Trillions were wiped from the stock markets as the US Job report dissappointed coming in at 142,000. U.S. manufacturing sector is in contraction for more than 7 months with new orders even further down. Distillate and diesel consumption is also on the lower end, further signalling issues with economic activity. What does this all mean? Will there be more pain ahead? Or was this the correction and now things will start to improve? This update helps to answer these questions.

1. Monday Macro View: Bloodbath and Oil Price Plunge – PREMIUM

The global markets have experienced a significant downturn this week, marked by steep declines in both equity and oil markets, driven by concerns over slowing economic growth and weaker-than-expected jobs data. It was a tough week for Wall Street, with the Nasdaq dropping 2.6% on the day and 5.8% for the week—its worst performance since January 2022. What comes next?

2. Baker Hughes’ Perspectives in Q2: Key Takeaways – PREMIUM

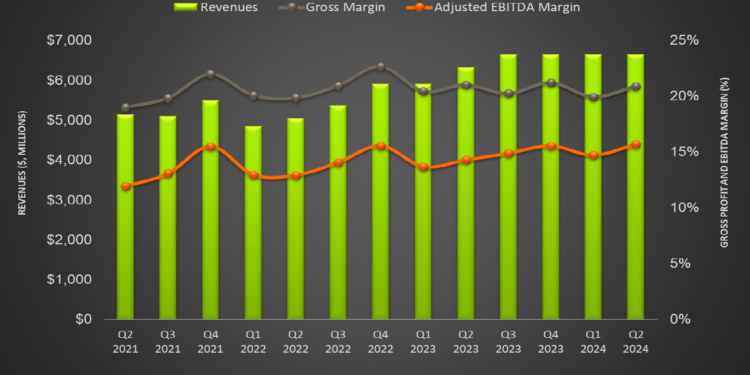

After Q2, Baker Hughes’s outlook on North America became more bearish than its previous outlook. Lower-than-expected drilling activity in the US in 1H 2024 restrained North American spending, and the expected North American softness in 2H 2024 can cause a slowdown. Read Avik’s detailed article on Baker Hughes’ financial performance and what is the company planning ahead.

3. Primary Vision Insights – ENTERPRISE

Our senior analyst, Mark Rossano, brilliantly covers the global oil and economic markets in this latest update. It is a must read for anyone trying to grasp what is happening and more importantly what will happen moving forward especially in regards to the Fed’s interest rate cuts and overall health of the U.S. economy. Mark says in the article that “it looks as though we are heading directly into a situation of additional economic pressure around the world”. That’s something concerning.

4. MST: US Economy Falters, China provides a glimmer of hope while Eurozone stagnates – PREMIUM

MST reveals important insights that require more than a surface-level view. China’s sharp export rise of 8.7%—its fastest in 17 months—might appear encouraging, but when paired with a mere 0.5% import increase, it signals a critical issue: domestic demand is sputtering. In the U.S., the unexpectedly strong Q2 growth rate of 2.8% provides some relief, but a deeper dive into labor market data (142,000 jobs added vs. 175,000 expected) exposes cracks in the recovery.Europe’s troubles are structural. Read the full article to find out more.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co