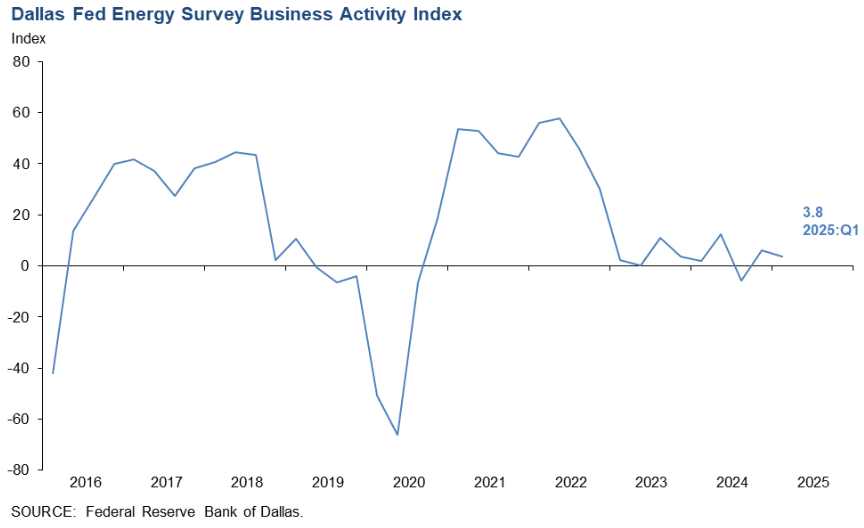

The latest Dallas Fed Energy Survey offers a sobering view of the U.S. oil and gas sector, and the findings align closely with the concerns I’ve raised in previous analyses about the headwinds that oilfield services (OFS) are expected to face in a high-cost environment. The business activity index barely held positive territory at 3.8, down from 6.0 in Q4 2024, and the outlook index dropped sharply by 12 points to -4.9. This signals growing pessimism among energy firms, further compounded by a 21-point jump in the uncertainty index to 43.1. These signals should not be overlooked—when uncertainty spikes and outlooks turn bearish, it often precedes a broader slowdown in drilling and completions activity.

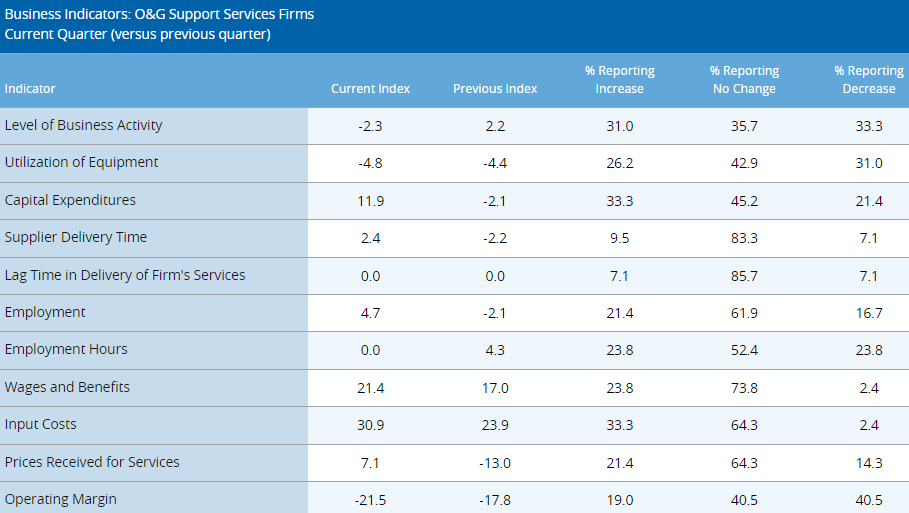

Production trends offered a slight glimmer of positivity with oil production increasing from 1.1 to 5.6 and natural gas from -3.5 to 4.8, but this modest growth doesn’t change the underlying reality. Rising costs are eroding margins and placing a ceiling on sustained growth. OFS firms saw the input cost index climb from 23.9 to 30.9, while E&P firms experienced higher finding and development costs (up from 11.5 to 17.1) and lease operating expenses surged from 25.6 to 38.7. This is precisely the issue I’ve been highlighting—service costs have risen so dramatically that even with efficiency gains, maintaining completions at scale is no longer viable at lower price levels.

I’ve previously argued that U.S. shale can’t sustain meaningful activity at $50 oil, and this survey validates that view. Historical Frac Spread Count (FSC) data shows that every time WTI approached $50, completions activity goes down. Furthermore with today’s high-cost environment where input costs, labor, and equipment pricing have all moved higher, the challenges for OFS companies and Shale producers are mounting.

The survey’s data on OFS margins confirms this ongoing pressure. The equipment utilization index held at -4.8, while operating margins for OFS firms fell deeper into the red, dropping from -17.8 to -21.5. Although the prices received for services index did swing back to positive territory (from -13.0 to 7.1), it’s not enough to offset the narrowing margins. This is the fundamental problem: even as service companies are able to command higher rates, their operating margins are being squeezed by rising costs that outpace revenue growth.

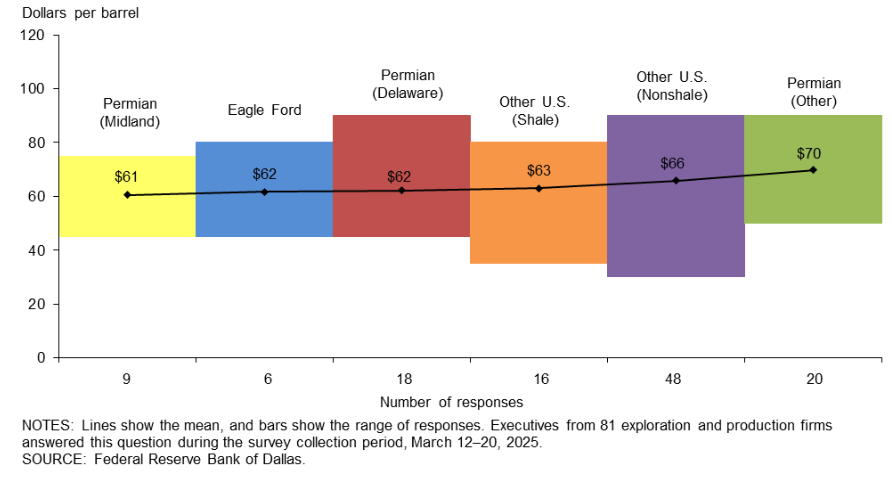

Note: The above chart is in response to the question: What WTI oil price does your firm need to profitably drill a new well?

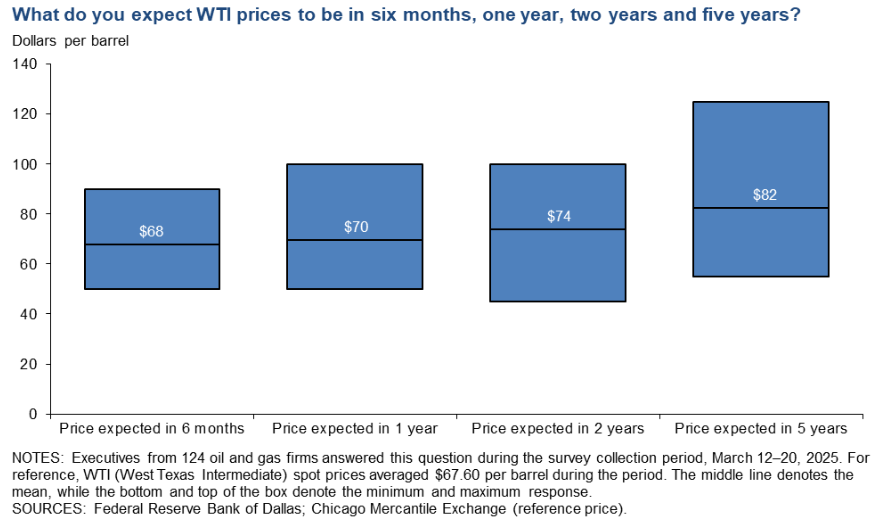

Moreover, the survey’s outlook for future WTI prices paints a cautious picture. Respondents expect $68 per barrel by year-end 2025, with a range of $50 to $100. In my recent interviews and articles, I have mentioned a plethora of factors that can be categorized as extremely bearish and present headwinds for oil markets. One of the most important factor in this regard is the supply overhang which has been estimated anywhere between 400,000 bpd to 600,000 bpd in 2025.

This strategic shift means that even if prices hold in the $70 range, we’re unlikely to see the same level of aggressive completions that characterized previous upcycles. But if oil drops to $50—something that remains a real risk in a bearish pricing environment—cash flows will be severely constrained, jeopardizing both shareholder returns and financial stability (this is something that we will be discussing in detail in our next Monday Macro View). This is where rising service costs become an even bigger issue. This dynamic also explains the lack of significant employment growth despite rising production. The aggregate employment index fell to zero, while hours worked and wages were relatively flat. This points to a cautious approach from operators who are unwilling to ramp up hiring in an environment where margins are thin and uncertainty is high. It’s yet another reflection of the broader trend I’ve been discussing—service costs are impacting profitability and making it increasingly difficult to justify expanding operations without a guaranteed price floor well above $50.

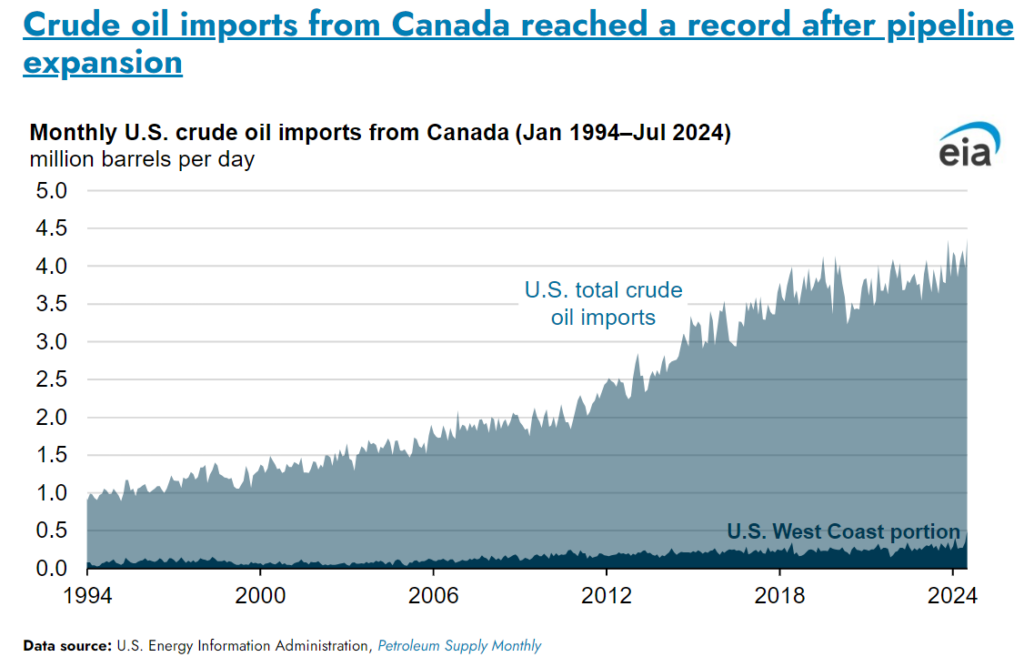

The recent 10% tariff imposed by the U.S. on Canadian crude oil imports is poised further impact pricing dynamics. Historically, Canadian crude grades have traded at a discount to U.S. benchmarks due to factors like transportation costs and quality differences. However, with the introduction of this tariff, the discount has widened. As per our calculations, a $70 barrel of Western Canadian Select (WCS) crude subject to a 25% tariff jumps to $88, adding an estimated $0.22 to $0.30 per gallon to gasoline prices, and around $0.40 when taxes are included. This surge in costs inevitably squeezes refining margins and has the potential to shift global crude trade flows.

To reiterate, the Dallas Fed’s latest survey underscores what we’ve been warning about. Rising service costs, higher capital expenditures, and structural changes in U.S. shale economics mean that the operators will be looking at some unique challenges moving forward. Even with efficiency gains, maintaining completions at scale now requires a higher price environment. If WTI retreats toward $50, expect to see a steep drop in activity, more margin compression for OFS firms, and a further shift toward capital discipline that prioritizes shareholder returns over production growth. The survey’s results align closely with this reality, and I’ll continue to monitor how these dynamics unfold as the year progresses.