Industry Forecast for Q4 and 2025: LBRT expects a “low double-digit” percentage reduction in Q4 activity in North America – a steeper-than-typical fall. Increasing uncertainty in the energy market can restrain operators from committing to completion activity. E&P operators, therefore, concentrate on efficiency gains through g consolidation, longer laterals, and high-graded acreage. The situation can improve in 2025. In 2024, frackers will focus on completion efficiencies and increased frac intensity with higher pump rates.

In 2025, the frac efficiency growth can decelerate. However, the low year-end frac activity and pressuring pumping prices can create a gap compared to the anticipated rise in demand and supply of horsepower in 2025. So, more investment in pressure pumping would be required in 2025.

Key Developments in Q3: Liberty Energy developed a partnership in a natural gas-rich Beetaloo Basin in Australia. During Q3, the Liberty Advanced Equipment Technologies division delivered the first digiPrime pumps. Also, Liberty Power Innovation (LPI) expanded its operations in the DJ Basin. Following its expertise in constructing and managing power plants for frac fleets, LPI sees rising demand for power in commercial and industrial applications. You can also read more about LBRT’s fracking activities in our report here.

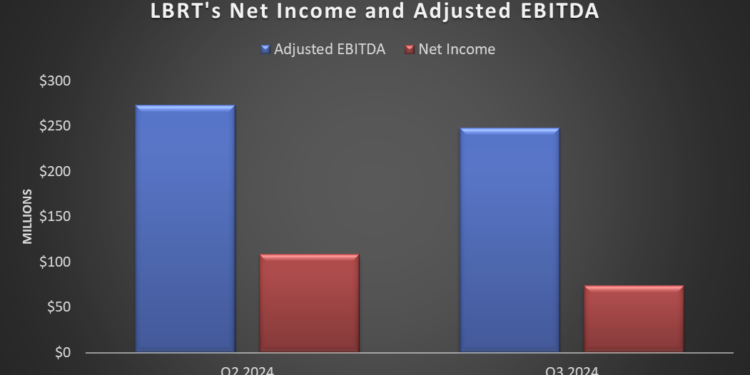

Fundamental Metrics Show Weakness: LBRT’s revenues increased by 2% quarter-over-quarter in Q3, while its adjusted EBITDA declined by 9%. The company’s EBITDA growth rate has been choppy over the past few quarters. Pumping efficiencies improved significantly in Q3, leading to modest topline growth, although a slowing demand environment demonstrated by frac fleet attrition, equipment cannibalization, and idling of fleets led to lower operating income. The company’s debt-to-equity, however, decreased to 0.06x as of September 30, 2024. During Q3, it repurchased 1.2% of its outstanding shares and has repurchased and retired 14.3% of its shares since July 2022.

Thanks for reading the LBRT Take Three, designed to give you three critical takeaways from LBRT’s earnings report. Soon, we will present a second update on LBRT’s earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-