Key Drivers And Strategies

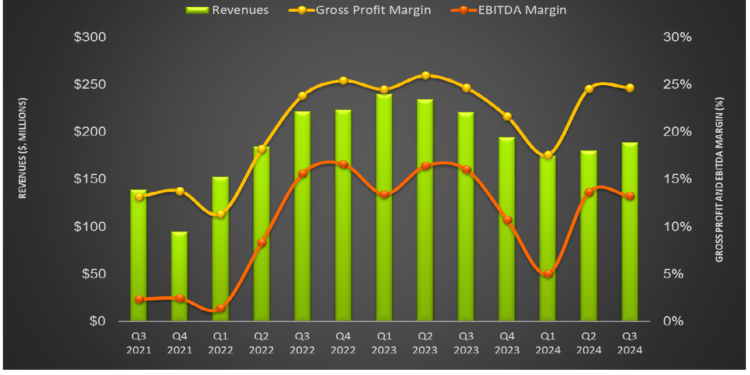

Our short article discussed our initial thoughts about KLX Energy Services’ (KLXE) Q3 2024 performance a few days ago. In 2H 2024, budget exhaustion and seasonality will affect oilfield service companies more severely than previously anticipated, due partly to energy companies’ efficiency gains. We have discussed this in several of our articles in the past couple of weeks. The typical headwinds, exacerbated by Thanksgiving break and the late December slowdown, can push down KLXE’s Q4 revenues by 10%-14% compared to Q3. Its Q4 adjusted EBITDA margin range can contract to 9%-13% compared to 14.7% in Q3 2024.

In 2025, KLXE’s management sees a little more upside because efficiency gains will likely plateau, and production will unlikely increase without activity gains. Natural gas supply can increase sharply due to LNG export and data center-driven demand. The company has engaged with new and existing customers on 2025 plans, which can lead to incrementally positive commercial momentum for 2025. The company can also witness steadily expanding margins and free cash flow generation in 2025. However, adverse events like geopolitical tensions, commodity price volatility, and shifts in customer spending patterns can mitigate or upend the anticipated results.

The company is particularly optimistic about Q1 2025 results following the late surge in Haynesville and a hint of incremental drilling completion demand from oil-directed activity. So, it is expected that FY2025 revenues will increase by 5%-10%. EBITDA margin can be ‘normalized” in FY2025. The 2025 growth maintenance capex is estimated to be in the $40 million-$50 million range.

A Discussion On Q3 Performance

Quarter-over-quarter, KLXE’s revenues in the Rocky Mountains increased by 11% in Q3, while its operating income decreased by 8%. Northeast/Mid-Con saw a moderate 7% revenue rise, while its operating income turned to a modest profit in Q3. KLXE’s adjusted EBITDA margin (company-wide) was resilient (down by 30 basis points) from Q2 to Q3.

Cash flow from operations declined, and free cash flow turned negative in 9M 2024 compared to a year ago. Nearly 80% of the capex earmarked for FY2024 ($50 million to $55 million) would be spent on maintenance. As shareholders’ equity base was nearly wiped out due to a high accumulated deficit, its debt-to-equity was not meaningful as of September 30, 2024. The company’s liquidity was $126 million in Q3.

Relative Valuation

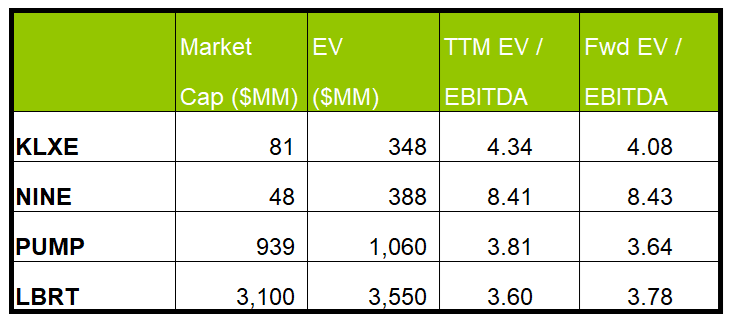

KLXE is currently trading at an EV/EBITDA multiple of 4.3x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is higher (4.1x).

KLXE’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is steeper than its peers’ because its EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a higher EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is lower than its peers’ (NINE, PUMP, and LBRT) average. So, the stock is undervalued compared to its peers.

Final Commentary

KLXE continues to face several challenges in the industry, which can significantly shave off its revenues and EBITDA margin in Q4. In 2025, some order will be restored as the headwinds taper off and natural gas prices recover. The company will have increased its customer base during the year, which can expand its margin and generate free cash flow. The recent surge in Haynesville activity and incremental drilling completion demand from oil-directed activity can be promising in Q1 2025.

However, free cash flow turned in 9M2024, which, along with a large accumulated deficit, can spell trouble for KLXE’s balance sheet. Although it has a sizeable liquidity balance, nearly nil shareholders’ equity will carry significant risks. The stock is relatively undervalued compared to its peers.

Premium/Monthly

————————————————————————————————————-