Primary Vision Network is consistently trying to update our readers with most important developments in the markets. We saw that NASDAQ took a plunge by 3% and DJIA dropped 626 points. Similarly, much is happening in the oil markets as Non-OPEC production continues to increase while OPEC+ is facing difficulties to maintain price stability. This update talks about all these things.

1. Monday Macro View: What’s happening with Oil Markets? – PREMIUM

The global oil markets have been anything but predictable lately, and recent developments in Asia’s crude oil imports reflect the complex dynamics at play. After hitting a two-year low in July, Asia’s crude oil imports rebounded in August, rising to 26.74 million barrels per day (bpd) from July’s 24.56 million bpd. On the supply side, Saudi Arabia, the world’s largest oil exporter, saw its exports to Asia recover in August, with shipments rising to 4.89 million bpd from 4.60 million bpd in July. Read more to find out!

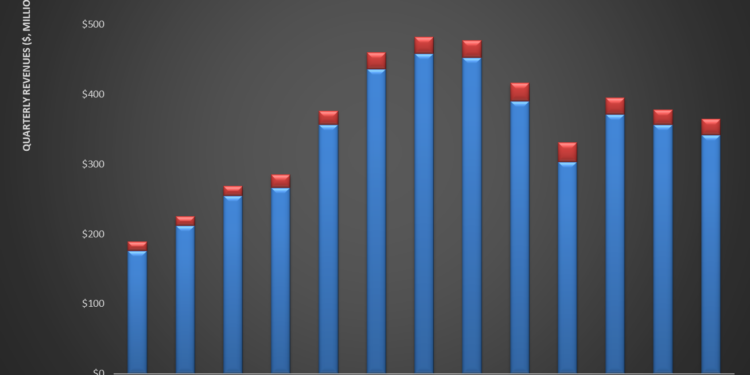

2. RPC’s Perspectives in Q2: Key Takeaways – PREMIUM

RES’s management observes a shift in completion activity from natural gas-heavy basins to oil-centric basins. Many oilfield services and equipment providers prefer to offer large equipment. RES will invest in Tier 4 DGB equipment due to customer preference for dual fuel frac spreads. RES believes that over time, it can acquire the necessary e-frac assets and capabilities. It also plans to invest in non-pressure pumping service lines such as coiled tubing, downhole tools…. and much more! Read Avik’s latest on the fracking industry.

3. Primary Vision Insights – ENTERPRISE

The crude markets have been struggling to break higher with brent moving back to the bottom of our range $77-$83. There is a growing concern about slowing demand, which has overwhelmed some of the bullish narratives that have hit the market. We’ve been adamant about the issues facing demand, but the market has been slow to accept a struggling global market. Some of the bullish setups that have yet to happen. Mark Rossano further adds: If the Fed cuts rates, it will have a very temporary effect as volume is the biggest issue as the Fed pushes the string on the yen carry trade. We are in for a bumpy ride! READ THIS INSIGHT to learn more!

4. MST: Fault lines appear in the global economy – PREMIUM

China’s economic landscape remains fraught with challenges, as factory activity is set to contract for the fourth consecutive month in August. Weak demand and sluggish recovery dominate the narrative, despite growth in high-tech manufacturing sectors like integrated circuits (9% y/y), 3D printing (3% y/y), and new energy vehicles (8% y/y). The U.S. economy grew at a 3% annual rate in the second quarter, slightly revised from the earlier 2.8% figure. However, the Chicago Business Barometer rose only marginally to 46.1 in August from 45.3 in July, remaining below the 50-point mark for the ninth consecutive month, indicating persistent contraction in the manufacturing sector.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co