The Market Outlook

We have already discussed SLB’s (SLB) Q4 2024 financial performance in our recent article. Here is an outline of the macro energy environment and the company’s strategies in a changing scenario. Energy operators will likely adopt a cautious approach regarding energy activity and discretionary spending. Nonetheless, SLB anticipates a better balance in oil demand and supply as energy security and rising energy demand from AI and data centers will keep energy investment steady.

In the international market, we can see a clear divergence in investment. While the United Arab Emirates, Kuwait, Iraq, China, India, Argentina, and Brazil can see increased investments, Saudi Arabia, Egypt, Australia, Mexico and Guyana can see a drop. Europe and Africa, too, can witness dissimilar movements. In North America, activity will likely fall following a slow recovery in natural gas activity. However, higher drilling efficiency and increasing revenues from data center infrastructure solutions will positively impact SLB’s North America prospect. The company also expects the LNG capacity expansion issues to be resolved.

Offshore and No-Core Outlook – 2025

In offshore, activities can remain muted in 2025 as utilization deteriorates in the North Sea, Australia, and Angola, Central and East Africa. However, several FIDs ramping up in 2026 across various deepwater basins can put its deepwater prospect on a recovery. Here is an outlook on the company’s digital sales, which we discussed in our short article. Its Digital & Integration segment can see revenue growth in the “high teens,” backed by increased demand for data and AI solutions.

In emerging activities, SLB has a robust portfolio of carbon capture and sequestration technologies, as well as geothermal and critical minerals. These activities should complement its growing exposure to data center infrastructure. In 2024, the market for such activities amounted to $850 million, which the company’s management expects to grow significantly in 2025.

Core business outlook – 2025

SLB expects revenue to remain nearly unchanged in the core energy business in 2025. While Production Systems and Reservoir Performance sales can see modest growth, the Well Construction segment is due for a decline. In particular, the company is bullish on artificial lift, completions, valves, and midstream production systems. Plus, it expects a rise in intervention and unconventional activity in international markets.

Q4 and FY2025 Outlook

In Q1 2025, SLB expects revenue and adjusted EBITDA to “be at similar levels as last year.” In Q2, however, the company expects activities to rebound. The Digital business can continue to grow with “accretive margins” due to higher demand for data and AI to drive performance and increased efficiency. Its end customer base will diversify further as it adds more privately owned customers. Energy customers’ initiatives to maximize their producing assets will boost SLB’s production and recovery-related sales. The focus on cost optimization, process enhancements, and leveraging digital transformation should support margin expansion in the medium-to-long term.

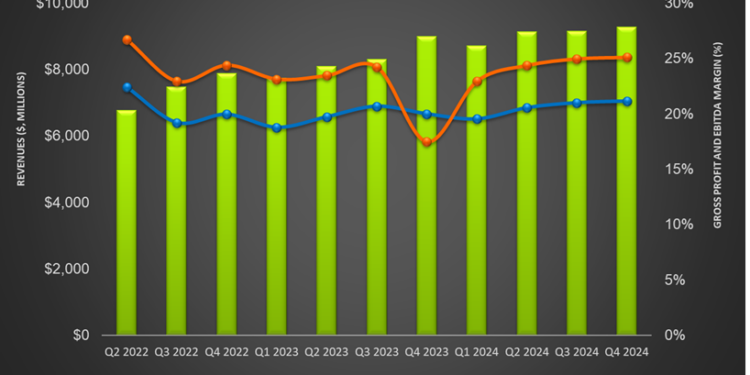

SLB’s Q4 Performance

Our short article discussed SLB’s revenue drivers for the operating divisions and key geographic regions. SLB’s Digital & Integration segment witnessed the sharpest quarter-over-quarter revenue and operating income growth, while the Well Construction segment saw the steepest revenue fall in Q4. SLB’s adjusted EBITDA margin reached 25.7% – 33 basis points higher than a year ago. Earnings per share increased by $0.03 in Q4 compared to Q3, despite $0.10 of impairment and $0.04 charges related to the cost-out program.

SLB’s SLB’s cash flow from operations remained nearly unchanged in FY2024 compared to a year ago. It increased quarterly dividends by 3.6% while accelerating the share repurchase program. During Q4, it repurchased 11.8 million shares for a total purchase price of $501 million. In 2025, it will continue to focus on capital discipline and strong cash flow generation.

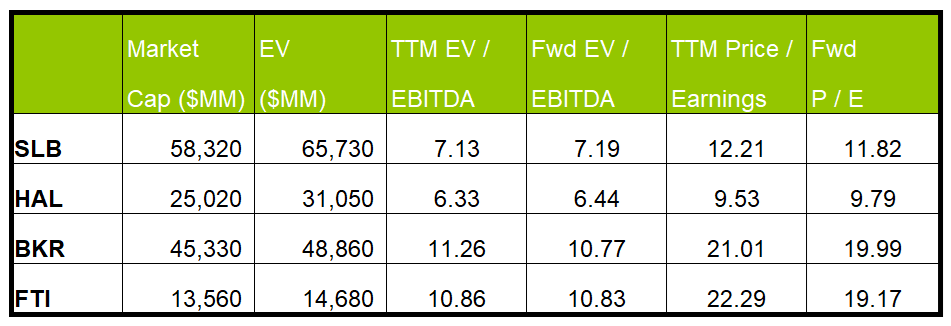

Relative Valuation

SLB is currently trading at an EV/EBITDA multiple of 7.1x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 7.2x. The current multiple falls short of its five-year average EV/EBITDA multiple of 11.7x.

SLB’s forward EV/EBITDA multiple versus the adjusted current EV/EBITDA is expected to expand compared to a fall for its peers because the company’s EBITDA is expected to decrease as opposed to a rise in EBITDA for its peers in the next four quarters. This typically results in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is lower than its peers’ (HAL, BKR, and FTI) average. So, the stock is reasonably valued compared to its peers.

Final Commentary

SLB’s management plans to go through the current landscape, which is bereft with energy operators’ cautious approach and increased investments in some regions worldwide. SLB will continue to benefit from the shift to higher energy demand from AI and data centers. These should positively impact SLB’s North American prospects. SLB will also gain from emerging operations, including carbon capture and sequestration technologies, as well as geothermal and critical minerals. Energy customers’ initiatives to maximize their producing assets will boost SLB’s production and recovery-related sales.

On the other hand, SLB faces challenges in lower well construction activities and offshore utilization in the North Sea, Australia, Angola, and Central and East Africa. In early 2025, the management increased quarterly dividends by 3.6% while accelerating the share repurchase program. It will continue to focus on capital discipline and strong cash flow generation. The stock is reasonably valued compared to its peers.

Premium/Monthly

————————————————————————————————————-