Since the start of the year, we have been closely tracking the evolution of the global economic landscape — a journey marked by an uneasy tension between hopes for recovery and the persistent weight of structural fragilities. Early 2025 began with a degree of cautious optimism: disinflation was progressing, major economies had avoided the worst recessionary scenarios forecast in late 2024, and risk sentiment was rebounding. Yet beneath these promising surface trends, vulnerabilities have been slowly but steadily accumulating.

Now, as we go deep into 2025, the global picture is one of divergence, softening momentum, and rising asymmetries across regions. The Market Sentiment Tracker continues to showcases these divergences and asymmetries.

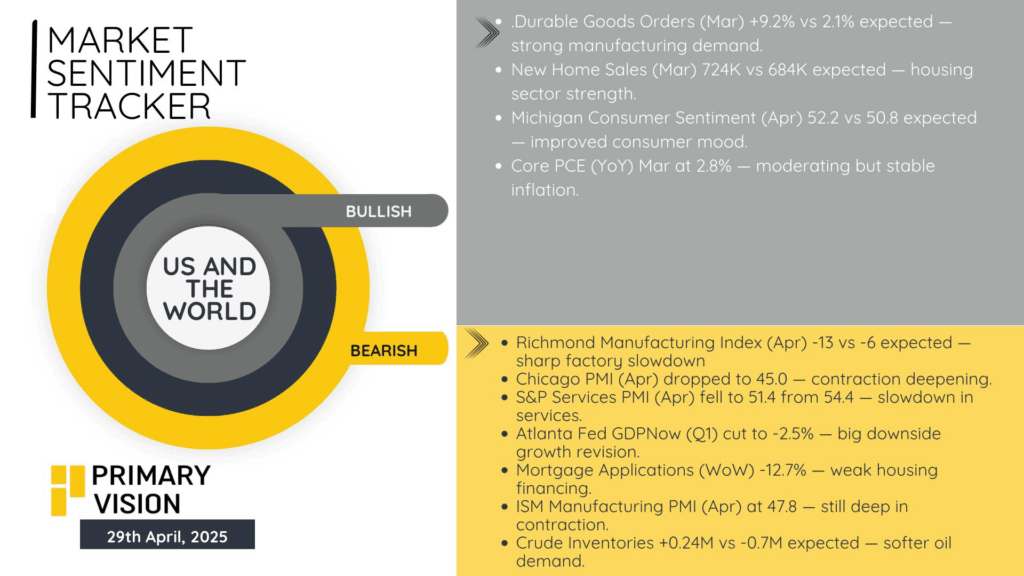

🇺🇸 United States: Resilient Pockets Amid a Broadening Slowdown

The U.S. economy is sending mixed but increasingly concerning signals. March durable goods orders surprised to the upside with a 9.2% gain, and new home sales at 724,000 confirm that some sectors are still drawing strength from consumer demand. Inflation pressures appear contained, with Core PCE stable at 2.8%, and consumer sentiment slightly improving in April.

Beneath that, however, a loss of economic momentum is becoming harder to dismiss. The Richmond Manufacturing Index collapsed to -13, Chicago PMI slipped further to 45.0, and the ISM Manufacturing PMI remained below 50, pointing to continued factory contraction. Services, once resilient, are now softening, with the S&P Services PMI falling to 51.4. The Atlanta Fed’s GDPNow estimate for Q1 swung sharply negative to -2.5%, suggesting the economy may have already entered a technical contraction. Mortgage activity fell off a cliff, down 12.7% week-over-week, and crude inventories rose against expectations, hinting at weakening final demand.

For now, sectors like manufacturing orders and housing sales are holding up parts of the economy, but the underlying trend is one of growing fragility.

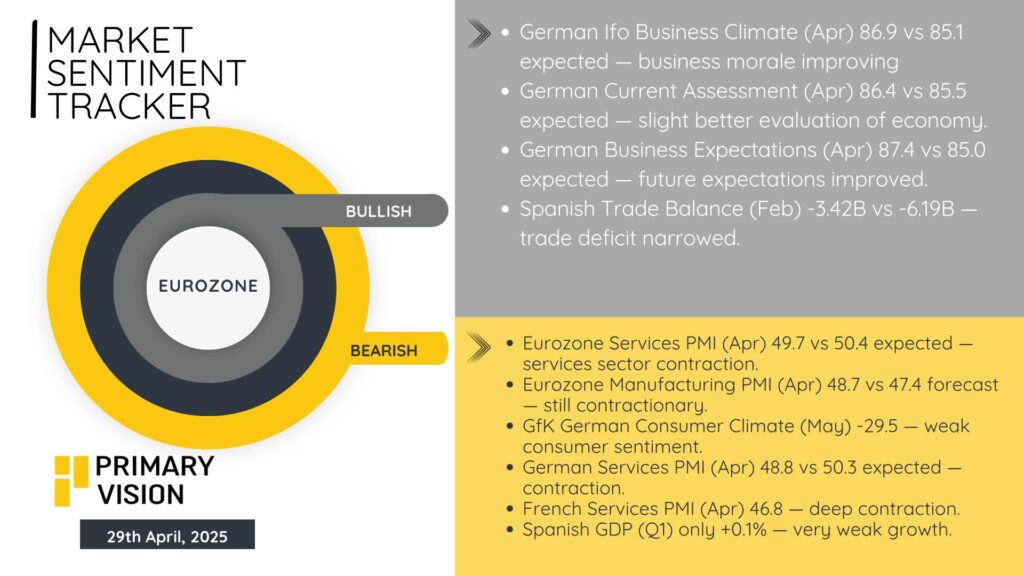

🇪🇺 Europe: A Business-Led Sentiment Recovery Without Real Growth

In Europe, corporate sentiment is beginning to firm even as real economic activity remains stuck in low gear. Germany’s Ifo Business Climate index rose to 86.9 in April, with improvements in both current assessments and expectations. Spain’s narrowing trade deficit also points to some external adjustment that could eventually help growth.

Yet activity indicators continue to pinpoint towards growing uncertainty. The Eurozone Services PMI fell into contraction at 49.7, and Germany’s and France’s services sectors both shrank meaningfully. Consumer confidence remains deeply negative, with Germany’s GfK survey at -29.5, and Spanish GDP barely grew, advancing only 0.1% in the first quarter.

Corporate optimism is improving, but without a clear pickup in consumer spending or services activity, Europe’s recovery risks becoming a sentiment rally unsupported by real momentum.

🇨🇳 China: Domestic Stability, External Drag

China’s April data points to tentative stabilization, led by the domestic economy. Manufacturing PMI ticked up slightly to 50.4, while Non-Manufacturing PMI climbed to 51.2, helping lift the Composite PMI to 51.7. Infrastructure investment and a gradual services recovery appear to be providing the backbone for this modest expansion.

However, external conditions remain a drag. New export orders slipped back below the 50 mark, signaling that foreign demand is under strain. Business sentiment also edged lower, with firms showing greater caution in their forward outlooks.

The data suggests that while China’s domestic growth engine is holding up, the external weakness could cap the recovery’s strength unless global conditions stabilize.