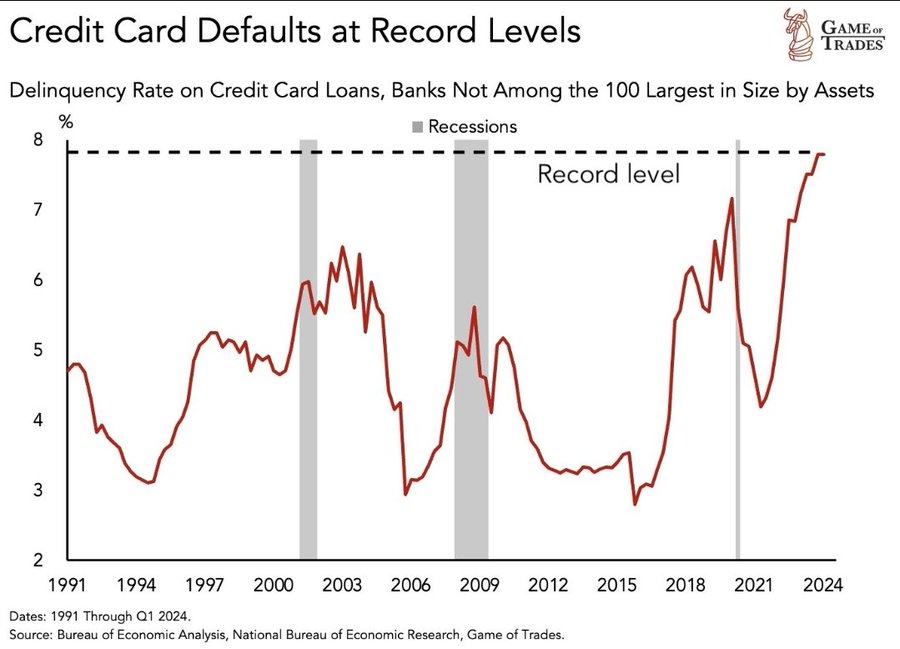

The focus needs to be on slowing down consumer spending, and by issuing endless bailouts and promoting the “Fed Put” we just continue in a foolish loop of QE. If we don’t take control of the situation, the law of diminishing returns and the invisible hand will come and help us along the way. We’ve now hit a record of credit card defaults, and based on the 90 day delinquency rates- it won’t be changing anytime soon.

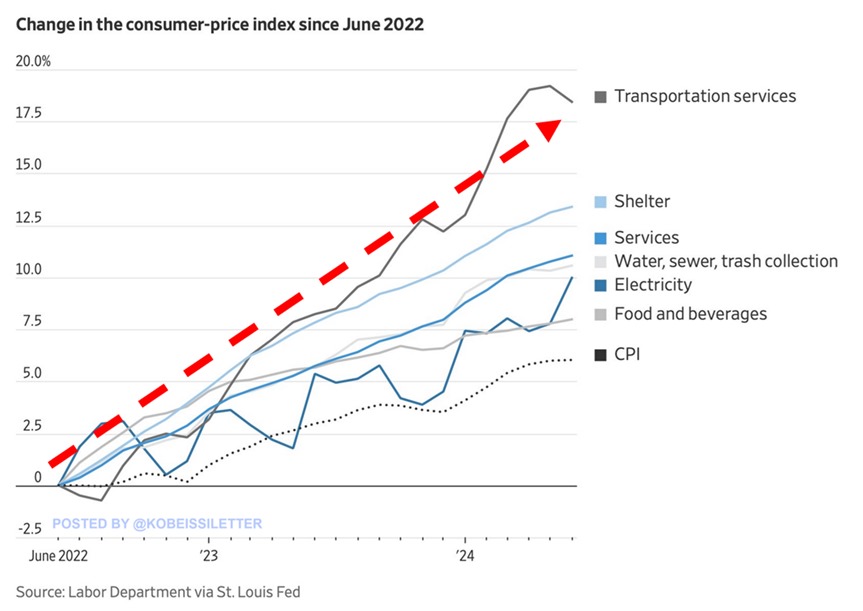

You might think- well if the consumer is struggling we should clearly cut rates and try to stimulate the economy? This is a narrative that misses the key construct of inflation, which is frivolous fiscal spending and printing. The CPI is still seeing more pressure to the upside, and the way to help purge the system is through elevated rates. We need the market to get away from an endless loop of ZIRP because it ends in poor deployment of capital.

How unaffordable has the US become?

- While US CPI inflation has risen by ~6.0% over the last 2 years, inflation in many necessities has been much higher.

- Transportation services prices have skyrocketed by 18.5% since June 2022.

- Shelter and services inflation have risen 13.5% and 11.0%, respectively, over the same period.

- Water, sewer, trash collection, and electricity prices have spiked by ~10%. Even food and beverages have seen an 8% increase since June 2022.

Affordability is still getting worse.

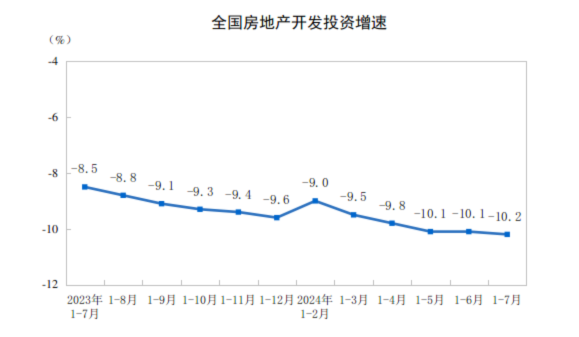

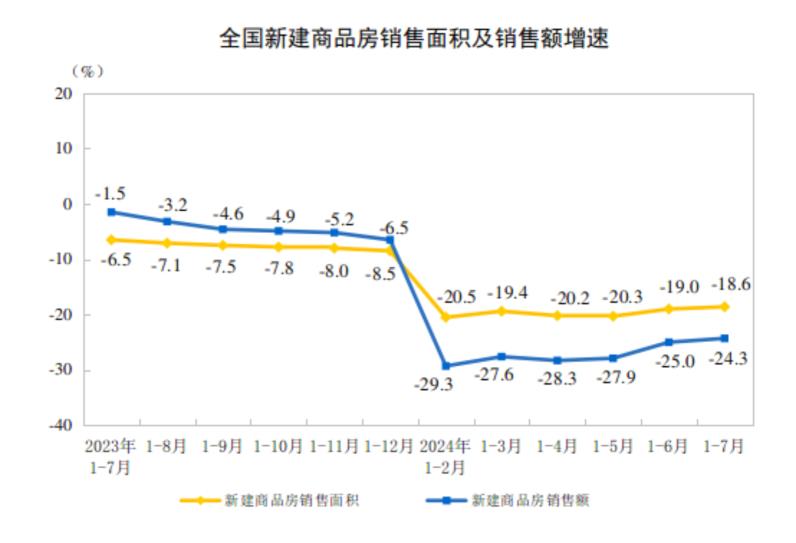

China isn’t in a better situation as economic data continues to miss all levels of expectations. The below information from Trivium outlines exactly what we’ve been discussing. The issues are permeating into all aspects of the government- even the ones that have been strong and received the most direct stimulus or support.

| The July econ data out of China hinted at a slowdown in two of the brightest spots of the economy: Industrial activity and business investment. Per data released by the stats bureau (NBS) on Thursday: Industrial value-added (IVA) grew by 5.1% y/y in July, down from 5.3% the previous month Fixed asset investment (FAI) grew by 1.9% y/y, down from 3.6% in June Retail sales of goods grew by 2.7% y/y, up from 2.0% in June Retail sales of services grew by ~5.4% y/y, down from 5.9% the previous month In a nutshell: This is a bad print. Household consumption remains subdued, while the drop in IVA and FAI growth suggests other parts of the economy may also be beginning to slow. Moreover, the property sector was still the biggest drag on the economy. Floor space under construction fell 21.7% y/y in July. The value of home sales fell 17.5% y/y. The sector is unlikely to see any near-term rebound in construction activity. New starts fell 19.7% y/y in July. What’s more, a collapse in real estate investment was the main drag on FAI. Real estate investment fell 10.8% y/y, worse than June’s 10.1% drop. Excluding real estate, we estimate FAI grew by 5.1% y/y. Still a bummer: Although this is an improvement on the headline figure, it is still the slowest growth rate this year, by a long shot. |

| Get smart: Industrial activity and business investment have been the main economic growth drivers so far this year. Last month’s slowdown in both metrics will concern policymakers. |

China’s RealEstate development investment fell 10.2% y/y in Jan – Jul, widening slightly Jan – Jun period.

New property sales, in floor area, slid 18.6% y/y, with new residential property sales down 21.1%.

This just highlights the plethora of issues impacting the market as the two largest economies weaken due to structural problems. We don’t see this pivoting in any meaningful way as problems persist in both economies.

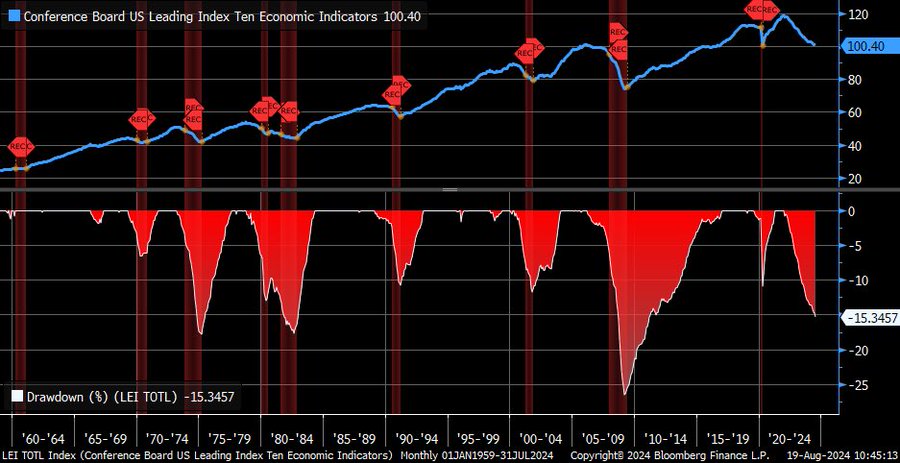

I can’t stress enough how stimulus isn’t the answer given the law of diminishing returns coming full circle. The U.S. is showing more pressure when using the Leading Economic Indicator which now sits at -15.3%, which is on its way to take out the drawdowns during the 1970’s and 1980’s.

Those two periods saw some of the worst inflation and wage price spirals, and if we cut too soon (which is likely) we will experience something very similar. We need to see a normalized yield curve to help curb spending and to usher in some deflation across the pricing structures.

When we turn to the political arena, I agree with Trivium’s summary saying that neither candidate will be a good thing for U.S.-China relations.

A leading Chinese foreign policy voice sees little upside to either US presidential candidate.

Earlier this month, one of China’s leading experts on US-China relations, Wang Jisi, published an article in Foreign Affairs on how China views the US presidential election.

- Wang is President of Peking University’s Institute of International and Strategic Studies.

In the article, Wang argues that while Trump and Harris are two very different candidates, Beijing doesn’t have a preference as both would be bad news for China (Foreign Affairs):

- “The likelihood that the next U.S. administration will view China’s development positively is low.”

- “[Chinese strategists] assume that whoever is elected in November 2024 will continue to prioritize strategic competition and even containment in Washington’s approach to Beijing.”

- “Beijing is preparing itself for the outcome of the U.S. elections with great caution and limited hope.”

Called it: We argued as much in a blog post on a potential Biden-Trump face-off back in May.

Get smart: No matter who wins the White House, China is buckling down for extended strategic competition with the US.

- That means strict adherence to China’s oft-stated foreign policy goals of supply chain security, global governance reform, and Global South solidarity.

There is a likelihood that some middle ground can be found as we need buyers of U.S. TSYs, while China needs support for their exports. There is a way to parlay something into a long term agreement, but I’m not hopeful anything actually comes to pass.

Instead, I expect both sides to roll out tighter restrictions with each country going back and forth. Here’s the most recent from each side:

China is tightening the screws on critical mineral exports.

On Thursday, the Ministry of Commerce (MofCom) issued export controls on antimony-based materials and related refinery technologies.

- The controls, which require exporters to get MofCom approval before selling the above things abroad, will go into effect on September 15.

ICYDK: Antimony is essential to a wide range of industries, including automotives, semiconductors, and military equipment.

- China is the world’s biggest producer of antimony, with about 48% of global mine production (Caixin).

Beijing’s motivation for the controls is unclear.

- These actions might be aimed at preparing for potential retaliation against future Western sanctions and tariffs, preserving domestic reserves, or both.

Get smart: Last year, MofCom placed export controls on graphite, germanium, and gallium – which are also critical to various industrial sectors.

- There’s little chance antimony will be the final critical mineral to get the export-control treatment.

Get smarter: The effectiveness of critical mineral export controls as a targeted retaliation tool is uncertain.

- Similar to Washington’s challenges in preventing chip smuggling, Beijing will find it hard to stop third countries from acting as intermediaries for a targeted country unless it completely shuts down critical minerals exports for everyone.

The US hasn’t been shy about floating new measures targeting Chinese companies, financial institutions, and even entire industries.

Here are some of the latest measures the US has proposed:

- In June, three well-placed Biden administration sources said that the US is preparing to roll out sanctions and export restrictions against Chinese banks and companies for supporting Russia’s war in Ukraine.

- Last month, US Speaker of the House Mike Johnson announced he’d push even more China-targeted legislation forward before the US election. This would likely include a new package of sanctions and efforts to restrict US investment in China.

- On August 4, insider sources claimed that the US Commerce Department is expected to propose a ban on both Chinese software in autonomous driving vehicles and the testing of Chinese-produced autonomous vehicles on American roads.

- On August 8, US lawmakers introduced a bill to tighten restrictions on imported goods that benefit from de minimis exemptions, meaning tax exemptions on small-volume imports under USD 800.

The US Department of Commerce could initiate sanctions on banks and ban autonomous driving software without congressional approval, meaning these measures could be imminent.

- The other measures must be reviewed by Congress once it reconvenes on September 9.

What to watch: If implemented, these measures would lead US-China competition into dangerous new waters and accelerate the decoupling of vast swaths of the global economy.

- That would mean increased risks and compliance headaches for MNCs across the board, particularly in sensitive industries like tech and finance.

What else to watch: Whether China abandons its policy of strategic non-retaliation as the US expands its pressure campaign.

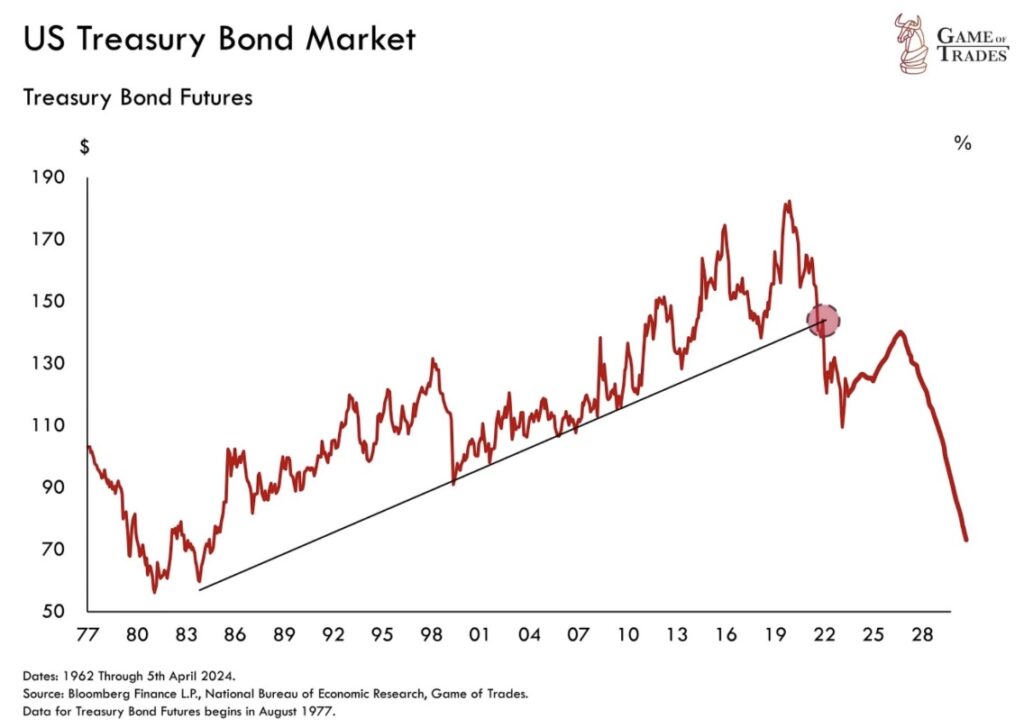

The biggest thing to watch at this point is the U.S. Treasury Bond market. We’ve been in a bond bull market since the late 70’s/early 80’s, and we are now seeing that come to an end. I’ve said countless times that it didn’t have to end this way, but we increasingly became selfish when it came to low rates, liquidity, and free money. This has led to a grossly oversaturated market that’s choking on liquidity and trillions of dollars in U.S. TSYs.

If the Fed cuts rates, it will have a very temporary effect as volume is the biggest issue as the Fed pushes the string on the yen carry trade. We are in for a bumpy ride!