Mark did a very interesting segment this week in the ECON show that talked about central bank tightening. As this has global repercussions, I’d like to talk about it in this article as well.

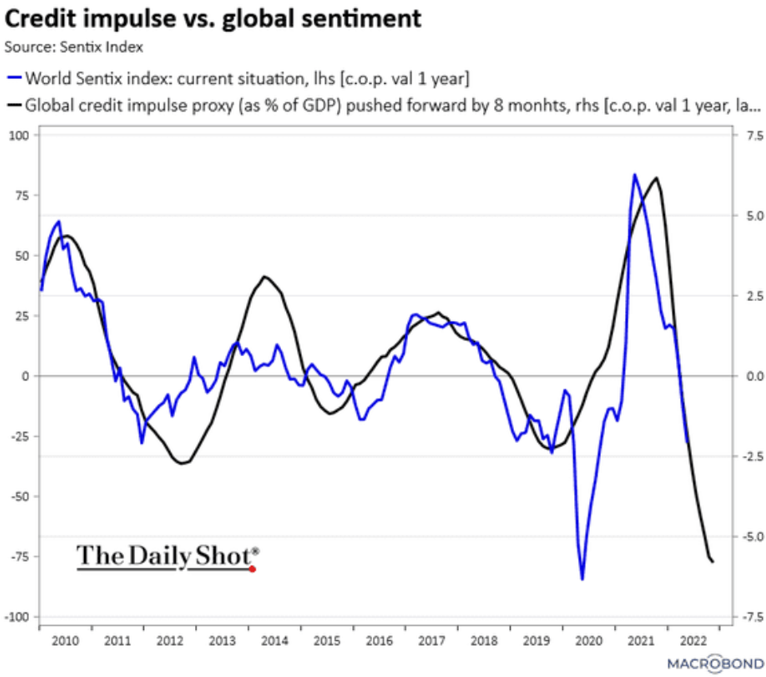

So globally, sentiment is falling as credit impulse has taken a plunge recently (see chart below). This is because headwinds remain in terms of an economic recovery given the reent events such as COVID lockdowns, continued Russian war etcetera.

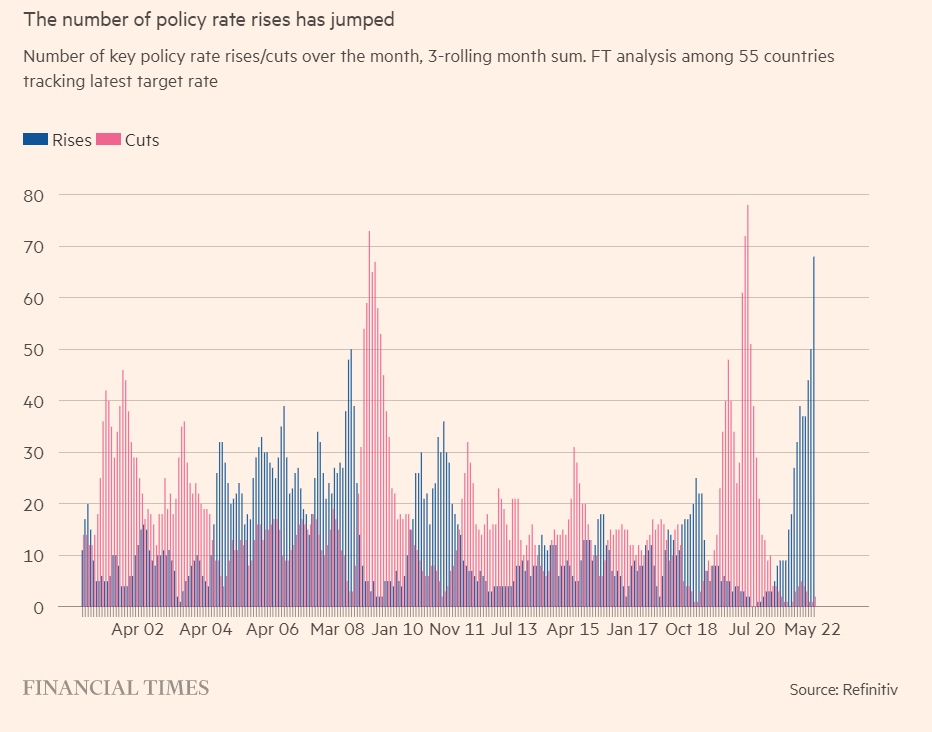

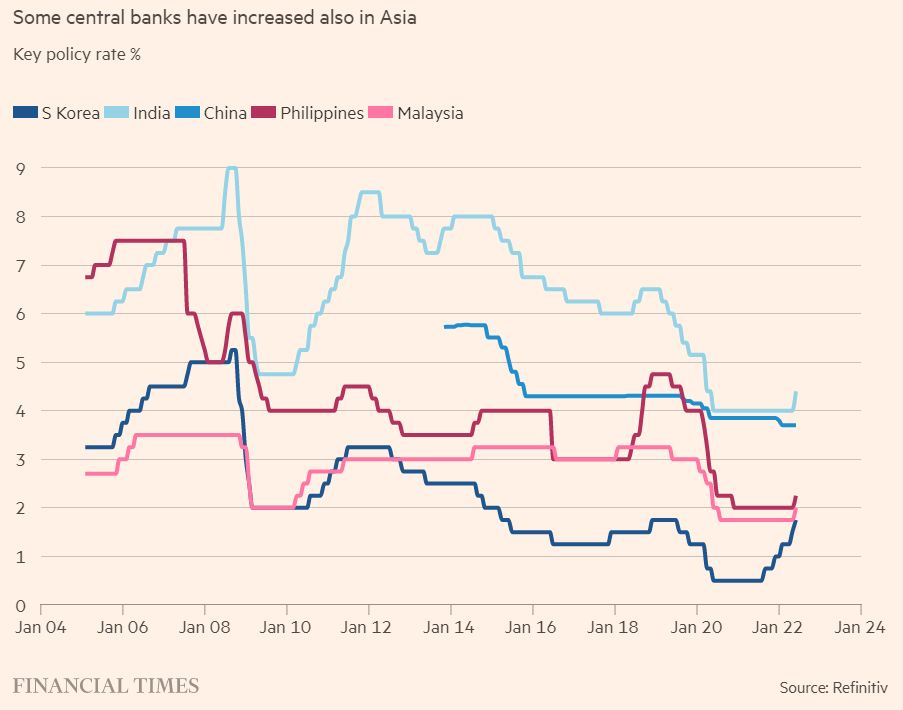

Also, the global tightening by central banks, has started to have “cascading effects” as it further slows down business activity that weighs down on global PMI. Recently, Canada has also increased interest rates by 50 basis point to 1.5 percent. The era of cheap money seems to be coming to an end. In the past three months alone, central banks all over the world has announced more than 60 increases – the largest number of increases since 2000.

Fed and BoE already have a few hikes to their name and ECB is expected to change its stance on rising interests soon. Recently, Fed has become very hawkish saying that there might be more of 50 basis point hikes moving forward.

Apart from these hikes, another important development has been that of Russian oil embargo. So far, only the oil coming via sea will be effected by the ban (two thirds of Russian oil travels to Europe via sea) and as Poland, Hungary and Germany gradually halts their imports via pipeline (mainly the Druzba pipeline) it will render almost 90 percent of Russian oil imports to Europe null and void. Oil production in Russia is already falling down and IEA estimates that it can take off 3 mbpd of oil from the markets in the coming months. Now that is a serious number – especially when we consider the falling global oil inventories, reduced spare capacity and very low distillate and diesel stocks.

There is much happening in the South Pacific as well. China couldn’t get its deal signed but Biden might be successful in its IPEF (Indo Pacific Economic Framework) as it recently upgraded the relation of status with ASEAN countries to ‘comprehensive strategic partnership’. On the other hand, there has been a resurgence of some tensions between the two economic behemoths (US and China) and as I have been trying to highlight for 2 years, we might see a renewed bout of trade war once again.

Needless to say all of these headwinds should be seriously considered, their variables mapped out and the interplay and interaction of those anticipated for policymakers to really navigate the uncertain world that lies ahead.

Have a great weekend, until next time!