The Drilling And Challenges

We discussed our initial thoughts about Patterson-UTI Energy’s (PTEN) Q3 2024 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. Based on the current contracts, PTEN’s management expects Tier 1 high-spec drilling rig count to remain steady in Q4 and 2025. Demand for lower-spec rigs from small E&P customers will likely decline in the drilling industry. PTEN’s management sees a headwind regarding completion activity due to customers’ capex cut, although frack activity will likely recover in 2025.

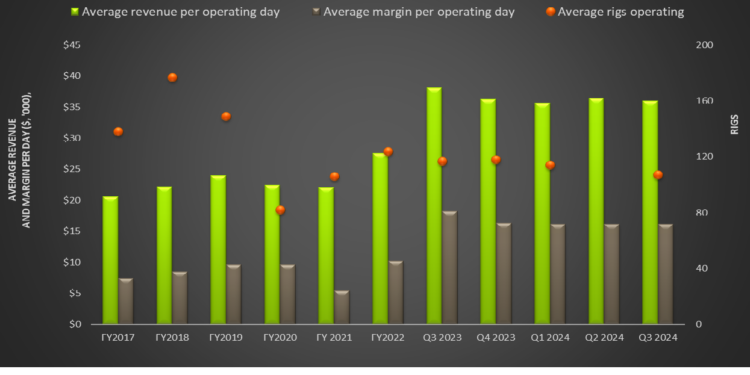

Regarding the energy market environment, the management is optimistic about a natural gas price recovery in 2025 as domestic demand rises and LNG takeaway begins to come online. The crude oil market appears relatively weak, although activity can recover next year. So, PTEN will maintain its 105 drilling rig count steady in Q4. It also expects an adjusted gross profit per operating day of $15,000 in Q4, or lower by 7% compared to Q3. The lower margin reflects a relatively weak contract book as it adjusts to the current market rate. In Drilling Services, the company’s adjusted gross profit can decrease in Q4, too.

PTEN has chosen not to pursue rigs that have become uncompetitive in an oversupplied market. So, it retired 42 rigs idle for more than three years and is retiring and decommissioning ~400,000 HHP of Tier-2 diesel frac equipment. It will reduce its pressure pumps by about 10% to 3 million HHP by 2024. After the NexTier merger, PTEN recorded $885 million in goodwill impairment charges. In Q3, the company identified 42 legacy non-Tier one rigs and equipment to be retired following the evaluation of its fleet of drilling rigs for marketability based on the condition of inactive rigs. Its management believes “these rigs have limited commercial opportunity and are unlikely to ever return to work with our significant capital investment.”

Frac Market Outlook

In Q4, LBRT expects lower pumping hours compared to Q3 in the completion business due to customers’ budget constraints and seasonality. In the Completion Services segment, adjusted gross profit can increase in 1H 2025 compared to 2H 2024. However, the company’s outlook on e-frac operations is much brighter as it expects to deliver higher-than-average returns than the legacy completion business. The share of electric frac equipment generated pumping hours will likely increase in Q4. It now expects electric horsepower to rise to 155,000 HHP. It will also continue to upgrade its fleet following the merger of NexTier and Patterson-UTI. According to the company’s estimates, 50% of its entire fleet of horsepower is powered by natural gas. Over the past year, it invested significantly in technology growth while maintaining financial discipline to enhance shareholder value.

In The Drilling Products segment, LBRT expects revenue and adjusted gross profit to increase in Q4 due to international business growth. PTEN has recently signed a joint venture agreement (Turnwell Industries) with ADNOC Drilling and SLB subsidiaries in the UAE. Turnwell has received a contract to drill and complete 144 unconventional wells for ADNOC.

Financials and Balance Sheet

Quarter-over-quarter, PTEN’s revenues in the Drilling Services segment decreased by 4% in Q3 2024. Revenues from the Completion Services segment increased by 3%, while Revenues from the Drilling Products segment increased by 5%. PTEN’s FCF increased by 1.25x in 9M 2024. The company plans to return at least $400 million to shareholders in 2024 through dividends and share repurchases. PTEN’s liquidity was $730 million as of September 30, 2024 (excluding working capital). Its debt-to-equity was 0.34x as of that date.

Relative Valuation

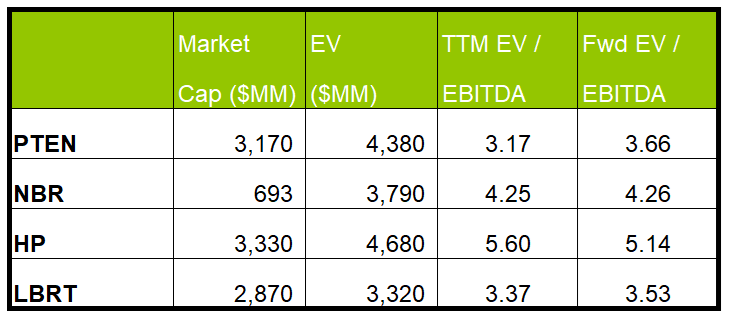

PTEN is currently trading at an EV/EBITDA multiple of 3.2x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.7x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 8.5x.

PTEN’s forward EV/EBITDA multiple is expected to expand versus the current EV/EBITDA. This contrasts the fall in the multiple for its peers because the company’s EBITDA is expected to decrease compared to a rise in EBITDA for its peers in the next year. This typically results in a much lower EV/EBITDA multiple. The stock’s EV/EBITDA multiple is lower than its peers’ (NBR, HP, and LBRT) average. So, the stock is reasonably valued, with a negative bias, versus its peers.

Final Commentary

PTEN expects lower-spec rigs from small E&P customers to decline due to customers’ capex cuts. It will not pursue rigs that have become uncompetitive in an oversupplied market. So, it retired 42 rigs in Q3 and retired and decommissioned ~400,000 HHP of Tier-2 diesel frac equipment. After the NexTier merger, PTEN recorded $885 million in goodwill impairment charges related to the inactive rigs. It also expects pumping hours to decline compared to Q3 due to customers’ budget constraints and seasonality.

However, the management sees a few brighter spots on the horizon. It expects the Tier 1 high-spec drilling rig count to remain steady in Q4 and 2025. The management is also optimistic about a natural gas price recovery in 2025. Its outlook on e-frac operations is optimistic as it expects to deliver higher-than-average returns compared to the legacy completion business. PTEN’s FCF increased by 1.25x in 9M 2024. The company plans to return at least $400 million to shareholders in 2024 through dividends and share repurchases. The stock is reasonably valued, with a negative bias, versus its peers.

Premium/Monthly

————————————————————————————————————-