Industry Forecast for Q1 And Beyond: Liberty Energy (LBRT) expects a “modest” increase in revenues and adjusted EBITDA in Q1 2025. However, pricing headwinds can adversely impact profitability. LBRT’s management focuses on technology innovation in completions services and power generation services business. It aims to enhance margin, improve capital efficiency, and lower emissions in the long term.

However, in early 2025, near-term price pressure will likely follow the slowdown of the late 2024 activities. It sees higher frac fleet sizes to meet increased horsepower requirements for higher-intensity fracs. An improved fracking activity can “support better pricing dynamics” in 2025. In the power/electrification business, it plans to meet the fast-growing requirements for power infrastructure solutions with modular solutions, accelerated deployment timelines, and scale.

Key Developments in Q4: Liberty’s Liberty Power Innovations recently collaborated with DC Grid to provide power solutions for electric vehicle hubs and data centers. The rising power demand is due to the proliferation of data centers and industrial electrification. LBRT has deployed 130 MW to complete service applications. It expects to deliver an additional 400 MW of power generation by 2026-end. You can also read more about LBRT’s fracking activities here.

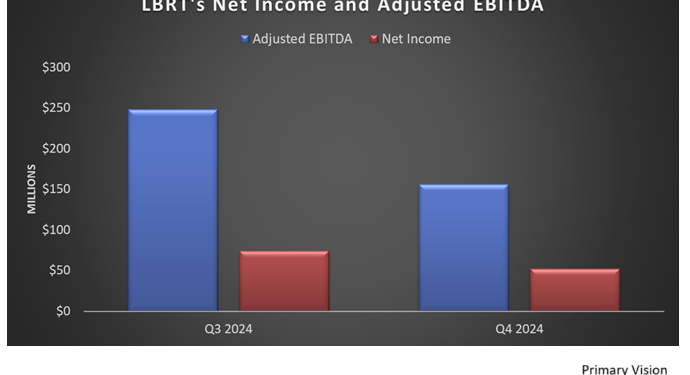

Notable Decline In Company Fundamentals In Q4: LBRT’s revenues decreased by 17% quarter-over-quarter in Q3, while its adjusted EBITDA declined by 37%. The company’s EBITDA movements have been choppy over the past few quarters. The typical year-end production slowdown negatively affected the fracking industry. Although The current uncertainties over geopolitics, Chinese economic growth, OPEC’s production plans challenge oilfield services companies’ prospects, the LNG export capacity expansion and increase in North American power consumption support multi-year natural gas growth.

The company’s debt-to-equity, however, increased to 0.10x as of December 31, 2024. During Q4, it repurchased 1.0% of its outstanding shares and raised its quarterly dividend by 14% to $0.08 per share.

Thanks for reading the LBRT Take Three, designed to give you three critical takeaways from LBRT’s earnings report. Soon, we will present a second update on LBRT’s earnings, highlighting its current strategy, news, and notes we extracted from our deeper dive.

Premium/Monthly

————————————————————————————————————-