STEP Energy is optimistic about an energy activity recovery in Canada in 2025. Fracturing utilization should improve while it plans to reactivate a coiled tubing unit during 1H 2025. It is also deploying its first electric backside equipment. In the US, however, it has decided to suspend frac operations. The stock appears reasonably valued compared to its peers.

Industry Outlook

We have already discussed STEP Energy Services’ (STEP) Q4 2024 financial performance in our recent article. Here is an outline of its strategies and outlook. STEP has turned “optimistic about the growth potential” compared to a relatively bearish sentiment in the previous quarter. Improved commodity prices, rising natural gas demand, and infrastructure projects will drive the turnaround. Such projects include the TMX and LNG Canada, following increased natural gas and LNG activities in the Montney and Duvernay plays in Canada. However, the political landscapes in Canada and in the US present potential risks and uncertainties, given the company’s presence in these countries.

STEP’s North American pressure-pumping business saw an 8% increase in 2024. In Canada, its proppant pumped increased by 64%. The rise in profit intensity signals increasingly complex operational demands in Canada.

Completion Operation Outlook

STEP expects its Q1’25 utilization to become “robust” in fracturing and cultivating spreads. Coiled tubing and nitrogen services activities will also become “busy.” Pricing for services has improved since Q4, as early 2025 trends show. However, the pricing remains a concern because it is lower than a year ago. On top of that, the weakening of the Canadian dollar against the U.S. dollar can compress its operating margin, particularly for the proppant operations. For Q2 2025, STEP estimates that some of its customers have a steady completion program outlook.

Following the improved outlook, STEP has reactivated a coiled tubing unit idled in Q4 2024. It expects to reactivate another unit during 1H 2025. However, the industry remains challenging and fracturing activity remains below 2024 levels.

Frac and Completions Update

STEP has been upgrading its fracturing fleets with the latest Tier 4 dual-fuel engine technology. Since 2022, it has invested $162 million of optimization capital. By Q4-end, 88% of the company’s Tier 2 and Tier 4 engines in the fracturing fleet turned to dual fuel, up from 75% a quarter earlier. It aims to achieve 100% gas-powered fracturing operations. Besides gas-powered frac spreads, it is deploying its first suite of electric backside equipment.

In 2024, STEP expanded its ultra-deep coiled tubing capabilities. This new technology allows increasing the lateral length of the horizontal wells. Also, the company’s STEP-conneCT downhole tool allows operators to make real-time decisions during milling operations. It utilized one of its two frac spreads in the US in Q4’24 and Q1’25. However, in Q2’25, the utilization fell even further as one of STEP’s competitors won the contract for the rest of the year. As a result of consolidation in the upstream industry and demand contraction, STEP has decided to suspend its US-based fracturing operations.

Q4 Performance Analysis

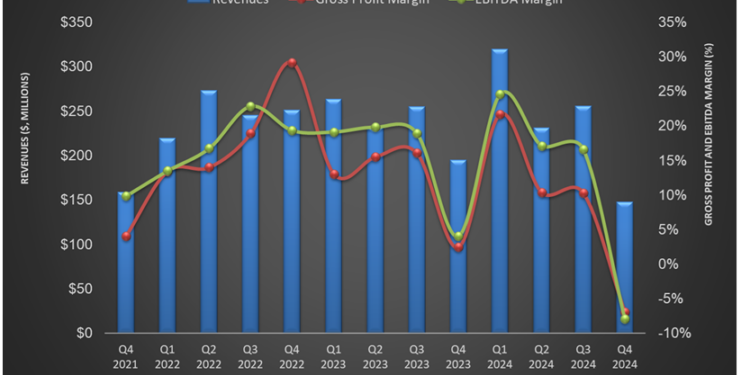

Year-over-year, STEP’s revenues decreased by 2% in Canada but took a steep downturn (55% down) in the US in Q4 2024. As a result, its adjusted EBITDA margin turned negative in the US. In Q4 2024, STEP’s fracturing operating days marginally decelerated in Canada, while it nearly crashed (88% down) in the US compared to a year ago. It incurred a net loss of $45 million in Q4 following an impairment charge of $23.9 million due to its decision to wind down the U.S. fracturing service line.

STEP’s cash flow declined (15% down) in FY2024 compared to a year ago, while its free cash flow decreased by 21% during this period. Its debt-to-equity improved to 0.15x as of December 31, 2024. In FY2024, it reduced its debt by 38%. In early 2025, it renewed its share repurchase authorization and plans to retire 3.6 million shares, or 5% of the outstanding shares.

Relative Valuation

STEP is currently trading at an EV/EBITDA multiple of 2.7x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is slightly lower, at 2.6x.

STEP’s forward EV/EBITDA multiple contraction versus the current multiple is less steep than its peers because its EBITDA is expected to increase less sharply than its peers in the next year. This typically results in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is lower than its peers’ (CFWFF, TOLWF, and NINE) average. So, the stock is reasonably valued compared to its peers.

Final Commentary

STEP achieved a set of improvements in early 2024. After Q4, 88% of STEP’s Tier 2 and Tier 4 engines in the fracturing fleet turned to dual fuel. It is deploying its first suite of electric backside equipment. It expanded its ultra-deep coiled tubing capabilities. In Canada, it expects fracturing and cultivating spreads utilization to become “robust” in Q1 as the company reactivates another coiled tubing unit during 1H 2025.

On the other hand, STEP continues to face a few significant challenges. Pricing remains lower than a year ago. The weakening of the Canadian dollar against the U.S. dollar is another concern. The most significant strategic change is the company’s decision to wind down the U.S. fracturing service line following the consolidation in the upstream industry and demand contraction. As a result, it recorded a huge impairment charge in Q4. The stock is reasonably valued compared to its peers.

Premium/Monthly

————————————————————————————————————-