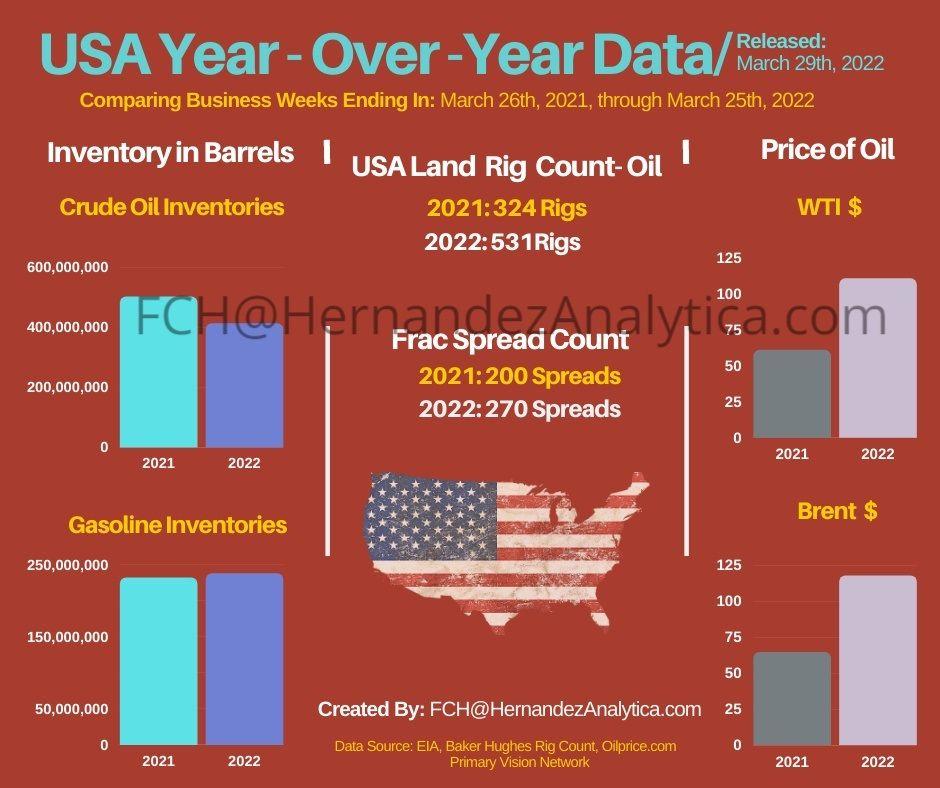

I have captured key industry data, as it relates to the previous business week.

The oil rig count has increased by 7 and has set a new high for 2022. The count is equally up by 256 rigs compared to the lowest point seen in 2021.

• Also, the price for Brent and WTI crude has increased by over 45.00 USD over the course of a year.

The below information that further complements the #infographic:

(Oil Rig Count: Baker Hughes report)

• March 26th, 2021: 324

• March 25th, 2022: 531

(Primary Vision Network – Frac Spread Count)

• March 26th, 2021: 200

• March 25th, 2022: 270

(Oilprice site: #WTI price)

• March 26th, 2021: 60.97 USD

• March 25th, 2022: 110.60 USD

(OilPrice site: Brent Crude price)

• March 26th, 2021: 64.57 USD

• March 25th, 2022: 117.69 USD

(EIA Crude Oil Inventories: agency reports with a week delay)

• March 19th, 2021: 502,711,000 Barrels

• March 18th, 2022: 413,399,000 Barrels

(EIA Gasoline Inventories: agency reports with a week delay)

• March 19th, 2021: 232,279,000 Barrels

• March 18th, 2022: 238,043,000 Barrels