There’s a strange kind of stillness in the air across global markets right now—like a quiet before either a storm or a soft turn. The data coming in from the U.S., China, and the Eurozone this week offers more questions than clarity. On the one hand, we’re seeing flickers of strength in production and consumption. On the other, warning lights continue to blink across housing, services, and consumer sentiment. The result? A world economy walking a tightrope—with central banks and markets waiting to see which way the wind blows next.

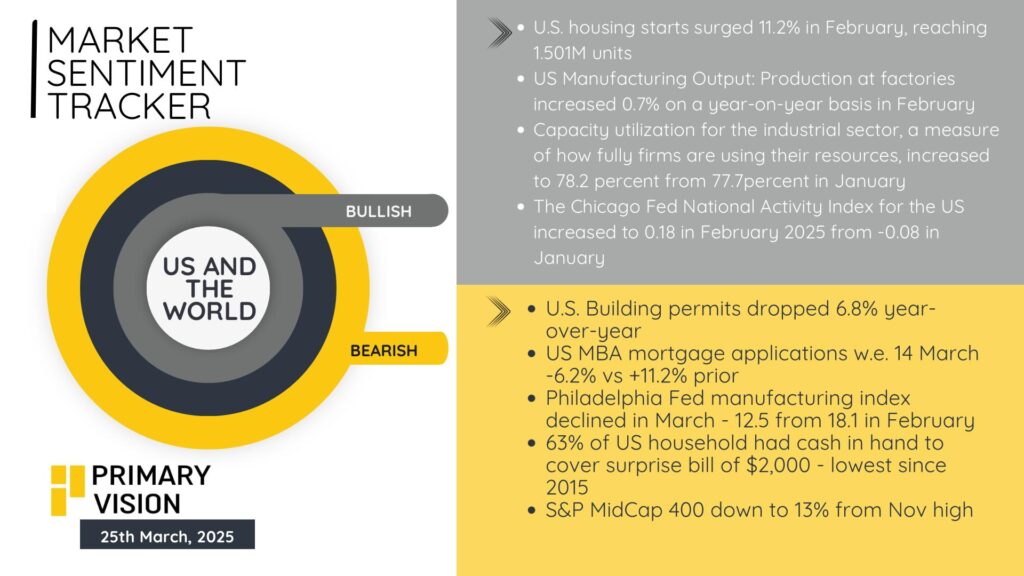

In the U.S., February’s housing starts surprised on the upside, surging over 11% to reach 1.5 million units—a rare moment of optimism in an otherwise volatile housing market. Industrial output also inched forward, with capacity utilization rising to 78.2%, suggesting U.S. factories are finally leaning into their productive potential. The Chicago Fed’s National Activity Index bouncing back into positive territory adds to the sense that under the surface, momentum might be building again. But the cracks are hard to ignore. Building permits—a leading indicator—slid nearly 7% y/y, mortgage applications are back down over 6%, and regional data like the Philly Fed Index has collapsed into deep negative territory. And perhaps most concerning, household financial fragility is rising: just 63% of Americans say they can handle a $2,000 emergency expense—the lowest share since 2015. For markets, it’s a difficult backdrop to trade with conviction. With consumer confidence breaking down and mid-cap stocks 13% off their highs, the bullish narrative lacks legs.

The Eurozone continues to operate in a narrow corridor between contraction and weak growth. The latest composite PMI nudged up to 50.4—not impressive, but at least above the waterline. What’s interesting is the growing divergence within the bloc. Output across much of the Eurozone has been on a 15-month streak of marginal growth, but France is increasingly becoming the laggard. Business activity there shrank for the seventh straight month, with factory output now falling for the 34th month in a row. That kind of persistent weakness from one of the Eurozone’s key economies isn’t just a local story—it bleeds into broader investor sentiment across the bloc. And while the PMI headline is technically expansionary, the fine print isn’t comforting: new orders continue to decline and service sector momentum has practically stalled. It’s a growth story on paper, but one that feels fragile underneath.

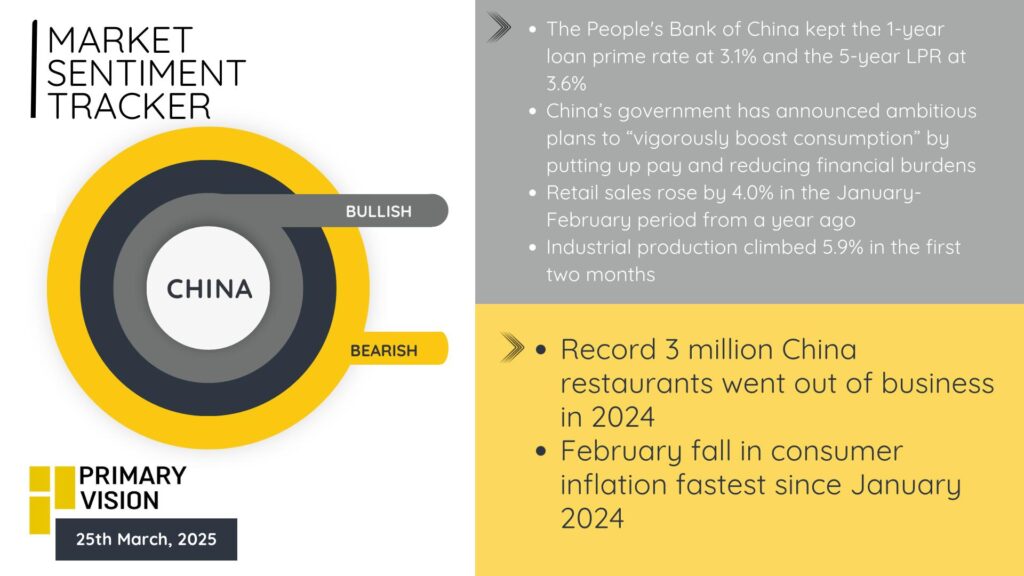

China’s economic situation might be the most complex of the three. On the surface, it’s all moving in the right direction—retail sales up 4%, industrial production climbing 5.9%, and the PBoC leaving its loan prime rates unchanged to support growth without stoking excess liquidity. The government is talking big again, promising to “vigorously boost consumption” by raising wages and reducing household financial burdens. These are all the right things to say, and recent data shows consumers are responding—just enough. But the structural weaknesses are hard to mask. Three million restaurants shut down across China in 2024—that’s not a small signal. And the February CPI decline was the sharpest since January last year, which could reflect weakening demand masked by strong output. The deflation story isn’t dominant yet, but it’s lurking. At best, China is rebalancing slowly. At worst, it’s still struggling to escape the gravitational pull of a property sector that has yet to find a floor.

Altogether, this week’s data suggests a global economy that’s holding up but still searching for its next clear driver. The U.S. is showing manufacturing resilience but household stress is growing. Europe is balancing on a knife’s edge, with slow recovery outside France and systemic weakness within it. China is talking up a recovery and posting decent numbers, but the underlying imbalances remain unresolved. If there’s a common thread across regions, it’s that soft landings—while possible—are still far from guaranteed. Markets are right to remain cautious. The easy gains are behind us; what comes next will depend on how governments, consumers, and central banks navigate what’s looking increasingly like a fragile calm.