Throughout this month, I have tried to specifically focus on emerging markets. Why? Firstly, these countries are the first victim of the recent commodity price surge and secondly, they have accumulated huge amounts of debt as such a rising dollar (as the dollar index hit 2 year high)has highly adverse effect on them. Sri Lanka is a real life example of this phenomenon and usually such developments are not isolated incidents but symptomatic of wider, more deep rooted problems in the system i.e. world economy. What is concering is the fact that Fed has now entered into a rate hiking cycle (what is known as recessionary monetary policy) in order to avoid “overheating” of the economy and prevent a “hard landing”.

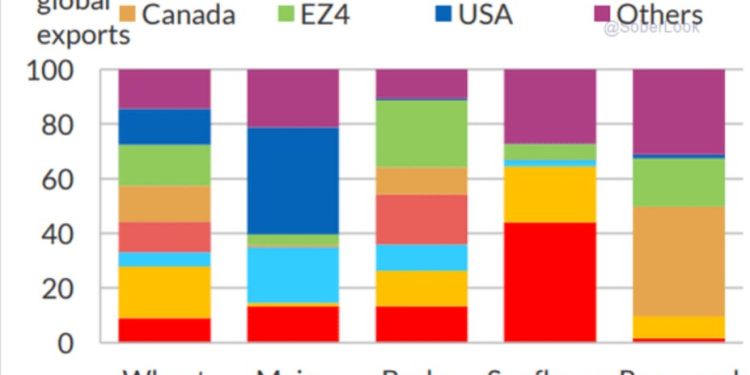

One of the most important component hurting emerging economies is the rising cost of food. We, at Primary Vision, have been talking about it almost in every ECON episode and I personally have written about it multiple times here and also in other outlets such as The Diplomat. The chart below shows a better picture in terms of importance of how events in Russia and Ukraine are impacting the global food markets. Russia and Ukraine both supply 30 percent of global wheat exports. Russia is a key player in fertilizers and countries like Brazil, that import 85 percent of its fertilizer, with one-fifth from Russia are expected to face serious problems. Prices of nitrogen fertilizer have increased even in the U.S. post invasion from $175/ton to a staggering $705/ton. UN’s FAO expected a further 8 to 22 percent of increase in food prices.

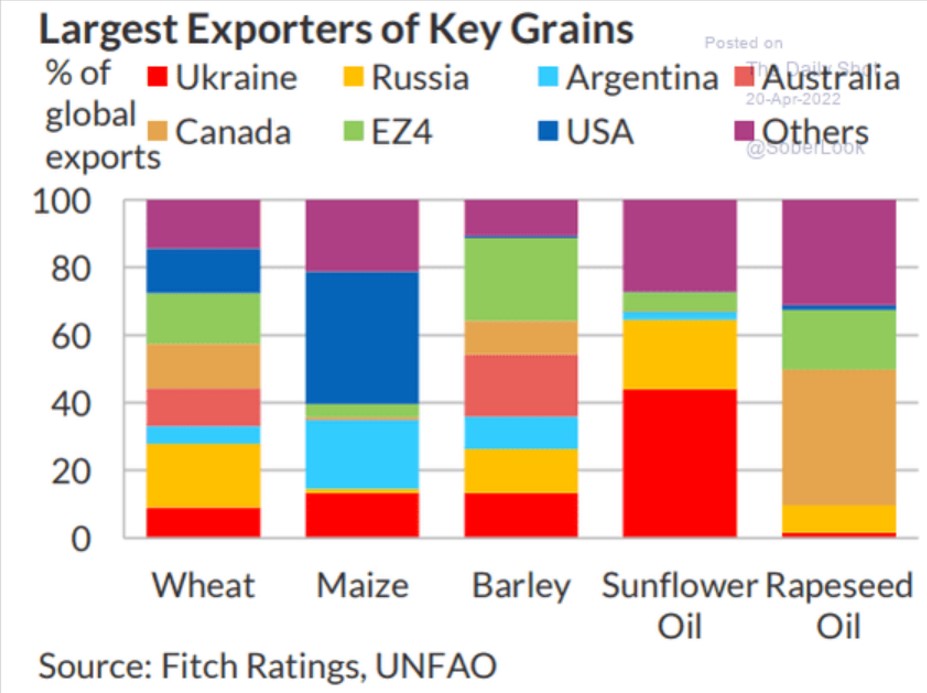

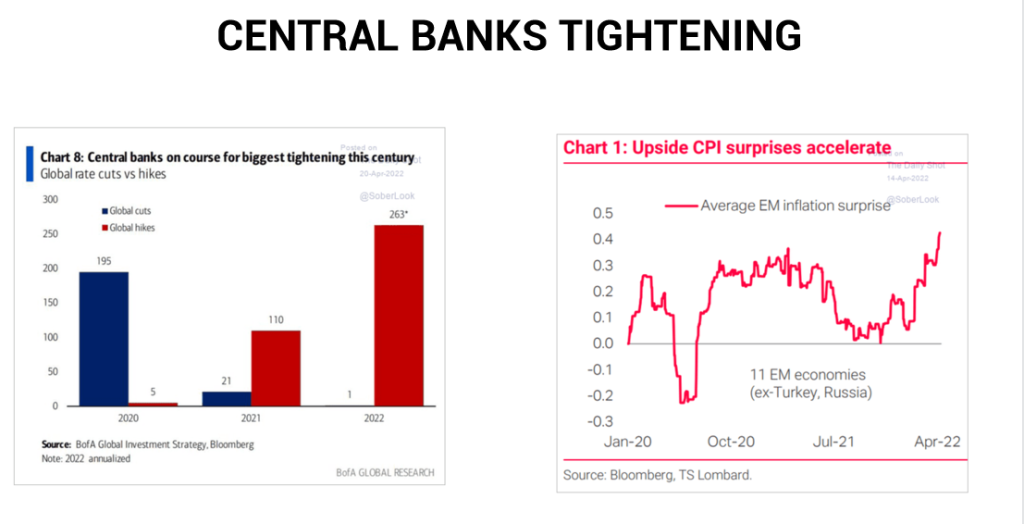

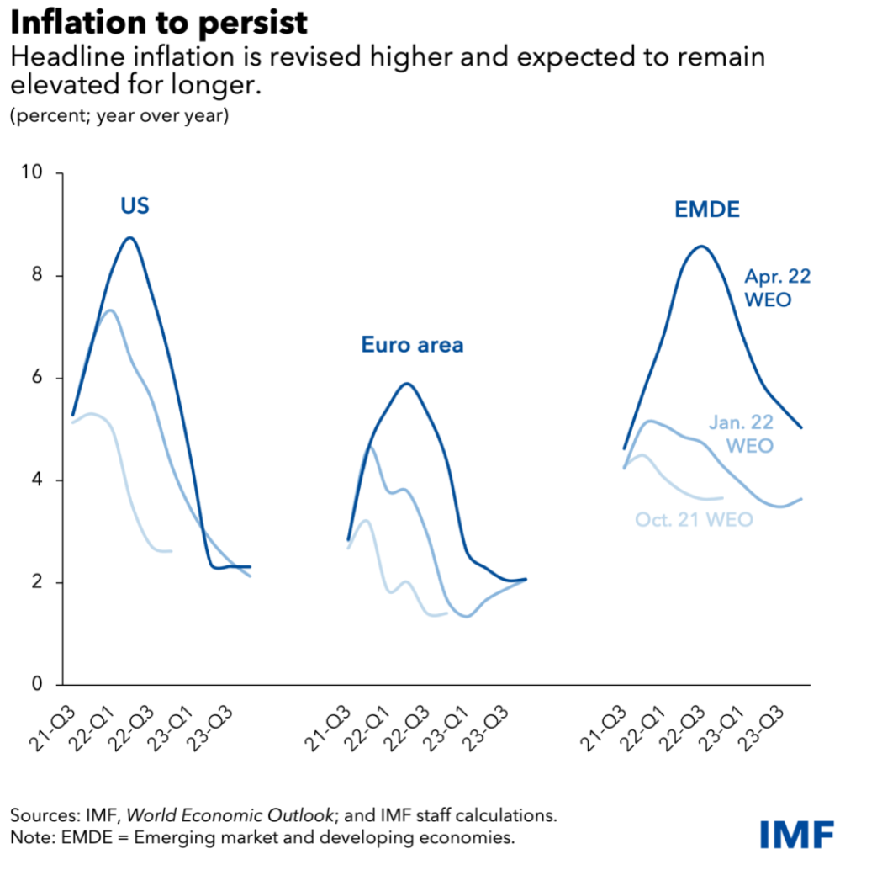

We now switch to inflation and interest rates. Right now, central banks are on course for the biggest tightening of this century! This means many things but amongst one is stronger dollar against basket of currencies from emerging markets. This rate hikes are also going to put downward pressure on growth and therefore, IMF will continue to revise down growth estimates- as they did recently. IMF is also expecting more “persistent” inflation levels which ties back to our point that inflation is sticky not flexible. It also means that the prospects of a global economic growth recovery will be delayed. The chart below puts these developments in perspective. Also, it is interesting to not the upside CPI surprises for emerging markets.

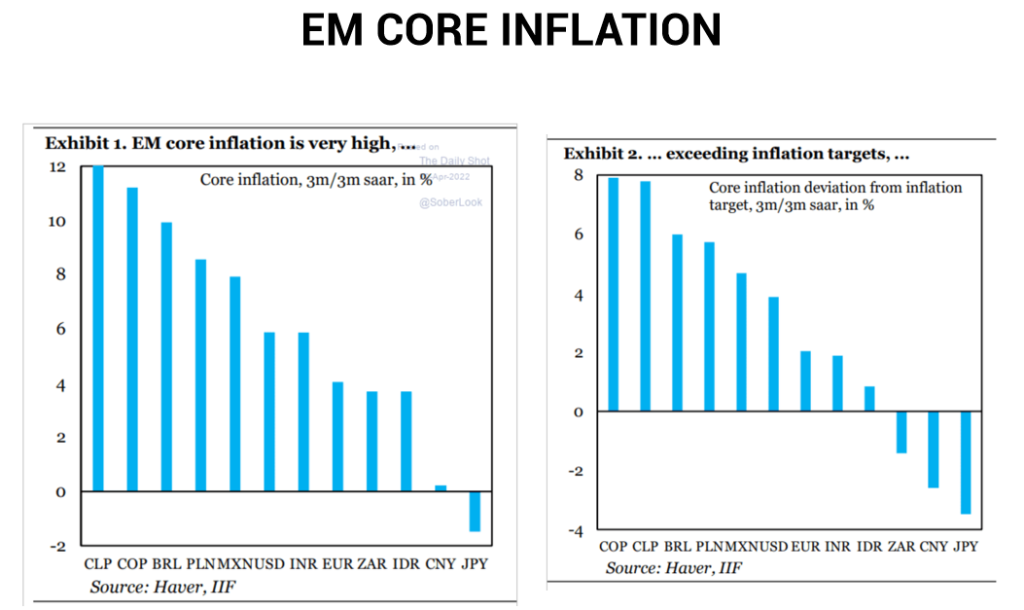

Few more interesting charts:

Inflation will persist! HIGHER FOR LONGER!

Coming back to EMs where core inflation is very high exceeding inflation targets and therfore we can expect EMs to raise interest rates giving way to some sluggishness acting as a headwind to economic growth.

Regarding the future prospects of inflation one may look where the oil prices are headed. Clearly rising energy costs have been a main contributor to overall inflation at a global level. Gas prices at its highest levels and with Germany set to ban Russian oil, [oil] prices might remain at elevated levels which will not only exacerbate the situation for emerging markets but also leave a serious dent in the developed world.

One can safely say that if circumstances aren’t as bad as are sometimes portrayed but there are certainly some serious headwinds ahead!

Have a great weekend and stay safe!