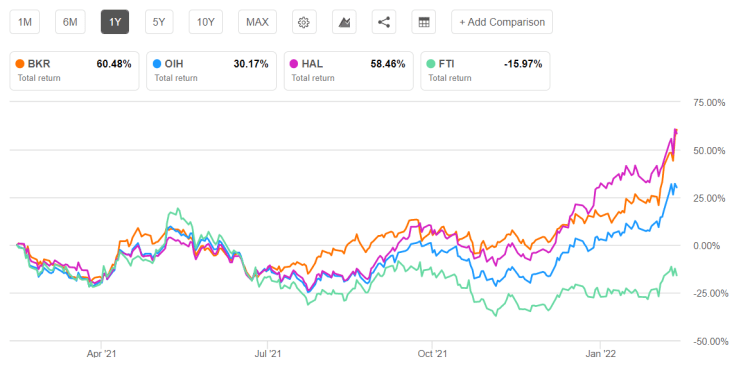

- Revenue estimates suggest a steadily increasing trend in the next couple of years

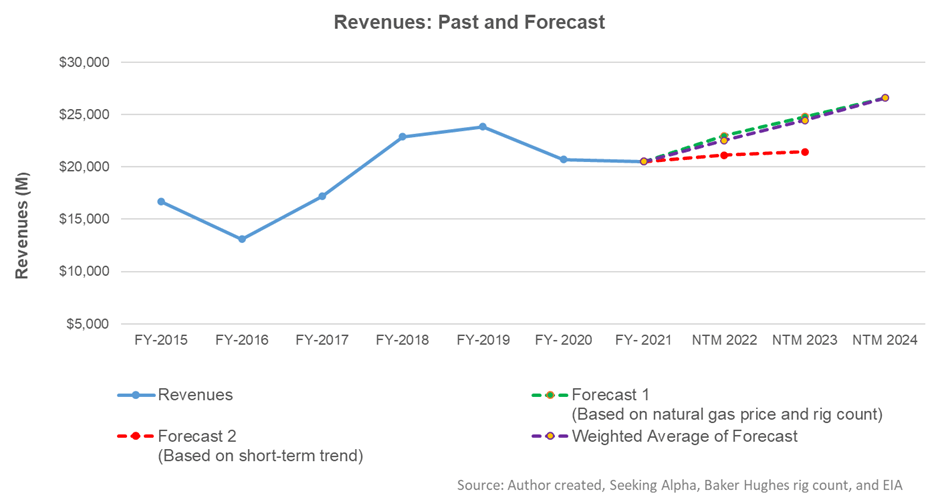

- EBITDA can improve in the next two years

- The stock is reasonably valued at the current level

In Part 1 of this article, we discussed Baker Hughes’s outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation among the natural gas price, global rig count, and BKR’s reported revenues for the past seven years and the previous eight-quarters, revenues will increase steadily in the next three years.

Based on the regression model using the average forecast revenues, the company’s EBITDA is expected to decrease moderately in the next two years. However, in NTM 2024, it can decrease moderately.

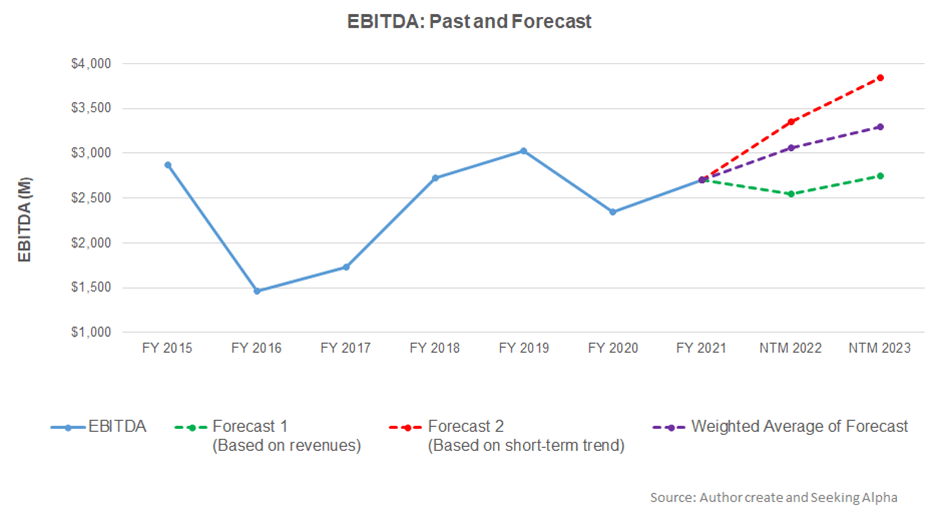

Target Price And Relative Valuation

Returns potential using BKR’s forward EV/EBITDA multiple (11.3x) is higher (7% downside) compared to returns potential using the past average multiple (15% downside). The Wall Street analysts also have negative return expectations (7.9% downside).

Baker Hughes is currently trading at an EV-to-adjusted EBITDA multiple of 14.0x, according to Seeking Alpha. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 11.3x. The current multiple is in line with its past five-year average EV/EBITDA multiple of 11.7x.

BKR’s forward EV-to-EBITDA multiple contraction versus the adjusted trailing 12-month EV/EBITDA is less steep than peers because the company’s EBITDA is expected to increase less sharply in the next four quarters. This would typically result in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is lower than its peers’ (HAL, SLB, and FTI) average. So, the stock is reasonably valued versus its peers.

Analyst Rating

According to data provided by Seeking Alpha, 22 sell-side analysts rated BKR “Buy” or “Strong Buy” in March, while six of them rated it a “Hold.” Only one of the sell-side analysts rated a “Sell.” The consensus target price is $34.67, which yields negative 8% returns at the current price.

What’s The Take On BKR?

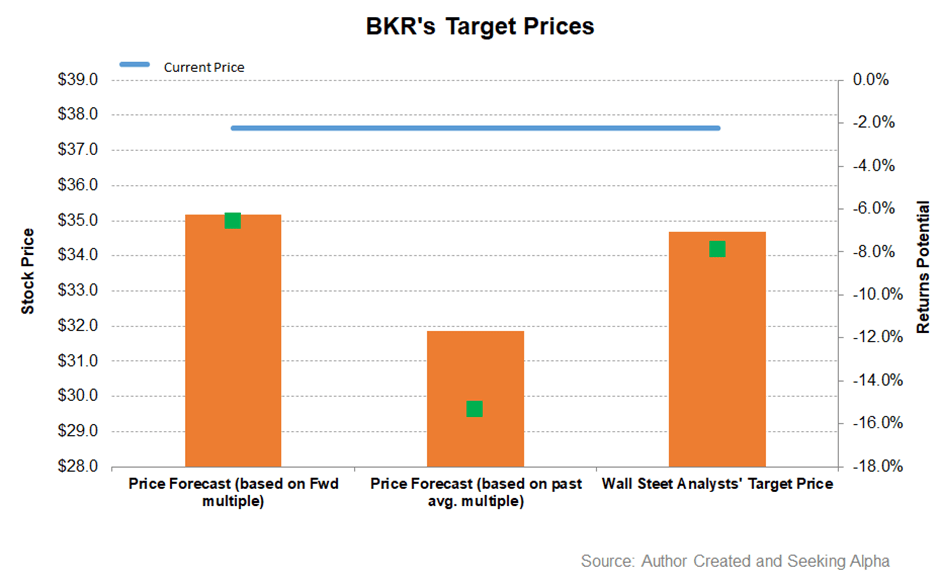

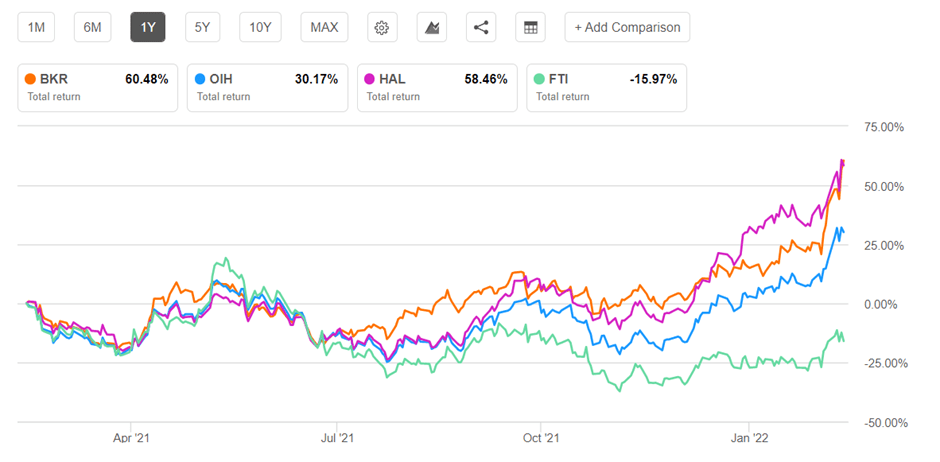

The two critical factors driving the company in the medium to long term are natural gas’s strength in acting as a preferred energy medium and the company’s transition to cleaner energy. It primarily looks into carbon capturing, hydrogen, emissions management, and clean and integrated power solutions. It also plans to expand into industrial energy technology. In the short term, a strong recovery in the energy activities in Latin America and the Middle East and stable activity in North America will drive revenues. The opportunities in the LNG, offshore production and new energy brighten the 2022 outlook. So, the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

The offshore market will rise, but some of the post-pandemic weaknesses relating to the structural challenges from years of underinvestment continue. BRR has sufficient balance sheet strength and low leverage. With improving free cash flow conversion from adjusted EBITDA, it has leeway into expansive capital market activities. After the recent stock price run-up, the relative valuation level is stretched. Nonetheless, investors can pick up the stock for steady returns with significant advantages in the current and long-term scenario.