Outlook And Strategy

We have already discussed Baker Hughes’s (BKR) Q2 2024 financial performance in our recent article. Here is an outline of its strategies and outlook. After Q2, Baker Hughes’s outlook on North America became more bearish than its previous outlook. Lower-than-expected drilling activity in the US in 1H 2024 restrained North American spending, and the expected North American softness in 2H 2024 can cause a slowdown. So, the company revised its forecast in North America from a “low to mid-single-digit range” decline to “mid-single-digits.” The Gulf of Mexico, on the other hand, can outperform in 2H 2024 because of higher production and BKR’s favorable product mix.

In international markets, BKR expects “high single-digit growth” in FY2024 compared to FY2023. This projection assumes the potential timing differences between transitioning rigs from oil to gas in Saudi Arabia. After 2024, BKR expects Latin America and West Africa offshore markets and the Middle East to drive the upstream growth. However, the growth rate can decelerate. It will seek to service customers that optimize production from existing assets, providing growth opportunities for mature asset solutions.

Order Bookings And Forecast

After 1H 2024, BKR is on course to achieve the guidance booking of $11.5 billion to $13.5 billion. Also, the booking orders are diversified, including CTS (Climate Technology Solutions) orders related to carbon capture and hydrogen-related projects of $392 million in Q2. Year-to-date, its new energy orders amounted to $684 million. On top of strong backlog conversion, the management expects the IET segment to benefit from productivity enhancements and process improvements in Q3.

It also expects the segment EBITDA to amount to approximately $525 million in Q3. Backlog conversion in Gas Tech Equipment, execution in Industrial Tech and Climate Tech Solutions, and the impact of aero-derivative supply chain tightness can affect the segment results in Q3.

In the OFSE segment, BKR expects international revenues to grow while its North American activity can remain flat. It expects EBITDA of $760 million (at the guidance midpoint) in this segment. This means the company expects EBITDA to increase by 13% and 7% in the IET and OFSE segments, respectively, quarter-over-quarter.

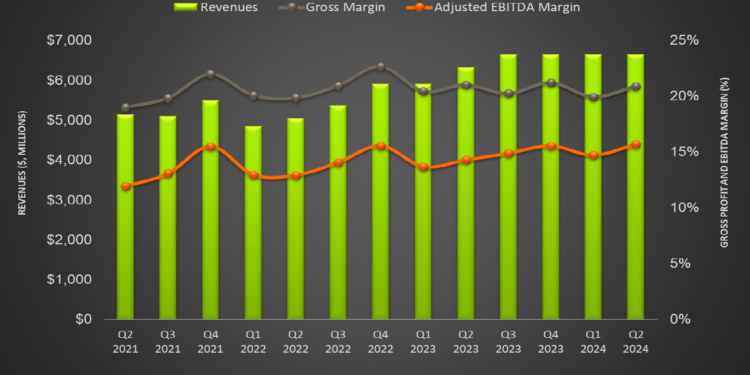

Q2 Financial Results

In the Industrial & Energy Technology segment, revenues increased by 19% quarter-over-quarter, while operating profit went up by 34%. In the Oilfield Services & Equipment segment, order booking inflated (12% up) in Q2. Among the significant orders in recent times, it secured a major Gas Tech and Climate Tech Solutions contract in Asia Pacific that will enhance gas operations and power CO2 capture at a customer’s LNG facility. It has a strategic collaboration with Air Products and received a contract there for CO2 and hydrogen compressors.

In July, BKR signed a long-term agreement for Wabash Valley Resources’ ammonia and carbon sequestration plant in Indiana. Offshore Brazil, it received another significant Petrobras award for workover and plug and abandonment services.

BKR’s cash flow from operations decreased by 14% in 1H 2024 compared to a year ago. Its FCF decreased by 31% during this period. Debt-to-equity (0.39x) improved slightly compared to December 31, 2023.

Relative Valuation

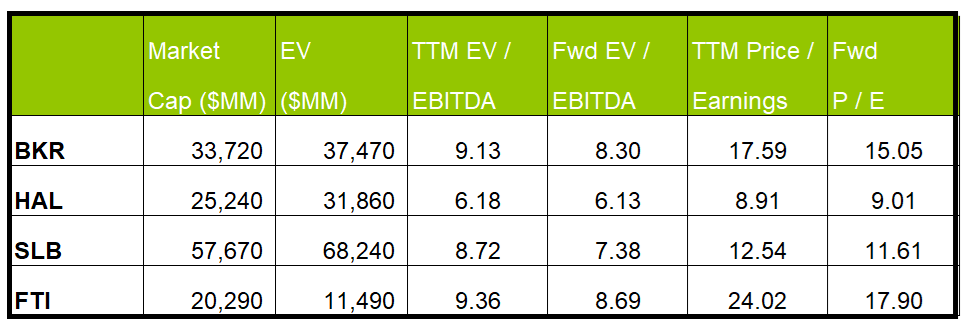

Baker Hughes is currently trading at an EV/EBITDA multiple of 9.1x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 8.3x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 10.2x.

BKR’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is slightly steeper than peers because the company’s EBITDA is expected to increase more sharply than its peers in the next four quarters. This typically results in a higher EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is higher than its peers’ (HAL, SLB, and FTI) average. So, the stock is reasonably valued compared to its peers.

Final Commentary

In the medium term, BKR expects Latin America and West Africa offshore markets and the Middle East to drive growth. It also sees energy operators optimizing production from existing assets, which will provide growth opportunities for mature asset solutions. It back increased in Q2. It won various clean energy projects in recent times. The management anticipates growth from non-LNG operations, including backlog conversion in Gas Tech Equipment and execution in Climate Tech Solutions, to become significant growth drivers in the long term.

However, North America can shave off its growth potential due primarily to lower-than-expected drilling activity in the US. Also, the company’s cash flows deteriorated in 1H 2024. The stock appears to be reasonably valued versus its peers.