Industry Outlook And NOV’s Strategies

We discussed our initial thoughts about NOV’s (NOV) Q3 2024 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook. In the near term, NOV’s management will be bearish about the energy market because of the slowdown in Chinese oil demand and excess OPEC capacity. These factors can affect upstream capex, which, in turn, can adversely impact oilfield services companies. Higher uncontracted time for the drilling customers can affect their capex in 2025. During Q3, the planned upgrade of two offshore rigs was delayed. Investments, however, can shift to more advanced rigs. One of NOV’s customers recently booked two hook load upgrades to convert sixth-generation drillships to 7th generation.

However, a sharp rise in AI-driven electricity demand and economic growth recovery will lead to higher energy demand in the medium-to-long term. The management also expects deepwater and emerging unconventional shale basins in international markets to become more profitable. Drilling activity can recover in 2026 and beyond as the FPSO supply chain improves. NOV anticipates a deceleration in demand for offshore drilling equipment and aftermarket spares and support for offshore drilling rigs in early 2025. By late 2025, demand for these operations can recover.

US vis-à-vis International

In the US, NOV does not expect activity to improve materially in 2025. Upstream consolidation, efficiency gains, capital discipline, and crude oil price uncertainty cap the OFS companies’ outlook in this region. Internationally, many markets are deploying fracking techniques in unconventional shales, including Argentina, Saudi Arabia, and the United Arab Emirates. In these markets, the rigs will require conversion (drilling rig fleet converted to fit-for-purpose AC rigs with high setbacks and high-pressure mud systems). These will also need specialized tools for hydraulic fracturing and coiled tubing for plug drill-outs. NOV’s downhole bits, drilling motors, friction reduction tools, vibration mitigation tools, and higher torque capacity drill pipe can see increased demand in such operations.

Backlog

NOV’s book-to-bill ratio declined to 1.1x in Q3 from 1.29x in 1H 2024. Despite that, it recorded strong orders in the Energy Equipment segment, with a total booking of $627 million. However, the backlog for flexible pipe for deepwater developments declined in Q3.

One of NOV’s key projects in Q3 was Kaskida’s high-pressure reservoir development in the Gulf of Mexico. Other projects include offshore Suriname and additional gas facilities in the Middle East. FIDs and project sanctioning have recovered since COVID-19. It is estimated that offshore producers have increased their FIDs to ~$100 billion yearly since COVID-19.

Acquisition Strategy And Challenges

NOV is focusing on acquiring small technology-oriented companies. In early October, it acquired Fortress Downhole Tools, which has developed setting tool technology that reduces downtime and uses less waste than conventional field tools. The acquisitions complement NOV’s completion tools portfolio. In digital, NOV’s cloud digital capabilities, enabled by the MAX platform, will drive efficiency. Through these strategies, it aims to develop a capital framework to return at least 50% of excess free cash flow.

NOV faces some near-term challenges also. In Q3, it did not book a wind turbine installation vessel order. Due to delayed project FIDs and uncertainty regarding the size of turbines, it does not expect a near-term order. However, based on the current expectations on the timing of offshore wind development FIDs, it expects opportunities to emerge in 2026 and 2027.

Q3 Financial Results

In Q3 2024, the Energy Equipment segment witnessed 2% year-over-year revenue growth, while the Energy Products and Services segment revenue decreased by 3%. The Energy Equipment segment saw operating income rise significantly (32% up) from Q3 2023 to Q3 2024. On the other hand, operating profit in the Energy Products and Services segment decreased by 21%.

NOV’s cash flow from operations turned significantly positive in 9M 2024, following a negative cash flow a year earlier. It returned $109 million to its shareholders in Q3 through repurchases and dividends. It has a net debt leverage ratio below one and a gross debt leverage ratio well below two.

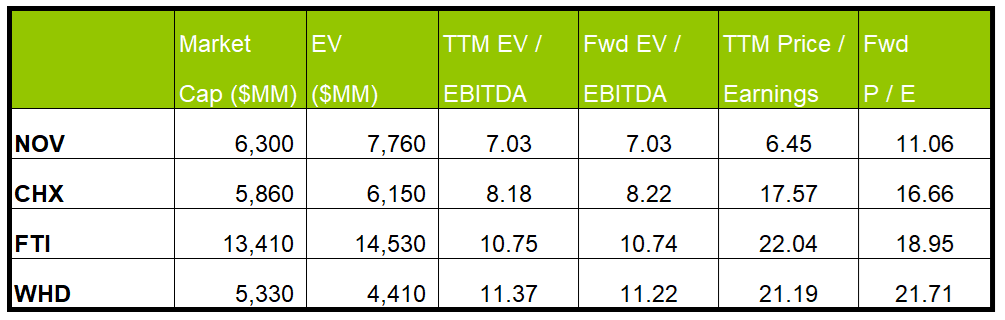

Relative Valuation

NOV is currently trading at an EV/EBITDA multiple of 7.0x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is nearly the same. The current multiple is lower than its past five-year average EV/EBITDA multiple of 25.9x.

NOV’s forward EV/EBITDA multiple change versus the current EV/EBITDA nearly equals its peers because its EBITDA, as well as its peers’ EBITDA, on average, are expected to remain unchanged in the next year. This typically results in a similar EV/EBITDA compared to its peers. The stock’s EV/EBITDA multiple is lower than its peers’ (CHX, FTI, and WHD) average. So, the stock is undervalued versus its peers.

Final Commentary

NOV’s management has a divergent view of the energy market environment for the near term and long term. Some economic and industry drivers do not favor a recovery by 2025. The out is particularly challenging in the US, given the upstream companies’ shakiness in new capital commitment. Delayed project FIDs and uncertainty regarding offshore wind turbine installation also adversely affected its performance in Q3. Internationally, however, NOV sees various onshore and offshore opportunities that can mitigate the lack of US growth. There is a higher demand for specialized tools for hydraulic fracturing and coiled tubing for plug drill-outs. Offshore wind development opportunities will emerge in 2026 and 2027.

NOV’s cash flow from operations turned significantly positive in 9M 2024. net debt leverage ratio below one and gross debt leverage ratio well below two indicates its balance sheet strength. The stock is relatively undervalued compared to its peers.

Premium/Monthly

————————————————————————————————————-