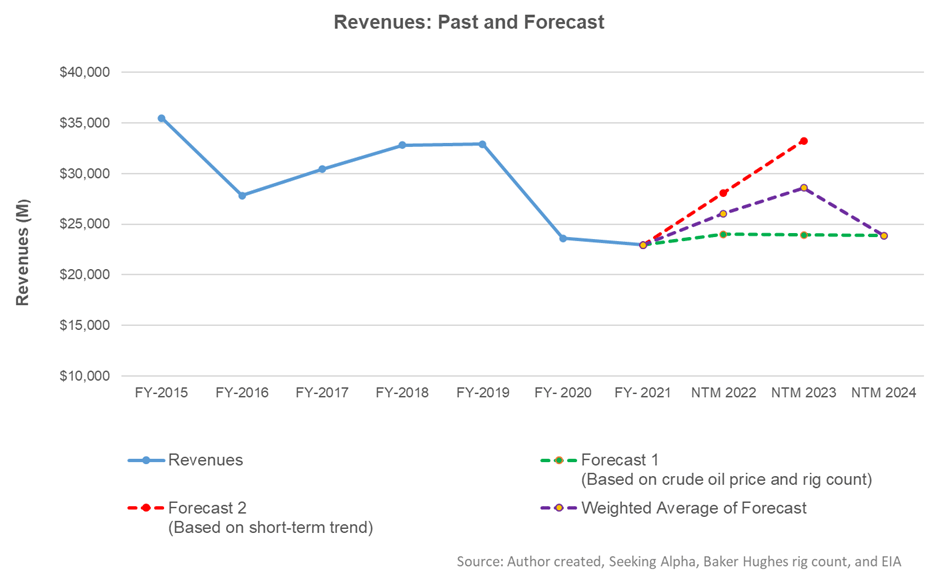

- Revenue estimates are higher in the next two years

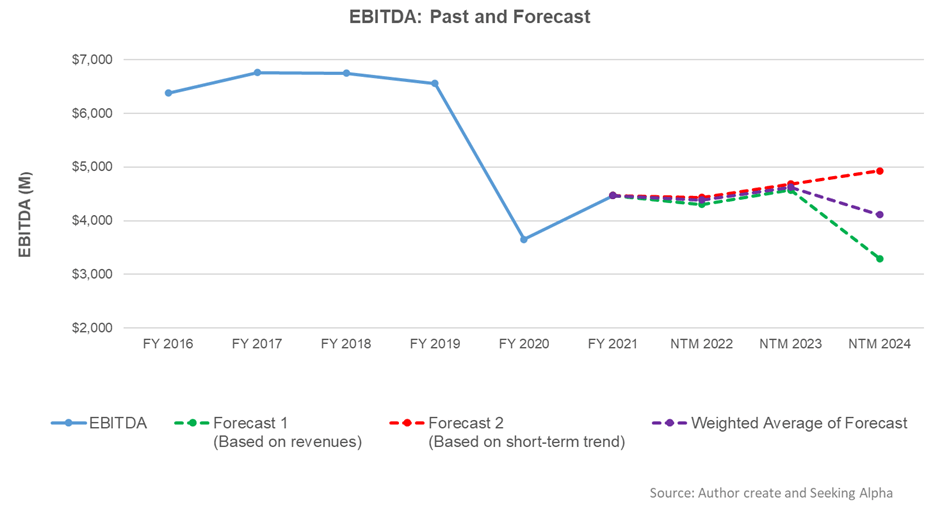

- EBITDA can decline marginally in NTM 2022

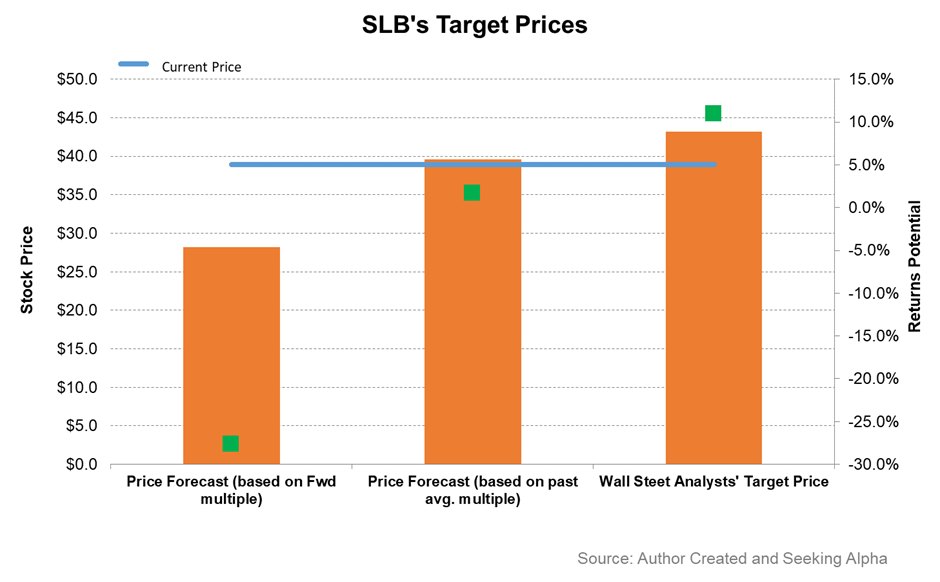

- The stock is reasonably valued at the current level

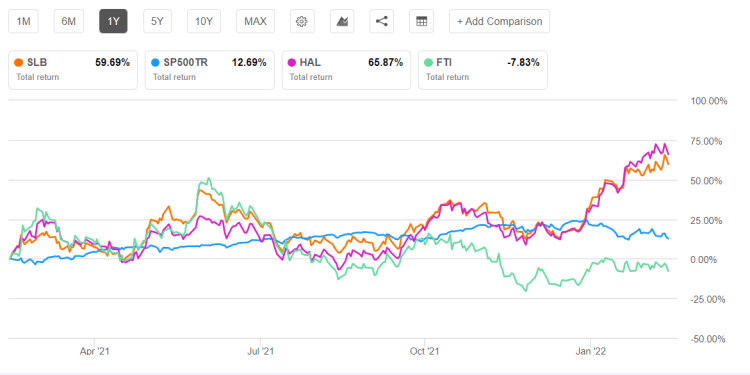

In Part 1 of this article, we discussed Schlumberger’s outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

A regression equation-based model on the relationship among the crude oil price, global rig count, and SLB’s reported revenues for the past six years and the previous eight-quarters suggests revenues to increase in the next two years. However, revenues can decline in NTM (next 12-months) 2024.

Based on the average forecast revenues, the model suggests the company’s EBITDA will decline marginally in NTM 2022. In NTM 2023, the EBITDA can rebound but may drop again in NTM 2024.

Target Price And Relative Valuation

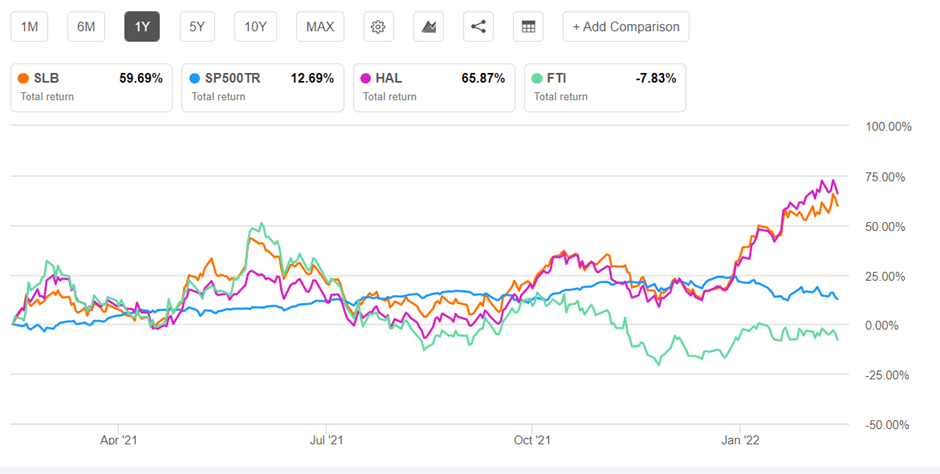

Returns potential using SLB’s forward EV/EBITDA multiple (10.9x) is lower (28% downside) compared to returns potential using the past average multiple (2% upside). The Wall Street analysts have slightly higher return expectations (11% upside).

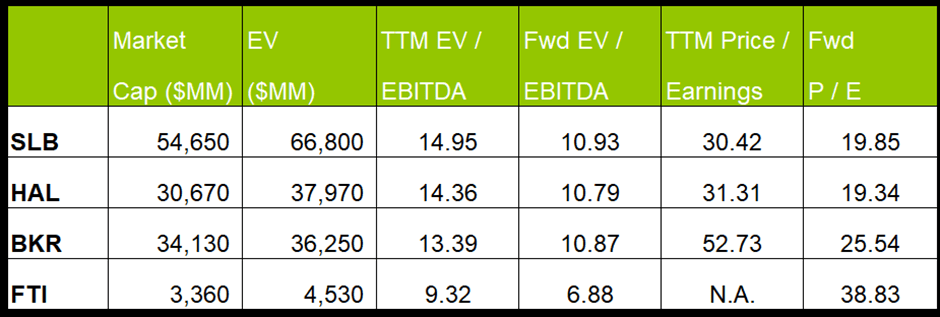

SLB’s forward EV-to-EBITDA multiple contraction versus the adjusted trailing 12-month EV/EBITDA is steeper than the peers because the company’s EBITDA is expected to increase more sharply than peers in the next four quarters. This would typically reflect a higher EV/EBITDA multiple than peers. The company’s EV/EBITDA multiple is higher than the peers’ (HAL, BKR, and FTI) average of 12.3x. So, I think the stock is reasonably valued at the current price.

What’s The Take On SLB?

Schlumberger’s management is currently stressing the foundation of solid multi-year upcycles. Short-cycle activity resurgence can facilitate more FIDs, and service pricing has improved. For the medium to long term, it mainly relies on two drivers to propel growth – technology and clean energy, which consists of low-carbon or carbon-neutral energy technologies. Its commercial DELFI customers and the DELFI cloud platform saw tremendous growth over the past year. It has also set a plan to reduce fuel use and electricity consumption by 30% in 2025. Its revenue growth in FY2022 can reach the mid-teens, while the EBITDA margins can expand by at least 200 basis points.

However, the operating margin in the Production Systems segment may continue to be depleted by global supply pressure and logistic constraints. Its free cash flow increased significantly in FY2022 over the previous year. Despite a higher capex budget in FY2022, its pursuit of a low capital-intensive strategy has helped the capital investment-to-revenue ratio stay low, which proves its operational efficiency. Plus, it reduced gross debt by $2.7 billion over the past year, which speaks volumes about its balance sheet. While the stock can move sideways in the short term, SLB has the financial power and low-cost drivers to power growth over a more extended period.